Japan Outlook: Slow but not Steady

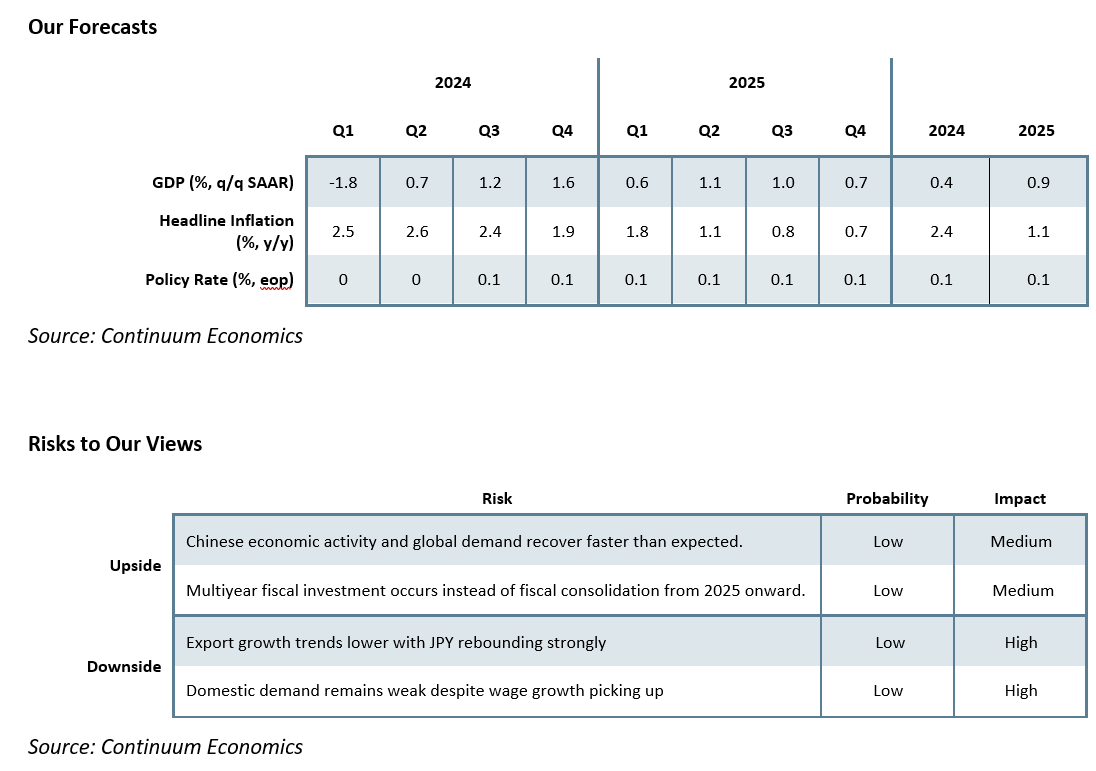

• GDP growth for 2024 has been revised lower to +0.4% as private consumption contracted stronger in Q1 2024 from moderating but still persistent inflationary pressure. We forecast consumption to gradually recover throughout the rest of 2024 as real wage turned from negative to positive yet limited by the willingness of Japanese to increase consumption at higher prices. Consumption growth in 2025 will only grow modestly as 2024 wage rises are unlikely to be repeated with a squeeze on company profit margins. The trade balance in 2024 should be solid with exports continue to benefit from soft JPY before returning to neutral for GDP in 2025 – we forecast +0.9% GDP in 2025. Government spending steadies throughout 2024/25 as the Japanese government’s fiscal room is limited.

• We are forecasting the BoJ to tighten the key policy rate by another +0.1% in September 2024 after announcing a reduction in bond purchase program in July 2024. While BoJ’s forward guidance suggest accommodative condition will stay, we believe the BoJ will hike short term interest rate marginally and allow a certain degree of freedom in long term interest rate to tighten financial condition.

• However, the CPI inflation trend is likely to surprise on the downside in H2 and falls below BoJ expectation from the lagged effects of the consumption slowdown. While Japanese businesses try to exert changes to price setting behavior, the lower PPI and customers’ reluctance will limit the magnitude of price increase and suggests less feed through to CPI than BOJ forecast even when real wage turns positive. This makes a September hike only a balancing move for short term wage driven inflation and mean that the terminal policy rate could be as low as 0.1%. Although, BoJ will not tolerate spike in yields, they will allow a gradual rise in 10yr yields above 1% by progressively reducing JGB purchases.

Forecast changes: We revised 2024 GDP lower to +0.4% from +0.8% because private consumption has contracted more than expected in Q1 2024. 2024 CPI is revised higher to +2.4% from +2.1% to address the translation from accelerating wage growth to inflation.

Macroeconomic and Policy Dynamics

Japanese headline inflation has remained above 2% after the BoJ exits ultra-loose monetary policy and enters positive interest rate era. The March 2024 wage negotiation has resulted in an average of 5% pay increase for large companies and up to 6.25% in total pay. Wage growth for small to medium firms will likely be lower than the headline but still sufficient to bring real wage into positive territory in H2 2024. Though consumption remains in contraction in Q1 2024, there are early signs of rebound (household spending was +0.5% y/y in April 2024) and is expected to be supported by accelerating wage growth (+2.1% y/y in April 2024). However, such revival of consumption should not be mistaken as a full-blown recovery as Japanese consumers would be wary of consuming at high price and revert to savings. Thus, our 2024 inflation forecast are revised higher to +2.4% from +2.1% while wage growth filters into the economy. CPI all items less fresh food and energy will rise at a slower pace. BoJ has revised CPI less fresh food higher to be +2.8% (2024), +1.9% (2025) and CPI ex fresh food & energy unchanged at +1.9% (2024), +1.9% (2025).

Our forecast for 2024 GDP is revised lower to +0.4% in reflection of the Q1 2024 CPI spike led restraint of private consumption and subsequent modest consumption rebound when wage picks up in the rest of 2024. 2025 GDP’s forecast of +0.9% is with normalized economic growth from more balanced wage/inflation dynamics. Private consumption is expected to rebound in Q2 to Q4 2024 only gradually, supported by real wage turning positive but limited by willingness to consume at high price, before returning to modest growth in 2025. Headline labor cash earning accelerated to 2.1% in April 2024, a delightful sight after March’s historic wage negotiation result. Government spending will be steady given the limitation in fiscal space and we are not forecasting another round of stimulus.

Continue to benefit from a weak JPY, the solid trade balance would be a major contributor towards Japan economic growth in 2024. Japanese Yr/Yr export to China and U.S. are growing almost by double digits percentage in April and the momentum is expected to carry on for the rest of the year on the lagged feedthrough of a soft JPY. Domestic demand is picking up, which may take some shine out of net export, but we forecast the trade balance to stay positive in the remainder of 2024. With the BoJ pushing rate hikes later and the Fed’s easing delayed, it does not look like the JPY will strength significant enough in 2024 to reverse this effect on exports in a medium run.

The strong CAPEX momentum has been cited by BoJ’s Ueda as a key reason to support his decision in changing monetary policy. With CPI further moderates and corporate tax breaks in 2024/25, investment should continue to grow and supports the Japanese economy.

BoJ has revised their inflation forecast in April for Yr/Yr CPI less fresh food from +2.4% to +2.8% for 2024 and from +1.8% to +1.9% for 2025 but kept Yr/Yr CPI less fresh food & energy at +1.9% for both 2024 and 2025. BoJ has traditionally viewed the +2% inflation target as a long shot because business culture in Japan did not favor passing cost to customers but such pricing behavior is changing in face of high input prices in the past two years (Figure 2). Moreover, another historic wave of wage hike is about to come and have persuaded the BoJ that the 2% target would be achieved in a sustainable and stable manner.

The biggest inflationary factor, fresh food and energy, moderates further and is not expected to resume the COVID era inflation as supply chain normalize and global food prices are soft. The National Yr/Yr CPI has retreated from the spike to 2.8% in February 2024 (led by durable goods) to 2.5% in April 2024 and is expected to resume its previous traction on a choppy path. In 2024, headline CPI is forecast to be +2.4% as global disinflation stays on its course with PPI falling below 1% Yr/Yr growth in the past six months while the accelerated pace of wage hike may push up prices in a short run. However, by 2025 we project that headline inflation would revert to the traditional Japanese pace and we forecast 1.1%. Japanese consumers are rejecting higher inflation by consuming less, which means a margin squeeze and likely lower wage increases in 2025.

Policy Outlook

The BOJ has left the era of negative interest rate and brought short term interest rate to the range of 0 and +0.1% after stronger than expected wage negotiation in March 2024 and CPI staying above 2% for all three categories. The BoJ is going to reinforce normalization by reducing bond purchase (in the ballpark of 1-1.5 trillion JPY) over the coming one to two years in the announcement in July 2024. They will likely slow net purchases to very low level by H2 2024 at about the same pace as 2010-11. The BoJ would like the market to decide long term interest rate and they are only favoring gradual changes in yields with commitment to intervene on any spike. It is worth noting that Ueda has hinted that the BOJ could also reduce ETF holdings in the future and QT could start with Japanese equities.

With wage growth begin to pick up its pace, we believe the BoJ will likely hike by another 0.1% to bring short term interest rate to the range of +0.1% and +0.2% in September. Ueda did mention the BoJ could hike in July 2024 but there is limited credibility in his words after not following through in the June meeting, in regard of bond purchase changes. We also feel a July hike, accompanied by a reduction in bond purchase, would be a step too far for the BoJ unless they are looking for multiple hikes in 2024. The room for further tightening is limited as we forecast CPI to move below 2% in Q4 2024 and we do not see more tightening in 2024/25 for the BOJ policy rate. The key is that consumer will be reluctant towards higher inflation and this is likely to squeeze corporate margin growth in H2 2024 and then mean that companies would turn to less wage increases in 2025. It is possible that the BOJ hikes the key policy rate multiple times in H2 based on wage growth alone and a desire for normalization. The failed normalization attempts in 2000 and 2006 show that the BOJ can go too far and then end up reducing the policy rate.