Recent Polls in South Africa: ANC’s Popularity Continues to Decline

Bottom line: We continue to foresee two possible outcomes of South African presidential elections on May 29, either an African National Congress (ANC) win or a coalition government. According to recent polls, ANC is at the serious risk of losing its majority dipping below 50%, even as low as 37% according to the Social Research Foundation’s poll. Unless something unforeseen occurs, we think an ANC-led coalition will be formed, either with Democratic Alliance (DA) or with other smaller parties. We see some moderate and temporary political volatility during and after the elections.

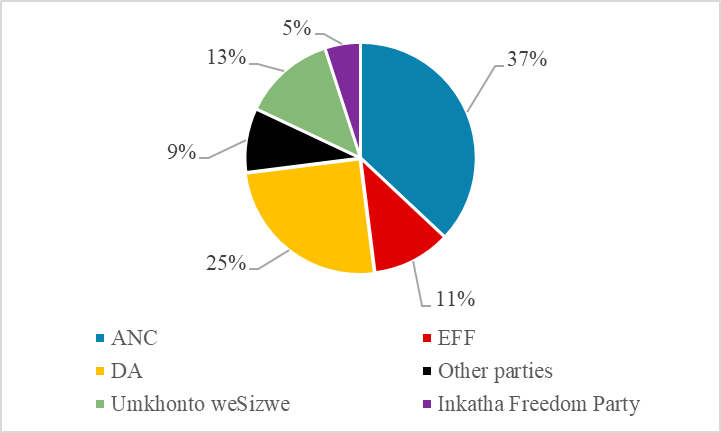

Figure 1: Vote Intentions Poll

Source: Social Research Foundation

The latest opinion polls in South Africa demonstrate an ANC victory would be a surprise on May 29, and a likely ANC-led coalition with the DA and/or other smaller parties would probably run the government. Despite previous polls gave the ANC around 42-45%, it appears support to ANC is falling close to elections.

According to the Social Research Foundation’s poll in March (Figure 1), which was conducted with 1,835 individuals, it appears ANC may garner as little as 37% of the vote. The main opposition DA is predicted to win 25% of the vote, Economic Freedom Fighters (EEF) 11%, the Inkatha Freedom Party 5%, while the Freedom Front Plus, African Christian Democratic Party and Action South Africa would both get 2%, the poll showed. Interestingly, the poll found that former president Zuma’s new party, Umkhonto weSizwe (MKP), could become the country’s third biggest with a 13% of the vote. SRF’s provincial surveys demonstrated the ANC would match the DA with 31% of the vote in Gauteng. In the Western Cape, the DA would remain the biggest party with 54% backing, compared with 20% for the ANC, while MKP would be the largest party in KwaZulu-Natal at 26%. Another poll by think-tank the Brenthurst Foundation and the SABI Strategy Group estimated support for the ANC standing at 39%.

On the basis of the results of the polls, we foresee two potential scenarios for the post-election. The first one, with 25% probability, is a clear ANC victory, particularly if ANC may get a late-stage surge that may add 5%-8% to its tally from swing voters in case ANC would be able to increase to 42-45% band in May as we think ANC could shoot ahead in the home stretch before May 29. The second one (with 75% probability) is an ANC led-coalition either with the DA and/or other smaller parties, which would likely be weaker than a one-party government at least for some time, and less able to undertake necessary fiscal reform policies and deal with power cuts (load shedding) – especially of the radical EFF poll over 15%. In both scenarios, we think the focus will be the domestic economy, as the unemployment, corruption, poverty, load shedding, financial bottleneck and inequality remain major hurdles.

- (25%) ANC wins and pursue similar policies: ANC could still get a majority if a swing back to them is seen or polls are inaccurate – previous elections have seen ex-ANC voters not voting for other parties but rather not voting at all. In this scenario, we believe that President Ramaphosa will keep the current policies implemented, with a stronger focus on socio-economic issues such as reducing unemployment, corruption and load shedding, strengthening government fiscal balance and increasing foreign investments into the country. (Note: According to the ANC manifesto, which was announced on February 24, the party promised to create 2.5 million work opportunities, eradicate corruption, and pledged to boost investment and support the private sector).

- (75%) ANC-led coalition: In this scenario, the coalition government will seek new policies around an ANC orientation. Taking into account that the DA promised to create two million new jobs, end the power cuts, accelerate privatization, especially in the energy sector, and halve violent crime in its party manifesto, a possible ANC and DA coalition could follow a more liberal framework, with a strong focus on private sector. However, if the ANC do badly, then it could cause internal ANC infighting to adopt some of the EFF or MKP policy, which are market and economically unfriendly. In the worst case the infighting could cause the coalition to collapse and reigniting political uncertainty. (Note: There's a very small chance the ANC may be out of government completely, but we deem it highly unlikely as the other parties should increase their shares considerably to collectively secure at least the absolute majority. (Less than 1% chance).

The political landscape on the opposition side remains complicated before the elections. EFF, which is the third biggest party in Parliament, has an increasing popularity. The party pursues radical far-left policies advocating state nationalisation and the expropriation of land without compensation, causing DA and EFF to be far apart precluding them to take part under the same umbrella coalition. (Note: Julius Malema, leader of EFF, acknowledged on April 10 that investors might fear his party’s policies, which include nationalizing mines and expropriating land, but added they would value more clarity, consistency and transparency). We think EFF will be the key determinant for the election, as the growing support to EFF continues to eradicate support to ANC.

There is another possibility that ANC’s votes can also be hurt by the rise of MKP despite Zuma’s participation in the elections still being uncertain. Zuma was sentenced to 15 months in jail in June 2021 after declining to testify to a panel investigating financial corruption and cronyism during his presidency, and the electoral commission had disqualified Zuma from participating in the elections citing the constitution precludes anyone sentenced to more than 12 months’ imprisonment. (Note: The electoral commission recently announced that it has appealed to the country’s highest court to rule on whether Zuma can stand as a candidate in general elections in May, results still pending). Some opinion polls suggested MKP at above 10 percent nationwide, so the decision by the court will be decisive.

We foresee current economic issues will be the key determinant of the elections as the country is struggling with macroeconomic problems, high corruption and nepotism. (Note: The corruption scandals continue before the elections as prosecutors charged former parliament speaker, an ANC veteran and former defence minister Mapisa-Nqakula with corruption and money laundering in early April). ANC’s popularity continues to eradicate due to severe power blackouts as the electricity crisis along with logistical constraints have broader negative effects on the cost of doing business and the cost of living. From the fiscal standpoint, the country still has need for large domestic and international financing.

As noted above, we expect a coalition government at a national level, for the first time in the country’s history. We think a clear ANC victory would be a big surprise. We see some moderate and temporary political volatility during and after the elections, but this could reignite in the future if the ANC see a low vote share and cause internal infighting in the ANC.