Emerging EMEA

View:

March 25, 2024

EMEA Outlook: Elections Set the Scene in Q2

March 25, 2024 2:00 PM UTC

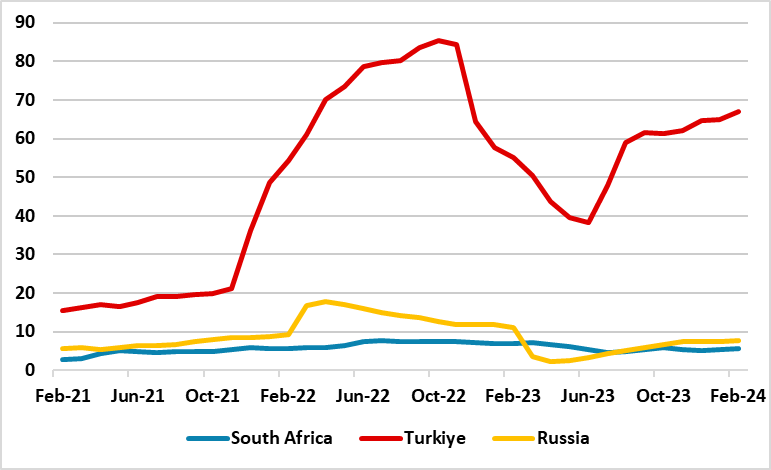

· Unlike South Africa and Russia, Turkiye continued with tightening monetary policy in Q1 due to stubborn inflation, pressure on FX and reserves. Meanwhile, Russia and South Africa halted their tightening cycles as of 2024 and will likely start cutting interest rates in Q3 depending on how

January 29, 2024

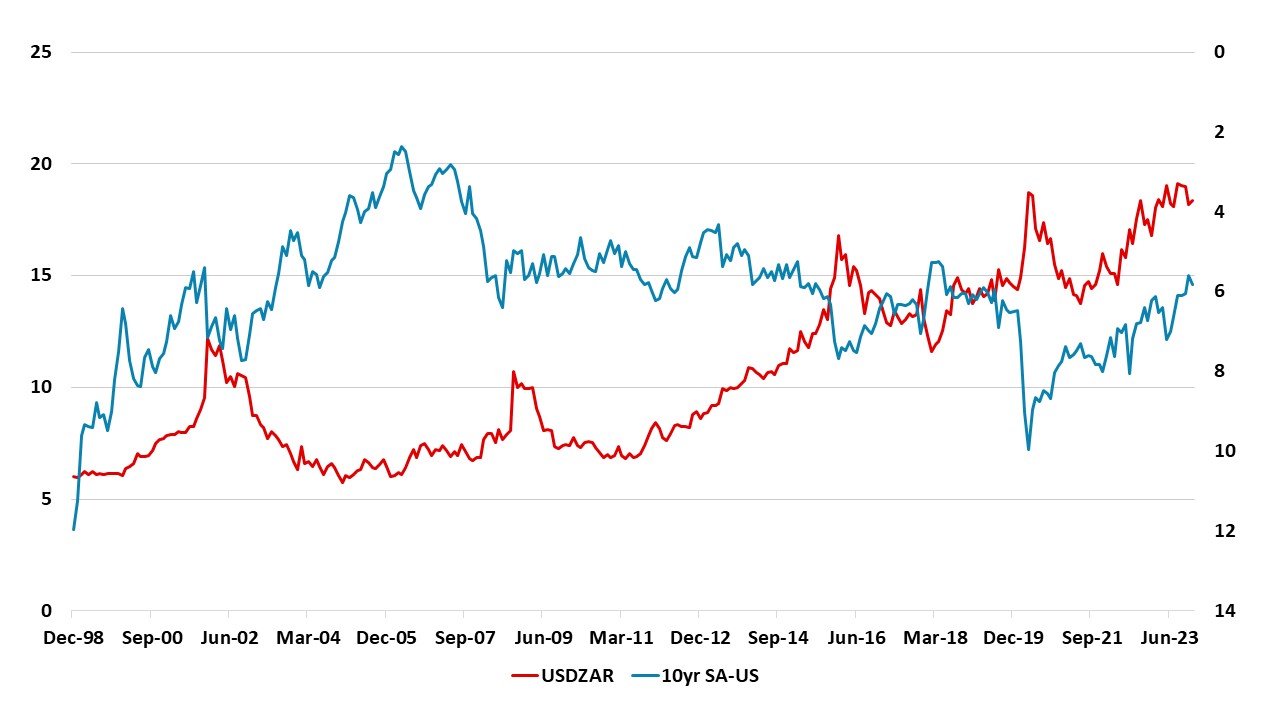

South Africa: Structural Issues to Dominate Long Term Growth

January 29, 2024 9:00 AM UTC

Bottom line: We expect 1.3-1.5% GDP growth in South Africa in the 2025-2030 period. We are concerned with the structural problems affecting economic dynamics negatively, including loadshedding, transportation bottlenecks, and shrinking trade surplus. Despite structural problems; growing population,

November 20, 2023

Ukraine War: Western Support Weakens, Elections on the Horizon, Peace Negotiations Remains Unlikely

November 20, 2023 11:28 AM UTC

As Ukraine counter offensive operations continues without much success, the possibility of a stalemate and frozen conflict increase in the medium term taking into account Russia's continued failure to gain ground in late 2023. What will happen in 2024?

Bottom Line: We foresee a protracted conflict,

November 14, 2023

South Africa: Structural Issues to Dominate Long Term Growth

November 14, 2023 1:07 PM UTC

Bottom line: We expect 1.3-1.5% GDP growth in South Africa in the 2025-2030 period. We are concerned with the structural problems affecting economic dynamics negatively, including loadshedding, transportation bottlenecks, and shrinking trade surplus. Despite structural problems; growing population,