Published: 2025-12-17T18:56:51.000Z

Preview: Due January 7 - U.S. December ISM Services - Headline and prices paid to slow

4

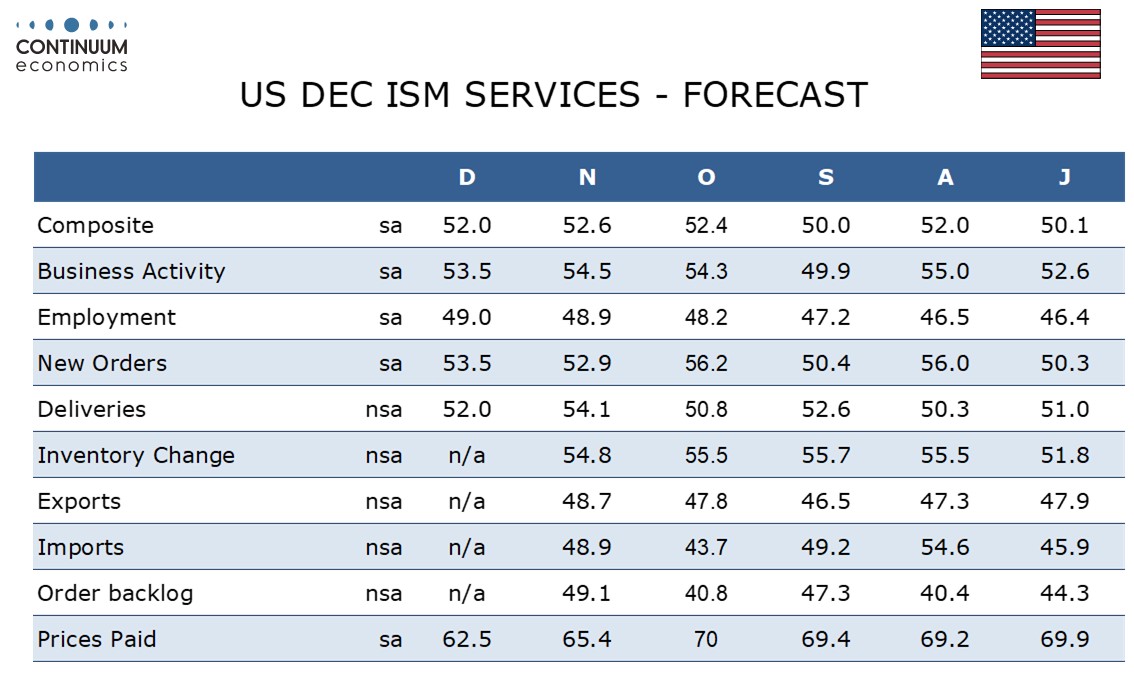

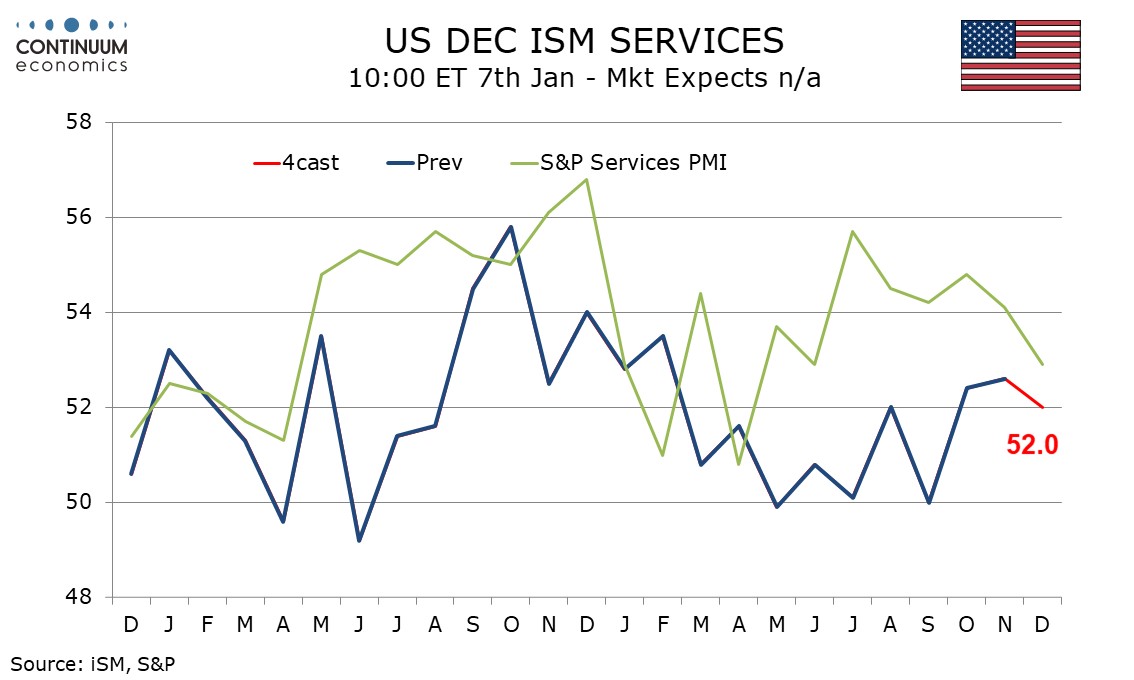

We expect December’s ISM services index to slip to 52.0 from November’s 9-month high of 52.6. A weaker December S and P services PMI suggests downside risk even if its level at 52.9 remained above November’s ISM services index.

The S and P’s service index was flattered in November by a strong rise in delivery times to 54.1 from 50.8 and we expect a correction back to 52.0 in December. We see both business activity and new orders at 53.5, the firmer down from 54.5 but the latter up from 52.9. We expect a marginal rise in employment to 49.0 from 48.9 to complete the breakdown of the composite.

Prices paid do not contribute to the composite and here we expect a fall to 62.5 from 65.4, extending a slowing from October’s reading of 70.0 that was the highest since October 2022. A second straight fall would suggest inflationary pressures from tariffs are peaking.