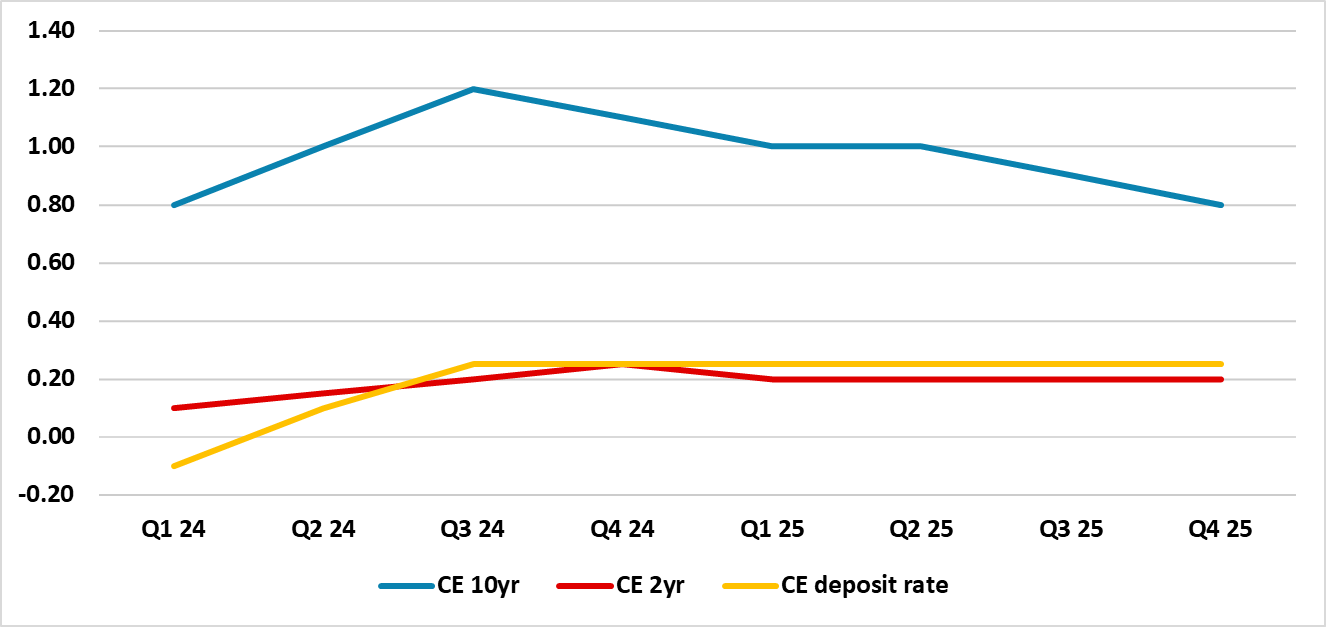

Japan: 10yr JGB Yields set to Rise Moderately

The more subdued profile of Japanese wages, plus a delay in the 1st BOJ hike, has prompted us to lower the forecast of a rise in 10yr JGB yields in 2024 – though we still see a rise above 1% (Figure 1). As BOJ tightening stops, we see 10yr JGB yields falling back again in 2025.

Figure 1: 10yr JGB Yield Forecast (%)

Source: Continuum Economics

10yr JGB yields are artificially low, both as the decline in U.S. and global bond yields and a reduction in hedge fund shorts have prompted too large a decline in yields since the early autumn. The delay in BOJ tightening expectations has also had a big effect. The o/n rate trades at a premium to the BOJ policy rate of -0.1% and so a strict reading of money market futures would mean a 10bps hike is not now discounted fully until the July BOJ meeting and a 2nd move into 2025.

The BOJ caution in preparing for an official rate hike in recent weeks, plus the lower than expected wage inflation data, has prompted this shift in expectations. Yet the BOJ has a window of opportunity to hike the policy rate and end ZIRP, before other global central banks start cutting and given the current headline and core inflation numbers. Additionally, anecdotal evidence suggests that some pick up in wage settlements will likely be seen in the spring, given the tightness of Japan’s labor market. Finally, in 2023 the BOJ has consistently acted quicker than their forward guidance would suggest on the 10yr JGB target.

We have pencilled in a 10bps hike at the April BOJ meeting, which would get the policy rate to zero. Then we look for a 2nd hike of 10bps to +0.10%. Given the BOJ previous tightening cycle in 2000 and 2006, we pencil in a 15bps hike also in Q3. Additionally, we feel that a good prospect exists of the BOJ also formally abandoning the yield curve control arm and scrapping the 1% reference rate for 10yr JGB yields. All of this will encourage the speculative bears, but more importantly will reduce domestic institutional demand unless 10yr yields are high enough. Thus we look for 10yr JGB yields to move above 1% in Q2 2024 and peak around 1.20% -- lower than our previous 1.6% forecast, given the delay in BOJ tightening and as wage inflation will likely peak at a lower level than we previously thought.

However, we do not see a persistent take-off in Japan inflation and see a relapse in H2 2024 and 2025 to disinflation tendencies. This will stop the BOJ tightening and indeed the Q3 hike of 15bps to 0.25% could be stopped. This is crucial for 10yr JGB yields, as it controls the scale of increase in H2 2024. In 2025, 10yr JGB yields will likely fall back below 1%, as the disinflation reality will likely break the view that inflation has broken out of the experience of the last 25 years.