Looking at the Candidates for U.S. FOMC Chair

There are now five candidates for Fed Chair, in a rough order of decreasing credibility, current Fed Governor Christopher Waller, current Fed Governor Michelle Bowman, former Fed Governor Kevin Warsh, National Economic Council Director Kevin Hassett, and Rick Rieder, Blackrock’s Chief Investment Officer of Global Fixed Income. Hassett is the favorite according to betting odds.

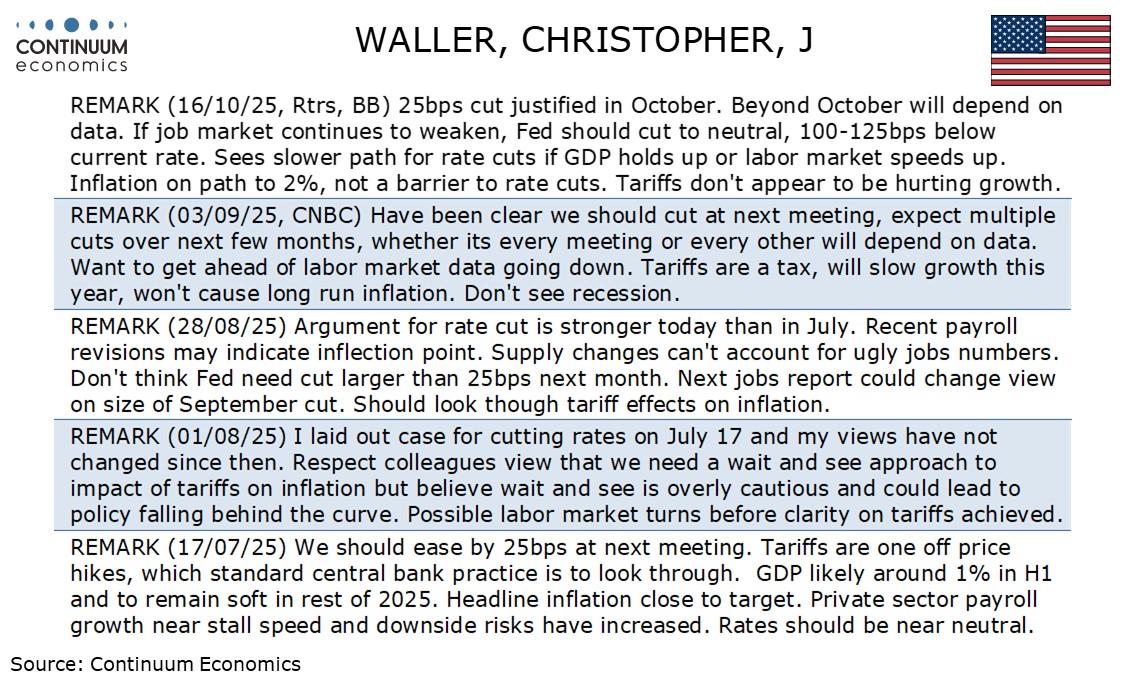

Any successor to Jerome Powell will face suspicions that they will compromise Fed independence and act in line with the wishes of President Trump, and may need to establish credibility. This would probably be easiest for Waller. His warnings of impending labor market softening earlier in this year, initially treated with skepticism from someone who as recently as 2024 had a somewhat hawkish reputation, turned out to be prescient. More recently he has shown that his dovish shift is not a rigid one, noting a contradiction between slower labor market data and resilience in GDP, and unwilling to advocate yet for easing beyond a 25bps move in October that he supports.

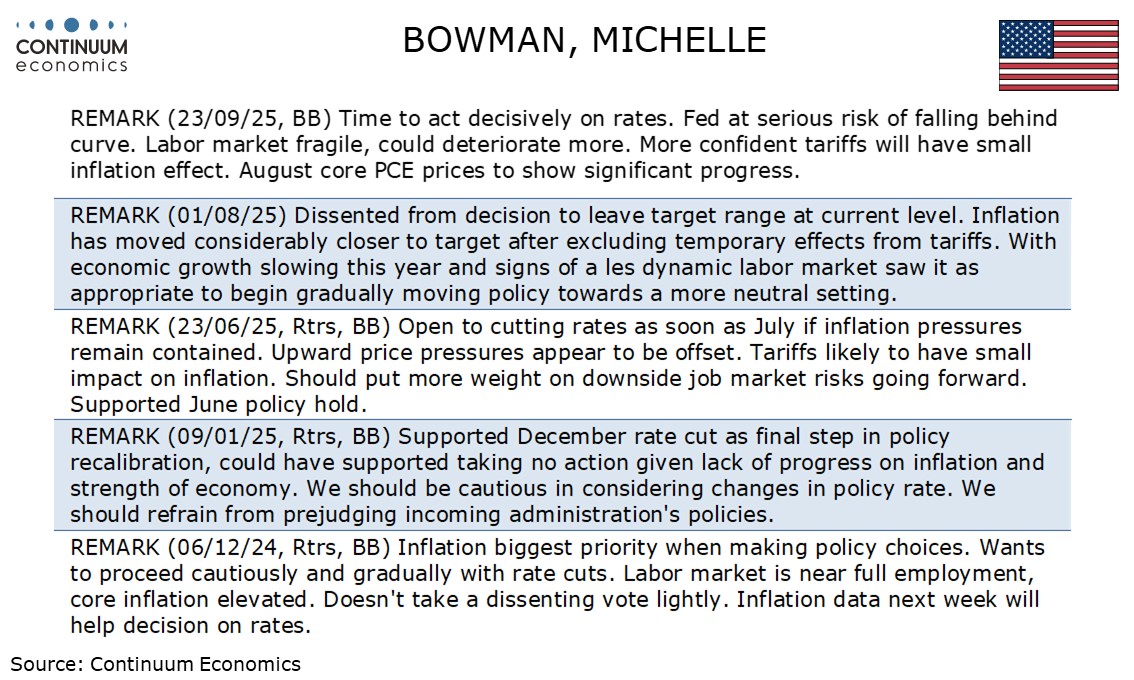

Bowman in transforming from a hawk to dove has undertaken a similar journey to Waller, though her transformation has been somewhat sharper. In September 2024 she cast a hawkish dissenting vote, calling for an ease of only 25bps rather than the 50bps that was delivered, and was then seen as probably the most hawkish voice on the FOMC, warning against high inflation even in late 2024. Her dovish shift only became publicly apparent in June of this year and came as more of a surprise than from Waller whose more frequent public comments gave a clearer picture of the evolution of his views. Bowman continues to speak less than Waller, though she has not said anything that clearly cast doubts on her credibility.

Both Waller and Bowman get some points in credibility by being current FOMC Governors. Warsh, who served as an FOMC Governor from 2006 to 2011 also gets points for experience at the Fed, and like Waller and Bowman, now sounds dovish despite having a past reputation as a hawk. Warsh’s hawkish stance on the FOMC was significantly more distant than those we saw from Waller and Bowman, meaning that there is no sudden shift to be examined. However his hawkish concerns over inflation as a Governor came at a time when hawkish policy was not needed, despite his warnings over the risks from Quantitative Easing at the time. Fed policy did stay too dovish for too long after COVID, but that was not the case after the Great Recession.

There would be more uncertainty over a choice of Hassett or Rieder. Hassett is better known having worked for both Trump administrations. Having previously advised John McCain, George W. Bush and Mitt Romney, he has a history of being a traditional Republican before serving in both Trump administrations, so it is unclear how loyal he would be to Trump as Fed Chairman. We cannot assume Stephen Miran’s stance as FOMC Governor would match what we might see from Hassett. However, Miran’s position as a dovish dissenter despite downplaying downside risks to the economy, basing his views on optimistic views on what Trump’s policies will mean for housing inflation and the neutral rate, could be similar to the views Hassett would advance as Chairman. That Hassett leads the betting odds suggests he is seen as being favored by Trump.

Rieder is the least known of the five, but certainly experienced in financial markets. He appears to have attracted attention due to a willingness to look at forward looking indicators while downplaying more traditional backward looking ones. This could be a recipe for very prescient decisions, something that recent Fed history has lacked, particularly as inflation surged in the aftermath of COVID. However gaining the confidence of the markets for such an approach, particularly when the Fed is seen as being under heavy political pressure, would be difficult.