FOMC Preview for October 29: 25bps Easing but Little Forward Guidance

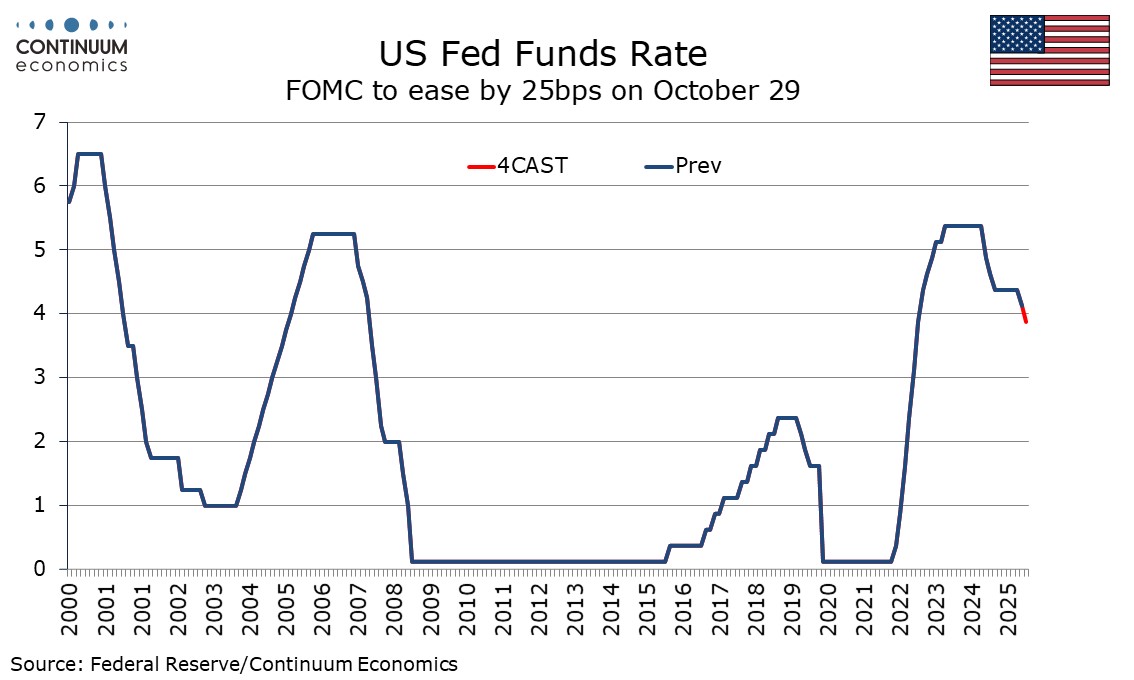

The FOMC meets on October 29 and a 25bps easing to 3.75%-4.0% looks likely, particularly after September’s CPI came in on the low side of expectations. The statement is however still likely to express concerns over inflation while the scale of downside risks on activity are uncertain, and not only because of the government shutdown. Little forward guidance is likely.

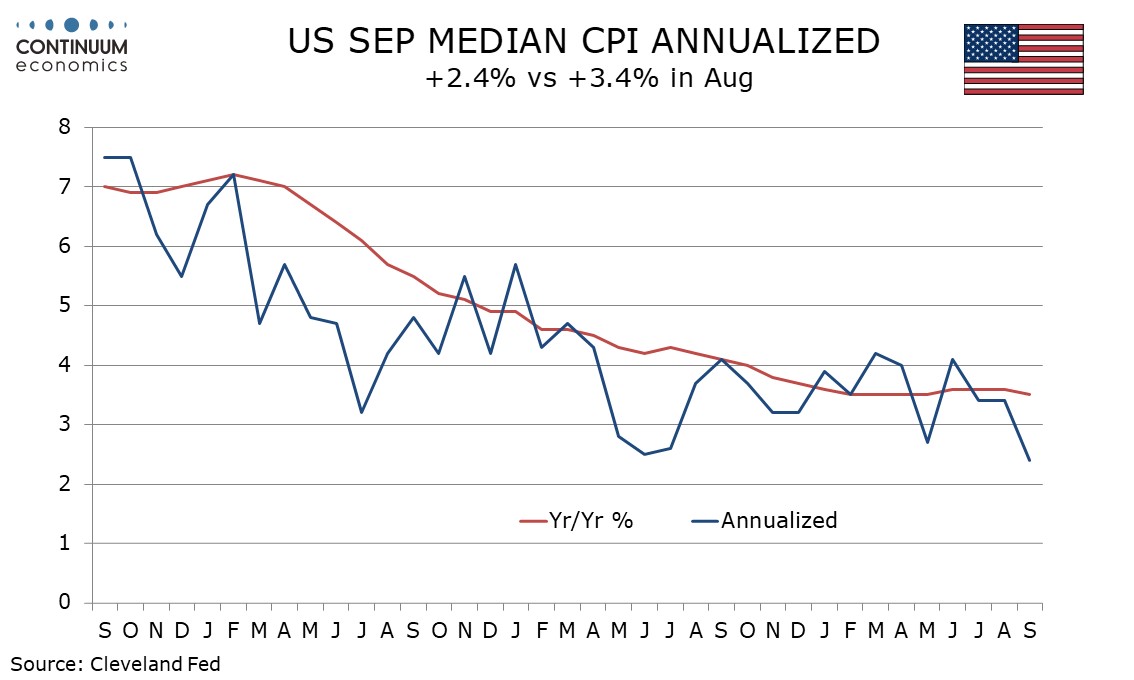

In September the FOMC stated that inflation has moved up and remains somewhat elevated. That is likely to be still valid. September CPI overall rose to 3.0% from 2.9% to reach its highest since January even if the core corrected to 3.0% after two months at 3.1%. Core PCE prices at 2.9% remain well above the 2.0% target in the latest available data, for August. Still, a 0.2% monthly core CPI increase for September after two straight 0.3% gains came as something of a relief. Owners' equivalent rent, which the Cleveland Fed's Median CPI is particularly sensitive to, led the slowing.

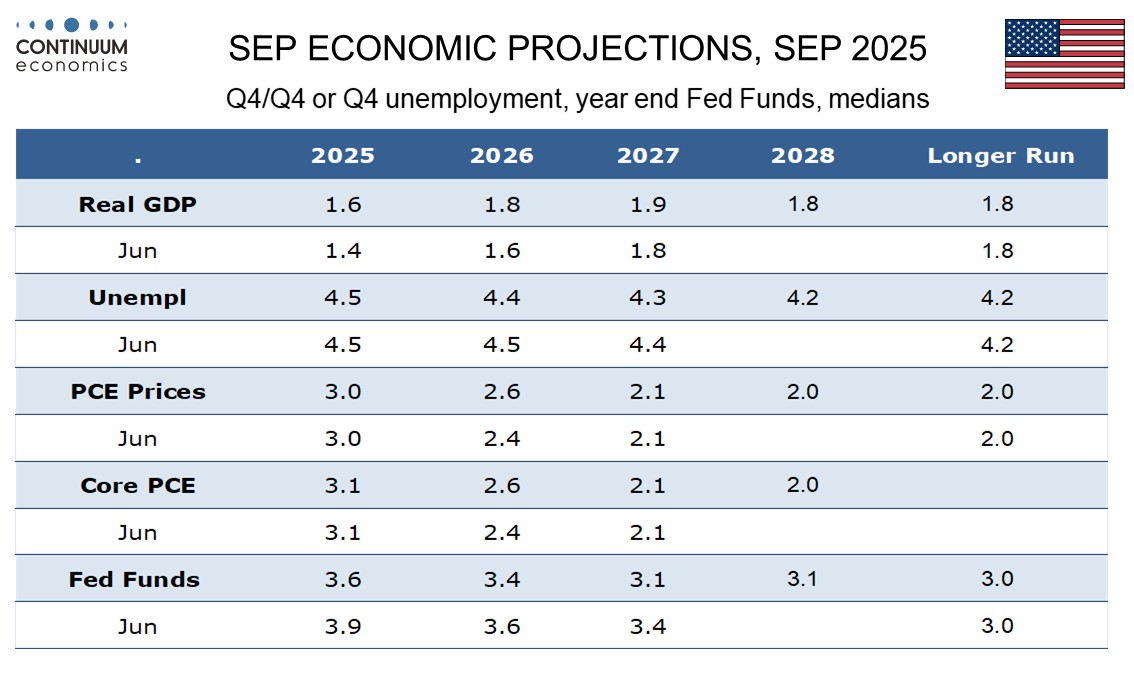

September’s FOMC dots showed a median expectation for two more 25bps easings this year and the CPI is likely to keep that view intact, allowing a 25bps October move. The dots however showed only nine of nineteen on the median, with nine more hawkish than the median and only one (Governor Stephen Miran) more dovish. However, of the twelve votes, we would see only four potential hawkish dissents against easing in October, Governor Michael Barr, Chicago Fed’s Austan Goolsbee, St Louis Fed’s Alberto Musalem and Kansas City Fed’s Jeffrey Schmid. A majority for easing looks assured. We expect at least one of Schmid and Musalem to dissent for steady policy, but that Barr and Goolsbee will vote with the majority after seeing the CPI. Miran is likely to cast a dovish dissent for a 50bps move.

With the October non-farm payroll delayed and Q3 GDP not yet visible the FOMC does not have much more information on activity than it did in September. Downside labor market risks persist with September’s ADP employment report having come in negative, but most estimates for Q3 GDP are healthy. Governor Christopher Waller, who has recently been dovish, has noted the contrast between strong GDP and weak labor market signals and feels the contrast is unlikely to persist. He has expressed support for a 25bps easing in October but wants to see more data before going further. This suggests the FOMC is unlikely to offer much forward guidance, even at Chairman Jerome Powell’s press conference. The dots will not be updated at this meeting.

On October Powell stated that the Fed may end balance sheet run-off in the coming months. This month’s statement looks likely to outline a schedule for winding down Quantitative Tightening, which was already significantly slowed in April, the slowing outlined in March’s statement. Powell is likely to stress that this does not carry any significance for future decisions on the Fed Funds target.