Taiwan: Gray Warfare After A Mixed Election

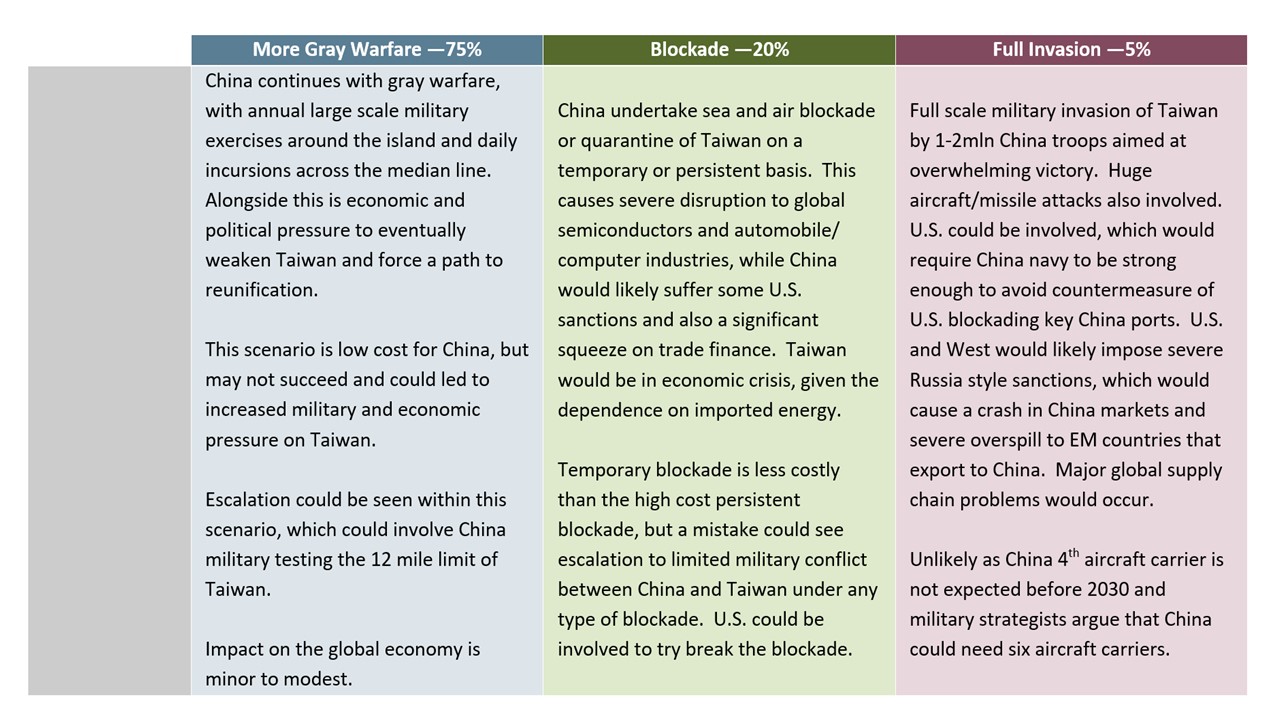

Bottom line: After the January 2024 Taiwan presidential election, the baseline (75% Figure 1) is for is for a continuation/esculation of the gray warfare before the new president takes power on May 20 and afterwards. This can gradual increase the pressure on Taiwan to move towards a political solution on reunification with China. It is also worth noting that the DPP will likely lose the majority in the 113 member legislative Yuan and the hung parliament or KTT control would weaken the DPP president even without China pressure. A full invasion remains high unlikely in the next 5 years as China military is not strong enough to ensure overwhelming victory. A blockade of Taiwan is possible (20%), but the economic costs could be huge for China and it could risk a limited military conflict could draw in the U.S. as well as Taiwan. President Xi control in China means that abrupt policy changes cannot be ruled out (e.g. abandoning zero COVID policies). A temporary multi day blockade could avoid these high costs for China.

With the Taiwan elections on January 13 expected to re-elect the DPP, and the U.S. focused on Ukraine and Middle East, how will the Taiwan situation develop after the election and in the coming years?

Figure 1: Taiwan Scenarios for the Next 5 Years

Source: Continuum Economics

More Gray Warfare Likely

China has been undertaking stepped up gray warfare since the 2022 visit of then U.S. house speaker Nancy Pelosi. This has involved almost daily incursions across the median line between China and Taiwan, which China had previously crossed infrequently. April 2023 saw large scale military exercise by China around Taiwan, as a follow-up to the August 2022 large exercise. China is also constantly probing Taiwan and flew a group of fighters to the 12 nautical mile limit with Taiwan in June 2023. How will the Taiwan situation change after January presidential election in Taiwan?

The expectation is that the Democratic Progressive Party (DPP) will secure victory in the upcoming presidential election in January 13 2024, ensuring policy continuity (William Lai is standing for the DPP in the presidential race). The opposition is split three ways, which should ensures the DPP victory. Attempt to have a joint candidate for the 2nd and 3rd largest parties in the presidential race (Taiwan People Party (TPP) and Kuomintang (KTT)) failed. It is also worth noting that the DPP will likely lose the majority in the 113 member legislative Yuan and the hung parliament or KTT control would weaken the DPP president without China pressure. Current opinion polls suggests that the KTT could get 56 seats and close to the 57 seat required for a majority. TPP is expected to get 6-8 seats, but is reluctant to form a coalition with KTT in parliament. Given the popularity of the opposition parties this could see the DPP getting less votes in the presidential race than 2020 and this could see China increasing pressure on Taiwan after the election. Thus the central prospect is for the current level of grey warfare to be maintained or intensified post-election and throughout2024. A lot of focus will be on whether China conducts large scale military exercises around Taiwan in spring 2024 before the new election takes power May 20.

Intensifying the military pressure on Taiwan could be an option that is used in 2024, but the prospect is that this will be incremental rather than a radical shift. One option is more frequent military exercises or more movement across the median line between China and Taiwan, but China can decide to gradually build pressure. Such a salami slicing increase in pressure suits China, as it falls short of a military conflict and it allows China to test how far it can go. One question is whether this could cause a miscalculation if China flies closer than 12 nautical miles, as Taiwan has promised a counterattack in self-defence. Then we would end up with a limited military clash that would send shockwaves around the world. Beyond 2024, the grey warfare will likely also increase incrementally, but military strategists are arguing that at some stage China could decide to dramatically increase tensions on Taiwan. Some political observers note that if a U.S. Republican president is elected in 2024, then China could face renewed trade pressures, but a re-elected Donald Trump (who gyrated between hot and cold toward Taiwan in 2016-17) could be less willing than President Biden to react to a severe escalation by China. Additionally, if President Xi stands for a new term in 2027, then some China political watchers feel that he could increase the pressure and then force the pace on reunification – though others argue that reunification is a goal by 2049 and hence allows time for a political change in Taiwan.

Blockade of Taiwan is another major option for China to escalate too. Most likely this would be a sea and air blockade, which is also sometimes referred to as a quarantine like Berlin in 1948-49. This is possible towards on a two to five year view and would cause major disruption to the global economy, given the dependence on Taiwan for advanced semiconductors. The global automobile and computing industries supplies of advanced semiconductors could be severely squeezed and cause curtailment of production and this could in itself have a major global economic impact. China is also currently dependent on Taiwan advanced semiconductors, which reduces the risk in the next few years until China scales up this industry. China would also most likely see a wave of sanctions in this scenario from the U.S. and G7 designed to hurt China, while global trade finance for China could be severly disrupted and impact imports and exports. Global supply chains risk then be thrown back to the worst of the pressures seen in 2020-21. Additionally, this option could force an escalation of military tension with the U.S. depending on who is the U.S. president, which could include the option of a U.S. attempt to break a sea or air blockade. In the worst case, attempts to break the blockade could cause a clash between U.S. and China military, which would cause huge shockwaves around the world. To avoid these heavy economic costs, one option for China is to have a temporary multi day blockade to disrupt, but avoid the heavier costs and risks associated with a more persistent blockade. Using economic logic would suggest a probability below 20%, but President Xi’s intentions are not clear and that is why we currently attach a 20% probability of this scenario over the next 5 years. President Xi for example abruptly shifted from zero COVID policies to an endemic policy in weeks, which shows that policy change can be radical rather than always incremental.

A full invasion military of Taiwan is now widely regarded as an unlikely option in the next five years. Some feel that China is getting closer, given that its missile and aircraft capability would be the crucial element in attacking Taiwan and potentially attacking U.S. air/sea forces. However, the majority of military thinkers still appear to feel that China needs more sea vessels with amphibious capabilities to mount a sea invasion of 1m-2m troops on the scale of D Day in 1944, which would be a massive military challenge. Additionally, it is now understood that if the U.S. becomes involved that they could use their large number of aircraft carrier groups to blockade key China ports and squeeze China from an economic standpoint. China needs more aircraft carriers, as it currently only has three. The U.S. Department of Defense report on China shows commitment to a significant scale up of the military by 2027 (here), though work has not started on China’s fourth aircraft carrier and thus is likely not due until at least 2030. Some military strategists also argue that China would require up to six aircraft carriers to counter the threat from the U.S. Politically, external observers contrast China’s goal of unification with it’s likely wanting to ensure that the odds are stacked toward military victory before launching an invasion. This argues against early action. Russia’s difficulties with a land-based invasion of Ukraine on balance will likely delay the option of invasion.

Meanwhile, a full scale invasion would likely see severe Russia style sanctions, which would materially disrupt China exports and imports; freeze China overseas FX in G7 countries and see foreigners fleeing China assets. China needs more resilience in the financial system and a stable/resilient economy and this will likely take years and on the economic front.

On balance, our baseline (75%) is for a continuation of the gray warfare at the current intensity or higher in the coming years.