FOMC Minutes from June 18 - Doves in the minority

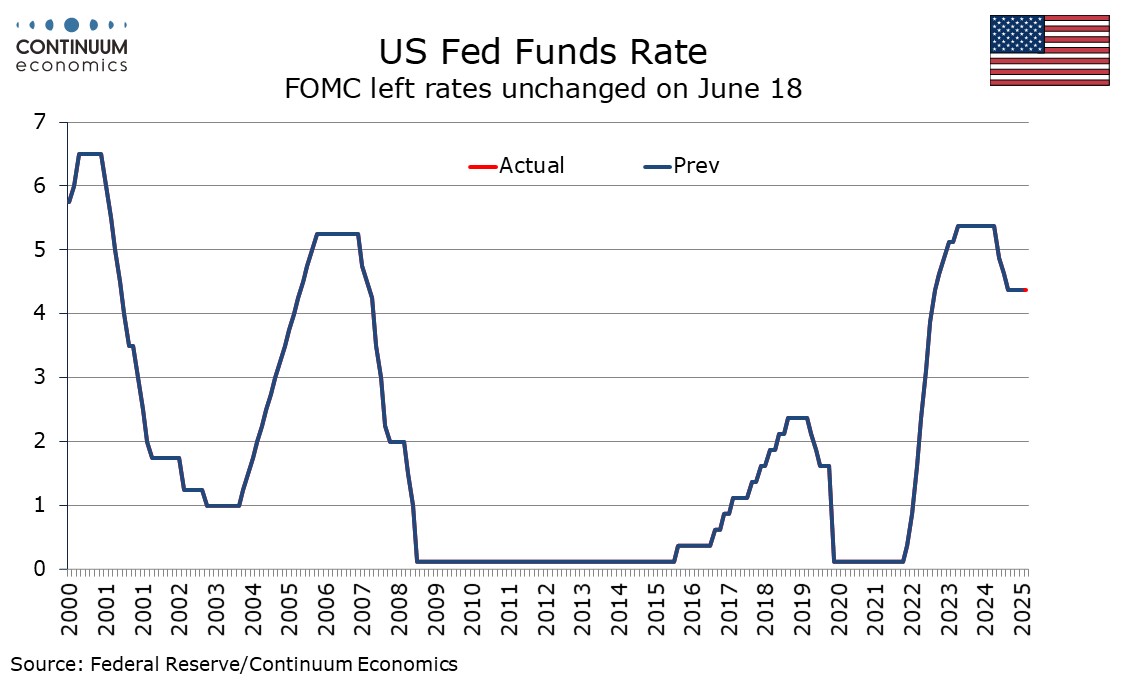

FOMC minutes from June 18 show agreement to leave policy at 4.25-4.50%, and general agreement that the FOMC was well positioned to wait for more clarity. While there was some debate over the future outlook, doves appear to be in the minority. A couple were open to easing at the next meeting in July, but that appears to have gone no further than Governors Waller and Bowman who publicly stated that was their view soon after the meeting.

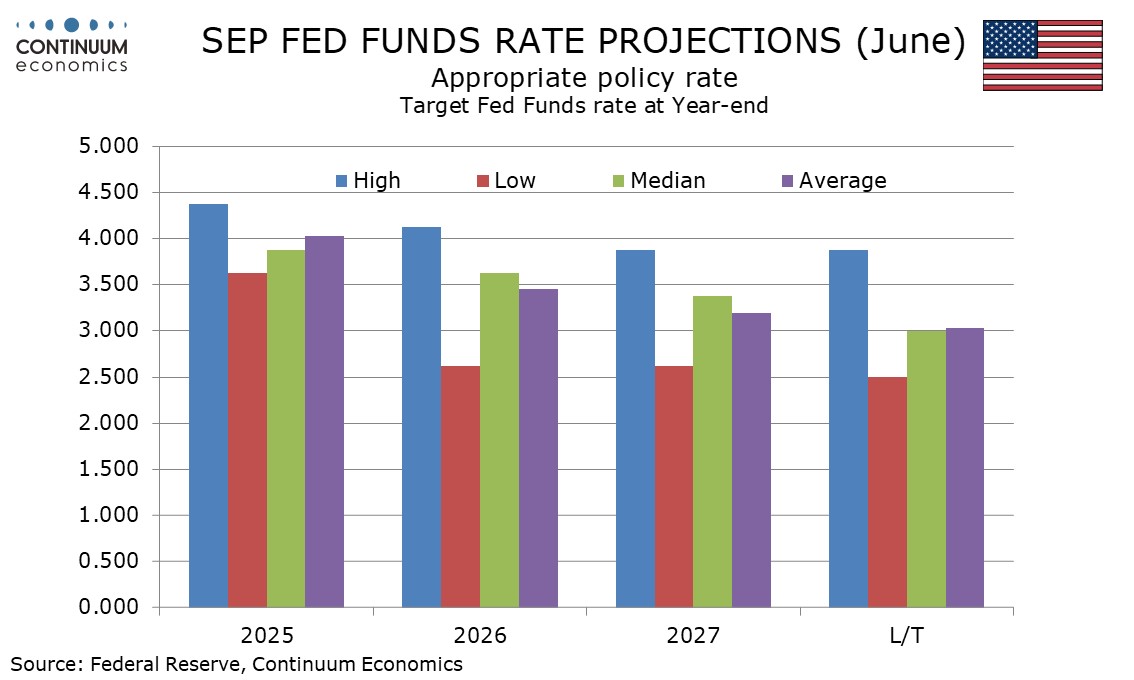

Some saw no easing this year and the dots show that there were seven of them out of nineteen participants. Several saw the current target range as not far above neutral, implying caution towards easing. Participants views on the likely rates path are not rigid, open to a more restrictive path than would otherwise be the case should tariffs generate a larger than expected increase in inflation, and a less restrictive path if the labor market was to weaken and inflation continues to fall. Participants agreed that risks of higher inflation and slowing activity had diminished since the May 7 meeting given scaling back of tariffs, but the hawks appear to outnumber the doves, with some seeing inflation risks as more prominent, whereas only a few felt that risks to the labor market were.

There was agreement that tariffs were likely to put upward pressure on inflation but uncertainty about the timing, size and duration. However only a few saw tariffs as having only a one-time impact and most noted risk that more persistent effects could be seen. Labor market conditions were judged as solid. Most expected tariffs or uncertainty to weigh on labor demand but only a few already saw signs of softness. The outlook was for continued economic growth though a majority expected the pace to moderate.

With the next meeting taking place on July 30, two days before the recent expected deadline for tariff decisions, it is unlikely that meeting will see uncertainty as having diminished further. Even if June CPI is weak, easing looks highly unlikely in July, particularly with unemployment having edged lower in June’s employment report, even if the detail of the report was mixed.