China Data: Mixed Momentum and No MTF Cut Until October

Overall the May data suggests that enough momentum exists for Q2 GDP to be above 5.0% Yr/Yr, which given the Q1 GDP figure means that the odds are good that the 2024 5.0% GDP target can be meet. However, we see a softer of H2 GDP and 4.0% GDP in 2025, given weak domestic demand is unlikely to change without more government stimulus.

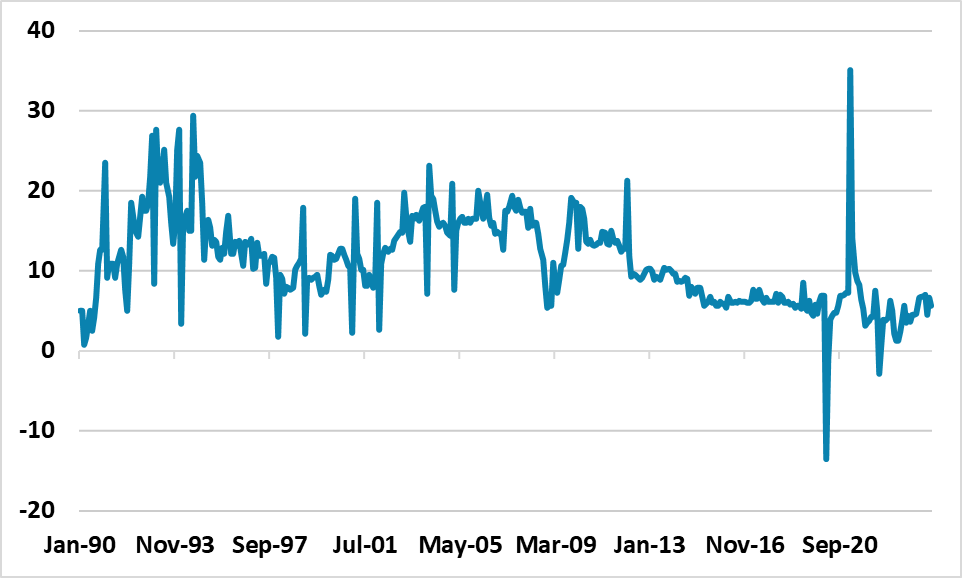

Figure 1: China Industrial Production (Yr/Yr %)

Source: Datastream/Continuum Economics

The May monthly data from China shows mixed momentum in the economy. Retail sales at 4.1% YTD Yr/Yr was higher than the 3.9% expectations, with catering/restaurants at 5.0% v 4.4% in May and a jump in a number of categories. However, the Labor day holiday period likely boosted retail sales and it was interesting that auto sales still remain weak at -4.4% Yr/Yr. We suspect that retail sales trends will soften in H2, given the lack of strong economic momentum and the cautious behaviour of private companies in hiring.

Industrial production came in weaker than expected at 5.6% YTD Yr/Yr, which is likely partially due to weak domestic demand. Auto production slowed to 7.6% versus 16.3% Yr/Yr, given the weak domestic auto sales. While the monthly export figures suggest that Chinese companies are increasing the export focus, the weakness of some areas of domestic demand will be a drag.

Turn to investment, Infrastructure investment remains healthy at 5.7% led by high tech manufacturing investment. However, the overall fixed asset investment at 4.0% YTD Yr/Yr continues to be dragged down by residential property investment at -10.1% YTD Yr/Yr. Home sales at -30.5% YTD Yr/Yr shows that the government measures have failed to spark life into household’s attitude to housing.

Overall, enough momentum exists for Q2 GDP to be above 5.0% Yr/Yr, which given the Q1 GDP figure means that the odds are good that the 2024 5.0% GDP target can be meet. However, we see a softer H2 GDP and 4.0% GDP in 2025, given weak domestic demand is unlikely to change without more government stimulus.

Some additional fiscal measures will likely be forthcoming, but the authorities will want to see the impact of the Yuan1trn of central government infrastructure that is only starting to kick in. On the monetary policy front, China decided not to cut the MLF rate at 2.50%, with the PBOC backed financial news reporting concerns about the Yuan and not wanting to squeeze banks interest rate margins. With the decision not to cut in June despite the signals from the Politburo and ultra-low inflation, it looks like the PBOC will now wait until the Fed cuts. We see the 1 Fed cut on September 18 and see the first MTF cut now in October by 10-15bps. We now see no further cuts in 2024 rather than the 30bps of MTF cuts previously forecast. A 25bps RRR cut will likely arrive in the next few months. However, the pace of monetary stimulus is unlikely to be enough to lift credit demand and this will also remain a drag into 2024.