Foreign Exchange

View:

October 03, 2025

October 02, 2025

Preview: Due October 3 - U.S. September ISM Services - August bounce was flattered by seasonal adjustments

October 2, 2025 3:45 PM UTC

We expect slippage in September’s ISM services index to 51.0 from 52.0, still above the levels seen in May, June and July, but implying a subdued pace of economic growth.

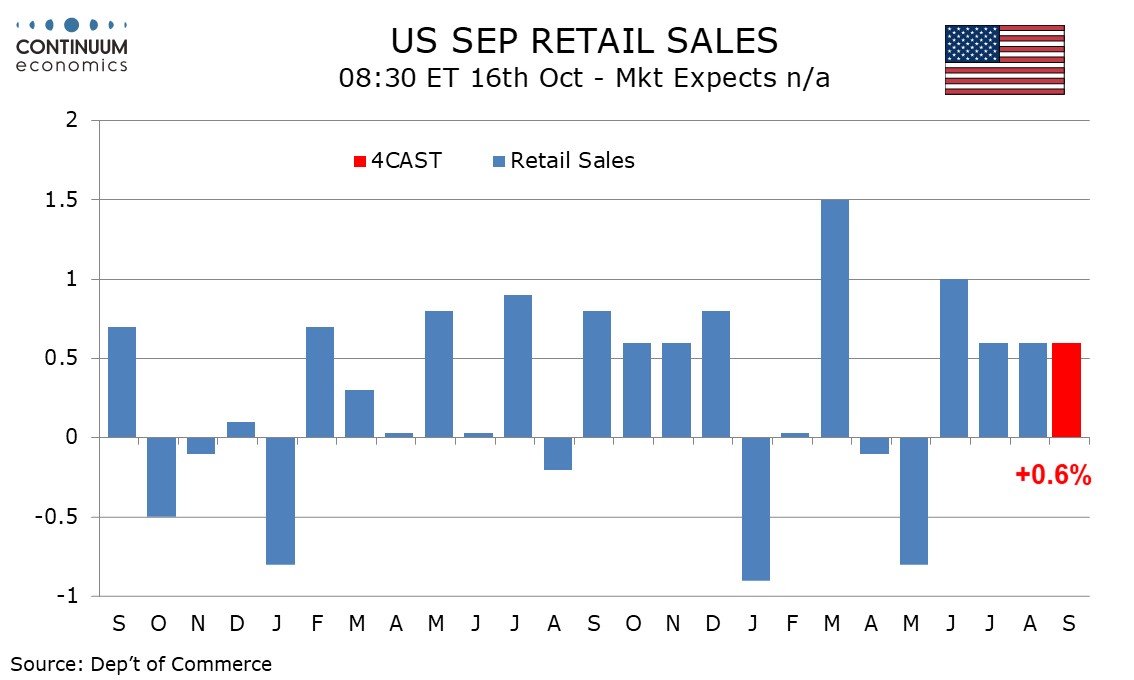

Preview: Due October 16 (dependent on shutdown ending) - U.S. September Retail Sales - Still growing, if more on prices than volumes

October 2, 2025 12:53 PM UTC

We expect a third straight 0.6% increase in retail sales in September, with slightly over half of the increase coming in prices, leaving only moderate growth in real terms. We also expect 0.6% increase ex autos but a slightly weaker 0.5% increase ex autos and gasoline.

October 01, 2025

Preview: Due October 16 (dependent on shutdown ending) - U.S. Setember PPI - Closer to trend after strong July and weak August

October 1, 2025 7:36 PM UTC

We expect September PPI to rise by 0.4% overall and 0.3% ex food and energy, with the latter gain coming near the average of a 0.7% bounce in July that was corrected by a 0.1% decline in August. Ex food, energy and trade we expect a moderate 0.2% increase after gains of 0.3% in August and 0.6% in Ju

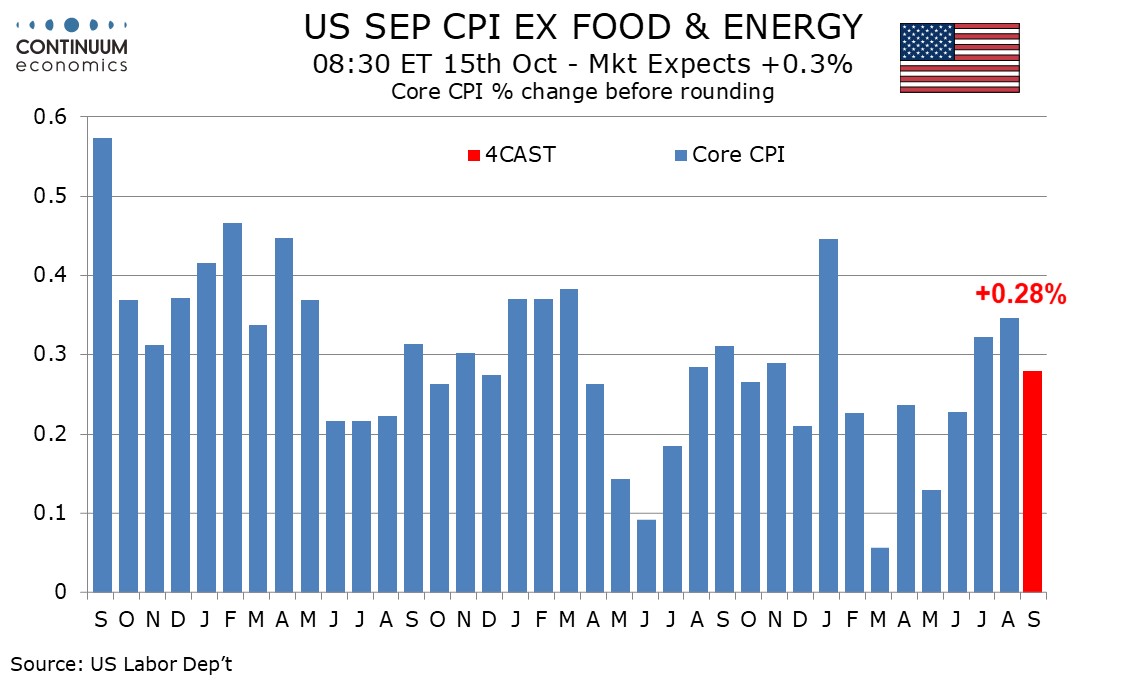

Preview: Due October 15 (dependent on shutdown ending) - U.S. September CPI - Firm but a little less so in core rate

October 1, 2025 6:29 PM UTC

We expect September CPI to increase by 0.4% overall and by 0.3% ex food and energy, matching August’s outcomes after rounding, though before rounding we expect overall CPI to be rounded down from 0.425%, and the core rate to be rounded up from 0.28%, contrasting August data when headline CPI was r

U.S. September ISM Manufacturing - Slightly firmer but a subdued picture

October 1, 2025 2:16 PM UTC

September’s ISM manufacturing index of 49.1 is up from August’s 48.7 and marginally beats 49.0 readings in June and March to record its highest reading since February. However there remains little direction to underlying trend.

U.S. September ADP Employment declines, initial claims and payroll releases face delay

October 1, 2025 12:48 PM UTC

ADP’s September estimate of employment is weaker than expected with a 32k decline, extending a recent slowing in trend. Adding to the negative message, August was revised to a 3k decline from a 54k rise. Given the government shutdown starting today this may be the last look at the labor market we

FX Daily Strategy: N America, Oct 1

October 1, 2025 8:55 AM UTC

US government shutdown looks set to start on October 1

Typically, shutdown is seen as negative for USD/JPY

ADP data to take on higher profile if official employment data not being released due to shutdown

EUR/JPY also looks vulnerable if risk sentiment weakens

FX Daily Strategy: Europe, Oct 1

October 1, 2025 4:31 AM UTC

US government shutdown looks set to start on October 1

Typically, shutdown is seen as negative for USD/JPY

ADP data to take on higher profile if official employment data not being released due to shutdown

EUR/JPY also looks vulnerable if risk sentiment weakens

September 30, 2025

Preview: Due October 1 - U.S. September ISM Manufacturing - Firmer but still short of neutral

September 30, 2025 3:00 PM UTC

We expect a September ISM manufacturing index of 49.0, returning to June’s level after rising to 48.7 in August from 48.0 in July. The index has not been above neutral since February.

U.S. August Job Openings slightly higher but September Consumer Confidence slips on labor market concerns

September 30, 2025 2:36 PM UTC

August job openings in the JOLTS report were slightly higher than expected with a rise off 19k to 7.227m but still present a picture of a fairly flat labor market. September consumer confidence at 94.2 from 97.8 was slightly weaker than expected, and showed perceptions of the labor market deteriorat

Preview: Due October 1 - U.S. September ADP Employment - May get more attention if Federal government shuts down

September 30, 2025 12:33 PM UTC

We expect a rise of 45k in August’s ADP estimate for private sector employment growth. This would match our forecast for overall non-farm payrolls but underperform our 50k forecast for private payrolls, correcting from three straight modest outperformances.

September 29, 2025

U.S. August Pending Home Sales - Significant bounce, follows strength in August new home sales

September 29, 2025 2:18 PM UTC

Pending home sales have seen a sharp 4.0% increase in August, which hints at a bounce in existing home sales in September. We have also recently seen a strong rise in August new home sales. Lower bond yields in anticipation of Fed easing appear to be having some impact.

September 28, 2025

September 26, 2025

Canada July GDP - First increase in four months

September 26, 2025 1:30 PM UTC

July Canadian GDP followed three straight declines with a rise of 0.2%, stronger than the 0.1% preliminary estimate made with June’s data. The preliminary estimate for August is unchanged. If both August and September are unchanged Q3 GDP would be up by around 0.7% annualized after a decline in Q2

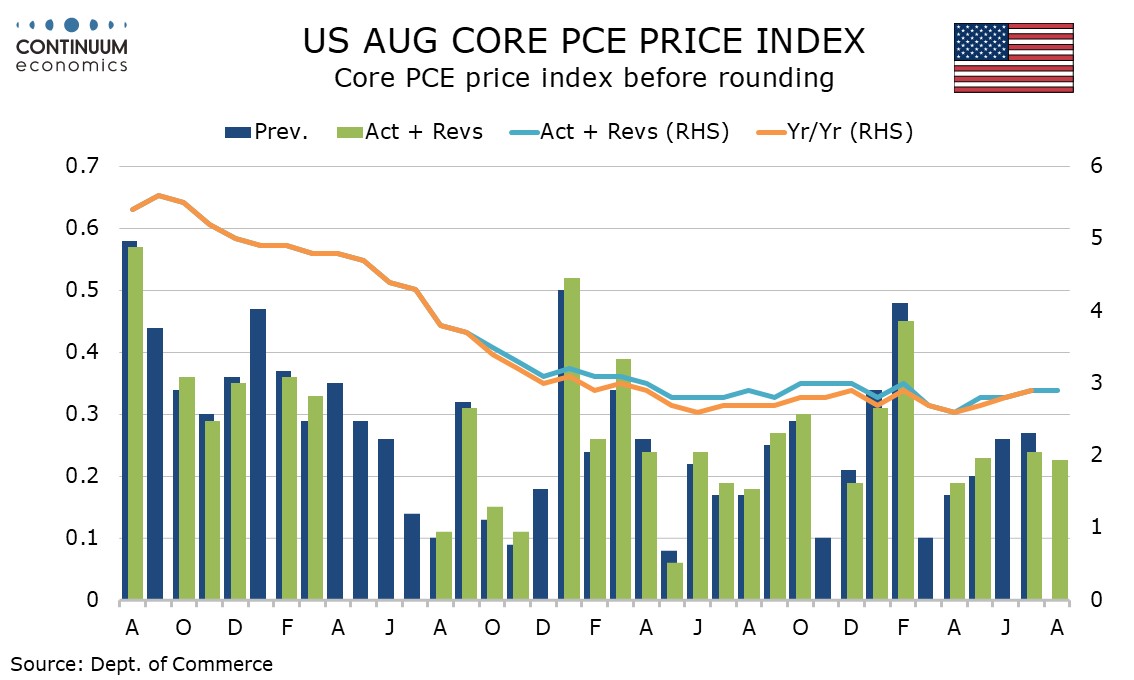

U.S. August Personal Income and Spending - Core PCE Prices maintaining trend, still above target

September 26, 2025 1:09 PM UTC

August personal income at 0.4% and spending at 0.6% are both a little stronger than expected while price indices are in line, 0.3% for overall PCE and 0.2% for the core rate, with the latter 0.227% before rounding. Each price index underperformed the August CPI counterpart by 0.1% (August PPI was so