Trump’s and Fed Easing

• Trump goal of substantially lower short-term rates could be achieved with a recession, but otherwise is unlikely even when Fed chair Powell is replaced. The majority of voting FOMC members will make decisions based on economics not politics. However, Trump fixation with lower rates and replacing Powell could end up hurt U.S. financial credibility further, especially if radical ideas are floated by Trump e.g. President reviewing FOMC decisions – though in reality the Senate would likely block radical institutional change.

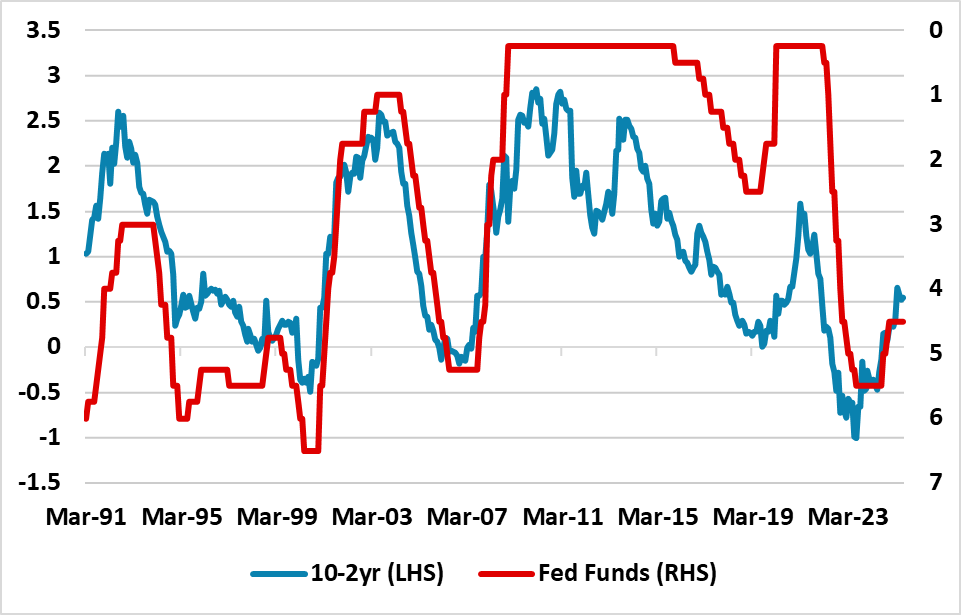

Figure 1: 10-2yr U.S. Treasury Yield Curve (%)

Source: Datastream/Continuum Economics.

President Donald Trump pressure on Fed Chair Powell has been tempered with the latest Trump soundbite that he is highly unlikely to fire Fed Chair Powell. Even so, the Trump administration pressure remains on the Fed chair over interest rates and renovations that could provide an excuse to fire the Fed chair early. Whether the renovations saga led to an early departure for Powell as Fed chair is possible and messy, but unlikely. Legal proceedings could also drag on and the supreme court cannot be guaranteed to side with Trump. Alternatively, it could be that Trump wants Powell and the Fed to take the blame from any surprise economic slowdown or that Trump wants to distract from the Epstein saga. However, the more interesting question is whether Trump can achieve his double desire of lower short and long-term rates.

Firing Fed Powell and replacing with an existing Trump loyalist e.g. Fed Waller could change leadership and probably get through the Senate banking committee, but may not change the voting patterns of the FOMC at each meeting. While the Fed chair does carry more weight than other FOMC members, a dovish Fed chair is unlikely to be able to swing all the regional Fed presidents sitting on the FOMC and remaining non-Trump favored Fed governors. Fed Waller and Bowman will likely lead pressure for lower policy rates through the summer, but Waller is talking about 25bps in July based on his interpretation of the data rather than a radical 50-100bps to get close to Trump desire of a 1.0-1.5% Fed Funds rate. While the economy is soft but not facing a hard landing, Fed easing later this year will likely come by consensus and be 25bps. We feel that it will be followed by three 25bps cut in 2026, as tariff produce a temporary rise in monthly CPI and PCE in the coming months but then return to normal into 2026. A dovish Fed chair could end up producing split votes more often and also hurting Fed credibility through a different message to the FOMC consensus. A dovish Fed chair might help to deliver quarterly cuts a bit quicker, but not achieve Trump goal.

Trump could look at more radical options, such as a non-credible uber dove that will push to cut interest rates aggressively. However, the senate banking committee could easily stop such a potential appointee, which would leave Trump fighting the senate banking committee or having to come back with a more credible person. Other options include appointing the U.S. Treasury secretary to the board; having FOMC decisions reviewed each meeting by the president or adding more Fed governors to swing the proportion of Trump supporting voters. All of these would require political consensus in Washington and most would fail to get sufficient support in the Senate. All of these would cause higher anxiety in financial markets that Fed credibility is being undermined. Already over the last few week 10yr breakeven inflation expectations have crept higher, which traders and fund managers says has been caused by Trump’s recent pressure on Powell.

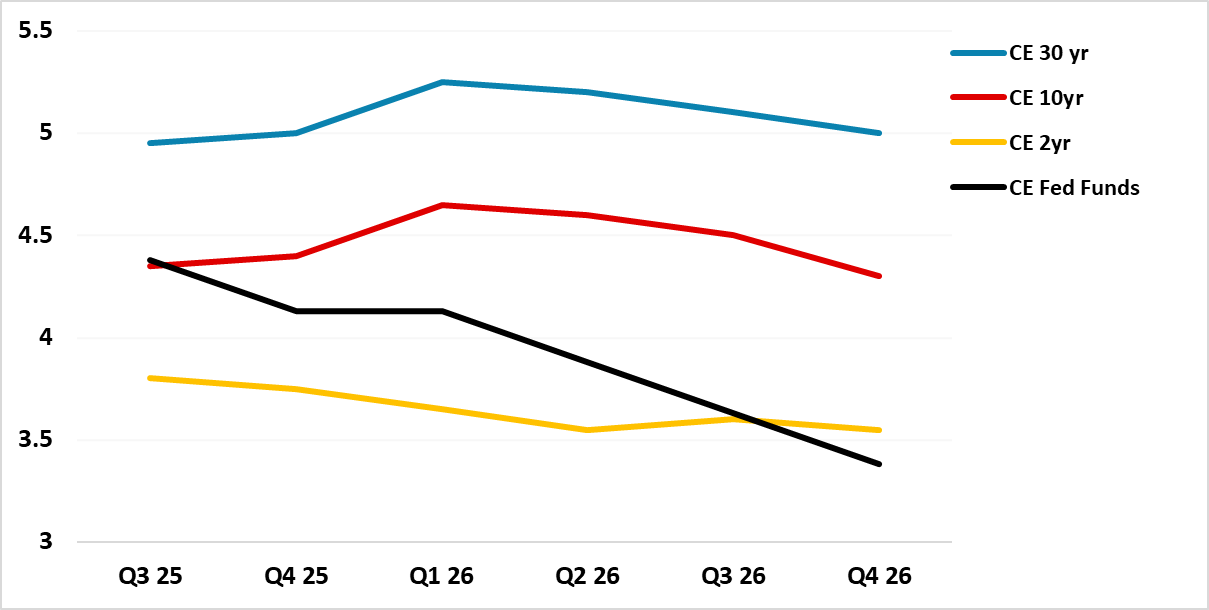

While the USD sold off earlier in the week on reports that Trump was looking to soon fire Powell, it is also worth watching the steepness of the U.S. Treasury yield curve. Firing Powell for example could produce a small to modest decline in 2yr yields, but could produce a rise in 10 to 30yr yields. As we highlighted in the June DM Rates Outlook (here), the 10-2yr (Figure 1) or 30-5yr curve is not historically steep. 2026 easing would naturally also see further yield curve steepening, as happens during easing cycles. Additionally, though 10yr real yields are around 2%, we feel that may have to be closer to 2.5% to finance a 6-7% budget deficit in 2026 and given that Trump pressure on the Fed will remain in 2026. This can keep to 10 and 30yr yields elevated (Figure 2).

Figure 2: 30, 10, 2yr U.S. Treasury and Fed Funds Forecast (%) Source: Continuum Economics.

Source: Continuum Economics.