Preview: Due July 31 - U.S. June Personal Income and Spending - Core PCE Prices to outpace Core CPI

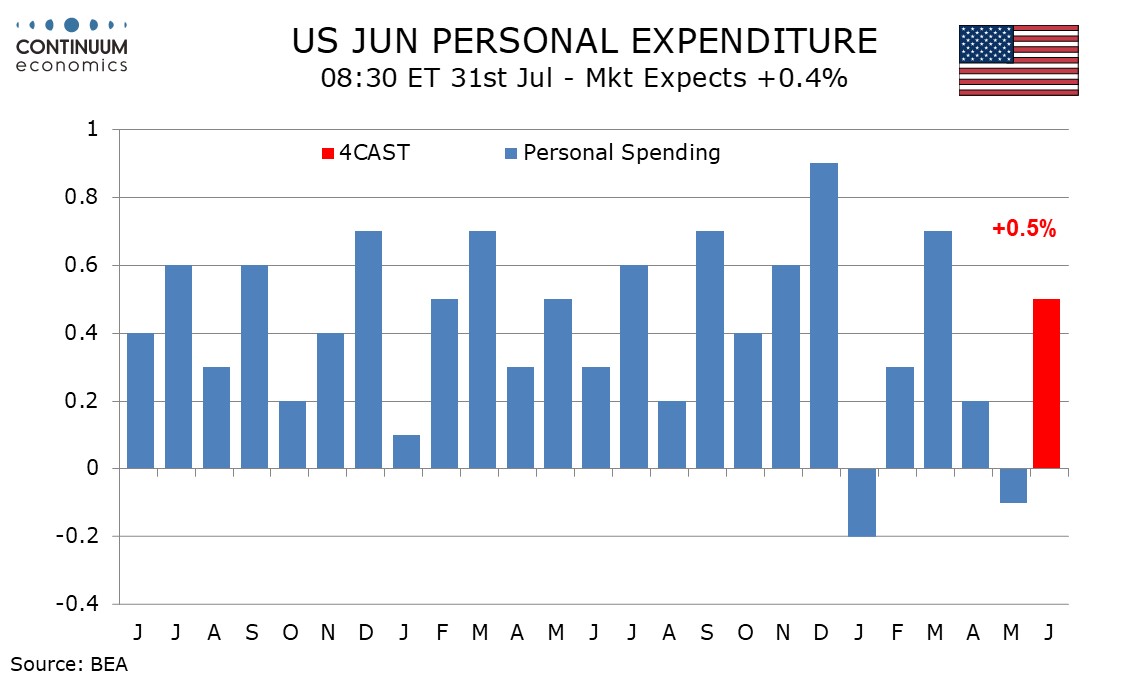

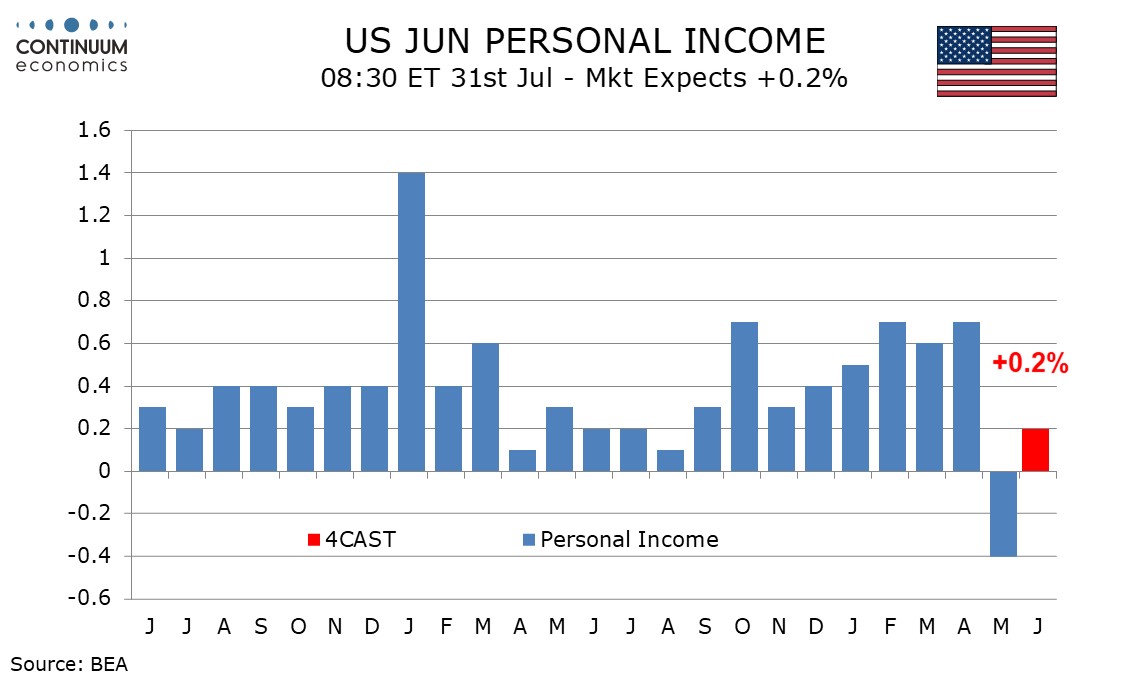

June’s personal income and spending report will be largely old news, with Q2 totals seen in the GDP report. Ahead of the GDP report we expected a stronger 0.3% increase in core PCE prices, with a weak 0.2% rise in personal income but a solid 0.5% rise in personal spending. If these forecasts prove accurate, some upward back month revisions will be needed.

CPI rose by 0.3% overall in June but a slightly lower than expected 0.2% ex food and energy. We expect June core PCE prices to be a little firmer than core CPI with PCE auto prices to be less negative than CPI auto prices were. Excluding autos, CPI goods data did show some hints that tariffs were starting to feed through. GDP data implies a 0.4% rise in core PCE prices in the absence of revisions.

Without revisions a 0.3% core PCE price index would see yr/yr growth in core PCE prices pick up to 2.8% from 2.7%. We expect overall PCE prices to rise by 0.3%, matching the CPI, with PCE prices getting less of a lift from gasoline than did the CPI. This would see overall PCE prices rising to 2.5% yr/yr from 2.3%, though again upward revisions are likely.

Slower growth in average hourly earnings and a dip in the workweek in June’s non-farm payroll breakdown suggests a below trend 0.1% increase in wages and salaries. We expect the other components of personal income to rise in line with a moderate underlying trend, after a dip in May corrected strength in the first four months of the year led by various government benefits. GDP data implies a 0.5% rise in personal income but flat wages and salaries in the absence of revisions.

Retail sales rose by 0.6% in June but the contribution to personal spending may be a little less than that with autos having been stronger in the retail sales data than industry auto data implied. However we expect a stronger 0.5% rise in services to leave overall consumer spending up by 0.5% increase, following two weak months in which equity weakness may have weighed on spending. GDP data implies a 0.6% rise in personal spending, suggesting revisions will be modest.