Canada October retail sales - A weak month, but November seen stronger

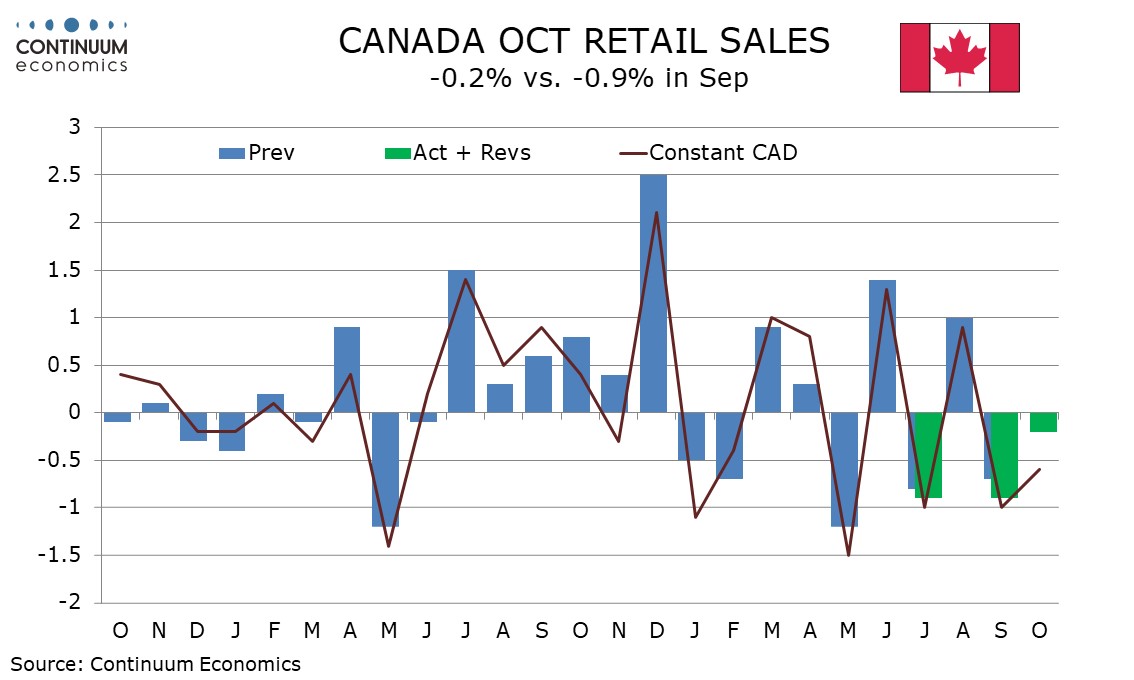

Canadian retail sales with a 0.2% October decline are weaker than the unchanged estimate made with September’s report, and suggest a continued subdued consumer picture. However the preliminary estimate for November is quite strong, with a rise of 1.2% projected.

A stronger than expected Q3 Canadian GDP increase came despite subdued consumer spending, but with employment growth picking up in September, October and November, consumer fundamentals may be starting to improve, and supporting spending in November.

The October detail is however clearly weak, with sales down 0.5% in real terms and down by 0.6% ex autos even in nominal terms. Food and beverages fell by 2.0% led by a 10.6% plunge in beer, wine and liquor stores.

3m/3m data still looks fairly flat though monthly data has been volatile, with gains in June and August marginally exceeding declines in May and July. We now have two straight declines, October by 0.2% and September revised down to -0.9% from -0.7%, but a 1.2% rise in November would erase these losses.