Mexico: Political Noise Amplifies Market Fears Amid Sheinbaum's Win

Claudia Sheinbaum's election win was expected, but MORENA's strong victory was surprising. This led to market concerns, significant peso depreciation, and fears of anti-market policies under Sheinbaum's possibly more radical government. Lopez-Obrador's proposed judicial reforms added to market worries. Despite uncertainty, Mexico's dependence on U.S. trade may limit radical changes. The future of the peso and Mexican markets largely depends on upcoming U.S. elections, with concerns over potential policy shifts under a Trump administration.

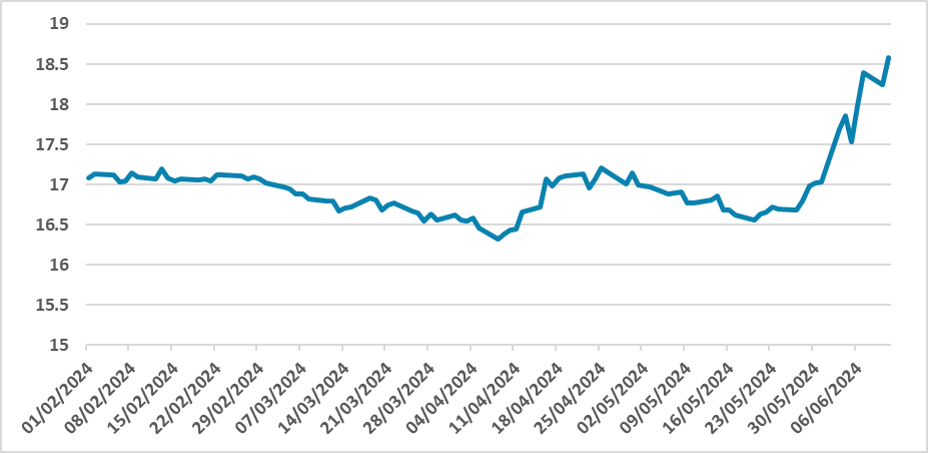

Figure 1: MXN/USD

Source: Refinitiv

The victory of Claudia Sheinbaum in the Mexican elections was widely expected by the markets, as most polls already pointed in that direction. However, the massive victory of the left-ruling party MORENA was unexpected. MORENA achieved a constitutional majority of 2/3 in the Chamber of Deputies but fell short by three seats to achieve a 2/3 majority in the Senate. However, a small number of members from the Movimiento Ciudadano could help them make constitutional changes. This changes the picture significantly, as Sheinbaum may not be a continuity of Lopez-Obrador's government, as most expected, but rather a more radical government, capable of changing the rules of the game in Mexico considerably.

This new scenario imposed a bad mood on the Mexican markets, with significant depreciation of the Mexican Peso (MXN) after the elections. However, this movement was exacerbated by recent announcements from Lopez-Obrador, who will try to approve the reform of the judicial system before the end of his mandate. Although this proposition will likely be vetoed by the current Congress, it made markets think that once the new Congress is installed, Sheinbaum will pursue anti-market policies, prompting another round of MXN depreciation.

We believe a significant majority of the markets will start to anticipate anti-market policies for Mexico and account for a significant deterioration of Mexican institutions. However, some factors still need to be considered. Mexico highly depends on its trade with the U.S., and the free trade deal has several clauses of fair competition, which could be a check and balance for anti-market reforms. Moreover, it is yet unclear which type of policies Sheinbaum will pursue. For now, the turmoil in the market seems more related to market pessimism and the notion that U.S. interest rates will remain high for longer, rather than any actual anti-market policies in Mexico.

More important for the future of Mexico will be the results of the U.S. elections, as a Trump administration could jeopardize U.S.-Mexico relations. We believe the result of the U.S. elections could prompt the MXN to remain above the 19 MXN/USD mark. For now, we do not see the MXN recovering below the 18 MXN/USD mark until the end of the year. We also don’t see much room for Banxico to cut the policy rate, as the inflationary risk from MXN depreciation is high.