Trump 2.0: Markets Guessing Policy Priorities

If Trump is elected president we still feel that the top priorities for implementation will likely be reducing immigration and making permanent tax cuts that are due to lapse in 2025. Trump would likely jawbone on all issues, but actual policy changes are more important for persistent moves in markets. The key is now the close race for the House of Representatives. A divided congress would make actual policy change more difficult and would occupy Trump’s focus, while GOP control of House and Senate could speed through key policies and allow focus on other issues. Actually ending the Ukraine war could likely be a 2025 or 2026 issue, while major tariff increases are more likely a 2026 implementation issue as Trump tries to soften up countries by tempering USD strength and trying to stop currency weakness by other countries. Uncertainty is high however, both given Trump previous unpredictability and his tendency to move towards the centre in elections and drift back to the right post-election.

Financial markets are actively debating what policies would be a priority if Donald Trump is elected U.S. president. The nomination of JD Vance as running mate, plus a Trump interview with Bloomberg, have raised expectations that a lower USD/China trade tariffs and quick end to the war in Ukraine could have high priority.

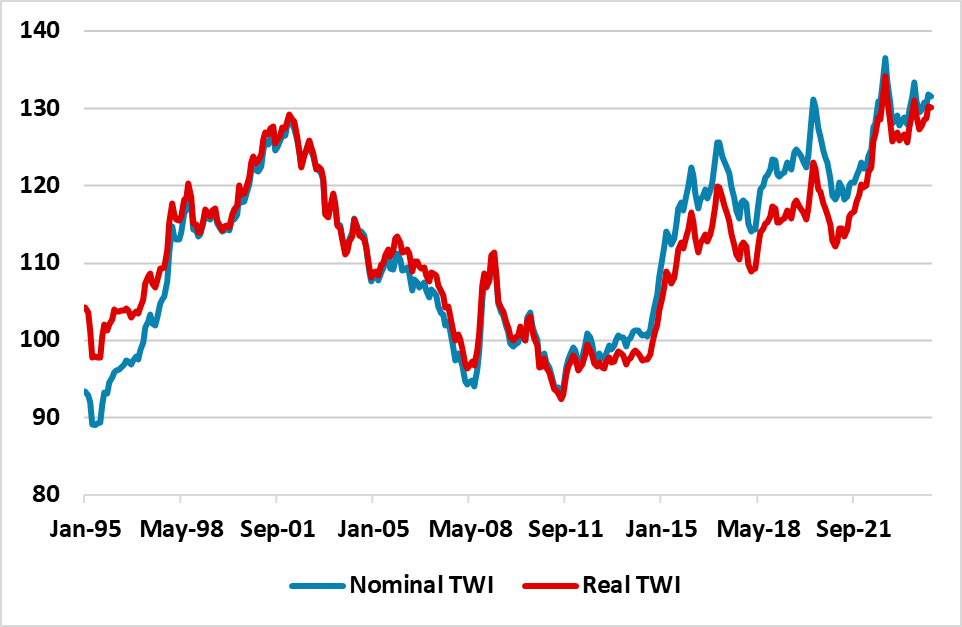

Figure 1: USD Higher Than Trump’s First Term (Yr/Yr %)

Source Datastream/Continuum Economics

JD Vance has noted a strong preference for end the Ukraine war, but also for a weaker USD and tariffs against China, which has sparked debate in financial markets now that Vance is Donald Trump’s running mate. However, Trump views are ultimately the most important and Wednesday Bloomberg interview (here) is a critical read for those trying to understand policy priorities if Trump is elected president. Key point we would make are the following

· House election is close and critical. Opinion polls suggest that the race for the House of representative is currently too close to call. In contrast, polls suggest that the Senate should be gained by the Republicans, while Trump maintains a modest lead even before the awful assassination attempt that might boost Trump chances by getting wavering GOP supporters to actually vote. We have held the view that the top two priorities if Trump is elected president were to get immigration down (given the importance to voters and the party) and make permanent the elements of the 2017 tax cuts due to lapse (Trump key 1 term policy success). A divided congress would make this more difficult and would occupy Trump’s focus, while GOP control of House and Senate could speed through these policies and allow focus on other issues. The scale of tax changes are also a function of House control, as a Democrat House would likely block new additional tax cuts.

· Fed Powell to serve term. Fears over Fed independence will likely be tempered by Trump acknowledgement that Powell will likely serve his full term until 2026. Additionally, Trump has sought to distance himself from Project 2025, which advocated replacing senior civil servants with Trump appointees – though some political analysts note that Trump tends to drift towards the centre before election and shift right post-election. Trump still wants lower interest rates, but this could end up being jawboning that does not impact Fed decision making. This could all soothe political interference concerns among foreign investors.

· End Ukraine war. Trump has long noted that he could quickly end the Ukraine war. Expectations are that this would be by dramatically reducing funding for Ukraine and forcing Ukraine to the negotiating table with Russia to try to get a settlement along current Ukraine territory held by Russia. While Europe would be outraged, internal divisions in Europe plus the unstable French and German governments likely means that Europe would be unable to fill the void from the U.S., this could increase geopolitical risk around Europe more generally – though we suspect that Putin would have to consolidate for at least 5 years if a peace deal were reached. Timing is probably 2025 given the Ukraine war is now moving slowly but Trump could be focused on the immigration and tax cut issues. However, multi-year Trump may ask some European countries to pay the U.S. for defense support, if they fall short of 2.0-2.5% of GDP military spending.

· Tariffs on China/Europe and lower USD. Trump views on China having unfair trade advantage means that threats would likely escalate towards China to resolve the trade deficit. However, we are not sure that any major tariff increases would occur in 2025, given it is better to threaten to get agreement – the 2018 trade war came well after Trump was elected. One option is to complain about a higher USD and weak Yuan, which came across in the Bloomberg interview. This would try to stop China weakening the Yuan as it did in 2018. It is also worth noting that Trump’s Bloomberg interview saw him complaining about a weak JPY and the large trade deficit with the EU. The USD is higher than Trump’s first term (Figure 1). This could mean that a future Trump administration tries to jawbone the USD lower, which is at odds with market expectations that Trump would be good for the USD. – based on higher inflation and hence higher for longer rates. Ultimately, the stance of Fed policy and relative interest rate differentials would be most important, which would be a function of the cyclical U.S. economic position and the sequencing of policy implementation by a future Trump administration. Lower immigration, avoiding tax cuts lapsing, plus a softer USD, could have some boost to inflation, but perhaps not as much as some U.S. Treasury players fear if tariff increases do not occur in 2025. We still see U.S. yield curve driven by Fed easing and medium-term fiscal concerns.

· Tough on China economic/less on Taiwan. Donald Trump has been reluctant to get involved in foreign wars and it is noticeable that he appears to be softening support for Taiwan and perhaps making it contingent on semiconductor production being shifted to the U.S. and/or Taiwan paying the U.S. for military support. This does not however mean Trump will be soft on trade with China and will make demands for a new trade pact.

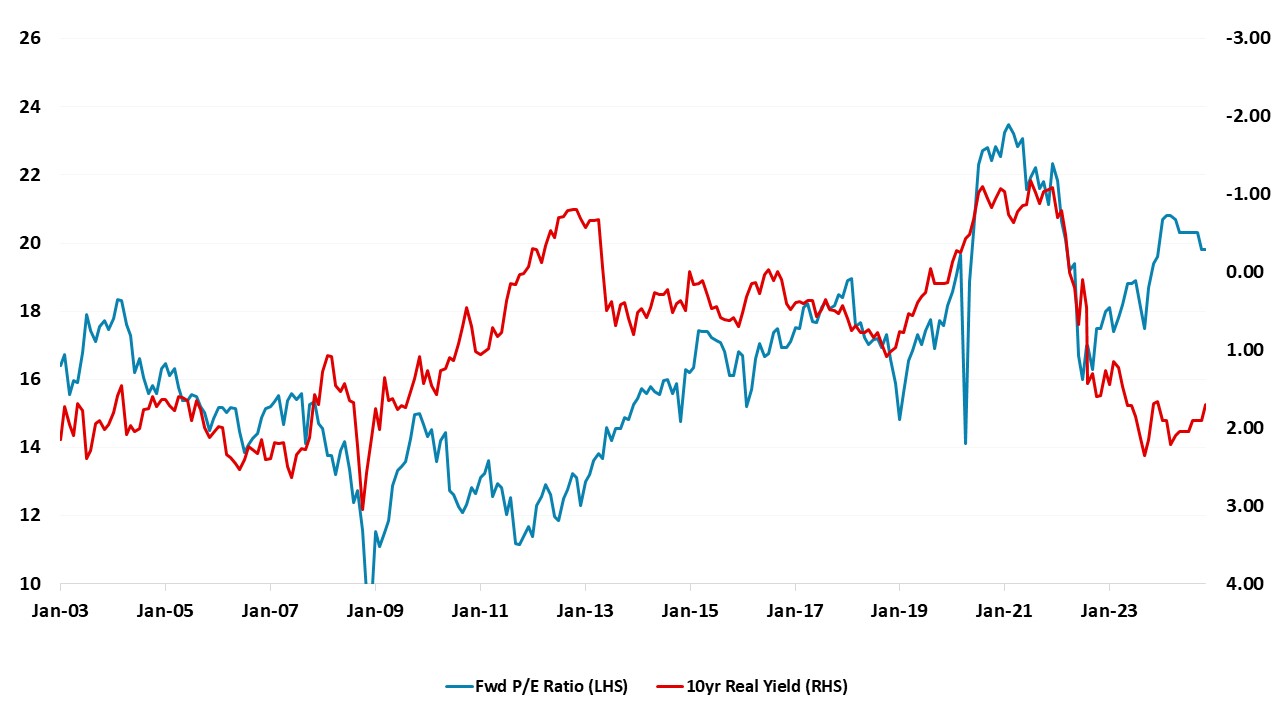

We will continue to monitor hints on Trump policies, alongside developments in the U.S. presidential and congress races but at this point we are not looking to make strategic changes to our June Outlook market views (here) of a softer USD; steepening yield curve and choppy U.S. equity market. U.S. equities are more overvalued than in Trump’s first term, but real 10yr yields are higher and largely discounting fiscal slippage (Figure 2).

Figure 2: 12mth Fwd S&P500 P/E Ratio and 10yr U.S. Treasury Yield Inverted (Ratio and %)

Source: Continuum Economics with forecasts to end 2024