BCB Minutes: Hawkish and Consideration over Hikes

The Brazilian Central Bank kept the policy rate at 10.5%, emphasizing a hawkish stance amidst global uncertainties and risk aversion. Inflation is projected at 3.2%, above the 3% target. The board remains cautious, with potential rate hikes if the economic situation worsens. A rate cut may be possible by year-end if inflation and economic activity slows down.

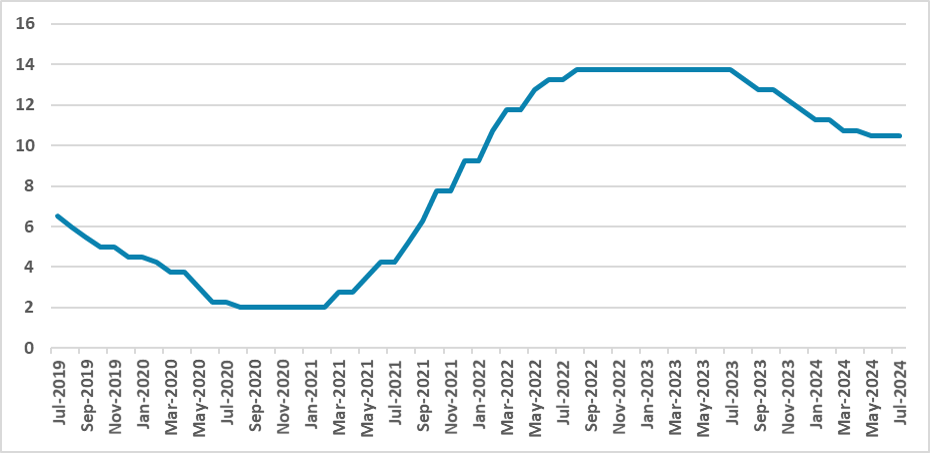

Figure 1: Brazil Policy Rate (%)

Source: BCB

The Brazilian Central Bank (BCB) has released the minutes of its last meeting, in which it kept the policy rate (SELIC) unchanged at 10.5%. Overall, the minutes reflect a more hawkish stance of the committee compared to previous ones. Regarding foreign markets, the BCB highlighted that the global environment remains adverse due to uncertainties about the easing cycle in the U.S. and the dynamics of inflation and economic activity in most countries. They also emphasized the risk aversion situation, which demands caution, especially from emerging markets, as the fundamentals of each country affect exchange rates to varying degrees. It is important to note that the meeting occurred before the recent sell-off in Japan, which increased volatility in global markets.

Due to the shift towards continuous targeting, the relevant horizon is now six quarters ahead. According to the BCB's projections, inflation is likely to end at 3.2%, which is above the 3% target. They noted that economic activity is showing greater dynamism than previously expected. The Committee also stated that there is no direct mechanical link between the Fed Funds rate and the SELIC, nor between the exchange rate and domestic interest rates. This means that neither the depreciation of the BRL nor a Fed rate cut in September will directly affect the BCB's decisions, unless these factors have a direct impact on inflation.

The committee expressed concern about unanchored expectations, which are now at 4.0% for 2024 and 3.8% for 2025. Most members stated that their risk assessments are now biased towards the upside. We see this as a result of higher inflation expectations for 2025 and the higher exchange rate levels.

The board unanimously voted to keep the policy rate unchanged and stated that monetary policy will need to remain in contractionary territory until inflation converges towards the target, including expectations. They also emphasized the importance of fiscal policy acting as a counter-cyclical instrument, sending a message to the government to pursue credible fiscal policies to mitigate the risks of increased disinflation costs. Finally, the committee mentioned the possibility of a rate hike, stating that if the economic scenario deteriorates, the BCB could increase the policy rate.

At 10.5%, the policy rate is clearly in contractionary territory, and inflation has not deteriorated significantly to the extent of requiring a hike. We believe that a hike would be premature at this point. We still expect inflation to cool down somewhat in the second half of the year alongside weakening economic activity, which would ultimately allow the BCB to cut rates at the end of the year. However, we will closely monitor whether these conditions materialize. So far, we see the hike comments as an intention to demonstrate the BCB board's commitment to inflation convergence.