Saudi Arabia

View:

September 22, 2025

Commodities Outlook: Markets in Motion

September 22, 2025 10:30 AM UTC

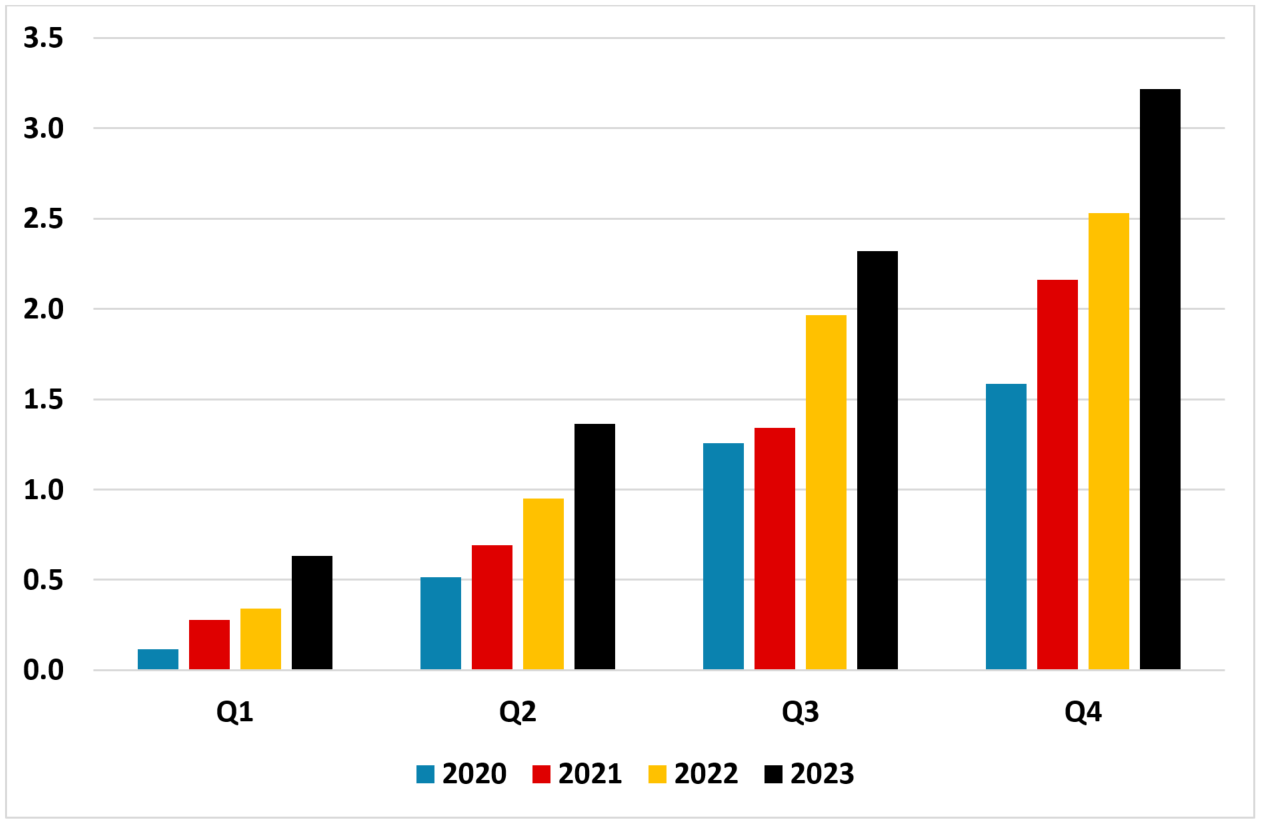

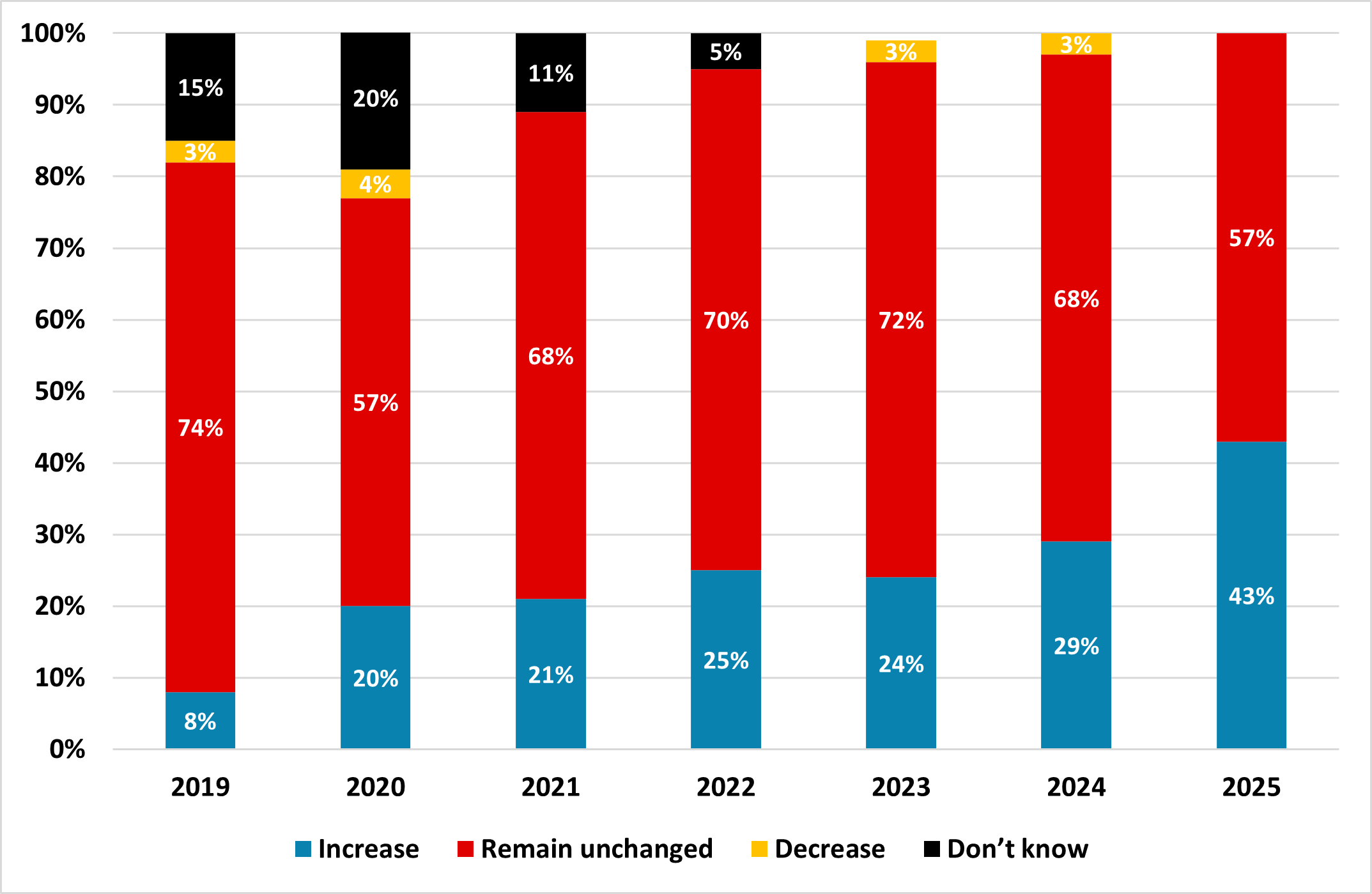

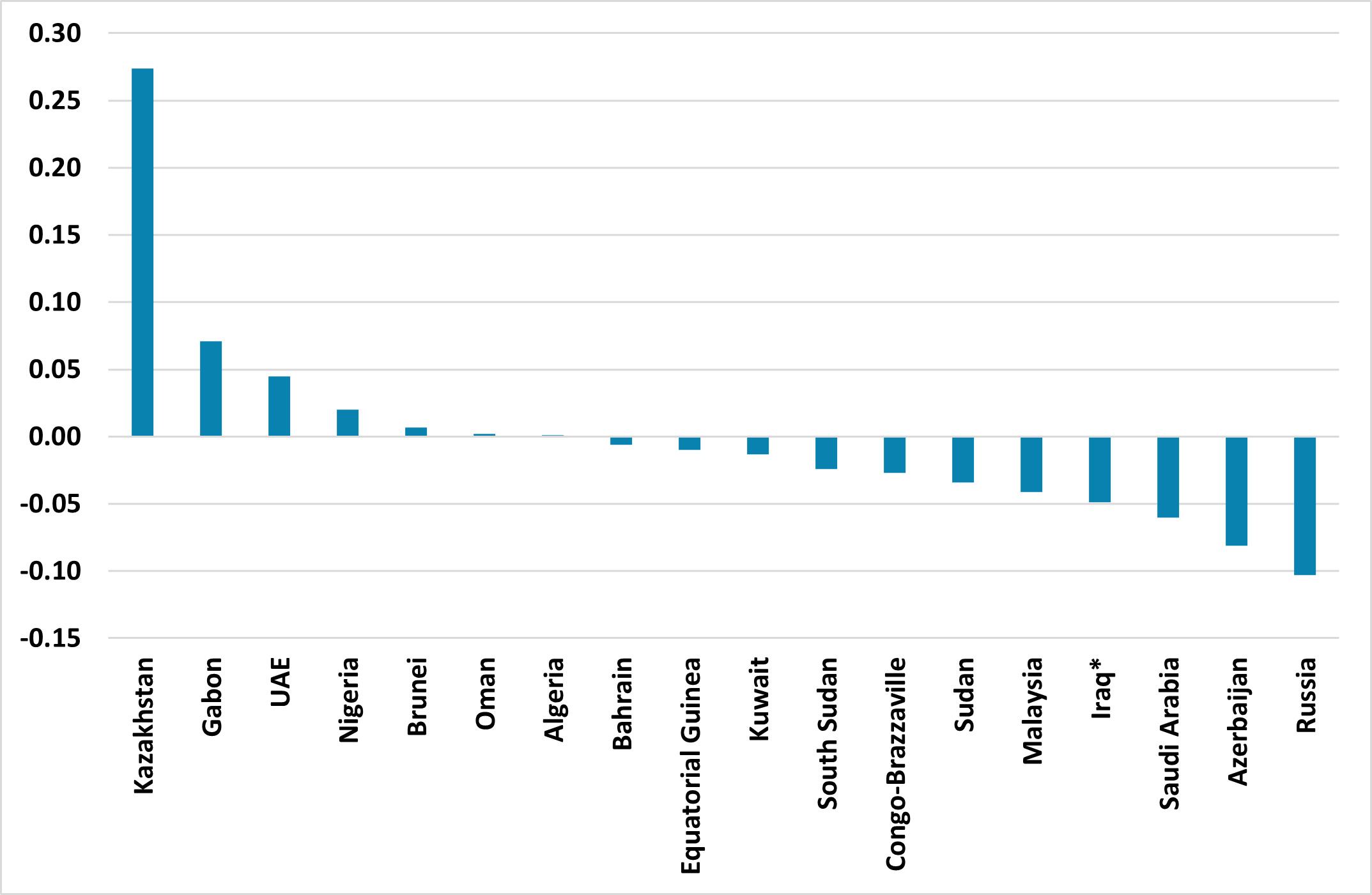

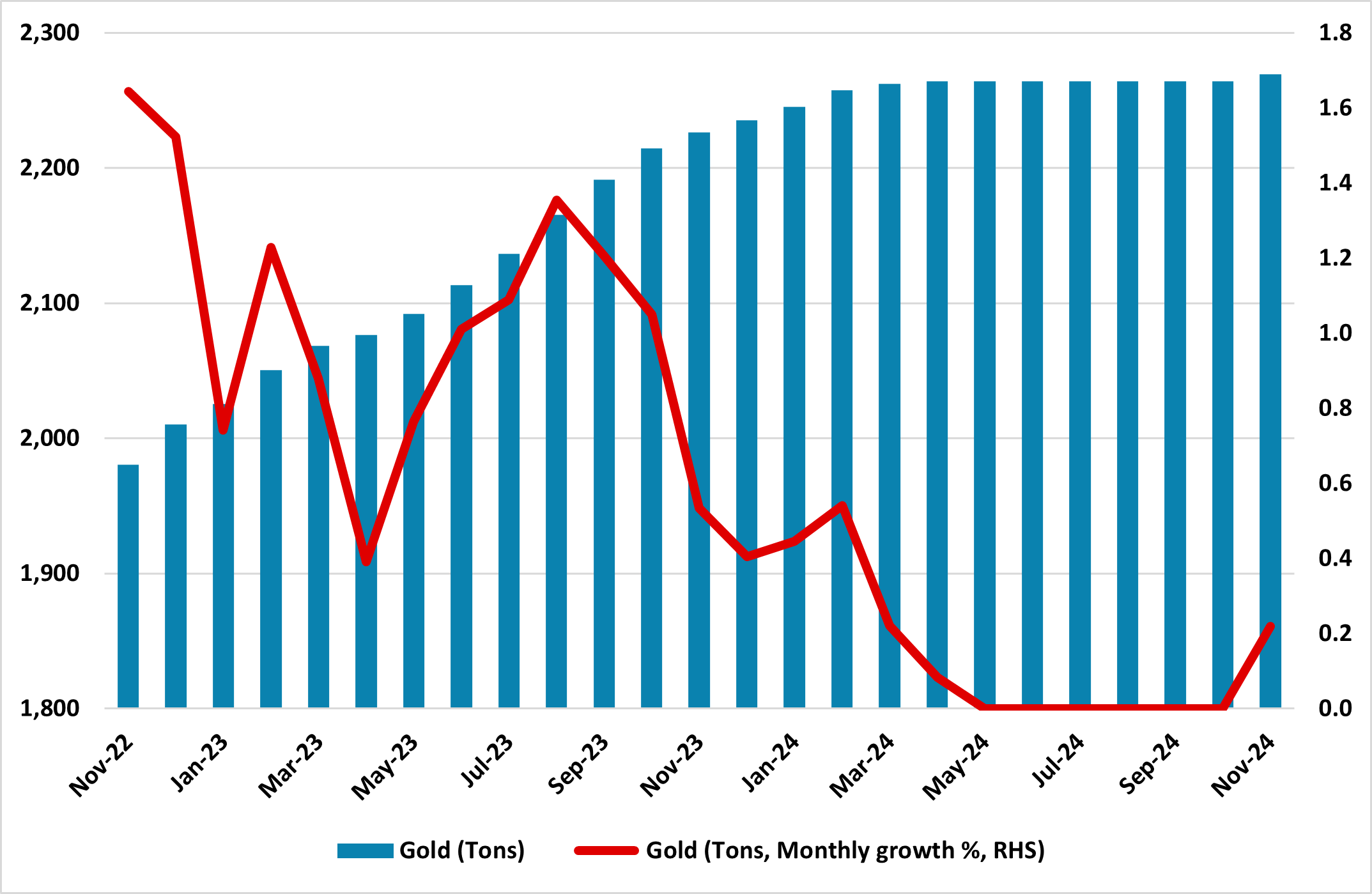

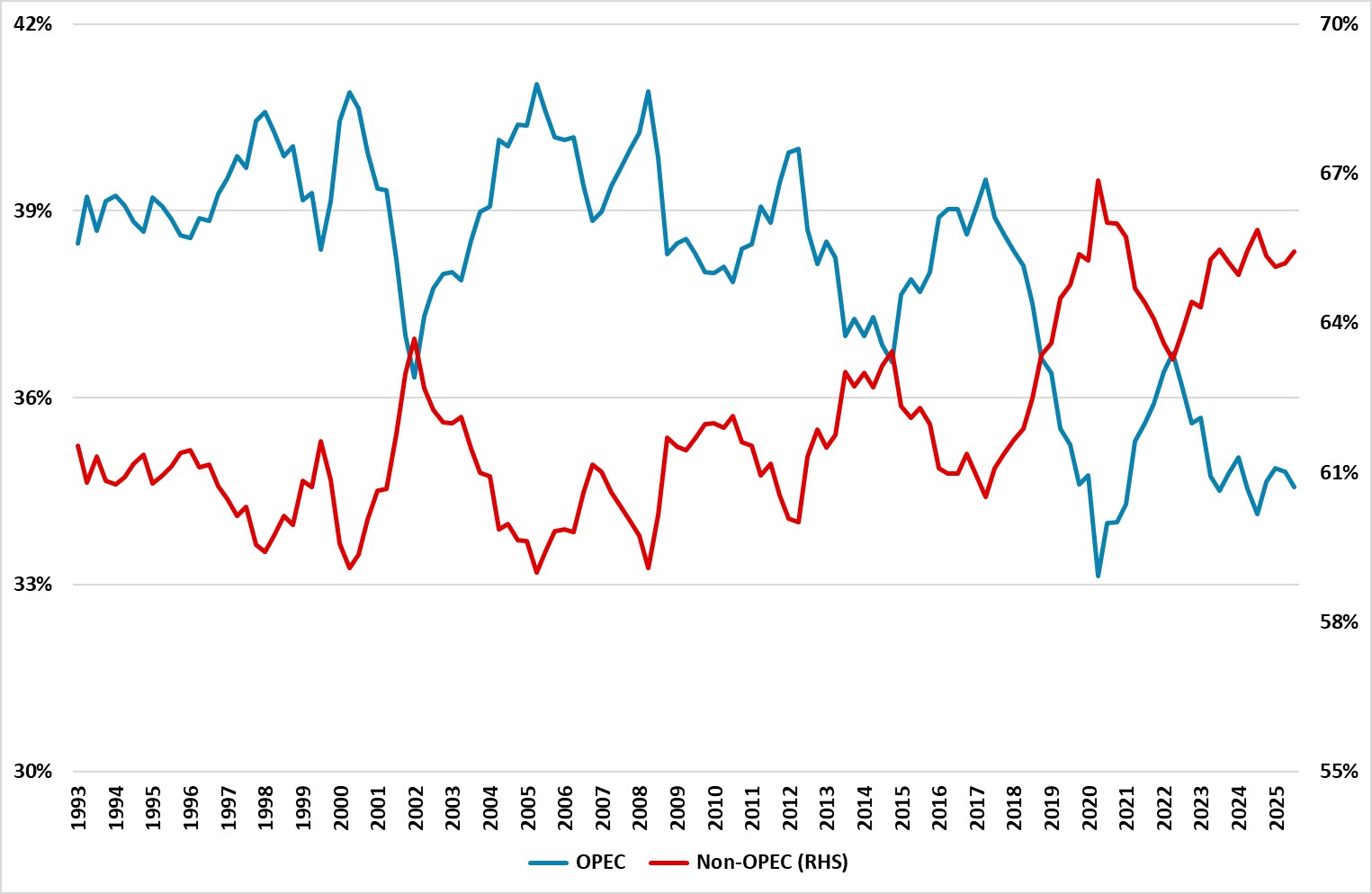

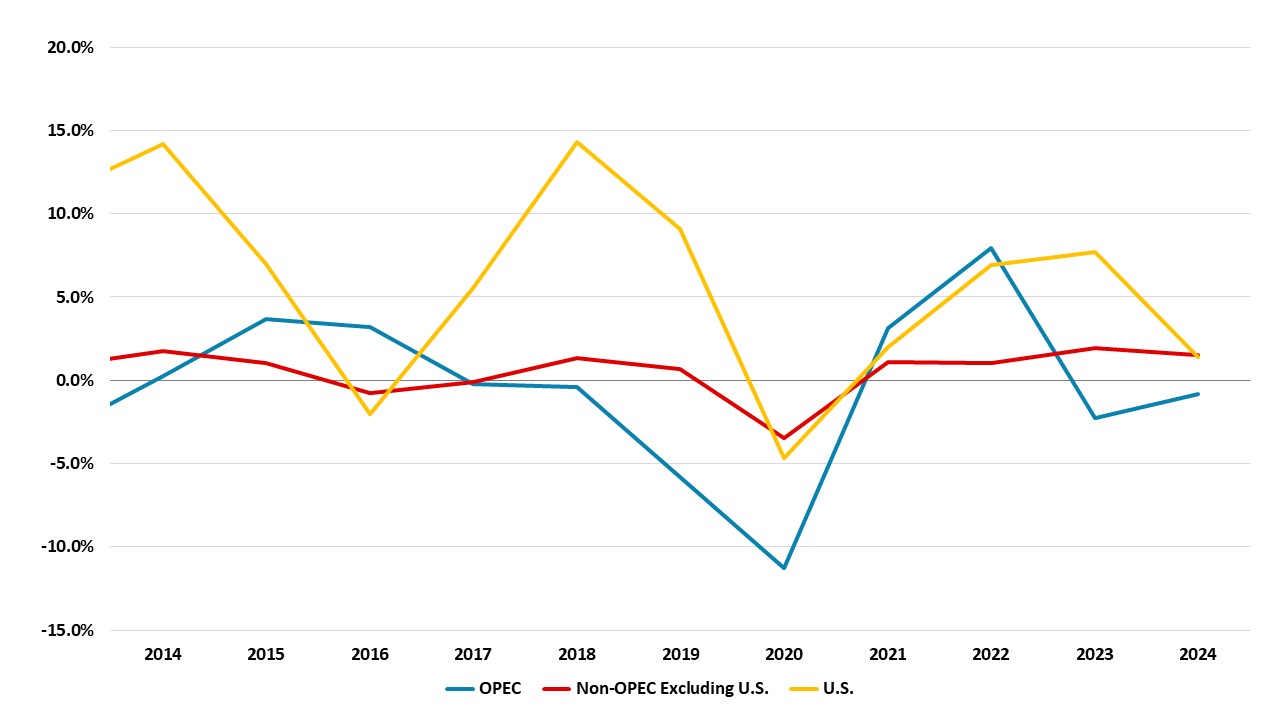

OPEC+ has entered a new supply cycle, gradually reversing a second layer of voluntary cuts. The latest 1.65 mln b/d tranche is being phased out at 137,000 b/d monthly, likely completed by September 2026, while 2 mln b/d of group-wide cuts remain until the end of 2026. Non-OPEC supply growth will lik

September 09, 2025

June 20, 2025

Commodities Outlook: Policy Realignment

June 20, 2025 9:30 AM UTC

In Q2 2025, eight OPEC+ countries pledged a faster oil supply hike, motivated by market share losses, internal frictions, and geopolitical shifts. However, actual output has fallen short due to overproduction offsets, domestic consumption, and capacity limits. Further gradual increases are expected,

April 22, 2025

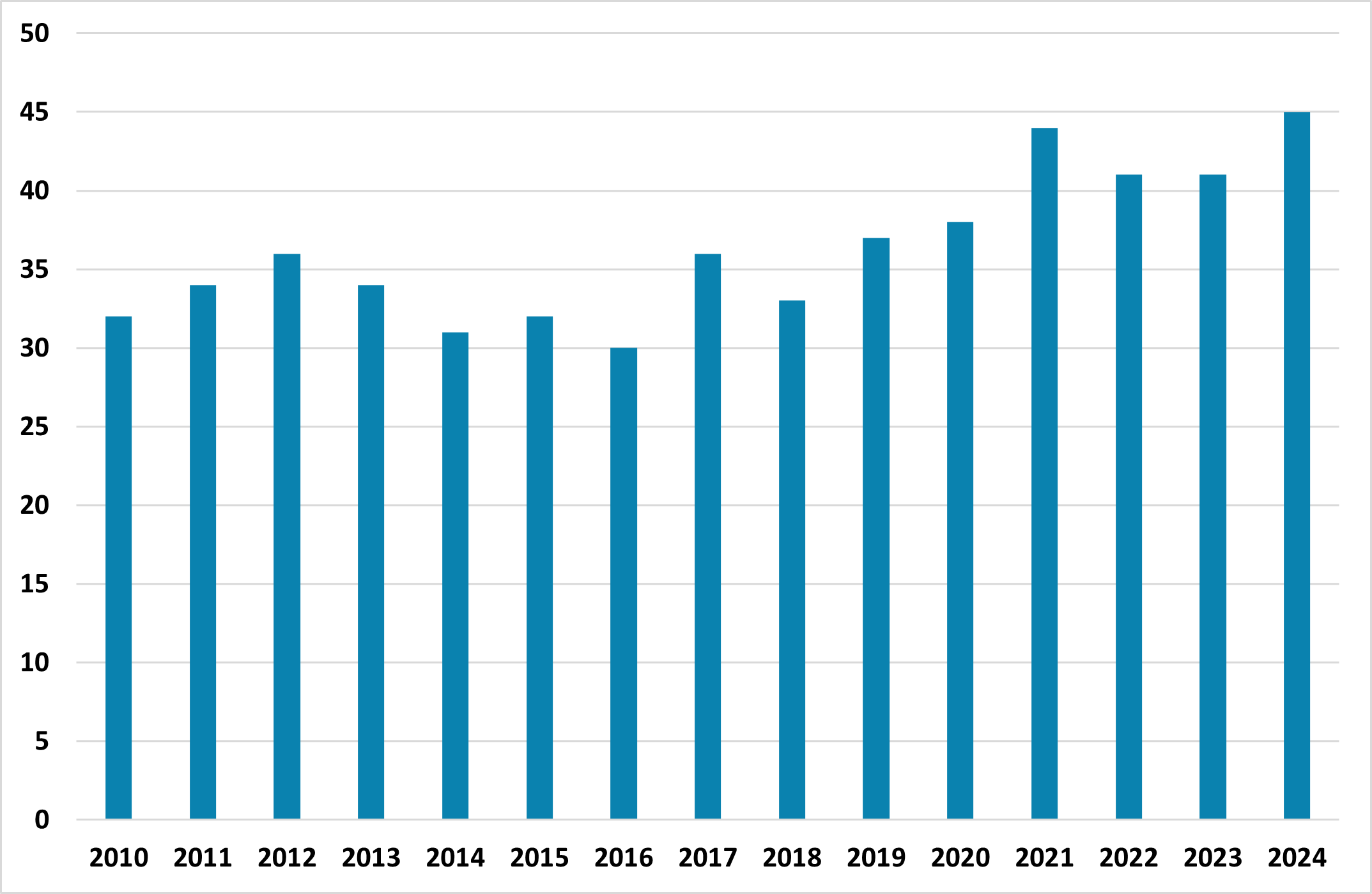

Foreign Official U.S. Treasury Holders: The Kindness of Strangers

April 22, 2025 7:30 AM UTC

Official holdings of U.S. Treasuries show a mixed picture with China, Brazil and Saudi Arabia well off peak holdings. Two drivers of some of these country flows are the peak in global central bank FX reserve holdings in 2021 and an increased holdings of other currencies in the last decade. Neverth

March 24, 2025

Commodities Outlook: Shifting Dynamics

March 24, 2025 11:00 AM UTC

The oil market faces mixed forces, including geopolitical pressures, demand concerns, and supply shifts. OPEC+ plans production hikes, driven by stricter U.S. sanctions on Iran and Russia and President Trump’s push for more supply. However, global demand prospects, especially in the U.S. and China

December 18, 2024

Commodities Outlook: Strategic Caution

December 18, 2024 11:00 AM UTC

The oil supply outlook depends on OPEC+ policies, with the reversal of the voluntary 2.2 million b/d cuts being officially delayed until April 2025. However, we expect the progressive rollover of these barrels into the market to be further postponed at least until the third quarter of 2025, as the c

October 21, 2024

September 23, 2024

Commodities Outlook: Fragile Foundations

September 23, 2024 9:30 AM UTC

Oil prices in the short to medium term will be shaped by demand in China and the U.S. In particular, we expect weak data in China to continue weighting on oil prices in Q4 2024, with limited upside risks from supply-side developments. In 2025, demand growth will likely remain slow in the first half,

June 20, 2024

Commodities Outlook: Fundamentals Kick In

June 20, 2024 10:00 AM UTC

West Texas Intermediate (WTI) is projected to end 2024 at USD82. We anticipate that the voluntary cuts introduced in November 2023 will likely be reversed during H1 2025 and not in Q4 2024, as initially communicated by OPEC+. The scenario is built on our expectation that demand will not increase suf

June 06, 2024

March 08, 2024

January 25, 2024

January 19, 2024

January 17, 2024

December 15, 2023

Commodities Outlook: Economic Forces at Play

December 15, 2023 11:21 AM UTC

• Oil prices in 2024 hinge on OPEC's production policies and global economic growth. We expect the agreed-upon 2.2 million bpd voluntary cuts to be implemented in Q1 2024, most of them extending into Q2 due to weak global growth. With Saudi Arabia supporting the cuts, we assign a 60% likeli