Mexico CPI Review: Some Pressure in Services

INEGI reported a 0.2% CPI decrease in May, with annual CPI stable at 4.7%. Electricity prices dropped, contributing to the decline. Core CPI rose 0.2%, while Non-Core fell 1.3%. Persistent Services CPI and food price shocks may sustain inflation. Peso volatility could also pressure inflation, likely prompting Banxico to maintain higher interest rates.

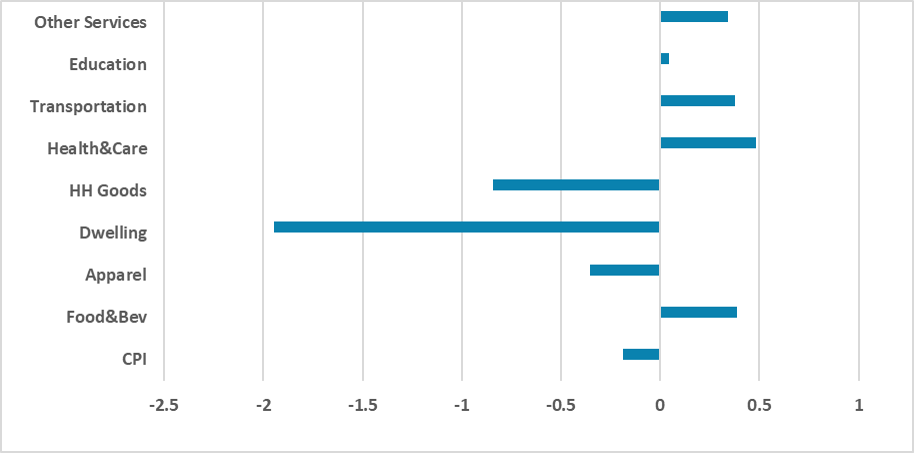

Figure 1: Mexico’s CPI by Group (%, m/m)

Source: INEGI

The Mexico National Institute of Statistics (INEGI) has released the CPI figures for May. The data show that the CPI decreased by 0.2% during the month. On annual terms, the CPI has increased by 4.7% (Y/Y), remaining stable from April. The negative figure is in line with the historical average for May as electricity prices drop during this month due to the end of high tariffs as Mexico approaches summer. The result came in a bit lower than market expectations, which were predicting a -0.1% drop during May.

Looking at groups, the biggest drops came from the Dwelling group (-1.9% m/m) due to the lower price of electricity. However, household goods also fell during the month (-0.8%), contributing to the negative CPI variation during the month. Food and Beverages grew by 0.4%, and in Y/Y terms, they accumulated a 5.8% rise, which is a worrying sign.

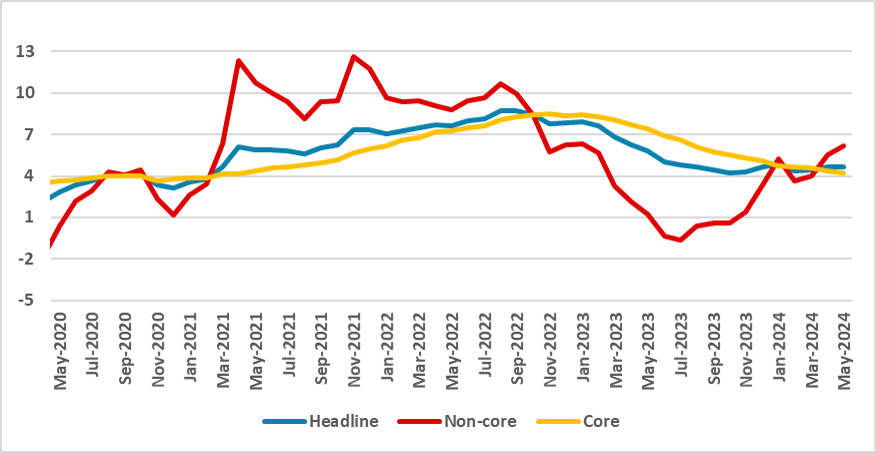

Figure 2: Mexico’s CPI (%, Y/Y)

Source: INEGI

It is important to note the difference between Core and Non-Core CPI. Non-Core CPI dropped by 1.3% in the month due to the drop in electricity prices, but on annual terms, it rose to 6.2% from 5.8% in April. However, Core CPI grew by 0.2% (m/m) in May and accumulated a 4.2% (Y/Y) rise on annual terms. We also see some heterogeneity within the Core group. While Core goods grew by 3.4% (Y/Y), Services are showing greater persistence, standing at 5.2% (Y/Y).

Looking forward, we believe that heated labor markets will likely keep Services CPI sticky, and there is a good chance that the shock in the Food and Beverages group could spread to other groups. This will prevent headline CPI from registering stronger falls throughout the year. Additionally, the recent volatility in the Mexican Peso after Claudia Sheinbaum's victory and the most important MORENA gathering of the Constitutional majority in Congress will likely frighten international investors, making the MXN Peso weaker in the coming months. This all points to inflation being a bit stickier in the short term, and if we couple it with de-anchored expectations, Banxico will likely need to keep interest rates higher for longer. We still see some room for Banxico to cut 25bps in their next meeting, but we believe now that most of the members will switch their thinking towards continuing the pause.