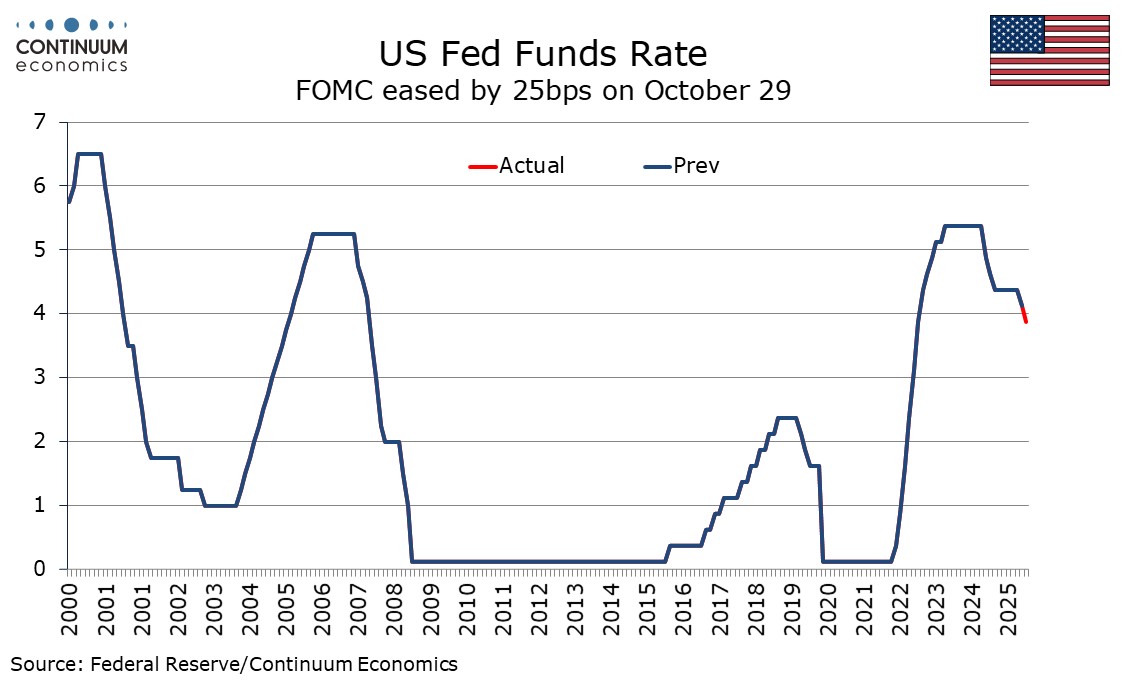

FOMC Minutes from October 29 and data postponements reinforce doubts over a December move

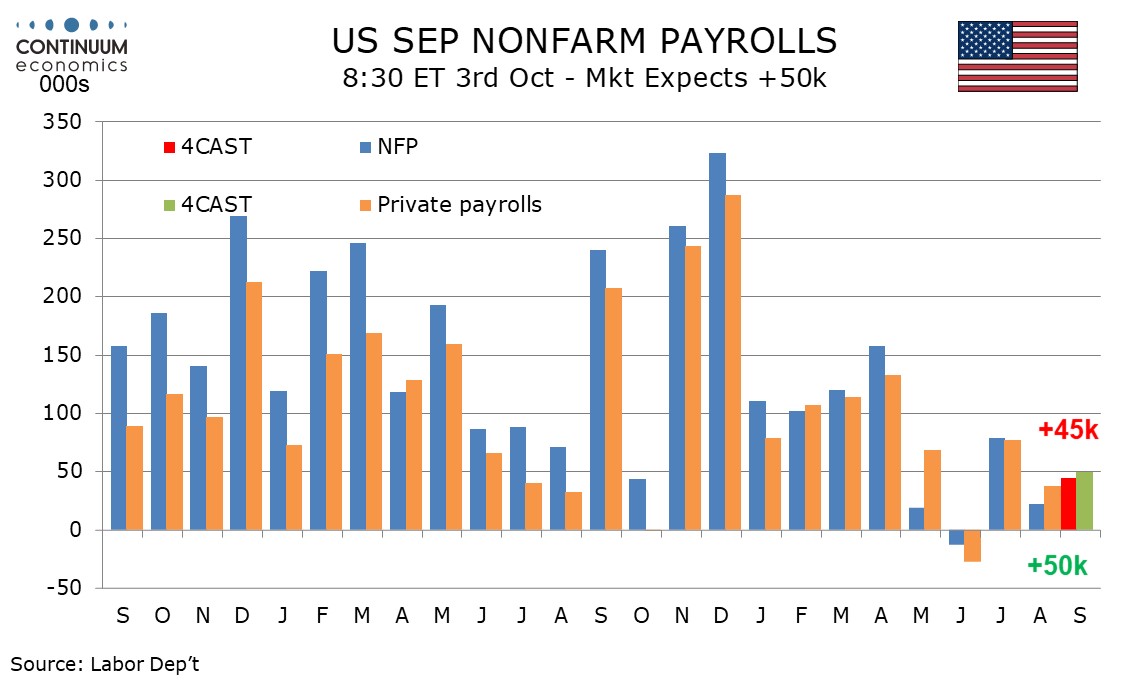

FOMC minutes from October 29 state that participants expressed strongly differing views over what policy decision would be appropriate in December. With the Labor Department today announcing that the forthcoming non-farm payroll for September will be the last before the December 10 FOMC meeting, the absence of key data will be a problem for the FOMC. Should September’s payroll show resilience, the case for a December easing could weaken.

Several assessed that a further easing could be appropriate in December if the economy evolved about as expected. Many however suggested that under their outlooks it would likely be appropriate to keep the target range unchanged. Many seems slightly larger than several but the many probably includes more non-voters. Still, if data is in short supply, making the case for another easing could be difficult. It is still unknown whether the Fed will see more inflation data, or Q3 GDP, by December 10. However, with November CPI due originally on December 10, any postponement would make it too late for the meeting. November’s non-farm payroll has been postponed to December 16 from December 5 and will include partial details for October, with a non-farm payroll but not an unemployment rate.

Most participants did judge that further easing would be appropriate, with the division over December being on the timing. Many who saw further easing as appropriate saw evidence having accumulated that the inflationary impact of tariffs would be limited, but most noted that further rate reductions could add to the risk of higher inflation being entrenched or misinterpreted as a lack of commitment to the 2% target.

In debating the decision to ease taken at the meeting, many were in favor, some supported the decision but could also have supported a hold, which several were in favor of, even if there was only one hawkish dissent (from Kansas City Fed’s Schmid). Those who preferred to keep policy steady expressed concern that progress toward to 2% inflation target had stalled. Almost all participants thought it was appropriate to conclude the reduction in the Committee’s aggregate securities holdings on December 1, as was decided at the meeting.

Participants generally expected inflation to remain elevated in the near term before moving gradually to 2%. Several pointed to persistence in core nonhousing services inflation, while several remarked that businesses planned to rase prices gradually in response to tariffs. Participants generally expected labor market conditions to soften gradually in coming months. Economic activity appeared to have been expanding gradually, though consumption appeared to be disproportionately supported by high-income households.