BoJ: The Pace of Exit

The BoJ has kicked the can down to the spring wage negotiation before another step in monetary policy. While current inflation forecast has exceeded BoJ's 2% target in all three items of headline, ex fresh food and ex fresh food & energy, the wage growth did not reach a "sustainable" level, which Ueda quantified that at 2% in his remarks. The pace of BoJ's exit of ultra loose monetary policy will be interesting with wage growth only expected to slowly pick up while CPI would further moderate in 2024. At the end of the day, we believe the Bank of Japan will determine their pace of policy change by data dependency rather than a preset path.

Even since Kuroda stepped down in March 2023 and was taken over by Ueda, market believe he was tasked to bring normalization to Japan's monetary policy after decades of ultra-loose monetary policy. It would be a difficult task for Ueda if the Japanese economy and inflation stays within the range of previous decades but the COVID-19 driven global QE has driven the Japanese inflation above average and given the BoJ a window to exit as the underlying inflationary does not look transitory. Throughout 2023, the BoJ has officially phased out YCC by stating rate cap to be of reference, in sight of inflation figures remains above the 2% target. With BoJ inflation forecast for 2024 to be above 2% in all items, the last question for market participants would be the pace of exit from ultra-loose monetary policy.

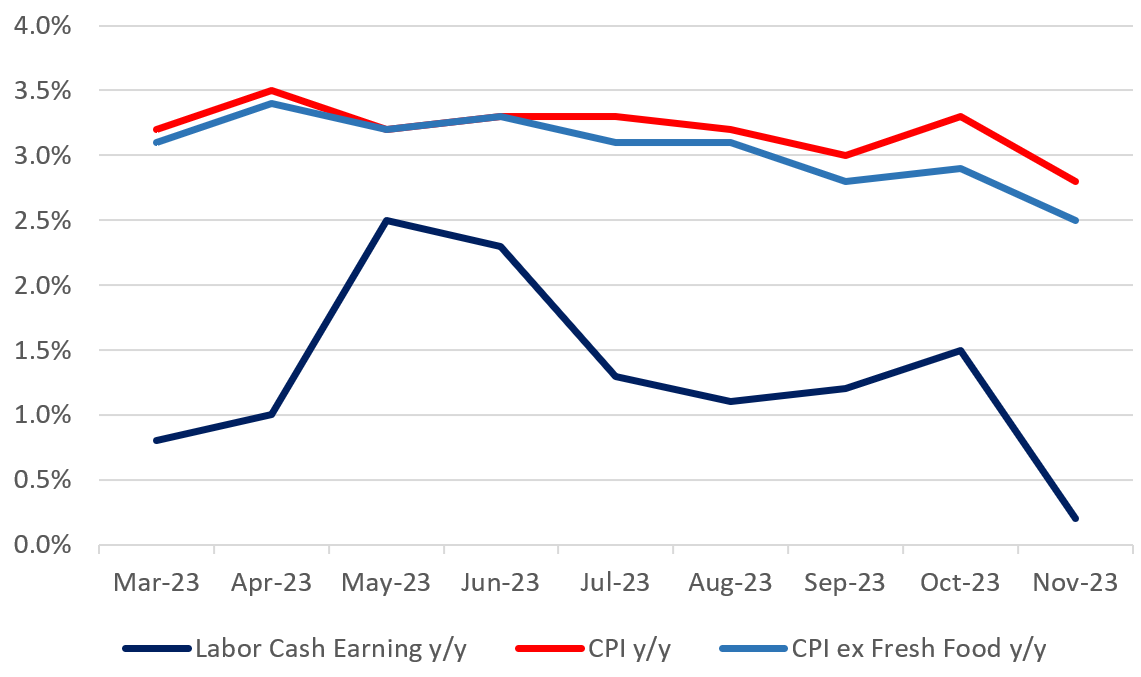

Figure 1: Japan y/y Labor Cash Earning, National Headline and ex Fresh Food CPI

For the past decades, even with the backdrop of ultra-loose monetary policy, Japanese inflation has not been achieving the 2% level for an extended period of time. Along with the deep rooted business - wage - price dynamics, such target was always seen as a long shot for BoJ and the corresponding data has limited interaction with the BoJ simply because they were not going to further ease in spite of stating "will further ease if necessary". However, everything changes after the COVID-19 led global QE, as it drove input prices significantly higher (PPI showing close to double digit y/y growth in 2022 till Q1 2023) which placed a burden so heavy on the Japanese business that they have begun to change their price setting behavior, passing some of the cost to consumers and increased wage by the most in decades. Thus, the BoJ has put CPI and wage data behind a magnifying glass as they are the key building blocks towards their sustainable 2% trend inflation target. BoJ are forecasting less fresh food CPI to be stubbornly close to 3% in 2024, less fresh food and energy to be close to 2% in 2024/25, both has been revised multiple times higher since Ueda succeeded Kuroda in April 2023. This seems to suggest the inflation picture is more dynamic than the central bank estimates and they will have to be more data dependent in changing their monetary policy, which is clear shown in their back and forth rhetoric towards policy when wage inflation chops.

| Timeline | Labor Cash Earning y/y | BoJ Officials' Rhetoric |

|---|---|---|

| March 2023 | 0.8% | Ueda succeeded Kuroda, openly stated future monetary policy will be directed by data. Said standard monetary policy to not immediately respond to supply-driven inflation. |

| April 2023 | 1.0% | Ueda repeats its appropriate to maintain YCC, easy monetary policy. At the same time, BOJ considered a comprehensive review of long-term easing report. |

| May - June 2023 | 2.4% | One of the largest wage hike after the spring wage negotiation. BoJ did not respond immediately. |

| July 2023 | 1.3% | BoJ revised the upper band for 10yr JGB in YCC to be 1% from 0.5% by referring it to reference rate |

| August 2023 | 1.1% | Ueda says his focus is on a 'quiet exit' reducing monetary easing, no change to policy. |

| September 2023 | 1.2% | Ueda said "still a distance to go" to exit loose policy, no change to policy. |

| October 2023 | 1.5% | Ueda says its important to raise labour productivity to push real wages up, won't necessarily wait for for positive real wages to exit YCC and negative rates. The Bank now see the upper bound of 1.0 percent for 10-year JGB yields as a reference rate with no pre-determined fixed rate operation at any level, which almost equals to a removal of yield curve control. Occasional intervention is expected if yields spike as such volatility is not favorable. |

| November 2023 | 0.2% | Ueda said BoJ is still not foreseeing sustainable, stable inflation with enough confidence, the chance of moving rates out of negative in 2024 is "not zero" but in no hurry to unwind ultra-loose monetary policy. Kicked the can down to the March 2024 wage negotiations in later remarks. |

As CPI moderates throughout 2023 despite a brief spike in Q3 on higher energy prices, BoJ has tilted their focus towards wage growth. They see the pace of wage growth as the most important in supporting the sustainable reach of 2% inflation target as input prices driven inflation has faded (PPI in November 2023 is at 0.2% m/m and 0.3% y/y). Yet, the moderation in input price inflation seems to be less persuasive for Japanese employers to further raise wage after the initial push. It clearly affects BoJ's decision in monetary policy for we see Ueda's rhetoric changed from suggesting the bank may not wait for positive real wage to exit ultra-loose monetary policy by year end 2023 to deciding to wait fro more confirmation of wage in the March wage negotiation in 2024. The moderation of headline CPI below 3% in Q4 2023 could also be a factor, though it does not change the broader picture in CPI and policy forecast.

Market participants have been closely watching the BoJ since their first indication of moving out of ultra-loose monetary policy given their impact toward the global economy. After a few surprises (12/2022 and 07/2023- changes in YCC target with no forward guidance), market participants got the memo that data would be more reliant than Ueda and other BoJ officials remark. Before the latest release of November Labor Cash earning, the market has priced in one hike in July 2024, which was pushed back to September 2024 after the dismay 0.2% y/y headline labor earning. Our central forecast sees the medium term rate to remain at 0.25% with the first move of interest rate to be April 2024 after the March wage negotiation. We see the BoJ to hike from -0.1% to 0.1% in Q2 2024 and to 0.25% in Q3 2024 for headline and less fresh food CPI will stay above 2% with wage growth continue to move closer to 2% but will be limited by the economics growth in 2024. And from there onward, we believe inflation and wage growth will return to the average Japanese pace. Thus, BoJ will likely stop at 0.25% unless both inflation and wage steadily surprise to the upside. JGB yields have been depressed in the Nov/Dec 2023 after the spike in October 2023 (1% target in 10yr JGB became reference rate) which is more led by global markets rather than policy changes and should be intervene with the steps of BoJ.