Federal Reserve

View:

January 05, 2026

January 02, 2026

Bessent: New Fed Inflation Range and Dropping Dots?

January 2, 2026 11:30 AM UTC

U.S. Treasury Secretary Bessent over the Christmas period suggested that the Fed should shift to targeting an inflation range and drop the quarterly dots. What impact would this have? Such a change would give the Fed more flexibility on the margin, but not significant. This could make communicat

December 30, 2025

U.S. Consumption Vulnerable to Asset Market Hit

December 30, 2025 8:42 AM UTC

Overall, we see consumption growth prospects as being modest for 2026, as low to middle income households still struggle with the cost of living crisis. Additionally, the slowdown in immigration is causing less overall employment gains and in turn less absolute increase in real income and consumptio

December 19, 2025

December 18, 2025

U.S. November CPI - Is the tariff impact fading?

December 18, 2025 2:10 PM UTC

November’s CPI is significantly lower than expected, at 2.7% yr/yr, 2.6% ex food and energy, compared with 3.0% for both series in September (October data will not be released). November’s core CPI index is up only 0.16% from September’s, implying an average rise of less than 0.1% per month ov

December 17, 2025

DM Rates Outlook: 2026 Yield Curve Steepening Before 2027 Flattening

December 17, 2025 9:21 AM UTC

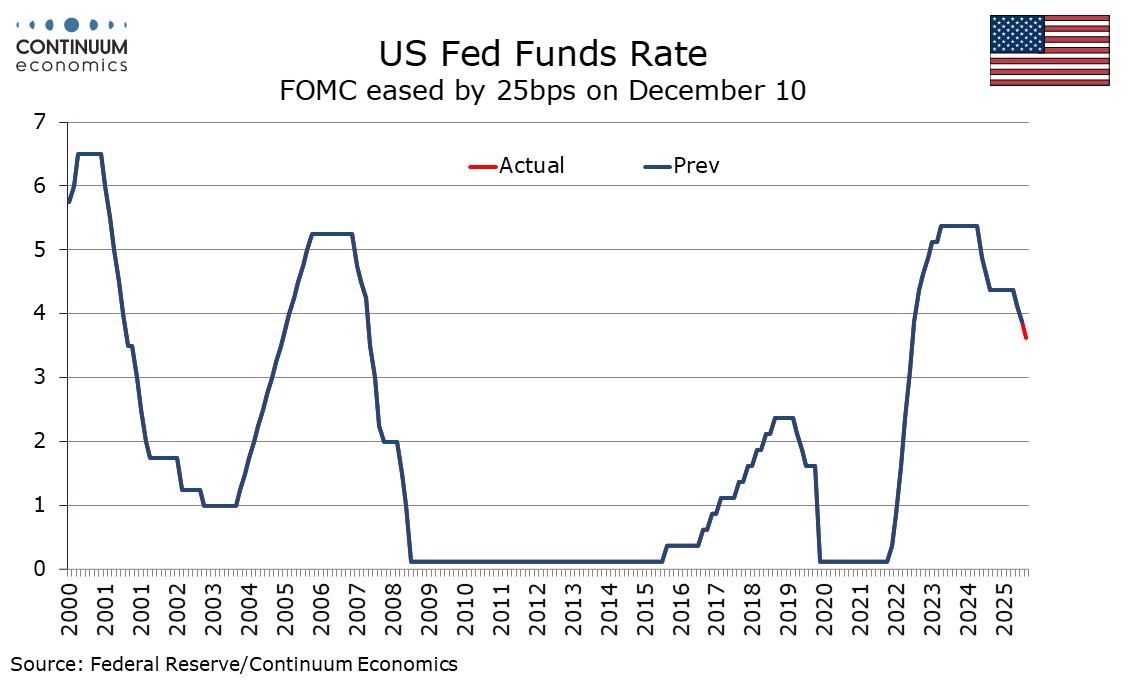

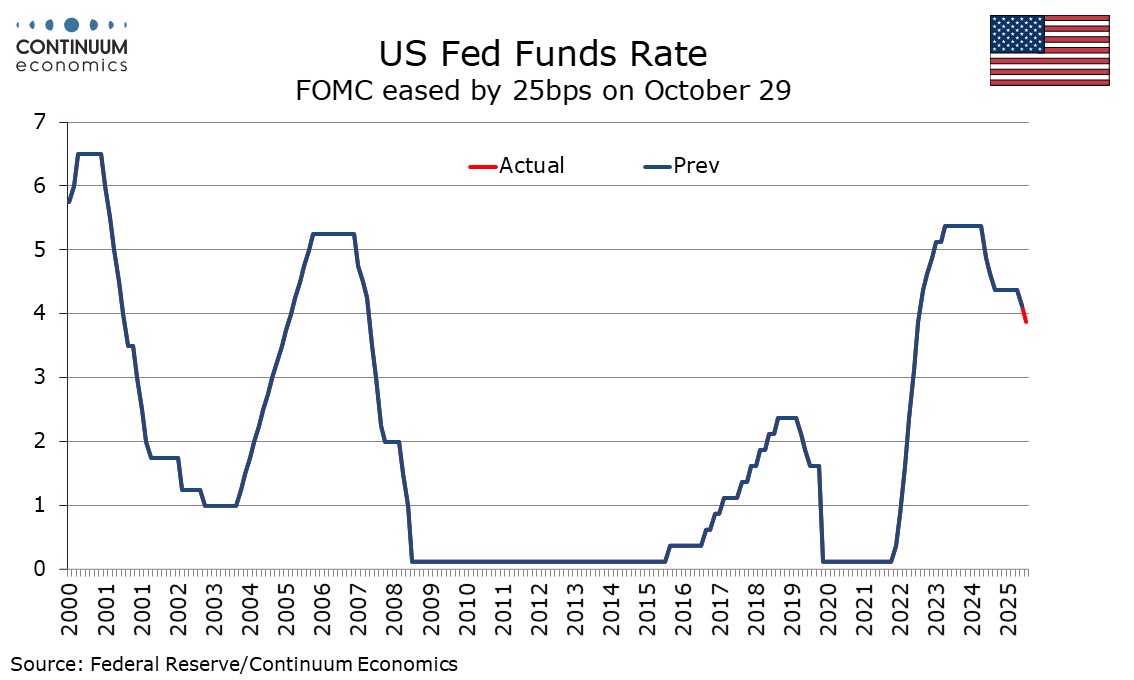

· Multi quarter, we still look for 50bps of further Fed easing by end 2026, which will likely initially bring 2yr yields down to 3.35%. However, once the Fed Funds rate get closer to 3.0-3.25% and the assumed slowdown turns into a soft landing, the 2yr will likely move to a premium ve

December 16, 2025

December 15, 2025

December 12, 2025

U.S. Outlook: Consumers Vulnerable, but Recession Unlikely

December 12, 2025 4:38 PM UTC

• US GDP growth is likely to look solid in Q3 2025 supported by resilient consumer spending, but with slowing employment growth and resilient inflation weighing on real disposable income that will be difficult to sustain. However, while consumers look vulnerable, business investment looks h

December 10, 2025

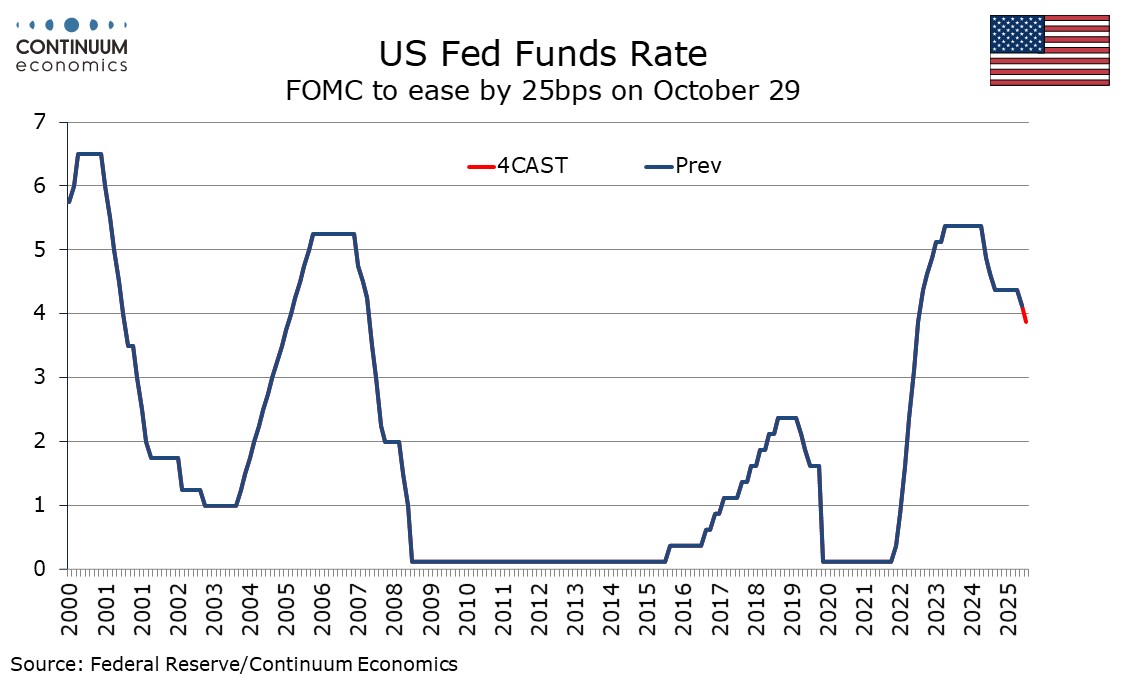

Fed: Slower 2026 Easing

December 10, 2025 8:34 PM UTC

Powell in the press conference made clear that the Fed is now in a wait and see mood, with policy rates entering a broad measure of neutral policy rates. This means further weakening in labor demand and then consumption would be required to prompt an early 2026 cut. We are less upbeat than the Fed

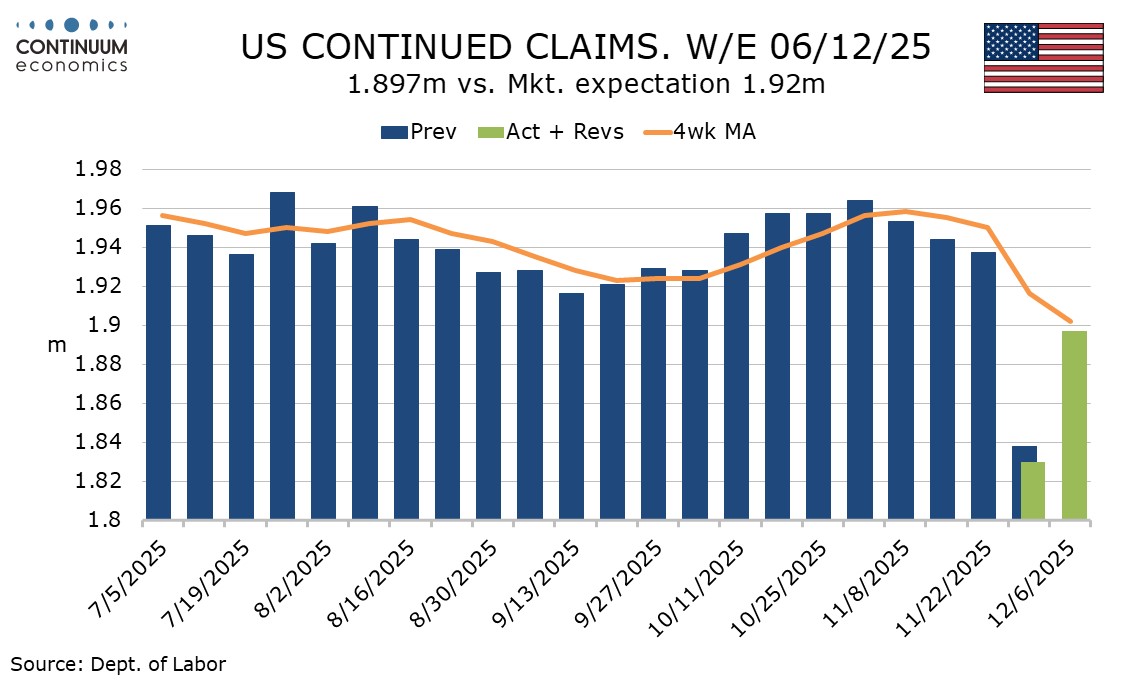

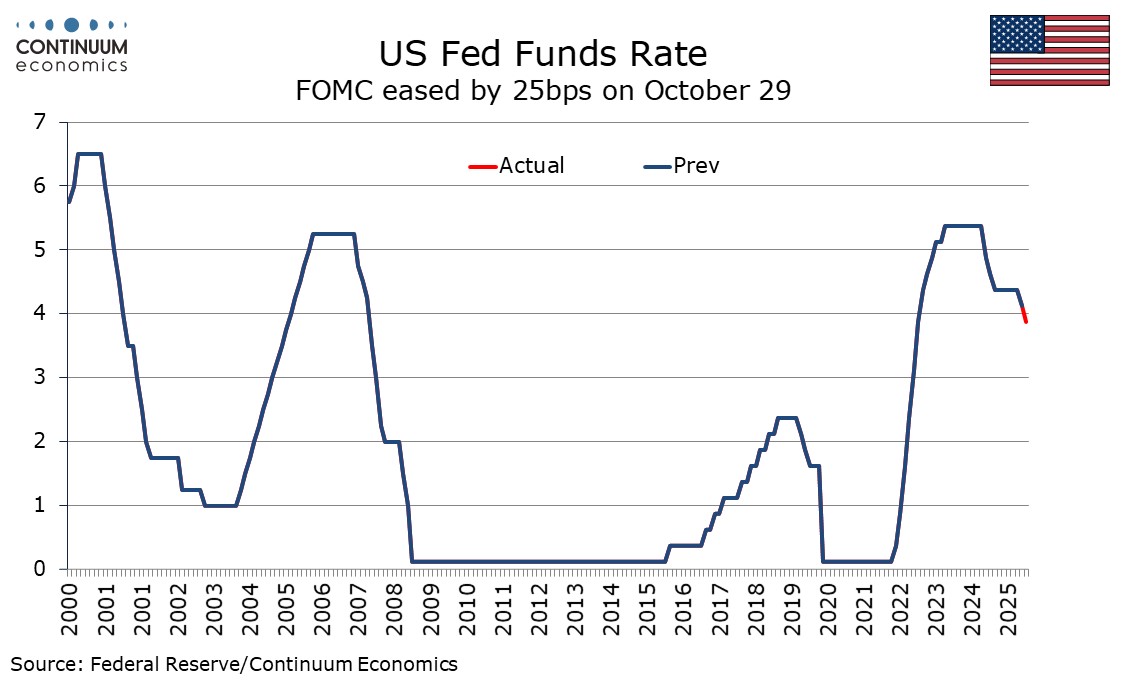

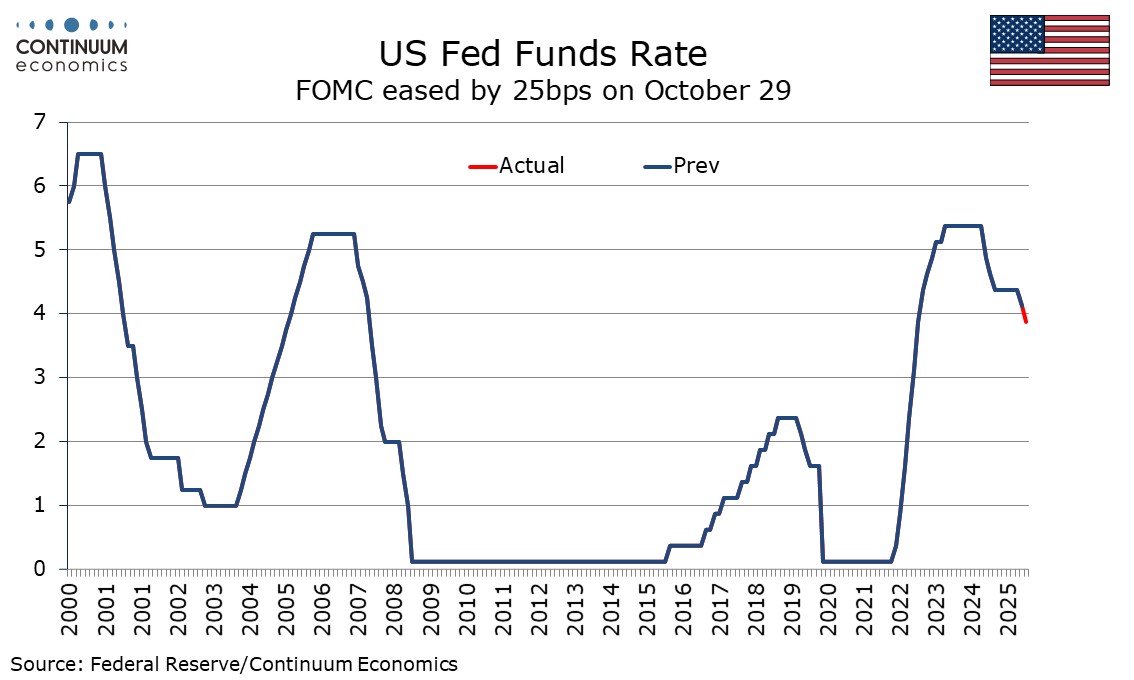

FOMC eases by 25bps, dots unchanged from September

December 10, 2025 7:21 PM UTC

The FOMC has eased by 25bps as expected to a 3.50-3.75% Fed Funds target range, with two hawkish dissents for no change from Schmid (who dissented in October) and Goolsbee, while Miran again dissented for a steeper 50bps ease. The dots are unchanged from September, implying one 25bps ease in both 20

December 05, 2025

FOMC Preview for December 10: A close call for a 25bps easing

December 5, 2025 4:09 PM UTC

The FOMC meets on December 10 in what looks sure to be a hotly debated decision, though a 25bps easing in the Fed Funds target range to 3.50-3.75% looks likely, justified by labor market risks. However, at least two hawkish dissents for unchanged policy are likely. The meeting will deliver updated d

December 02, 2025

New Dovish Fed Chair and U.S. Yield Curve

December 2, 2025 1:00 AM UTC

· The initial knee jerk reaction if NEC Hassett is nominated as Fed chair would be for further yield curve steepening in the 10-2yr area. Even so, the dynamics of FOMC voting could mean that Hassett as Fed chair in itself does not deliver more Fed easing. This is already evident with

November 24, 2025

November 21, 2025

November 20, 2025

November 19, 2025

FOMC Minutes from October 29 and data postponements reinforce doubts over a December move

November 19, 2025 8:03 PM UTC

FOMC minutes from October 29 state that participants expressed strongly differing views over what policy decision would be appropriate in December. With the Labor Department today announcing that the forthcoming non-farm payroll for September will be the last before the December 10 FOMC meeting, the

November 18, 2025

November 17, 2025

November 14, 2025

FOMC Minutes from October 29 to reinforce doubts over a December move

November 14, 2025 4:13 PM UTC

FOMC minutes from October 29 are due on November 19, and will be closely watched after Chairman Powell after the meeting stated there were strongly differing opinions on December. The minutes are likely to suggest that a December easing, which Powell on October 29 stated was far from assured, is lik

November 13, 2025

November 12, 2025

November 07, 2025

November 04, 2025

U.S. Treasuries: Waiting for Data and Yield Curve Steepening

November 4, 2025 1:57 PM UTC

• Multi quarter we still look for 75bps of further Fed easing by end 2026, which will likely initially bring 2yr yields down to 3.4%. However, once the Fed Funds rate get closer to 3.0-3.25% and the slowdown turns into a soft landing, the 2yr will likely move to a premium versus Fed Funds

November 03, 2025

October 31, 2025

U.S./China Trade Framework: Avoiding Escalation

October 31, 2025 7:48 AM UTC

· The U.S./China framework deal avoids renewed escalation of trade tension, but is unlikely to be followed by a comprehensive trade deal in 2026 as China does not want major import and bilateral trade commitments. The economic effects will likely be small and the deal main aim app

October 29, 2025

FOMC - Strong Differences of Opinion Leave December Decision Dependent on Incoming Information

October 29, 2025 7:58 PM UTC

After a statement that contained no major surprises, the highlight of FOMC Chairman Jerome Powell’s press conference was his comment that there were strong differences on policy going forward, and that a December ease was far from assured. While we still feel that on balance easing in December is

FOMC eases by 25bps, to conclude quantitative tightening on December 1

October 29, 2025 6:21 PM UTC

The FOMC has eased rates by 25bps to a 3.75%-4.00% range as expected and decided to conclude the reduction of its securities holdings on December 1 as Chairman Powell had hinted at on October 14. There were two dissents, Governor Miran favoring a 50bps move and Kansas City Fed’s Schmid delivering

October 24, 2025

FOMC Preview for October 29: 25bps Easing but Little Forward Guidance

October 24, 2025 3:49 PM UTC

The FOMC meets on October 29 and a 25bps easing to 3.75%-4.0% looks likely, particularly after September’s CPI came in on the low side of expectations. The statement is however still likely to express concerns over inflation while the scale of downside risks on activity are uncertain, and not on

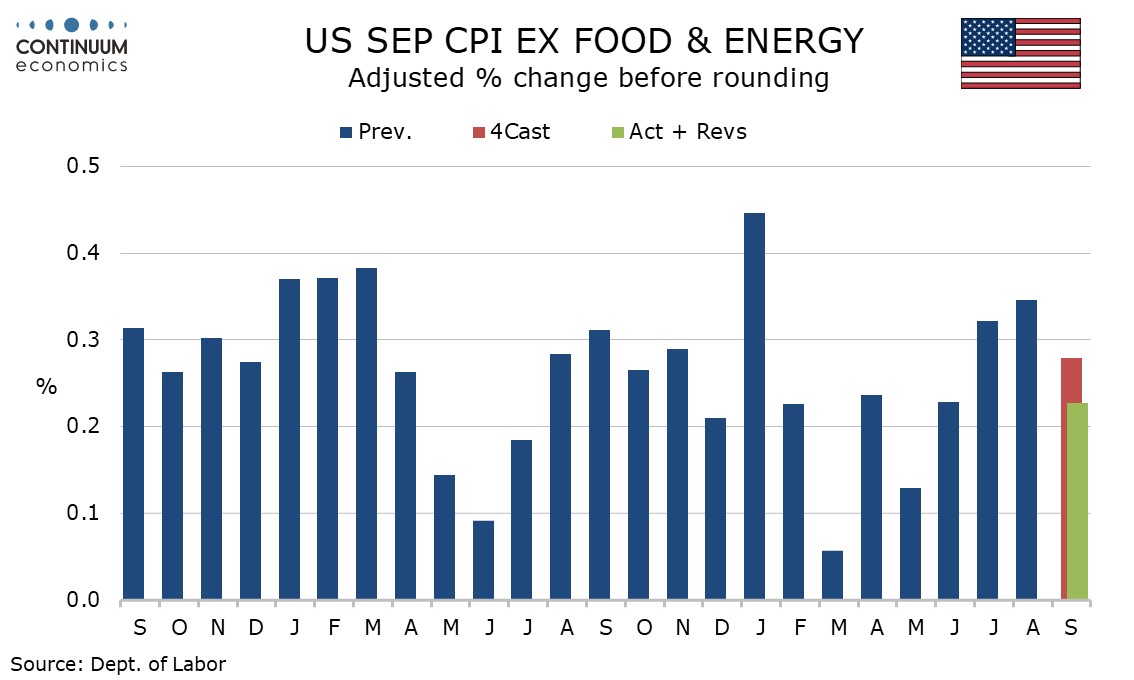

U.S. September CPI - Soft enough for an October FOMC easing but still above target

October 24, 2025 12:58 PM UTC

September CPI is on the low side of expectations at 0.3% overall, 0.2% ex food and energy, and should not pose an obstacle to a likely 25bps easing at the October 29 FOMC meeting. The core rate was up by 0.23% before rounding, slower than July and August gains that rise by more than 0.3% before roun

October 17, 2025

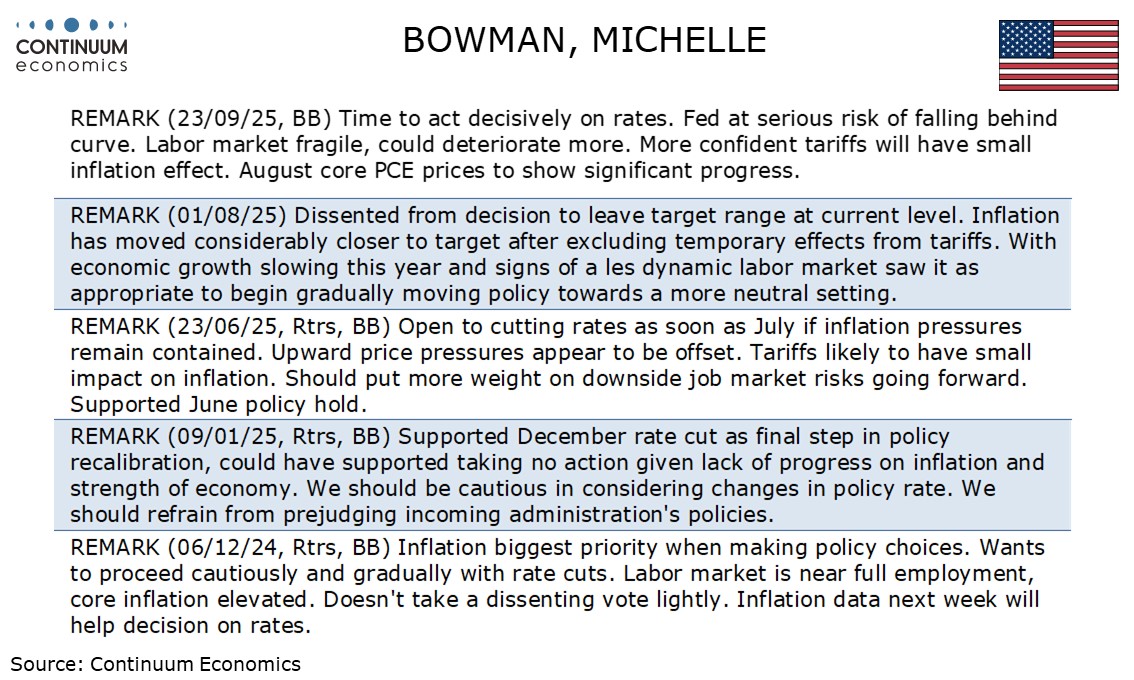

Looking at the Candidates for U.S. FOMC Chair

October 17, 2025 3:22 PM UTC

There are now five candidates for Fed Chair, in a rough order of decreasing credibility, current Fed Governor Christopher Waller, current Fed Governor Michelle Bowman, former Fed Governor Kevin Warsh, National Economic Council Director Kevin Hassett, and Rick Rieder, Blackrock’s Chief Investment