FOMC Preview for July 30: No change given uncertainty on tariffs and their consequences

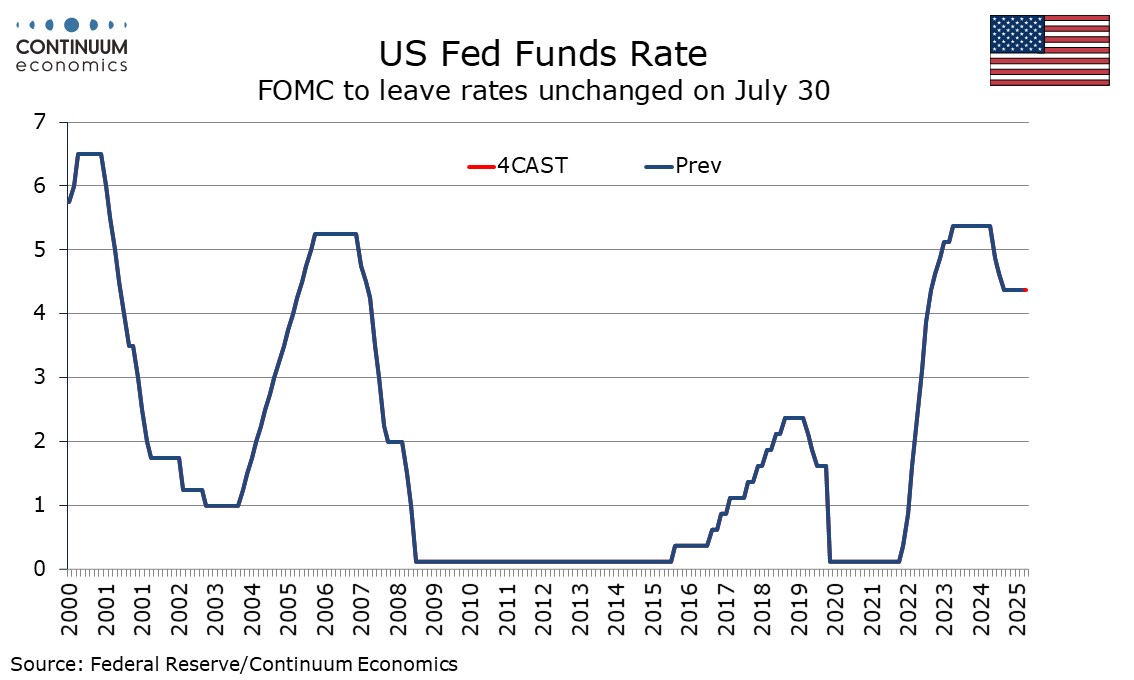

The FOMC meets on July 30 and recent data suggests no reason to move rates from the current 4.25-4.50% level, though Q2 GDP data due on the morning on the decision will impact the wording of the statement. This meeting will not see an update to the dots leaving focus on Chairman Powell’s press conference. This is likely to stress uncertainty over tariffs as justifying a wait and see stance.

At the last meeting on June 18 the FOMC stated that although swings in net exports have affected the data recent indicators suggest economic activity has continued to expand at a solid pace. Minutes from that meeting showed that Q2 GDP was expected to rise after a marginal drop in Q1, with continued growth in real private domestic final purchases. Net exports are set to bounce from a pre-tariff decline in Q1, but inventories are likely to provide some offset. If Q2 GDP surprises, the FOMC will need to reflect that in the statement, though underlying details will matter as well as the headline.

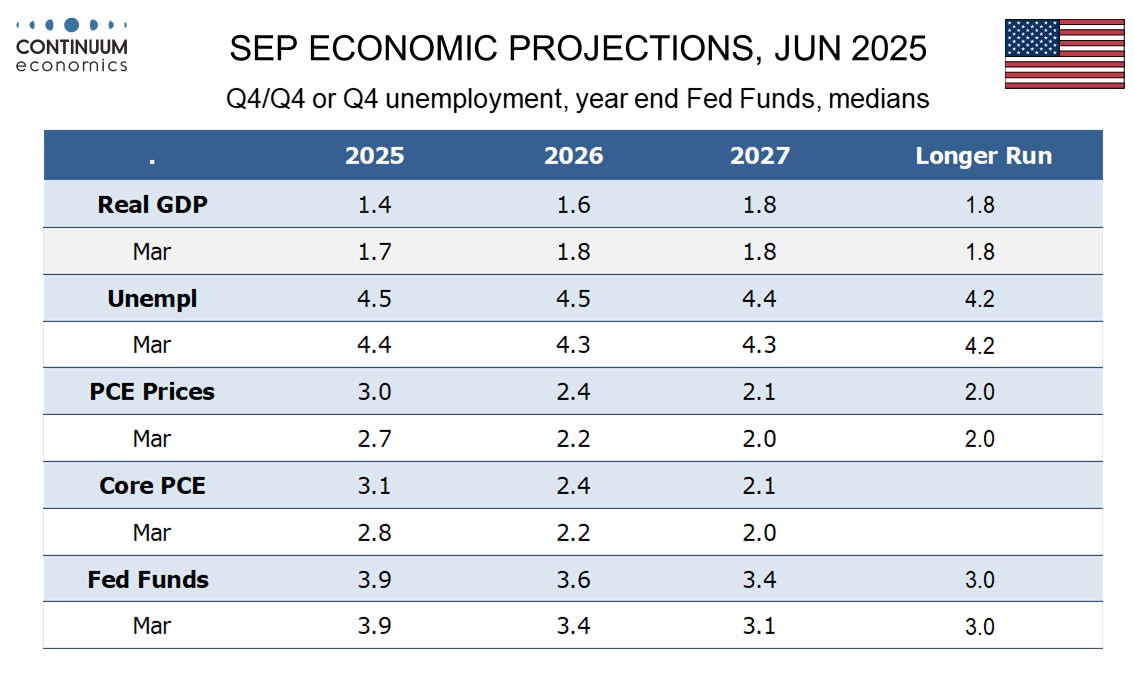

On June 18 the FOMC stated that unemployment remained low and labor market conditions remained solid. June’s employment report, where unemployment slipped to 4.1% from 4.2% sustains that. Inflation was described as remaining somewhat elevated. June CPI saw the core rate edge up to 2.9% from 2.8%. While the core rate was subdued on the month at 0.2%, there were signs of tariff-pass through in goods excluding autos, and with fresh tariff decisions due on August 1 the risk of future tariff-induced inflation remains significant. Indeed, a reference in the June statement to uncertainty having diminished is likely to be removed. It will continue to be described as elevated and may even be described as having increased.

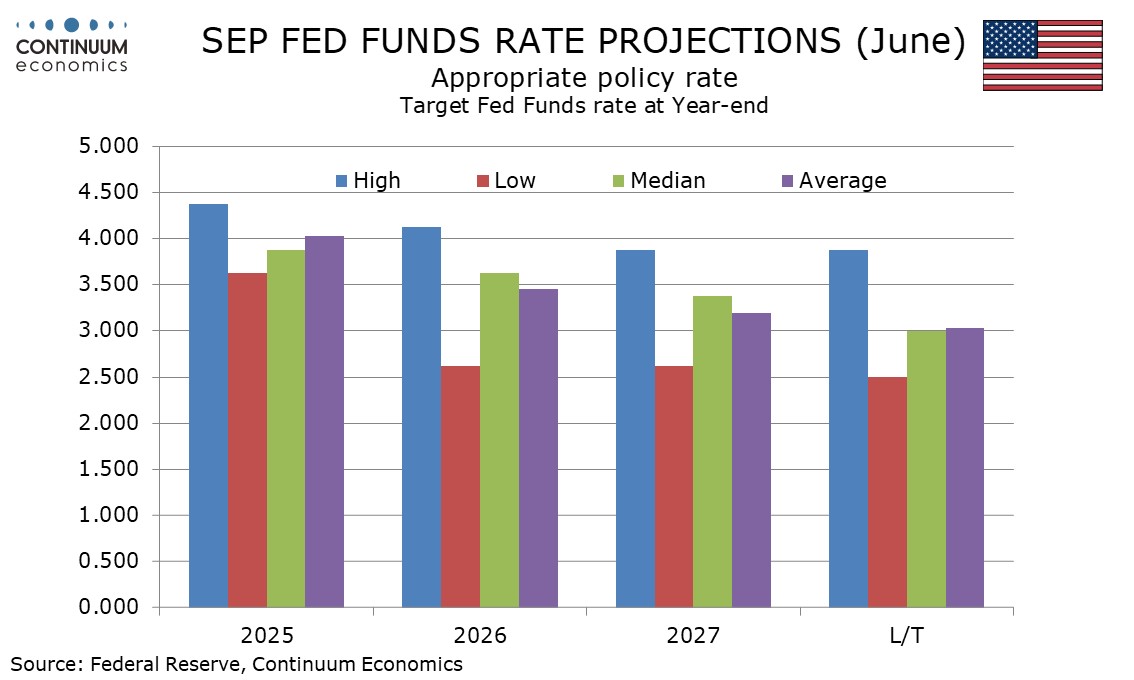

The rest of the statement, which left future policy decisions dependent on incoming data, the evolving outlook and balance of risks, is likely to see few changes. The vote for unchanged policy was unanimous in June and we expect it will be again in July, but markets should watch closely for any dissenting votes for easing. After June’s meeting Governors Waller and Bowman suggested easing could be seen in July, but after June’s inflation and employment reports, the case for such a move does not appear strong. Any votes for ease could be seen as politically influenced.

The political pressure to ease will be a focus at Chairman Powell’s press conference and he will tread carefully. Options will be left open for the next meeting in September, after which employment and CPI data for both July and August will have been seen. He may hint that easing is possible in September should inflation continue to show limited feed-through from tariffs or the labor market weakens, though he is unlikely to suggest that he expects either. In fact he will be watching tariff developments and incoming price data closely. If inflation picks up in Q3, the Fed is likely to remain on hold.