China Response to Trump Tariffs: Yuan Depreciation and Fiscal Policy Easing

A U.S./China trade war looks highly likely in H1 2025. We would feel that Trump will threaten and then introduce across the board tariff of around 30% on all China imports versus an average of around 20% currently. China will likely respond with targeted tariffs and more restriction on rare earth metals export to U.S. Secondly, Yuan depreciation and we scope to 7.65 on USCNY by mid-2025. Thirdly, Yuan3-5trn of fiscal policy stimulus.

How and when will the incoming Trump administration threaten trade tariffs against China and what will China response be?

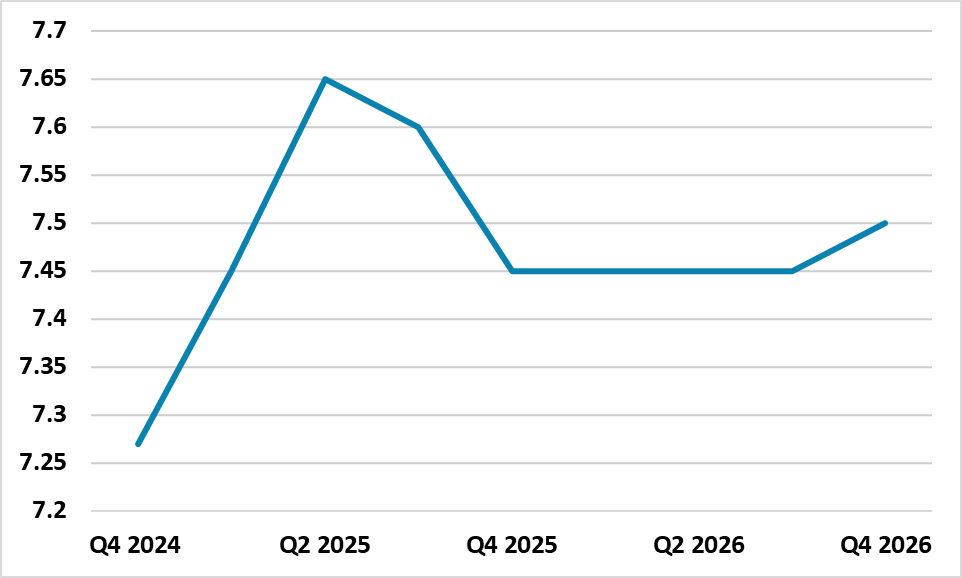

Figure 1: USDCNY Forecast

Source: Continuum Economics

President elect Trump will likely threaten tariffs against China for more trade concessions in Q1 2025. Donald Trump has said one of his first calls would be with China president Xi to get a better trade deal, while Trump also feels that recent tariff threats against Canada and Mexico have already proven successful in getting more help on immigration. The 2018-19 playbook (Figure 2) would suggest that actual tariff increase would likely be within 1-3 months, which is highly likely as China will not quickly capitulate to Trump’s initial demands. Thus a U.S./China trade war looks highly likely in H1 2025. The caveat is that Trump’s unpredictable nature could mean that an early or latter trade war are also options.

Figure 2: Chronology of U.S./China Trade War

| Aug-17 | USTR investigates China trade |

| Jan-18 | US imposes tariffs on China solar panels and washing machines |

| Mar-18 | U.S. imposes tariffs on steel and aluminium tariff across many countries |

| Apr-18 | USTR issues report under 301 report and U.S imposes tariffs and China counters on select goods |

| May-18 | Trump threatens to impose tariffs on extra USD100bln of goods and China agrees to substantially reduce trade deficit with U.S. |

| Jun-18 | U.S. impose 25% tariff on USD50bln on China goods in July/August 2018 and China announces similar counter tariffs |

| Sep-18 | U.S. announces 10% tariff on USD200bln of China goods with threat to increase to 25%. China announces 10% tariff on USD60bln of U.S. Imports |

| Nov-18 | USMCA comes into effect with rules of origin to protect U.S. automobile industry |

| May-19 | U.S. increases tariffs on USD200bln to 25% |

| Jun-19 | Presidents Trump and Xi agree truce at G20 summit |

| Jul-19 | China announces target of reducing U.S. Treasury holdings by 25% |

| Aug-19 | Trump threatens to Impose tariffs on extra USD300bln of goods and USD112bln take effect Sep 1 2019 at 15% |

| Aug-19 | Yuan depreciation accelerates and US declare China a currency manipulator |

| Oct-19 | Trump announces first phase trade deal with China, which comes into effect Feb 2020. |

| End 2020 | 58% of targets meet by first phase deal, due to COVID pandemic |

Source: Continuum Economics

We would feel that Trump will threaten and then introduce across the board tariff of around 30% on all China imports versus an average of around 20% currently. China will likely respond with targeted tariffs on U.S. goods, but could widen the restrictions on rare earth mineral exports from China to hurt the U.S. High uncertainty exists over the trajectory however, given that tactics could vary from the 2018-19 playbook that saw moderate tariff, escalation and threats that were not carried out.

The 2 response will likely be to weaken the Yuan to help export competitiveness as it did in 2018. Since Trump’s victory, China has already allowed the Yuan to decline. A 30% tariff across the board tariff on China exports would like see the authorities managing a depreciation to the 7.50 area on USDCNY and 40% tariffs to 7.65-7.75 area. Trump likes to escalate on tariff threats and so any China response could see Trump threatening to deliver 40% tariff. This is all enough to see 7.65 by mid-2025. China Politiburo is already pointing to a moderately loose monetary policy for the 1st time since the GFC (here).

However, China does not want to trigger capital flight, which could be intensified by too quick or a large depreciation of the Yuan. Large scale capital flight from China causes concerns about domestic protest against the CCP and thus to be avoided. This CNY volatility can spillover to other EM currencies from a sentiment standpoint and as other countries look to sustain competitiveness versus China.

The 3 response will be fiscal policy stimulus, where some can arrive before a trade war starts. We do see a package of stimulative fiscal policy measures for 2025 including Yuan1-3trn infrastructure spending; Yuan1trn funds to buy completed homes for affordable housing and Yuan1trn capital injection to the big six state banks. This is based on our view that the U.S. will threaten; then scale in tariffs incrementally, as the Trump administration seek to get concessions from China (here). The total size of new measures that will likely be announced in H1 2025 are Yuan3-5trn. The Yuan6trn 2025-27 LGFV debt swap and Yuan4trn of 5 years of unofficial local government debt consolidation will also help growth on the margin (here), as they allow LGFV’s and local government to spend more normally rather than being debt restrained. If the trade war with the U.S. is really bad or the economy surprises significantly on the downside, then further fiscal stimulus could be seen. However, China authorities remain reluctant to repeat the 2009 or 2015 surge in debt growth, with total government/corporate/household debt now higher than the U.S./EZ.

Meanwhile, China knows that it will likely have to agree a renewed trade deal with the U.S. and we see this occurring by late 2025, which should help to produce relief in EM currencies and thus a late bounce for CNY versus the USD. We see USDCNY to 7.45 by end 2025.