South Africa’s Load Shedding Suspended for 121 Consecutive Days, but Risks Remain Alive

Bottom Line: Despite power cuts (load shedding) was a major headwind for South African economy in Q1, it appears the situation got better in Q2 as Eskom announced on July 26 that load shedding remained suspended for 121 consecutive days since March 26 reflecting an improvement in the reliability and stability of the generation coal fleet. We think there is still a risk that load shedding could return back due to likely hike in demand during colder periods and when major industries increase their production coupled with possible breakdowns of coal-fired power plants, unit repairs, and theft of electricity transmission infrastructure. We foresee the key in solving this issue will be new coalition’s determination and strong political will in accelerating energy investments and long-term electricity production, and the transition will take time.

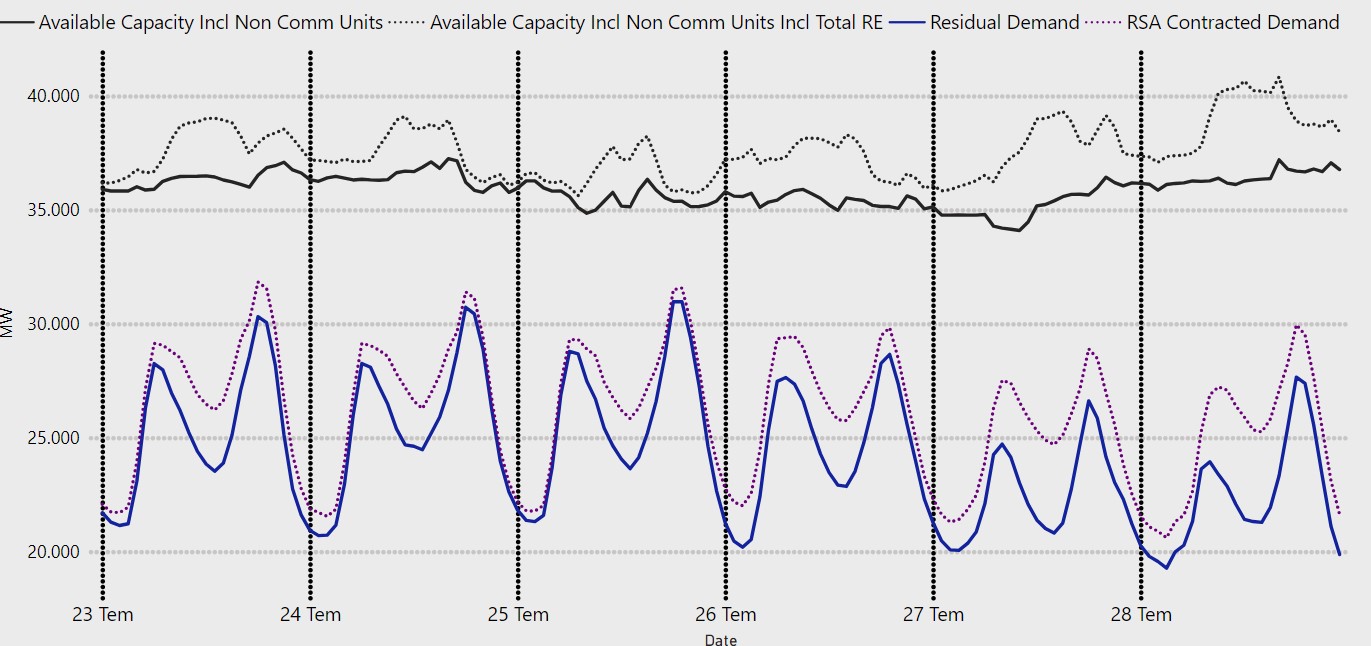

Figure 1: System Hourly Demand & Available Capacity, July 23 - July 29

Source: Eskom

(Note: When we compare hourly RSA contracted demand against available capacity to check what the amount of surplus/shortfall was in the past week; we see that available capacity matched with the total RSA contracted demand for specific periods during the day).

There is some good news for South Africa from the load shedding front particularly in Q2, after power cuts hurt the economy in Q1. Despite Stages 2 and 3 load shedding were implemented broadly in March, South Africa’s national electricity utility company, Eskom announced on July 26 that load shedding remained suspended for 121 consecutive days since March 26, reflecting an improvement in the reliability and stability of the generation coal fleet. Eskom indicated that the mentioned period included 87 days of constant supply throughout the winter period. The suspension helped businesses and households to relieve facing increasing costs from using alternative sources such as diesel backup generators.

Equally important, Eskom reached 35,000 MW of available capacity as of July 23 outstripping an evening peak demand of 30,740 MW, while this available capacity is the highest value since July 16, 2018. According to sources, Eskom achieved an average Energy Availability Factor (EAF) of 70% over the past ten days and it is looking to bring more units online by the end of 2024. (Note: According to Medium-Term System adequacy outlook 2024-2028 published by Eskom on October 30, 2023, Eskom had planned to reach the target of hitting an EAF of 65% by March 2024, and reaching 70% by March 2025).

In addition to the increase in available capacity, it is worth noting that rooftop solar is also contributing a significant portion of electricity generation mix as homes and businesses have recently added rooftop solar. Eskom data showed that there were about 2,264.5 MW of rooftop solar PV installed in South Africa as of July 2022, which increased to 5,790.5 MW of solar PV in 2024, demonstrating the spike in solar PV investments.

Speaking about the current stance of the power cuts, Eskom chairman Nyati recently said that Eskom sees light at the end of the tunnel and is confident that the permanent end of power cuts is near. Despite this, President Ramaphosa stated on July 23 that the electricity system is still vulnerable, and South Africa cannot yet rule out the possibility of further load shedding. Ramaphosa added that “We have been working closely with independent power producers in steering their projects through to the construction phase, contributing significantly to the reduction in the severity of load shedding.”

Taking into account that Eskom also highlighted that managing the morning and evening demand peaks has become increasingly difficult and had to implement load reduction, -which involves cutting back on electricity supply to high-demand areas to prevent infrastructure overload-, we think it is early to claim that the load shedding is behind. Despite recent recoveries, we think there is still a risk that load shedding could return back due to likely hike in demand during colder periods and when major industries increase their production coupled with possible breakdowns of coal-fired power plants, unit repairs, and theft of electricity transmission infrastructure.

We feel Eskom still needs to find a long-lasting solution to the crisis either by improving its power availability permanently via upscaling generation and EAF, or by reducing demand, and we think that it is not straightforward to improve availability or curb demand in the short run. We foresee the key in solving this issue will be new coalition’s determination and strong political will in accelerating energy investments and long-term electricity production, and the transition will take time.