Preview: Due December 16 - U.S. October Retail Sales - Autos to lead a dip

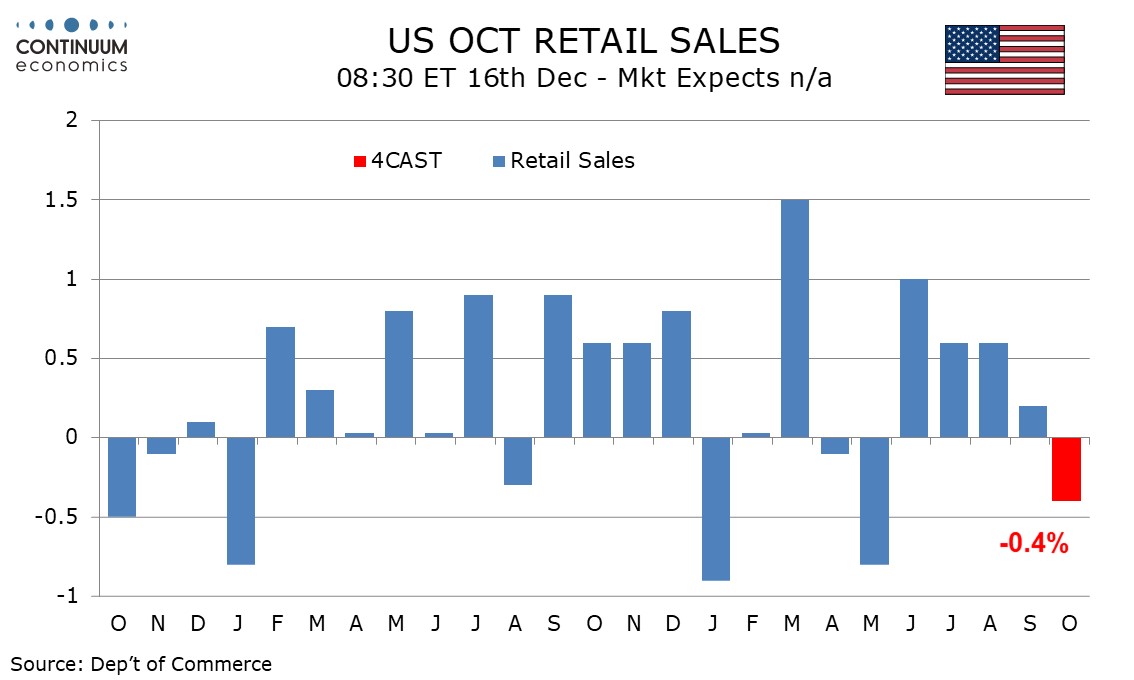

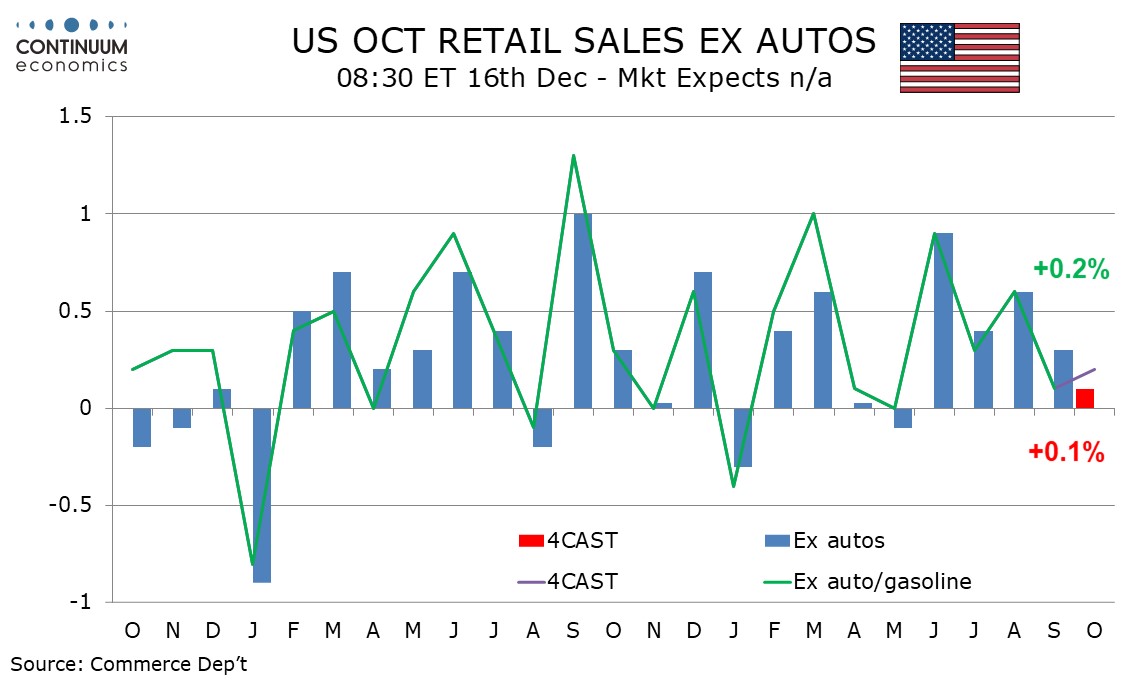

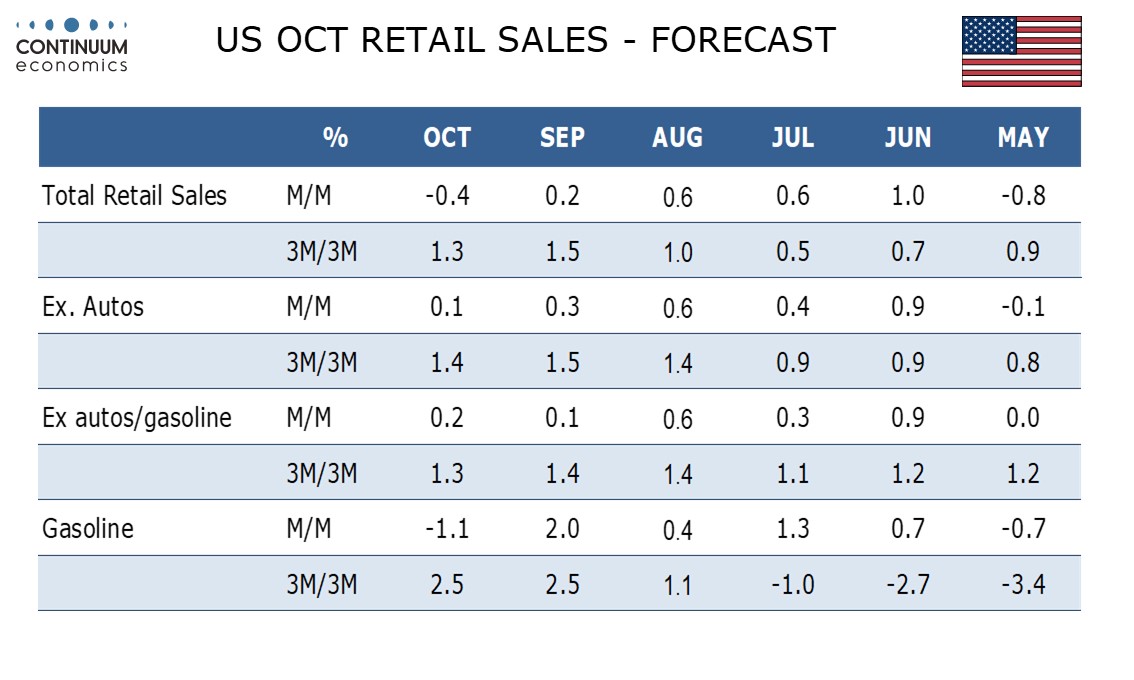

We expect a 0.4% decline in October retail sales in September, with autos set to be the main negative after the expiry of a tax credit for electrical vehicle purchases. Elsewhere however we expect subdued data, with a 0.1% increase ex autos and a rise of 0.2% ex autos and gasoline.

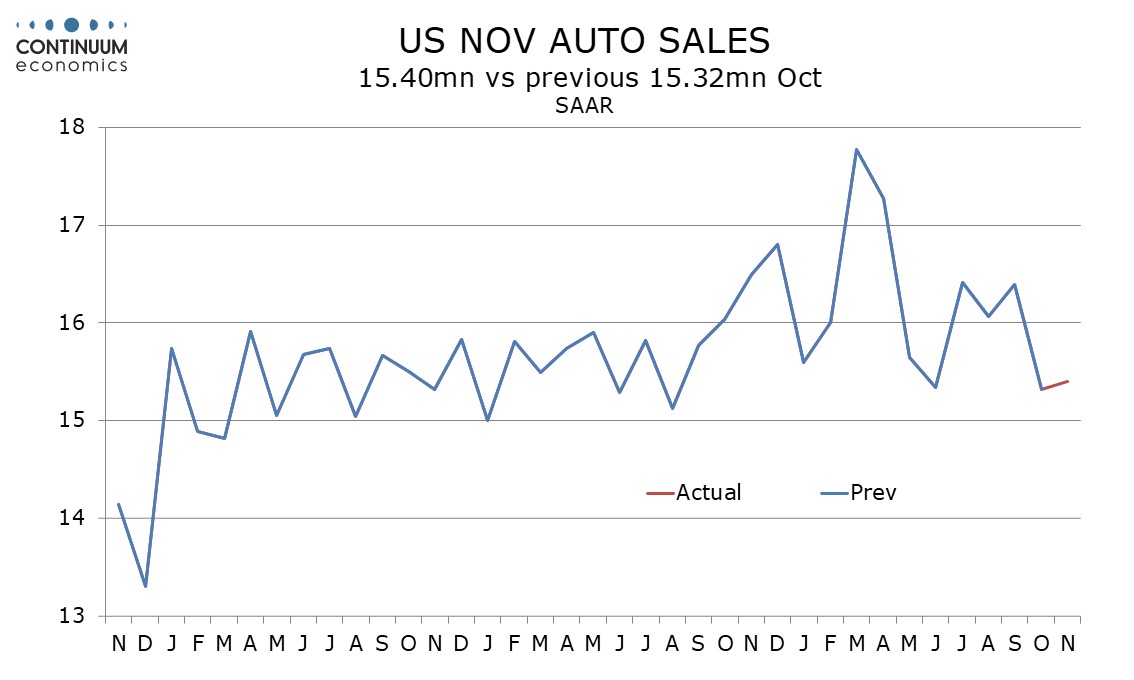

Industry data shows auto sales slipped significantly in October, returning to near June’s level after three stronger months in Q3. November saw no significant recovery.

September sales ex auto and gasoline with a rise of only 0.1% were well below trend, but the government shutdown that persisted through October may prevent a strong rebound in October.

Q3 saw consumer spending running well ahead of disposable personal income, suggesting that consumer momentum may be poised to slow.

We expect only a marginally improved 0.2% increase in sales ex auto and gasoline which may fall short of price gains. After a rise in September, gasoline prices slipped back in October. This is likely to restrain sales ex auto to a rise of only 0.1%, the slowest since a decline in May when tariff worries were near their peak.

I,Dave Sloan, the Senior Economist declare that the views expressed herein are mine and are clear, fair and not misleading at the time of publication. They have not been influenced by any relationship, either a personal relationship of mine or a relationship of the firm, to any entity described or referred to herein nor to any client of Continuum Economics nor has any inducement been received in relation to those views. I further declare that in the preparation and publication of this report I have at all times followed all relevant Continuum Economics compliance protocols including those reasonably seeking to prevent the receipt or misuse of material non-public information.