Bank of Japan

View:

July 31, 2025

July 30, 2025

DM Household Sluggish Borrowing

July 30, 2025 10:45 AM UTC

· Overall, restrained credit supply from banks; abundant employment/income or wealth for most households but restrained financial conditions for low income households could have restrained household lending growth to GDP. However, the surge in government debt and ensuing fear of fut

July 29, 2025

July 02, 2025

DM Central Banks: Overlooking Lagged 2021-23 Tightening and QT?

July 2, 2025 8:30 AM UTC

We are concerned that DM central banks are underestimating the lagged impact of 2021-23 tightening and ongoing QT, which impacts the transmission mechanism of monetary policy. Central banks need to consider cyclical and structural issues, but also need a more rounded view of the stance and implica

June 23, 2025

DM Rates Outlook: Yield Curve Steepening?

June 23, 2025 8:30 AM UTC

• We see the U.S. yield curve steepening in the next 6-18 months. 2yr U.S. Treasury yields can step down with cautious Fed easing on a modest/moderate growth slowdown and also if the Fed keeps an easing bias in H2 2026. 10yr U.S. Treasury yields face a tug of war between lower short-dated y

Japan Outlook: Hot Inflation Partially Transitory

June 23, 2025 3:00 AM UTC

· Growth in private consumption remains sluggish in Q1 2025 on negative real wages. Wage hike in 2025 so far looks little affected by U.S. tariffs and should remain above 2% for the rest of 2025. The subtle change in business price/wage setting behavior will be supportive for consum

June 17, 2025

BOJ QT And Steeper Yield Curve

June 17, 2025 8:41 AM UTC

Despite the slowdown in the pick-up in BOJ QT, monthly bond purchases are set to slow from Yen4.1trn pm to Yen2.1trn pm by Q1 2027. With bond maturities BOJ QT is getting bigger and will mean that supply pressures continue to drive yield curve steepening. We see 1.85% 10yr JGB yields by end 2025

May 01, 2025

April 29, 2025

March 25, 2025

Japan Outlook: Inflation Sustainably Above 2%?

March 25, 2025 10:00 AM UTC

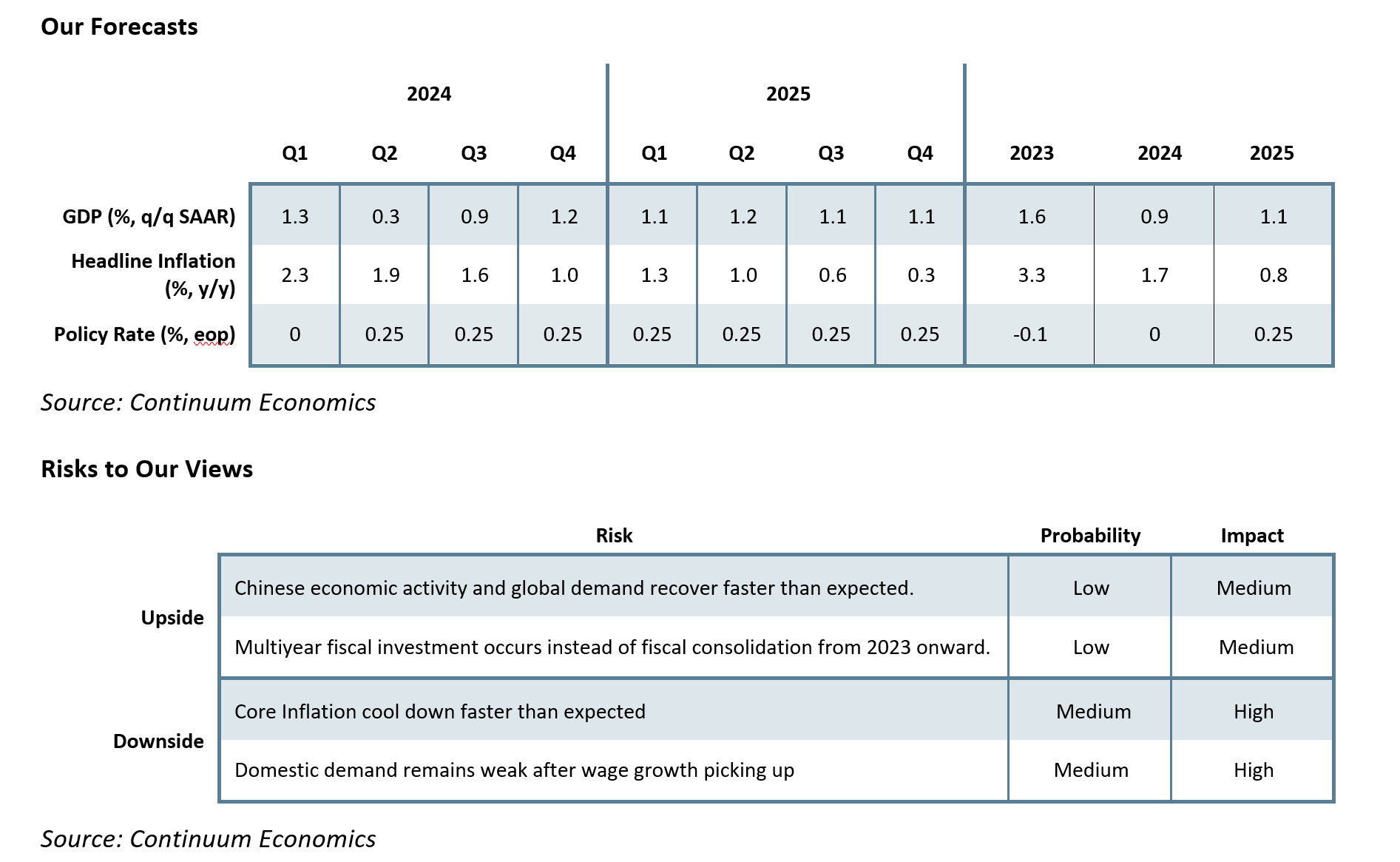

· Private consumption will have a modest growth in 2025 along the gradual change in business price/wage setting behavior before slowing to average in 2026. Wage hike in 2025 looks to be at least on par with 2024 after early result of the spring wage negotiation. SMEs are going to be

DM Rates Outlook: Policy Divergence

March 25, 2025 9:30 AM UTC

• 2yr U.S. Treasury yields can step down with cautious Fed easing on a modest/moderate growth slowdown and also if the Fed keeps an easing bias. 10yr U.S. Treasury yields can be helped by this easing and see a move down through 2025. However, the budget deficit will likely be 6.5-7.0%

March 18, 2025

January 24, 2025

January 20, 2025

January 07, 2025

December 20, 2024

Japan Outlook: Lukewarm Japan and BoJ

December 20, 2024 12:00 AM UTC

· Due to the slow recovery in consumption, 2024 GDP has been revised lower to -0.5%. Private consumption will continue to grow throughout 2025/26 gradually as business price/wage setting behavior gently shift and Japanese consumers adapting to higher inflation. Wage growth in 2025 wil

December 19, 2024

DM Rates Outlook: Policy and Spread Divergence

December 19, 2024 12:07 PM UTC

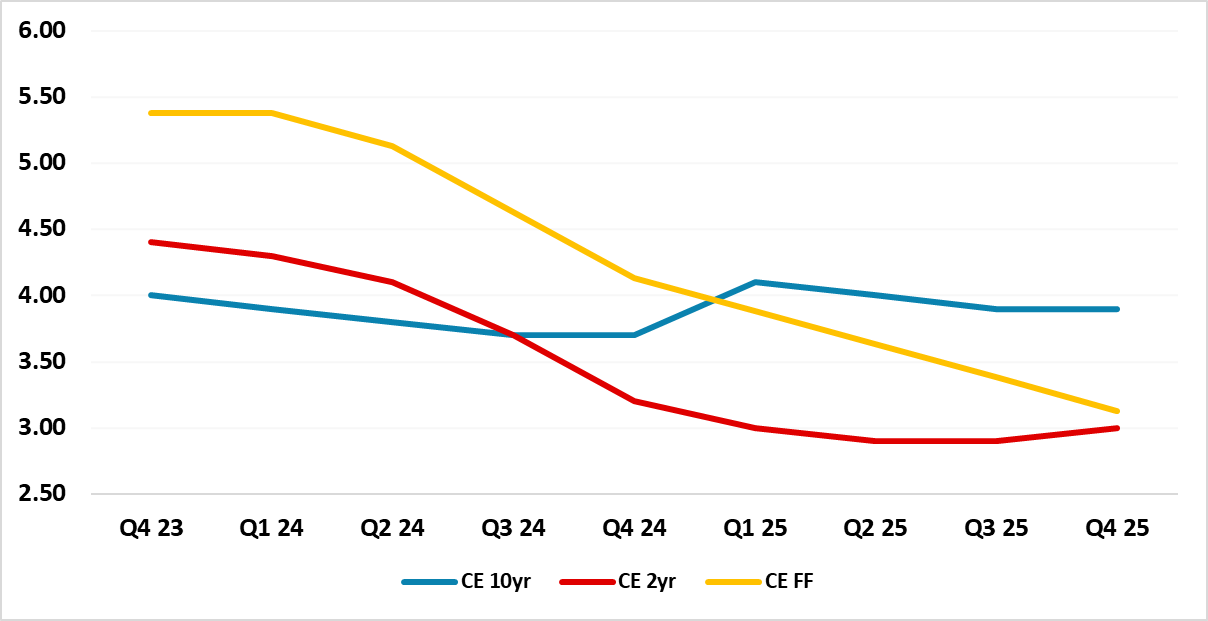

• 2yr U.S. Treasury yields can decline initially as the Fed finishes easing (Figure 1), but as the sense grows that the rate cut cycle is stopping, we see the 2yr swinging to a small premium versus the Fed Funds rate – as the market debates the risks of a future tightening cycle. For 10y

October 31, 2024

October 24, 2024

September 24, 2024

DM Rates Outlook: Rate Cuts Arrive Except Japan

September 24, 2024 9:00 AM UTC

• For U.S. Treasuries, we see 2yr yields coming down further on our baseline soft landing view, as the Fed moves consistently to a 3.00-3.25% Fed Funds rate. However, with considerable Fed easing already discounted, 2yr yield decline should be modest and 2yr yields should bottom mid-2025. 1

Japan Outlook: A Hawkish Take

September 24, 2024 5:30 AM UTC

· GDP growth for 2024 has been revised lower to +0.2% after the consumption contraction in Q1 2024 and the subsequent sluggish recovery in Q2. Private consumption is expected to pick up along improving real wages but its magnitude will be limited by the unwillingness to consume at high

September 20, 2024

September 19, 2024

July 31, 2024

July 29, 2024

June 24, 2024

DM Rates Outlook: Rate Cuts Arrive Except Japan

June 24, 2024 8:45 AM UTC

• For U.S. Treasuries we see a steady easing process from the Fed from September, which can allow 2yr yields to fall consistently. However, the decline in H2 2024 will be slower at the long-end from traditional yield curve steepening pressures and then we see fiscal stress in H1 2025 unde

June 21, 2024

Japan Outlook: Slow but not Steady

June 21, 2024 12:15 AM UTC

• GDP growth for 2024 has been revised lower to +0.4% as private consumption contracted stronger in Q1 2024 from moderating but still persistent inflationary pressure. We forecast consumption to gradually recover throughout the rest of 2024 as real wage turned from negative to positive yet

June 14, 2024

June 11, 2024

May 27, 2024

BoJ's Door Closing But Window Opens

May 27, 2024 5:23 AM UTC

Since the BoJ moved interest rate to 0% in March, most market participants expects further tightening as it is hard to believe the BoJ would hike once after all these years of ultra-loose monetary policy, in face of higher inflation. However, with headline inflation trading closer to 2%, it seems th

May 16, 2024

France and Japan: Debt Fuelled Growth Problem

May 16, 2024 10:30 AM UTC

Most of the surge in debt/GDP in Japan and 40% in France is due to higher government debt and this should not be a binding constraint provided that large scale QT is avoided – we see the ECB slowing QT in 2025 and are skeptical about BOJ QT in the next few years. The adverse impact of higher deb

April 26, 2024

April 25, 2024

BoJ's Intervention and its impact

April 25, 2024 6:24 AM UTC

In the period of time when JPY significantly weakens or strengthens, BoJ will intervene in the FX market either through verbal or actual intervention. As JPY weakened significantly in the past months, once again we found ourselves in the proximity of FX intervention with unknowns for anonymity is ke

April 22, 2024

BoJ Preview: Showing no hurry

April 22, 2024 6:13 AM UTC

Our central forecast is for the BoJ to remain on hold for interest rate and signals the market they are in no rush to further tighten while allowing trend inflation data to lead policy direction in their forward guidance. BoJ has moved interest rate to 0% and officially removed YCC in March, citing

March 25, 2024

Japan Outlook: Beginning of A New Era?

March 25, 2024 4:54 AM UTC

Bottom Line:

Forecast changes: We revised 2024 GDP lower to +0.8% from +0.9% because private consumption is now expected to contract in Q1 2024. 2024 CPI is revised higher to +2.1% from +1.7% to address the stronger wage hike Japanese unions secured.

March 22, 2024

March 19, 2024

March 13, 2024

BoJ Preview: 50-50

March 13, 2024 3:17 AM UTC

Our central forecast is for the BoJ to change forward guidance in March, indicating trend inflation will be achieving target and ultra-ease monetary policy is no longer necessary and hike interest rate to 0% in April as wage growth has accelerated and the latest wage negotiation is likely to ensure

March 12, 2024

Japanese Equities: Yen Headwind Rather than Tailwind

March 12, 2024 11:23 AM UTC

Bottom Line: Japanese equities tailwind from a weak JPY boosting corporate earnings will likely go into reverse, as the extreme JPY undervaluation ebbs with small BOJ rate hikes and Fed easing. We also forecast less nominal GDP growth in 2024 and 2025 than the market consensus. As this come thro

January 23, 2024

January 18, 2024

Japan: 10yr JGB Yields set to Rise Moderately

January 18, 2024 10:15 AM UTC

The more subdued profile of Japanese wages, plus a delay in the 1st BOJ hike, has prompted us to lower the forecast of a rise in 10yr JGB yields in 2024 – though we still see a rise above 1% (Figure 1). As BOJ tightening stops, we see 10yr JGB yields falling back again in 2025.

January 15, 2024

BoJ: The Pace of Exit

January 15, 2024 5:41 AM UTC

The BoJ has kicked the can down to the spring wage negotiation before another step in monetary policy. While current inflation forecast has exceeded BoJ's 2% target in all three items of headline, ex fresh food and ex fresh food & energy, the wage growth did not reach a "sustainable" level, which Ue

December 19, 2023

Japan Outlook: Normalizing Monetary Policy Soon

December 19, 2023 9:00 AM UTC

Bottom Line:

· GDP growth for 2023 has been revised lower to +1.6% as private consumption has been dampened in the second half of 2023 by higher inflation and negative real wage. Sluggish growth should be expected for private consumption in 2024 even when wage hike (to be limited by ec