Taiwan, Province of China

View:

June 24, 2025

Asia/Pacific (ex-China/Japan) Outlook: Slower Trade, Softer Inflation, and Looser Policy

June 24, 2025 9:24 AM UTC

· Asia’s growth profile in 2025 reflects a region navigating structural transition amid external strain. Investment-led economies like India are benefitting from infrastructure spending, industrial policy momentum, and political continuity. In contrast, trade-reliant markets such as V

June 05, 2025

April 30, 2025

China South China Sea Tensions

April 30, 2025 10:30 AM UTC

We see recent China activity as part of the normal grey warfare for long-term influence in the South China sea. It has involved the use of China coastguard and militia fishing boats rather than China PLA Navy, though the risk of escalation between the Philippines and China remains. China likely wa

April 23, 2025

Trump Under Pressure

April 23, 2025 7:15 AM UTC

A deteriorating economic; volatile financial markets and weakening approval ratings are all putting pressure on the Trump administration to do trade deals. However, Trump instincts means he still likes tariffs, while negotiations will not be quick with China restraints and non-tariffs list desired

April 22, 2025

Foreign Official U.S. Treasury Holders: The Kindness of Strangers

April 22, 2025 7:30 AM UTC

Official holdings of U.S. Treasuries show a mixed picture with China, Brazil and Saudi Arabia well off peak holdings. Two drivers of some of these country flows are the peak in global central bank FX reserve holdings in 2021 and an increased holdings of other currencies in the last decade. Neverth

April 15, 2025

Nervous U.S. Long Term Asset Holders

April 15, 2025 8:30 AM UTC

Overall, foreign equity investors can no longer count on U.S. exceptionalism and could face lower long-term corporate earnings growth, which at a minimum will likely slow net inflows. Bond investors also face ongoing policy volatility, which likely means a need for an extra risk premium – t

April 14, 2025

U.S./China High Stakes Poker

April 14, 2025 7:30 AM UTC

The economic hit from a hard stop in U.S. imports/exports is too damaging for both sides and our baseline is still for a truce and de-escalation, in the coming weeks. This could be negotiations on a new trade deal with a more moderate reciprocal tariff on both sides and the extra reciprocal tariffs

April 10, 2025

Trade Deals with the U.S.: Pressures and Obstacles

April 10, 2025 7:17 AM UTC

Pressures to do trade deals include the weaker U.S. economy and higher inflation when it arrives/foreigners becoming nervous of their USD30trn plus holdings of U.S. securities and more crucially risks to Trump and GOP approval ratings from Republican voters. Obstacles to quick trade deals include Tr

April 08, 2025

Reciprocal Tariffs: The Hit To Other Countries

April 8, 2025 9:30 AM UTC

Overall, we are still assessing the effects on non U.S. countries from the tariffs being imposed by the U.S. via direct trade/business investment/currency and financial & monetary conditions swings. The impact will be adverse to GDP, but for some major countries could be less than the U.S. How

April 02, 2025

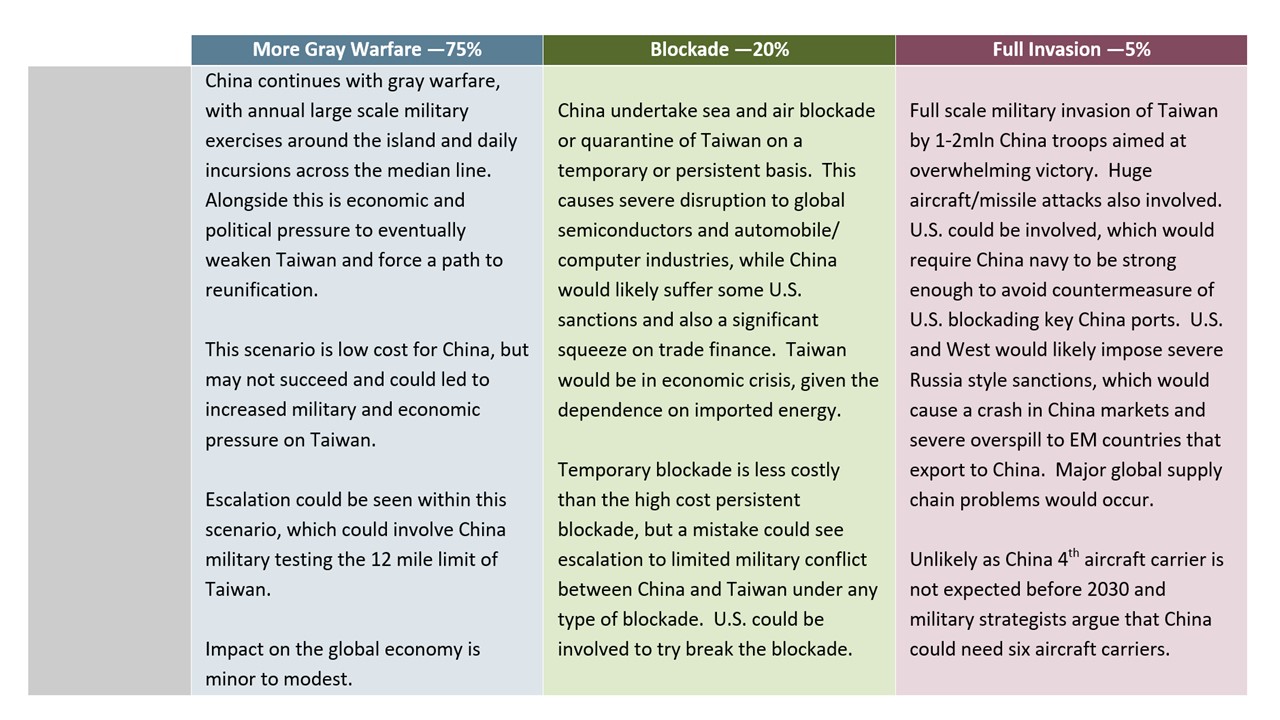

Taiwan: Grey Warfare or More?

April 2, 2025 7:05 AM UTC

China grey warfare against Taiwan will continue, but we would only see a 5% probability of China invading Taiwan in 2025 and 2026. The U.S. is pivoting towards Asia and China, while President Trump is not China friendly. A war with the U.S. over Taiwan would be very costly in military and eco

March 31, 2025

U.S. Trade Surplus Countries: No Special Treatment?

March 31, 2025 9:04 AM UTC

Quick dilutions of tariffs or exemption will likely be slow in coming for countries that the U.S. has trade surpluses with, as the Trump administration are currently more focused on tariffs for tax revenue and trying to switch production back to the U.S. than trade deals. Trade policy uncertainty

March 27, 2025

Car Tariffs Then Lenient Reciprocal Tariffs?

March 27, 2025 8:59 AM UTC

The 25% tariffs on cars underlines that tariffs are not just about getting better trade deals, but in Trump’s view raising (tax) revenue and trying to shift production back to the U.S. Combined with other tariffs being implemented, plus policy uncertainty, we see a moderate overall hit from t

March 25, 2025

Asia/Pacific (ex-China/Japan) Outlook: Resilience Through Realignment

March 25, 2025 10:44 AM UTC

· In 2025, growth across emerging Asia will remain steady but uneven, with investment-driven economies such as India and Malaysia outperforming on the back of infrastructure and industrial policy momentum. While global demand is set to recover modestly, geopolitical friction and tariff

March 21, 2025

Trump Product and Reciprocal Tariffs

March 21, 2025 9:00 AM UTC

It appears that we will get bad news from April 2 on extra tariffs before any good news. Firstly, the announcement effect of tariffs for many countries and extra products will hurt U.S. business and consumer sentiment. Secondly, part of the reason for tariffs is extra tax revenue and to try to s

March 10, 2025

Trump and Dollar Policies

March 10, 2025 6:04 AM UTC

The Trump administration could decide to more broadly talk the USD down or less likely try to reach a cooperative Mar A Lago accord with big DM and EM countries. A more cohesive alternative is a forced currency deal for countries to appreciate their currencies to avoid more tariffs and withdraw

March 04, 2025

December 19, 2024

Asia/Pacific (ex-China/Japan) Outlook: Trump Tariffs, China +1 and Growth

December 19, 2024 10:57 AM UTC

Emerging Asian economies are projected to lead global growth in 2025, with India and Southeast Asia at the forefront. These regions will anchor resilience in Asia, even as China's economic growth remains moderate.

Inflation trajectories will vary across Asia, with India experiencing sticky prices

December 09, 2024

December 02, 2024

October 15, 2024

U.S. Tensions for China: Protected by BRICS and BRI?

October 15, 2024 9:30 AM UTC

BRICS can provide a political buffer but not economic, as BRICS are still searching for practical areas for cooperation. However, Donald Trump universal tariffs threats could focus BRICS on more intra EM trade. BRI has already helped to redirect China exports to EM countries, despite the slowdown

September 25, 2024

Asia/Pacific (ex-China/Japan) Outlook: Shifting Gears for Growth

September 25, 2024 7:57 AM UTC

Emerging Asian economies are poised to remain the fastest growing globally. India and Southeast Asia will drive regional resilience amid China’s cooling growth engine in 2025. For India, while the external environment remains challenging due to weaker global demand and geopolitical tensions, domes

August 29, 2024

June 21, 2024

Asia/Pacific (ex-China/Japan) Outlook: Growth Momentum but Delayed Rate Cuts

June 21, 2024 9:45 AM UTC

• Economic activity in emerging Asian economies is forecast to remain strong. Despite several challenges, including a tight oil market, constrained liquidity conditions, and delayed rate cuts, the region's economic activity is expected to show resilience. Other potential obstacles include u

June 07, 2024

May 30, 2024

April 18, 2024

China and the South China Sea

April 18, 2024 2:00 PM UTC

Bottom Line: A China coastguard vessel blocked two Philippines government vessels over the weekend in the Second Thomas shoal area near the Philippines, which has raised questions over whether the South China Sea will be another geopolitical flashpoint. We would say not in 2024, both given China

April 17, 2024

March 22, 2024

Asia/Pacific (ex-China/Japan) Outlook: Election Spending to Drive Growth

March 22, 2024 12:18 PM UTC

· In 2024, growth trends across emerging Asia will exhibit a mixed pattern. Encouragingly, there will be a resurgence in demand for global electronics following a period of stagnation in 2022‑23, which will provide a boost to regional trade. Moreover, the initiation of monetary policy

March 11, 2024

Elections to Keep Asia in Limelight in 2024

March 11, 2024 9:05 AM UTC

2024 is turning out to be a significant year for the Asian political scene. At the start of the year, eight countries were scheduled to hold elections this year, with close to 2.2bn people voting this year across emerging Asian economies.

With elections now over in four of the eight countries, the

March 06, 2024

March 04, 2024

Taiwan Speaker Reduces China/Taiwan War Risk

March 4, 2024 10:30 AM UTC

Bottom Line: Taiwan new speaker, Han Kuo Yu, has a willingness to open dialogue with China. This does not stop China likely undertaking large scale military exercises in the spring around Taiwan, as it still seeks to pressure the incoming DPP president. However, we see the new Taiwan speaker elect

January 16, 2024

January 15, 2024

Taiwan: DPP Weaker than 2020

January 15, 2024 8:49 AM UTC

The DPP have won the Taiwan presidential election. However, the DPP has lost its majority in parliament, while the 3rd party (Taiwan People Party (TPP) are signalling they will not form a coalition with (Kuomintang) KTT. This will restrain the DPP. However, China will still likely show its dis

January 03, 2024

Taiwan: Gray Warfare After A Mixed Election

January 3, 2024 11:02 AM UTC

Bottom line: After the January 2024 Taiwan presidential election, the baseline (75% Figure 1) is for is for a continuation/esculation of the gray warfare before the new president takes power on May 20 and afterwards. This can gradual increase the pressure on Taiwan to move towards a political soluti

December 18, 2023

Asia/Pacific (ex-China/Japan) Outlook: Going Big, Going Strong

December 18, 2023 10:05 AM UTC

· Following a stellar performance in 2023, the momentum of economic activity in emerging Asian economies is anticipated to remain broadly stable, albeit lose some sheen in the subsequent quarters. The economic activity levels should be sustained despite a tight oil market and a potentia