Preview: Due January 14 - U.S. November Retail Sales - A mostly subdued month, but December may be stronger

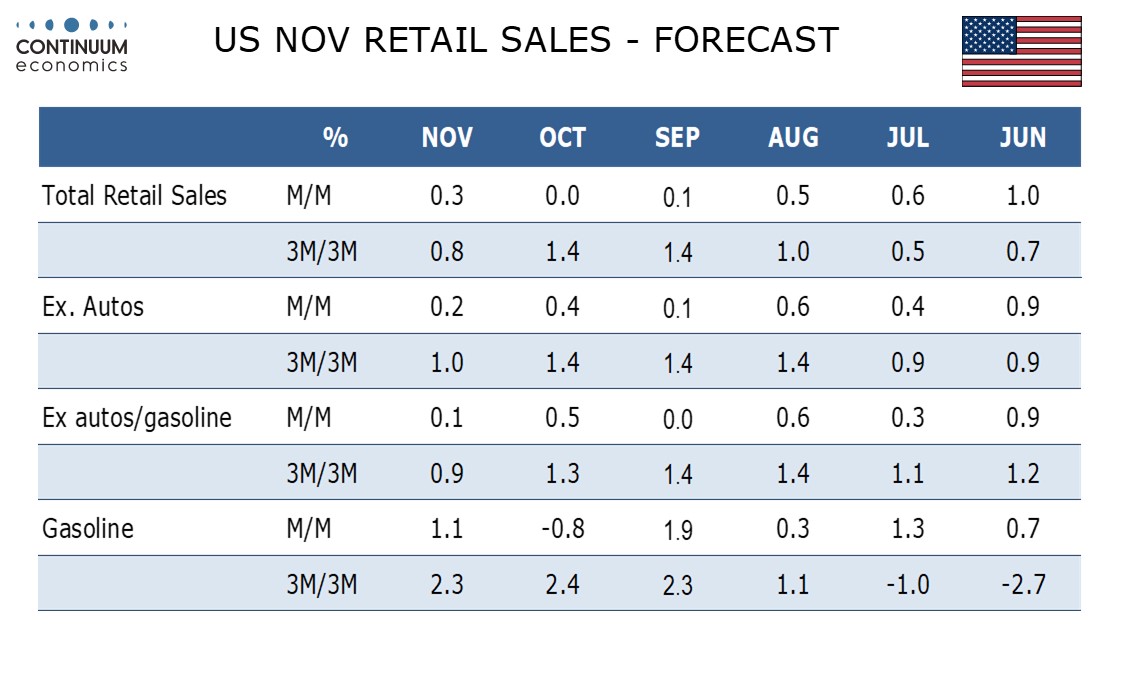

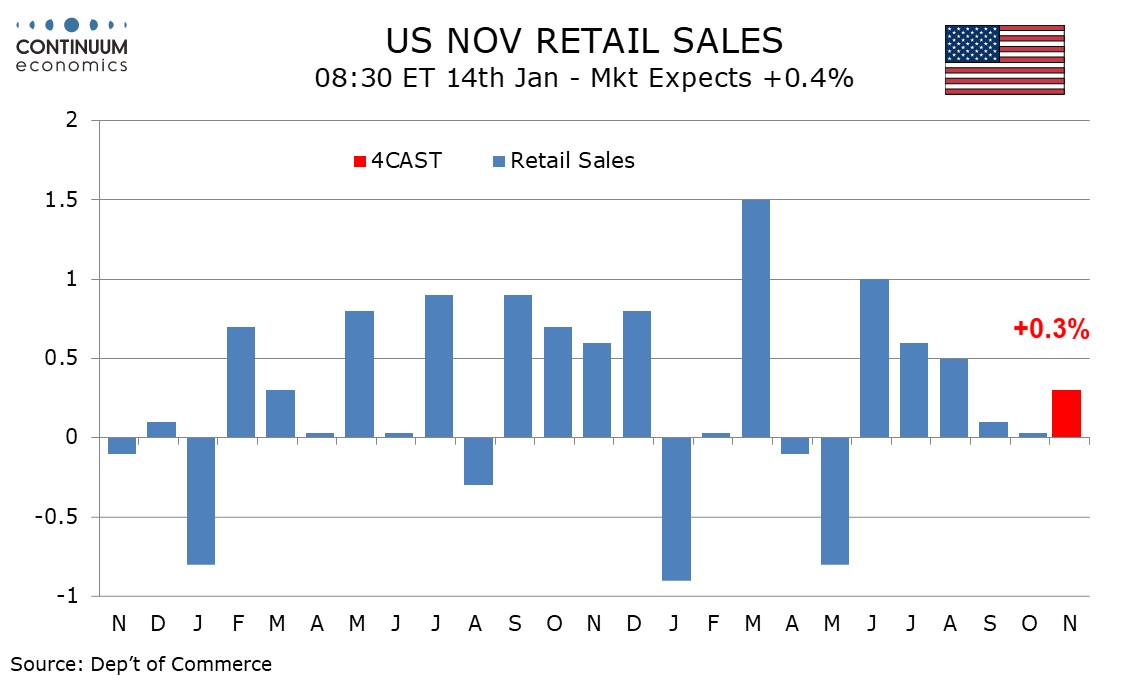

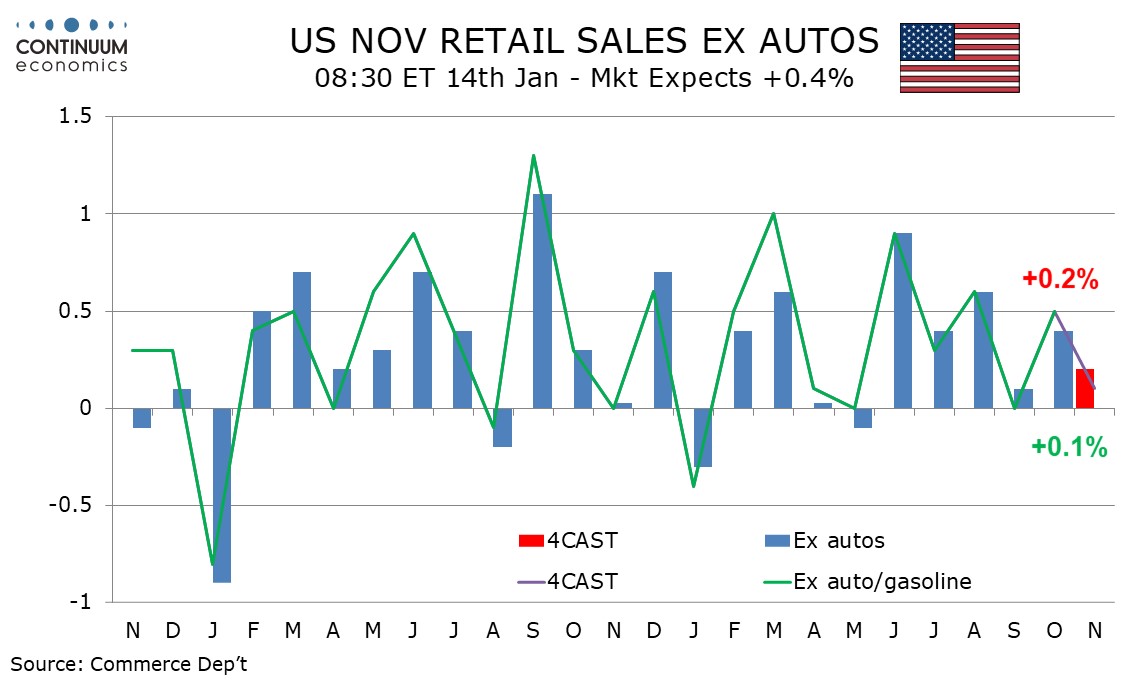

We expect a modest 0.3% increase in November retail sales, with positive contributions from autos and gasoline, Ex autos we expect a rise of 0.2% with ex auto and gasoline sales rising by only 0.1%.

The positive contribution from gasoline would be due to price increases, more than fully erasing a dip in October. CPI in November was mostly subdued however, suggesting prices will provide little boost to sales overall.

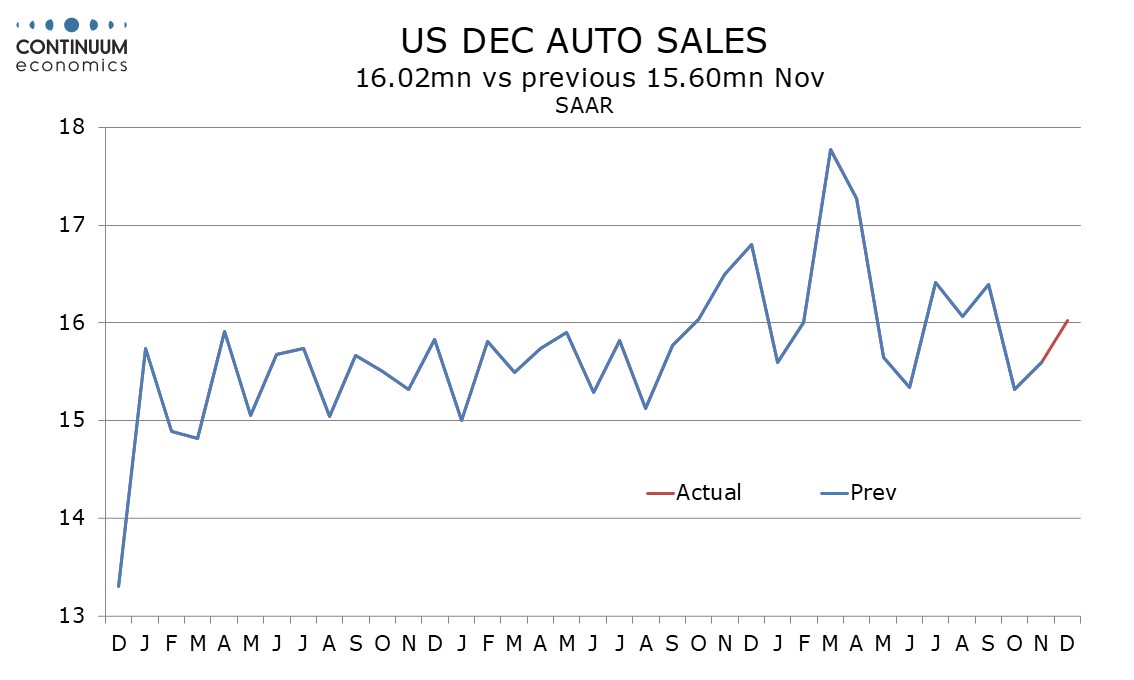

Industry data shows auto sales partially correcting a dip seen in October as a tax credit for electric vehicle purchases expired. Industry data hints at a further rise in auto sales in December.

Ex autos and gasoline we expect a 0.1% increase after a healthy 0.5% rise in October that followed a flat September. With Q3 consumer spending having significantly outperformed a flat outcome from real disposable income consumer spending is vulnerable to a slowing.

Overall sales with a 0.3% increase will be stronger than a flat October and a 0.1% increase in September, though that will leave three straight subdued months. However, with indications for December even ex autos somewhat firmer, the loss of momentum in Q4 looks set to be moderate.