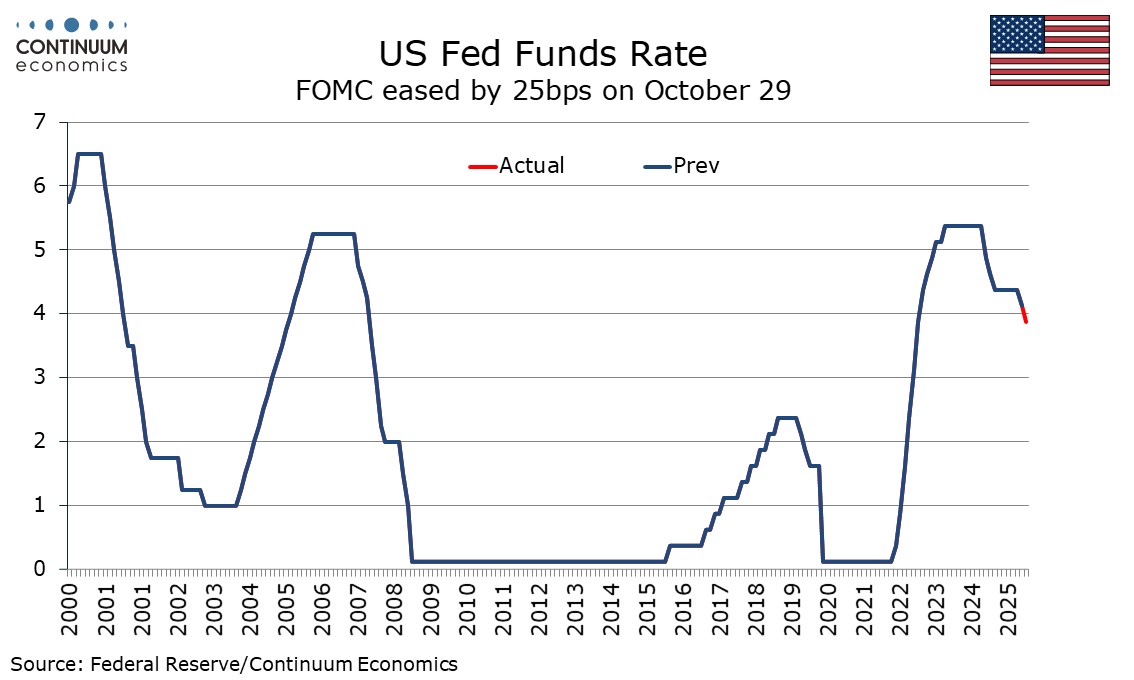

FOMC Minutes from October 29 to reinforce doubts over a December move

FOMC minutes from October 29 are due on November 19, and will be closely watched after Chairman Powell after the meeting stated there were strongly differing opinions on December. The minutes are likely to suggest that a December easing, which Powell on October 29 stated was far from assured, is likely to require some weak data. Few other than Governor Miran appear clearly committed to a December easing at this point, while several, if a minority of voters, appear opposed to such a move.

The minutes from the September meeting, which like that of October 29 delivered a 25bps easing, did not reveal a clear split between two camps, despite dots from that meeting suggesting that they might. The minutes from October 29 are likely to focus more on that meeting’s decision than what to do in December. It is known that there were two dissents from the 25bps ease, a dovish one from Governor Miran who wanted a 50bps move, and a hawkish one from Kansas City Fed’s Schmid who wanted no change. It appears clear that Miran’s aggressively dovish view is an outlier. However three non-voters, who will all gain a vote in 2026, Cleveland Fed’s Hammack, Dallas Fed's Logan and Minneapolis Fed’s Kashkari have stated they opposed the October move, Kashkari the more notable as he was not sounding hawkish until recently. St Louis Fed’s Musalem, who did vote for October’s move, now sees limited further room to ease, while Atlanta Fed’s Bostic, a non-voter, now feels rates should be held steady. Since the meeting, only Miran has given a clear call for a December easing. Comments since the meeting from mainstream to dovish figures have seen Governor Jefferson stating that the Fed should now proceed cautiously, Governor Cook now giving much away but stating she was attentive to risks on both sides, and San Francisco Fed’s Daly stating she is open minded about December.

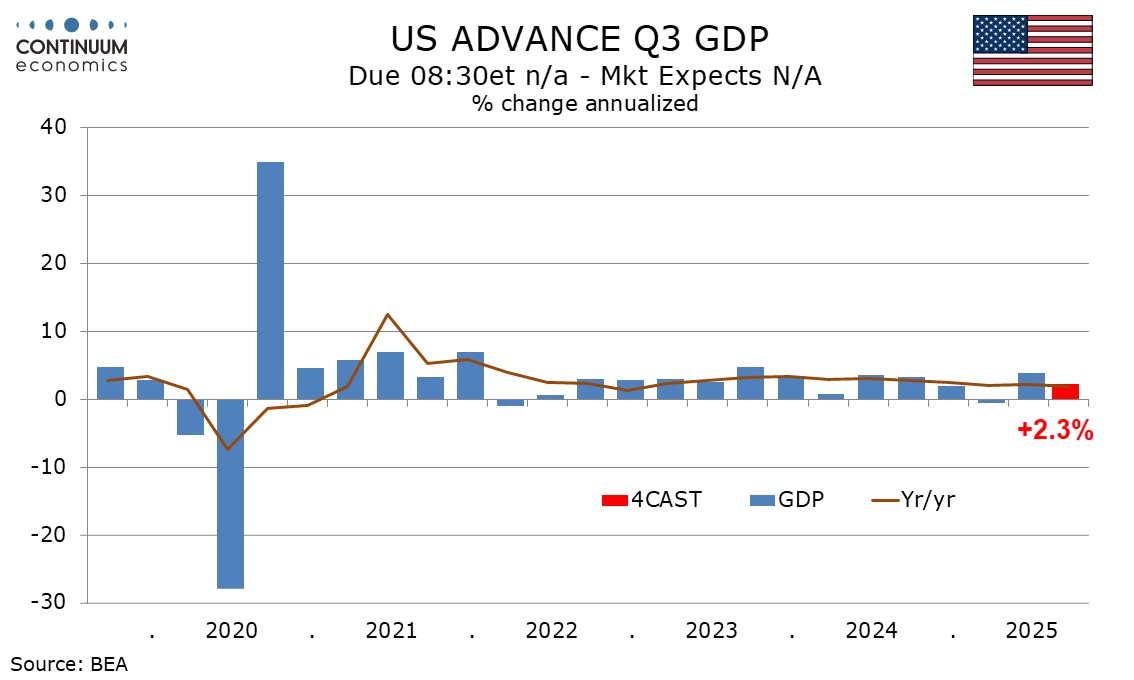

The minutes will see the arguments against an October easing outlined. Therese are likely to include stubborn inflation, uncertainty over the relative importance of easing demand and emerging supply shortages in the slowdown in hiring, and strength in GDP, both an upward revision to Q2 that was released after the September meeting, and estimates that Q3 GDP will come in firm, with some estimates for a rise similar to Q2’s revised 3.8% (out forecast is a more moderate but still respectable 2.3%). Before the meeting, Governor Waller, who was one of the first to advocate a resumption of easing, noted the contrast between signs of strength in GDP and weakness in employment, and while backing an October move wanted to see more data before going further. Still, the Fed did vote to ease in October. The case for easing leads from downside labor market risks, which will make recent resilience in consumer spending difficult to sustain. On inflation, some comfort was found in August core PCE data and September’s core CPI. Tariffs are lifting goods inflation but by less than many had feared. There are differences of opinion elsewhere. Powell on October 29 did see progress in core services, and that is likely to be the majority view on inflation excluding the tariff impact. Some, however, notably Hammack, Logan and Schmid, have expressed concerns over the resilience of inflationary pressure even outside the tariff impact.

The picture that emerges from the minutes is likely to show one camp that is clearly against further easing, though with many of them being non-voters the minutes may exaggerate their significance somewhat. The majority of voters are still probably willing to back a December easing if data shows continued labor market weakness and no alarming inflationary shocks, though a strong Q3 GDP could also strengthen the case of the hawks. The minutes will note the absence of some key data, something Powell on October 29 described as driving in fog, which argues for moving at a slower pace. It is likely, but not certain, that normal data service will have been restored by the time of the next FOMC meeting on December 10.