Emerging Markets

View:

September 08, 2025

New GST Slabs to Boost Demand as India Faces 50% US Tariffs

September 8, 2025 6:45 AM UTC

India’s landmark GST 2.0 reform, effective 22 September 2025, simplifies slabs to 5% and 18%, with a 40% rate for sin goods. By easing prices on essentials and mid-market products, the move aims to boost demand and partially offset the drag from US tariffs of 50% on Indian exports. While household

Modi in China: Eurasian Diplomacy Meets US Tariff Tensions

September 8, 2025 6:02 AM UTC

Prime Minister Modi’s visit to Tianjin for the SCO Summit underscored India’s pursuit of strategic autonomy—engaging China and Russia while reaffirming ties with the US. Publicly, India backed Eurasian financial and connectivity initiatives, while tactically reopening dialogue with Beijing. Fo

September 02, 2025

Protests Return to Jakarta—No Threat to Regime, But Signal to Watch

September 2, 2025 12:41 PM UTC

Indonesia’s recent protests are not just about housing allowances—they reflect deeper disillusionment with elite politics. The government may contain unrest in the short term, but the structural issues driving dissent will persist. For businesses and investors, expect periodic social volatility,

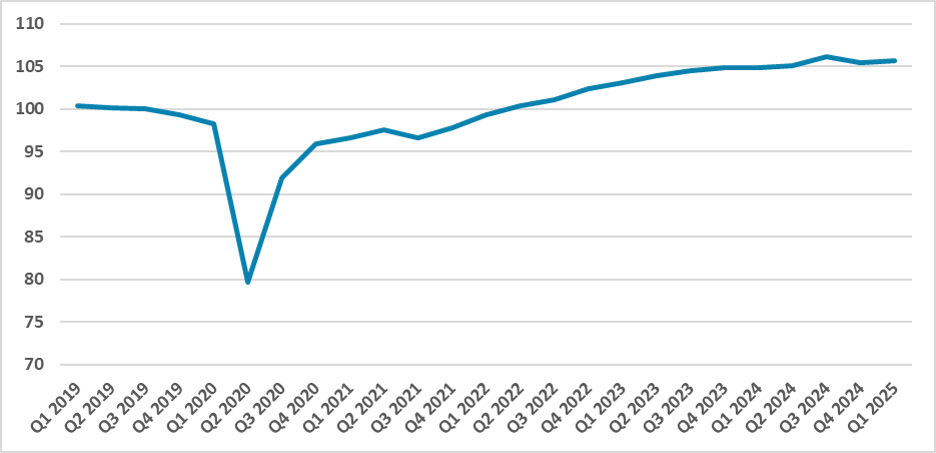

India GDP Review: Public Spending and Services Lift India’s Growth to Five-Quarter High

September 2, 2025 6:45 AM UTC

India’s economy grew 7.8% y/y in Q1 FY25, beating expectations. Strong gains in construction, services, and agriculture underpinned the recovery, while private consumption and investment remained subdued. However, sustaining momentum in FY26 will hinge on broad-based demand and improving global co

August 29, 2025

India GDP Preview: Q1FY26 Growth - Services Surge, Industry Slows: India’s Uneven Q1 Recovery

August 29, 2025 4:49 AM UTC

India’s economy likely grew 6.6% yr/yr in Q1 FY26, down from 7.4% in the previous quarter, as weak private investment and soft industrial output offset robust government spending. Growth was buoyed by strong public capex and resilient services, while manufacturing lagged. Full-year GDP is forecast

August 25, 2025

Tariffs and Tensions: India–US Trade Talks Stalled as Relations Sour

August 25, 2025 6:25 AM UTC

India–US relations have entered a tense phase after Washington doubled tariffs on Indian exports to 50%, the steepest duties applied to any US trading partner. The move, tied to India’s record Russian oil imports, has derailed trade talks scheduled for late August. With USD 87bn in exports at ri

August 21, 2025

Bank Indonesia Delivers Surprise Second Rate Cut to Shield Growth

August 21, 2025 5:10 AM UTC

BI is opting for early stimulus while macro buffers remain strong—stable rupiah, low inflation, and manageable deficits. However, this window may close quickly if external risks materialise. Business leaders should expect a monetary pause in Q3, but prepare for moderate volatility if inflation or

August 19, 2025

Rate Hold Expected as Bank Indonesia Eyes H2 Trade Risks

August 19, 2025 6:26 AM UTC

With headline inflation still well-contained, core pressures softening, and the economy showing signs of resilience, Bank Indonesia is expected to keep rates on hold. Further easing may come later in H2—but only if external risks re-intensify or domestic growth falters.

August 13, 2025

India CPI Review: Headline inflation drops sharply on account of food prices

August 13, 2025 7:38 AM UTC

India’s retail inflation fell to 1.55% yr/yr in July 2025, its lowest since 2017 and below the RBI’s 2–6% target band for the first time in over six years. The drop was driven by a sharp contraction in food prices, even as edible oil and fruit inflation remained elevated. With inflation well b

August 08, 2025

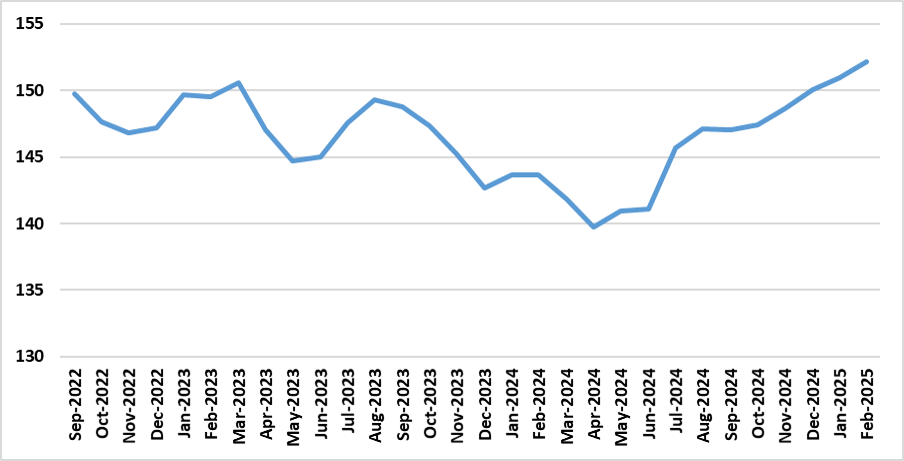

Mexico: Further 25bps Cuts Ahead

August 8, 2025 6:44 AM UTC

Banxico forward guidance, plus trade policy risks with the U.S. now see us forecasting an end 2025 policy rate at 7.25% with two 25bps cuts in September and December. We now feel that the risks to 2026 growth will encourage Banxico to move the policy rate down to 6.5% by spring 2026 by two 25bps rat

August 06, 2025

No Rush to Ease: RBI Flags External Risks, Holds Policy Steady

August 6, 2025 4:39 PM UTC

The RBI held the policy rate at 5.5% in its August 2025 meeting, opting for a strategic pause after front-loading 100bps of cuts earlier this year. While inflation has dropped sharply, global trade risks and sticky core prices argue against further easing for now. The central bank’s neutral stance

August 05, 2025

Indonesia Q2 GDP Beats Expectations

August 5, 2025 9:45 AM UTC

Q2’s outperformance gives Indonesia’s economic planners breathing space. Investment recovery is a strong positive signal, but sustaining growth in H2 will depend on policy agility, export resilience, and keeping domestic consumption robust.

August 04, 2025

Tariffs and Tensions: India Holds Its Ground Amid US Pressure

August 4, 2025 5:17 AM UTC

India has responded firmly to US tariff escalation, defending its strategic autonomy on Russian oil and domestic market protections. The economic hit is manageable, but the geopolitical signal is clear: India won’t yield under pressure. Talks will continue, but New Delhi won’t trade core interes

RBI to Hold in August as Policy Cycle Enters Pause Phase

August 4, 2025 4:00 AM UTC

The upcoming RBI August meeting is not about action, but observation. With macro indicators largely aligned and risks tilting toward caution, a rate hold by the RBI is expected. Inflation remains subdued, but growth is resilient—requiring no immediate policy move

August 03, 2025

Indonesia’s Trade Surplus Widens Sharply in H1 2025 Despite Tariff Headwinds

August 3, 2025 4:43 PM UTC

Indonesia’s June trade numbers reflect a strong first-half export performance, bolstered by frontloading ahead of US tariffs. The 62-month surplus streak highlights ongoing resilience, but softer trade momentum in H2 is anticipated as the tariff impact begins to filter through.

Indonesia’s July CPI Rises on Food Prices, But BI Still Has Room to Ease

August 3, 2025 3:27 PM UTC

Despite a food-driven uptick in July CPI, Indonesia’s inflation remains comfortably within Bank Indonesia’s target range. BI retains room to cut rates further in H2—though global uncertainty, particularly around US trade policy and Fed moves, may temper the pace of easing.

July 28, 2025

Indonesia’s 2026 Blueprint: Growth Goals Amid a Shaky Global Backdrop

July 28, 2025 5:54 AM UTC

Indonesia’s newly approved 2026 macroeconomic framework targets robust growth, fiscal discipline, and poverty eradication. However, external headwinds—including unresolved US tariff risks—and tepid domestic consumption pose serious execution risks. Without sharper prioritisation and institutio

The India–UK Free Trade Agreement: Big Win or Big Gamble?

July 28, 2025 4:37 AM UTC

India and the UK have signed a landmark Free Trade Agreement aimed at doubling bilateral trade by 2030. The deal grants India near-total duty-free access for its goods, boosts prospects for agriculture, textiles, and services, and safeguards sensitive sectors. It also signals New Delhi’s evolving

July 24, 2025

No Deal Yet: India–US Trade Talks Stretch Beyond August Deadline

July 24, 2025 5:42 AM UTC

India and the US have made progress in negotiations for an interim trade deal, but key sticking points—particularly around agriculture and autos—remain unresolved ahead of the August 1 deadline for new US tariffs. President Trump’s tariff-first strategy has pushed India to seek partial relief,

July 17, 2025

Deal or Dilemma: What the US–Indonesia Trade Pact Really Means

July 17, 2025 5:46 AM UTC

The US–Indonesia trade deal marks a significant geopolitical and economic pivot, reducing a threatened 32% tariff to 19% in exchange for USD 34bn in US imports and open market access. While the agreement offers Jakarta temporary relief, it locks the country into a transactional trade model amid ri

July 15, 2025

Tax Shortfalls and Slow Growth Complicate Indonesia’s Budget Plans

July 15, 2025 3:05 PM UTC

Indonesia’s fiscal position is coming under renewed strain, as weaker-than-expected revenue collection forces the government to widen its 2025 budget deficit to 2.78% of GDP—above initial targets but still below the legal threshold. Delays in VAT implementation, falling commodity prices, and mod

Solid Buffers, Soft Spots: India’s Debt Metrics in Focus

July 15, 2025 12:00 PM UTC

India’s fiscal metrics for FY26 show strong early gains, with a sharply lower deficit and robust revenue support from RBI dividends and capital spending. Externally, the country’s debt levels have risen but remain manageable, backed by healthy reserves and a low debt-to-GDP ratio. However, short

India CPI Review: CPI at 2.1%: Increased Headroom for One More Cut

July 15, 2025 4:33 AM UTC

India’s retail inflation dropped to a six-year low of 2.82% in May, driven by easing food prices and supported by favourable base effects. While disinflation continues to create monetary space, RBI's next rate cut will be data driven.

July 11, 2025

High Stakes and Heavy Metals: The Geopolitics of the US–Indonesia Tariff Deal

July 11, 2025 7:37 AM UTC

As the U.S. sharpens its protectionist stance, Indonesia is scrambling to avert a 32% tariff by offering a USD 34bn investment-anchored trade package, including energy and agricultural imports, Boeing orders, and sovereign wealth fund commitments. This negotiation goes far beyond trade—it is a hig

Negotiating the Fine Print: India’s Calculated Stance in US Tariff Talks

July 11, 2025 7:29 AM UTC

India and US continue to negotiate a favourable deal with August 1 as a firm deadline. India will remain unwilling to compromise on key sectors such as agriculture and dairy but concessions for auto sector are likely. However, no deal will be signed without certain benefits for Indian exporters as w

July 03, 2025

Indonesia CPI Review: CPI Inches Up, But BI Still Has Room to Ease

July 3, 2025 8:12 AM UTC

Indonesia’s inflation edged up to 1.87% yr/yr in June on higher food prices, but overall price pressures remain subdued. With CPI well within Bank Indonesia’s target range and growth momentum softening, the central bank retains room to cut rates again in the second half of 2025.

June 24, 2025

Asia/Pacific (ex-China/Japan) Outlook: Slower Trade, Softer Inflation, and Looser Policy

June 24, 2025 9:24 AM UTC

· Asia’s growth profile in 2025 reflects a region navigating structural transition amid external strain. Investment-led economies like India are benefitting from infrastructure spending, industrial policy momentum, and political continuity. In contrast, trade-reliant markets such as V

June 16, 2025

BI Likely to Keep Rates Unchanged Amid Global Volatility

June 16, 2025 5:41 AM UTC

Bank Indonesia is expected to hold rates at 5.50% in June after two cuts earlier this year, opting for a pause amid global uncertainty. Subdued inflation and a stable rupiah provide policy space, but the central bank is likely to wait for clearer signals from the Fed. A fresh rate cut remains likely

June 13, 2025

India CPI Review: CPI at 2.82%: Disinflation Deepens, But Risks Linger

June 13, 2025 7:18 AM UTC

India’s retail inflation dropped to a six-year low of 2.82% in May, driven by easing food prices and supported by favourable base effects. While disinflation continues to create monetary space, RBI's next rate cut will be data driven.

June 04, 2025

Indonesia CPI Review: CPI Moderates Making Room For Rate Cut

June 4, 2025 9:55 AM UTC

Indonesia’s inflation slowed further in May, while the country’s trade surplus narrowed to its lowest level in five years, deepening expectations that Bank Indonesia (BI) could pursue additional rate cuts later this year to cushion slowing domestic growth.

June 02, 2025

India GDP Review: Growth Outpaces Expectations as Q4 GDP Hits Four-Quarter High

June 2, 2025 11:56 AM UTC

India’s economy grew 7.4% y/y in Q4 FY25, beating expectations and capping full-year growth at 6.5%. Strong gains in construction, services, and agriculture underpinned the recovery, while private consumption and investment strengthened. However, sustaining momentum in FY26 will hinge on broad-bas

May 23, 2025

India Q4 FY25 GDP Preview: Growth Rebounds, But Underlying Demand Still Uneven

May 23, 2025 3:43 PM UTC

While the Q4 FY25 GDP figures indicate a rebound, the sustainability of this growth is uncertain. The economy's heavy dependence on government spending raises concerns about long-term fiscal health. India's economic recovery in Q4 FY25 reflects a partial rebound facilitated by government expenditure

India CPI Review: Soft Inflation Persists, RBI Gets Breathing Room

May 23, 2025 10:31 AM UTC

India’s retail inflation dropped to 3.16% in April, its lowest since July 2019, led by falling food prices and broad-based disinflation. With CPI below target for a third month, the RBI is poised for more rate cuts amid slowing global growth.

BI Cuts Rates to Cushion Growth Slowdown as Inflation Stays Benign

May 23, 2025 10:23 AM UTC

Bank Indonesia cut its benchmark rate by 25bps to 5.50% in May, citing subdued inflation and stabilising currency conditions. With Q1 growth slowing to 4.87%, the central bank has shifted focus to supporting domestic momentum, signalling potential for further easing in the second half of 2025.

May 12, 2025

Ceasefire or Reset? India Redraws the Rules

May 12, 2025 6:05 AM UTC

India and Pakistan have entered a fragile ceasefire after a week of precision strikes, drone warfare, and missile exchanges. But New Delhi’s clear message—that future terror attacks will be treated as acts of war—marks a strategic shift. Deterrence in South Asia has a new author, and India is

May 09, 2025

A Windfall with Caveats: RBI’s Likely Record Dividend

May 9, 2025 2:00 PM UTC

India is set to receive a record INR 3–3.5tn dividend from the RBI, offering a fiscal cushion amid softening tax revenues and rising geopolitical tensions with Pakistan. While this windfall may help the government stick to its 4.4% fiscal deficit target for FY26, it also highlights India’s growi

India CPI Preview: Cooling Prices, Warming Room for Rate Cuts

May 9, 2025 9:48 AM UTC

India’s retail inflation likely fell to 3.2% in April, its lowest since 2019, driven by a sharp decline in food prices. The benign inflation print strengthens the case for another RBI rate cut as growth momentum softens.

Deterrence on a Deadline: India, Pakistan, and the New Escalation Paradigm

May 9, 2025 6:29 AM UTC

India and Pakistan are now embroiled in their most serious military confrontation in years, with hostilities expanding across air, land, and unmanned domains. Following the May 7 cross-border strikes under Operation Sindoor, India launched a calibrated military offensive on Thursday targeting Pakist

May 08, 2025

Indonesia’s Q1 GDP Disappoints, Deepening Case for Rate Cut

May 8, 2025 8:05 AM UTC

Bottom line: Indonesia’s Q1 GDP growth slipped to 4.87% yr/yr, missing the 5% target as public spending declined. Household consumption edged down and fixed investment declined sharply. Looking ahead, Q2 may bring further softening.

May 06, 2025

Transit Revoked, Ties Recalibrated: What Bangladesh's Pivot Signals

May 6, 2025 5:32 AM UTC

India’s revocation of transhipment access to Bangladesh marks a broader shift in bilateral ties, driven by Dhaka’s strategic pivot towards China and Pakistan. The move reflects India’s growing unease over regional security and the erosion of mutual trust post-regime change in Dhaka. For India,

Standoff Renewed: India and Pakistan Edge Closer to the Brink

May 6, 2025 3:33 AM UTC

India–Pakistan tensions have sharply escalated following a deadly terror attack in Kashmir, prompting sweeping diplomatic, military, and economic measures on both sides. New Delhi has ordered mock civilian defence drills and restricted the flow of river Chenab. Additionally, ceasefire violations a

April 30, 2025

Mexico’s GDP Review: Saved from the Technical Recession, but Growth Slows

April 30, 2025 2:52 PM UTC

Mexico narrowly avoided a technical recession in Q1 2025 with 0.2% GDP growth, driven by a volatile rebound in agriculture. However, industrial output contracted and services stagnated, highlighting a broader economic slowdown. Uncertainty over potential U.S. tariffs and tight monetary and fiscal po

April 28, 2025

Argentina: Activity Continues Growing

April 28, 2025 1:15 PM UTC

Argentina’s economy grew 2.3% in February and 6% year-on-year, showing continued short-term recovery driven by financial and mining sectors. However, rising imports and an overvalued exchange rate are straining reserves, despite IMF support. While agricultural exports may ease pressure mid-year, s

From Tariffs to Technology: JD Vance’s Four-Day Engagement in India

April 28, 2025 6:24 AM UTC

US Vice President JD Vance’s visit to India marked a shift toward a more pragmatic and parity-driven partnership. While reinforcing trade, defence, and energy cooperation, the trip also highlighted the difficult negotiations ahead.

April 24, 2025

India Redraws Its Red Lines with Pakistan

April 24, 2025 10:24 AM UTC

In one of the deadliest attacks in Kashmir in years, 26 Hindu tourists were killed by Pakistan-backed militants in Pahalgam. India has responded by suspending the Indus Waters Treaty, expelling Pakistani nationals, and downgrading diplomatic ties — signalling a hard shift in its Pakistan policy. T

BI Holds Rates as Rupiah Takes Centre Stage

April 24, 2025 5:34 AM UTC

Bank Indonesia kept its policy rate unchanged at 5.75% in April, prioritising currency stability over immediate growth support. Despite subdued inflation and earlier indications of easing, the central bank is holding off on rate cuts amid heightened global uncertainty and rupiah weakness following U

April 22, 2025

Bank Indonesia to Hold Rates as Currency Pressures Mount

April 22, 2025 6:12 AM UTC

Bank Indonesia is expected to maintain its benchmark interest rate at 5.75%, reflecting a cautious stance amid the rupiah's depreciation and mixed economic signals. With the rupiah near five-year lows and influenced by external uncertainties, the central bank is balancing the need to support economi