Kevin Warsh Nominated for U.S. FOMC Chair

In October we ranked the five candidates for Fed Chair, putting Trump’s choice, Former Governor Kevin Warsh, in third place, behind current Governors Waller and Bowman but ahead of outsiders Hassett and Rieder. A muted market reaction suggests the market is neither elated nor dejected by the decision.

Kevin Warsh – a hawk tuned dovish

Warsh is in a difficult position, and could find himself torn between a desire to serve President Trump’s insistence on dovish policy and the need to comfort markets that Fed independence persists. While serving as a Fed Governor from 2006 through 2011 Warsh had a reputation as a hawk. His concerns about inflationary risk arising from Quantitative Easing in the aftermath of the financial crisis were not vindicated by what followed in the decade after the financial crisis, though the current decade has shown that Quantitative Easing can coincide with a surge in inflation.

That Warsh is now sounding dovish at a time when inflation is higher and unemployment lower than when he was known as a Fed a hawk does raise concerns of political bias, though his reputation as a hawk had been established while Republican George W. Bush was president, and did not suddenly emerge after the election of the Democratic President Obama. Political bias may have encouraged him to underestimate downside risks to growth under George W. Bush, though he was far from unique in that. It is difficult to make a strong case that Warsh has been guided primarily by political bias.

While having transitioned from a hawk to a dove, he does show a measure of consistency with his past positions in suggesting that the balance sheet is too high, a view directly contradicted by Fed’s Bostic today. Warsh feels that a smaller balance sheet would give greater scope for lower rates. However both recent bouts of trimming the balance sheet led to difficulties in money markets.

A difficult path towards confirmation

Warsh’s views will come under heavy scrutiny at his Senate hearings, when he will have to maintain a careful balance between a dovish monetary policy stance, something favored by most Democrats as well as President Trump, and the need for Fed independence, something traditional Republicans have tended to be the strongest defenders of. With affordability being a key issue across the political spectrum, he will have to demonstrate vigilance on inflation. Even if Warsh gives an outstanding performance in his hearings, confirmation may not be plain sailing. Retiring Republican Senator Thom Tillis from North Carolina, has pledged to oppose any Trump nomination to the Fed until the investigation into Chairman Powell is resolved. Without him the Republicans will not have a majority on the Committee.

Will Warsh be able to lead a less dovish FOMC?

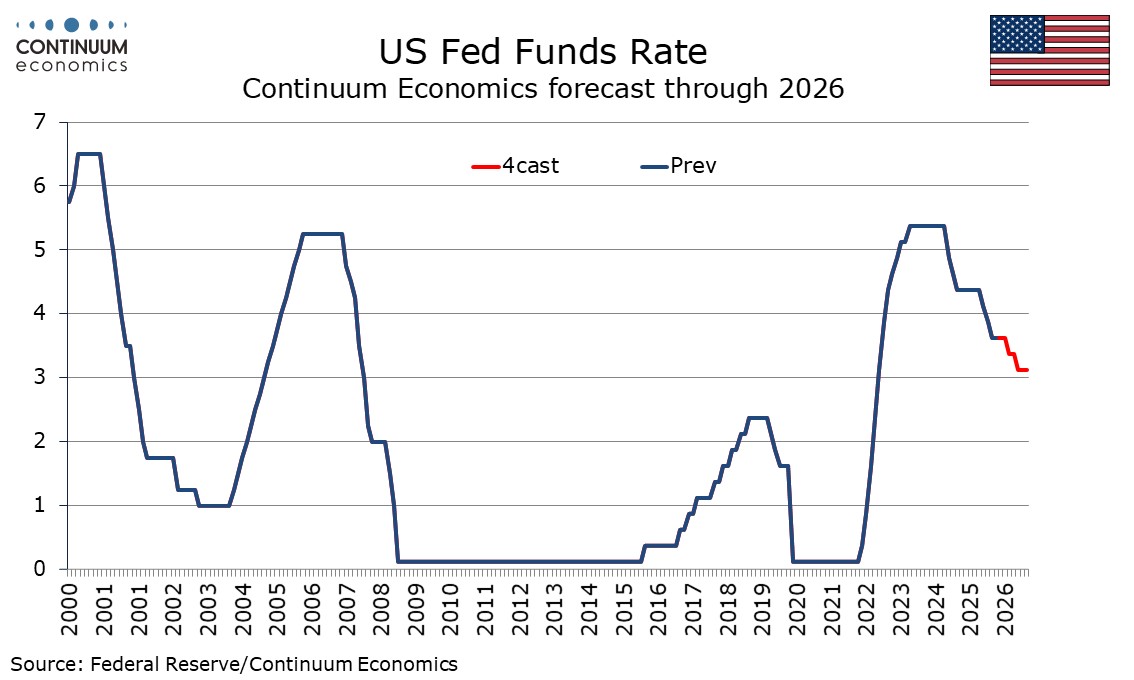

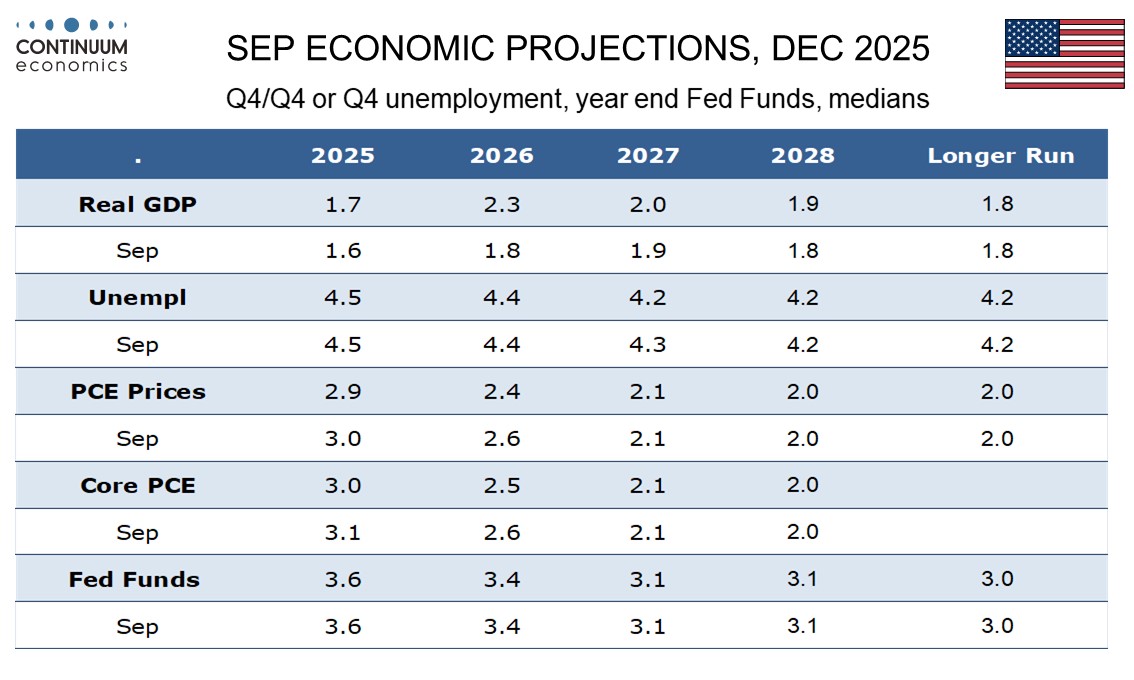

If approved for the job, Warsh will need to secure the trust of his colleagues. December’s Fed dots show a median view for only one 25bps easing in 2025 and one more in 2026, and they appear to see downside labor market risks as having eased since then (though they are also somewhat more optimistic on falling inflation). Justification for a more dovish policy can be made on a view that AI-induced productivity gains both reduce upside inflation risks and increase downside employment risks, meaning that resilience in GDP growth, which appears to be persisting in Q4, and may continue in 2026 given fiscal stimulus, can be downplayed. This will however become a much easier case to make if inflation actually does fall. By the time Wash takes office, with current Chairman Powell’s term expiring in May, he may have the fortune of seeing the lift from tariffs dropping put of the inflation data, though that is far from assured.

Should economic data be less than persuasive in making a case for lower rates, we doubt that Warsh would ignore the data, but he could find himself a dovish outlier on the Fed. Alternatively, he could seek to increase the authority of the Chair. Currently published Fed forecasts are the median of all FOMC participants, including the non-voting district presidents who tend to lean hawkish. Generating forecasts produced by Fed economists, perhaps with a strong input from the Chair, could lessen the influence of alternative voices, as could ceasing to publish the dots (as suggested by U.S. Treasury Secretary Bessent at the end of the year (here)), in which the view of each participant is given the same weight as that of the Chair. Should Warsh seek to increase his authority, it would be easier for him should Powell leave the Board of Governors when he steps down as Chair. Powell’s term as a Governor ends in January 2028. Whether Powell stays on the FOMC until then may depend on his confidence of Warsh maintaining Fed independence despite what is sure to be strong pressure from President Trump.