India's Q3 GDP: Strong But Uneven Growth

India's economic landscape witnessed a remarkable upswing in Q3-FY24, with a real GDP growth rate of 8.4%, surpassing both street estimates and the Reserve Bank of India's (RBI) projections. This surge not only solidifies India's position as the fastest-growing major economy globally but also underscores the economy’s resilience amid global economic uncertainties and a tight liquidity environment. Nonetheless, the numbers require a closer inspection given uneven growth in the economy.

Surpassing Projections:

The Q3FY24 GDP growth figure of 8.4%y/y significantly outpaced both our and the RBI's projections. The central bank had maintained an optimistic estimate of 6.5% for this period, broadly in line with our forecast of 6.4% y/y. The primary drivers behind this robust growth were the manufacturing and construction sectors. The government in its latest data release also revised the growth estimates for the previous two quarters by 40bps due to a lower base in the corresponding year-ago quarters, with growth rates of 8.2% y/y in June and 8.1%y/y in September.

Growth Drivers

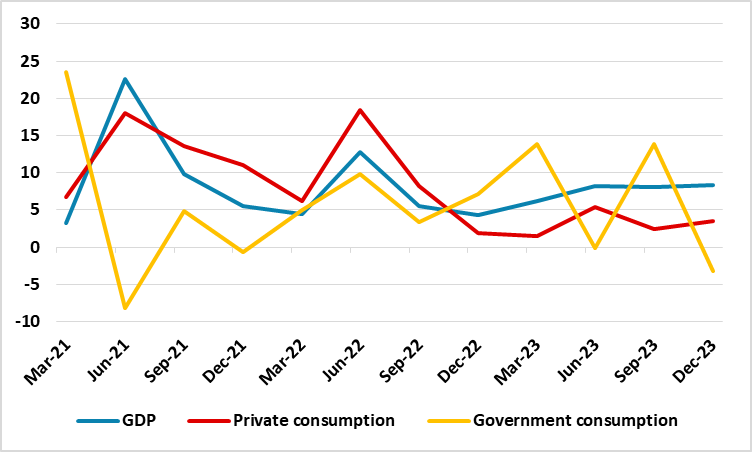

The strong growth in Q3 was fuelled by sustained momentum in investments, particularly in government capital expenditure. The trade deficit showed substantial improvement, contributing to overall GDP growth. Meanwhile, despite a sub-par year-on-year growth rate, there was an uptick in consumption demand, significantly influencing the quarter's GDP.

Figure 1: GDP growth and components (%y/y)

Source: Continuum Economics

The standout performer in the December 2023 quarter was gross fixed capital formation (GFCF), reflecting investment demand, which grew by a robust 10.6%y/y. This double-digit growth for the second consecutive quarter compared favourably to the average 7.4% growth recorded in the preceding eight quarters. Although contributing only 1-15% to total GFCF, government capital expenditure played a pivotal role in driving overall GFCF growth, with total capital expenditure (capex) by state and central governments combined growing by nearly 21% in nominal terms. Meanwhile, private sector investments continued to underwhelm. Net exports of goods and services experienced a significant decrease in the December 2023 quarter, almost halving compared to the preceding quarter. This reduction substantially alleviated the drag from the trade deficit on total GDP, with the trade deficit declining to 1.7% of GDP from an average of 4.6% in H1 FY24.

Private consumption, a crucial component of economic activity, grew by 3.5%y/y in Q3. While this indicates a positive trend, the rate of growth was more modest than anticipated. In contrast, government consumption contracted by 3.2% y/y during the quarter, influenced by factors such as a decline in revenue expenditure.

DIVERGING TREND

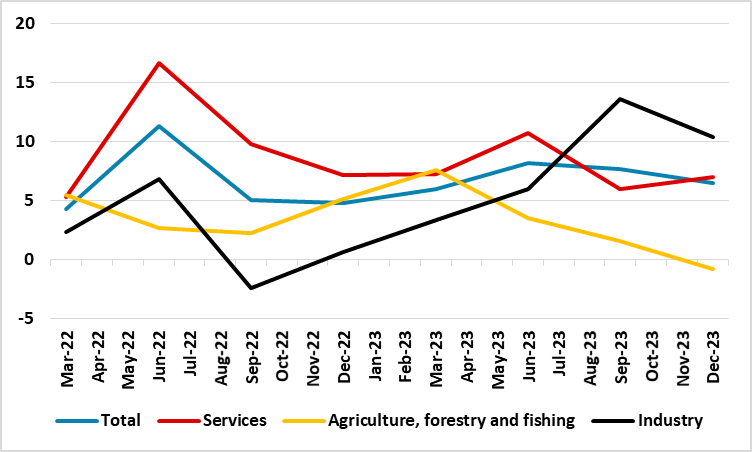

However, it is worth noting that it is the substantial uptick in net tax collections that had added volatility to India’s GDP numbers. A closer look at the data outlines how the GVA is substantially lower at 6.5% y/y. As a consequence, for a more authentic view of the economy, it would be prudent to consider India’s GVA growth for this year. Latest fiscal numbers show that India’s indirect tax collection rose 32% y/y in Q3.

Having said this, the manufacturing sector, which contributes about 17% to India's GDP on average, saw an extraordinary expansion of 11.6% y/y during the quarter. This surge is indicative of increased production, enhanced operational efficiency and the positive impacts of the government's 'Make in India' initiative. The government’s consistent push for Production Linked Incentive scheme is another factor contributing towards this growth. Simultaneously, the construction sector demonstrated a commendable growth rate of 9.5%y/y. The construction boom can be attributed to increased infrastructure development, government initiatives, and sustained public spending on key projects ahead of the upcoming elections.

While the services sector recorded a robust growth rate of 6.7%y/y, sectors like public administration, defence and related services outshone with a growth rate of 7.5%y/y. However, the trade, hotel, transport, and communication segments, while growing, exhibited a slightly lower rate of expansion. It is worth noting that several factors contribution to the growth in the services sector during the quarter. The October to December period is also the festive and wedding season in India. India’s wedding industry is pegged at about US$75bn in 2023. Fuelled by growing urbanisation, elevated disposable incomes, the ascent of wedding technology (wed-tech), the wedding sector is now the fourth-largest industry in India. The Cricket World Cup was also held during the quarter and is expected to have supported service sector growth.

Figure 2: Gross Value Added (GVA, %y/y)

Source: Continuum Economics

On the flip side, adverse weather conditions took a toll on the agriculture sector, leading to a contraction of 0.8%y/y. The disappointing monsoon rains, the weakest in five years, resulted in lower crop yields, prompting the government to impose export restrictions on essential farm commodities.

OUTLOOK

Following these dynamics, we will be revising our growth estimate for FY24 and our expectations of growth in FY25, in our upcoming March Outlook. For now, we expect over 7.5% y/y growth in FY24, and a close to 6.8% y/y growth in FY25.

However, risks are tilted to the downside, as concerns about uneven growth persist. Private consumption growth, though expected to pick up during the festive season, fell short of expectations. Further, caution is warranted in interpreting the headline growth figures, given the divergence between GDP and GVA and the uneven performance in private consumption and government expenditure.

Investors are likely to remain wary in the near term as India navigates the upcoming electoral landscape, a tighter liquidity environment and potential inflationary pressures. The slow recovery in private investment will be particularly tracked by investors. However, India remains a favourite investment market, especially given expectations of the ruling Bhartiya Janta Party returning to power in June 2024 and business policy seeing little to no changes.