Japanese Equities: Yen Headwind Rather than Tailwind

Bottom Line: Japanese equities tailwind from a weak JPY boosting corporate earnings will likely go into reverse, as the extreme JPY undervaluation ebbs with small BOJ rate hikes and Fed easing. We also forecast less nominal GDP growth in 2024 and 2025 than the market consensus. As this come through we feel that foreign investors could start to take profits on winning trades and stall the rally in the remainder of 2024 for Japanese equities.

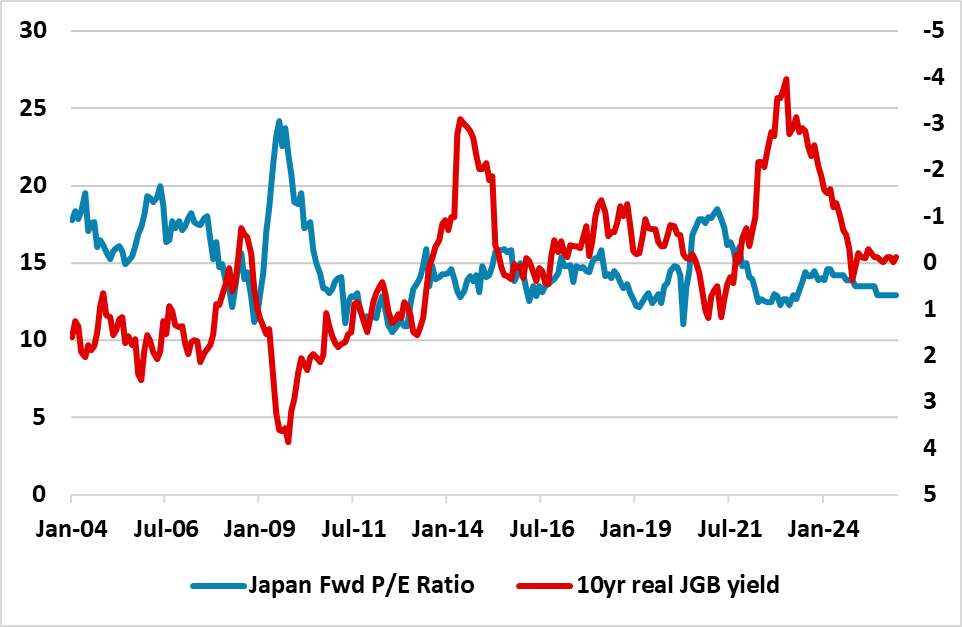

Figure 1: Japan 12mth Earnings Yield minus 10yr Real Government Bond Yield (using CPI inflation)

Source: Continuum Economics. Continuum Economics projections until end-2025 using inflation and 10yr JGB yield forecasts.

In terms of Japanese equities, the corporate reform story will be a positive for years and will help to deliver better earnings per share growth than recent years in 2024. The momentum behind better shareholder returns is a structural force that will help in future years. However, a fair portion of the recent earnings improvement in corporate earnings growth has been due to Japanese Yen weakness, which we see reversing – we forecast 125 on USD/JPY by end 2024, given the extreme undervaluation of the JPY will be less sustainable with Fed rate cuts. This means downside risks to the corporate earnings story. The previous JPY tailwind to corporate earnings turns into a headwind. Meanwhile, higher CPI inflation has caused a slowdown in consumption undermining the idea of sustainable strong GDP growth. While 2024 wages will likely move higher, we feel that this is a one off and 2025 will likely see lower wage settlements with lower CPI inflation. Expectations of 19% and 8% earnings per share growth for 2024 and 2025 are too optimistic.

Meanwhile, the argument that 10yr real JGB yields support a higher price/earnings ratio will fade, as we see higher 10yr JGB yields with the BOJ ending yield curve control in the coming months but then inflation coming down more than expected in 2025 (Figure 1). Equity only valuation are now average rather than the cheap levels that existed in 2023. A further rise could be seen in price/earnings ratios if corporate earnings momentum holds up more than we expect in 2024, but that is not our baseline view. Finally, Japanese equity market outperformance has been largely driven by foreign accounts rather than Japanese households and foreign investor could take profits if any of the actual drivers of optimism fade. Overall, we see no further gains for the Nikkei 225 in 2024 and look for a small 5% rise in 2025.