BoJ's Intervention and its impact

In the period of time when JPY significantly weakens or strengthens, BoJ will intervene in the FX market either through verbal or actual intervention. As JPY weakened significantly in the past months, once again we found ourselves in the proximity of FX intervention with unknowns for anonymity is key to meaningful intervention. In this chapter, we will look into the cues for actual intervention and illustrate its historic impact.

The Japanese Yen has weakened significantly in recent years from monetary policy driven yield differentials, especially against the U.S. Dollar. No country would like its currency to be weaken or strengthen extremely as it brings disruption to economics activities and Japan is of no exception. We have seen BoJ intervening multiple times in the past two years and we know they going to do it again as JPY weakens rapidly but its cue and impact seems to be little discussed. In this chapter, we will first look into the signals before an actual intervention and then illustrate the historic impact of such intervention.

Before an actual intervention, we will likely see that either the JPY is strengthening or weakening significantly in a short period of time and the Japanese cabinet or BoJ officials will verbally intervene. Verbal intervention, also known as "jawboning", is the act that finance minister or BoJ members suggesting an actual intervention maybe imminent, in order to stall the underlying momentum for JPY. Such action may deter speculators because interventions will likely bring JPY to the opposite direction considerably. The key here is the different rhetoric from Japanese finance minister and BoJ officials. The difference in wordings suggest the imminence of an actual intervention, thus should be treated carefully.

In the past, we usually heard multiple escalation of rhetoric from either Suzuki or Kanda, both finance minister, before they instruct the BoJ to intervene in the FX market. Let's take a closer look at the latest verbal intervention from Suzuki from March to April 2024 and assess how close we are from the next FX intervention.

While the JPY has weakened against the USD to a large extent from May 2021, the last wave of rally begins in March 2024 where after a brieft correction USD/JPY rallied from 146.50 to 154.80 now. As usual, Suzuki began with "excessive moves in FX undesirable, before quickly escalated to "it's important for currencies to move in a stable manner" and "is closely watching FX moves with a high sense of urgency" on the 21st of March as USD/JPY reached 151.8 (an area that is close to BoJ's intervention back in October 2022), further escalated to "won't rule out any steps to respond to disorderly fx moves" on the 1st April and "in constant communication with Vice Finance Minister Kanda on fx" as USD/JPY's rally is unfazed by such verbal intervention.

The next step of verbal intervention, taking reference from the past, would be "will intervene if necessary before BoJ conducting a rate check with major banks to prepare for intervention. The BoJ likes to keep their intervention anonymous, which means they will seldom announce or denounce they have intervened in the market. The act of keeping market participants guessing is also a tactic to psychologically intervene. This playbook may change depending on the pace of volatility but these are the wordings Japanese finance minster like to use.

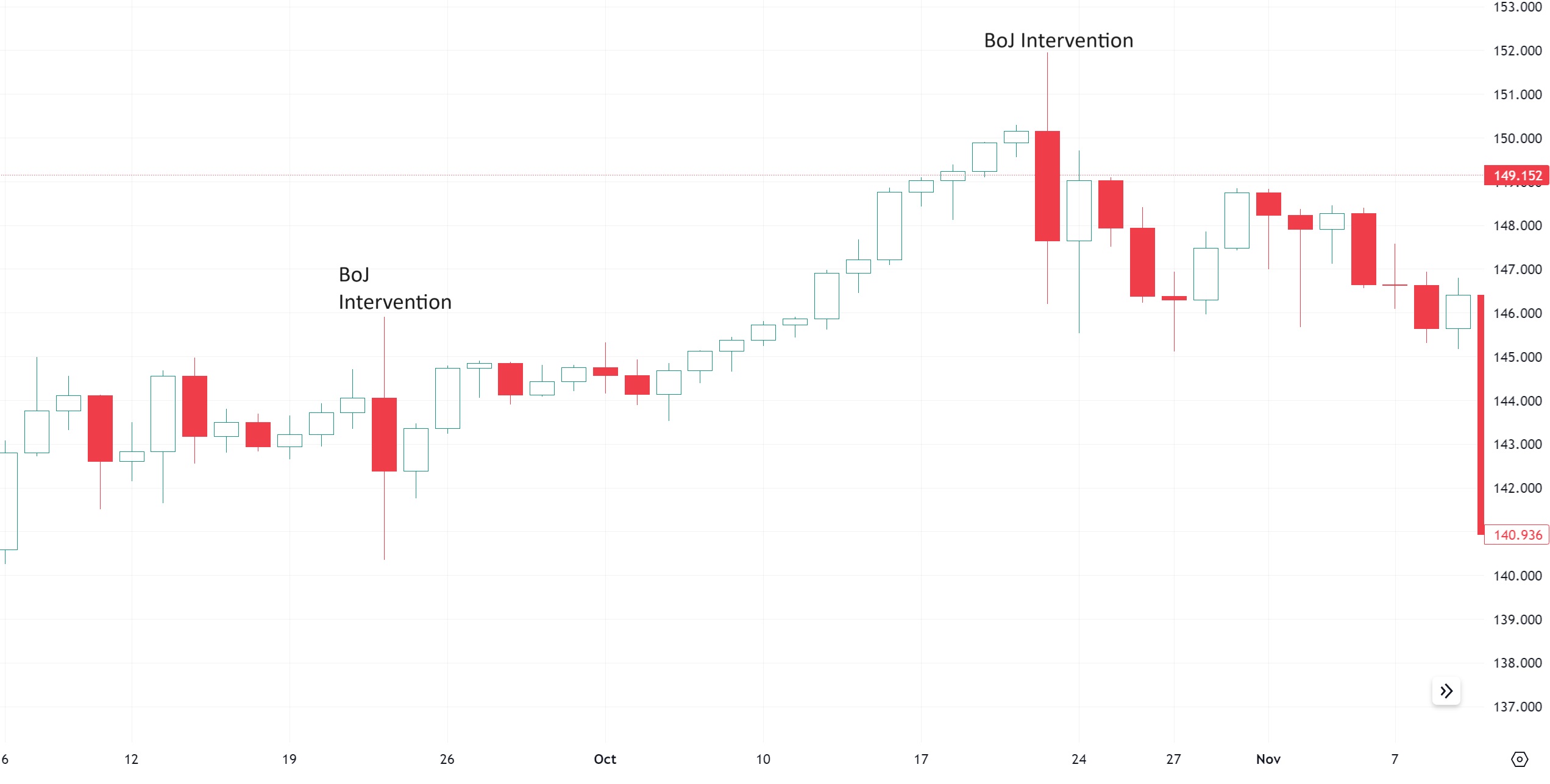

Figure: USD/JPY Daily Chart

The last confirmed intervention from Ministry of Finance are on 22nd September and October 2022. We can see the impact of intervention to be stark. Both intervention sees USD/JPY to drop immediately by five figures from session high. It will be pain for short term speculators but it does not seem to have a lasting impact for the September intervention. It is not until the October intervention, combined with hope of monetary policy change amid news of Ueda's succession that bring USD/JPY lower in the coming months. So, does it implicate intervention only have short term impact? Let's dive into historic intervention and its result.

Japan intervenes in Aug and Oct 2011 to stall JPY strength. USD/JPY bottomed at 75.65. The first intervention's impact lasted three days and the second intervention is successful but still see its impact halved in less than ten days. G7 nations jointly intervene in March 2011 against yen strength after earthquake is successful in reversing the extreme strength till 76.31 but see its impact faded in five month. Japan intervenes in Sept 2010 selling yen after USD/JPY hits a 15-year-low at 82.87, its impact was neutralized in two weeks. A 15 month campaign from Mar 2004 by Japan to stall JPY strength sees initial result with a ten figure plus reversal of JPY strength but see JPY strength continue in trend till May 2025. The BOJ intervenes to sell JPY in May and June 2002, supported by the U.S. Federal Reserve and European Central Bank but does not have a lasting impact as USD/JPY remains in a solid down trend for the coming years. The BOJ also intervened to sell JPY after the Sep 11 attacks in the United States but USD/JPY continue to slip for another two weeks before reversing course. The BOJ sells JPY multiple times from January 1999 to April 2000, including once via the Fed and once via the ECB, are both impactful with the first ones effects faded in six months. Multiple intervention attempts between 1997-1998 with The Asian financial crisis only sees their impact on the consecutive days of intervention. 1993's BoJ intervention in selling JPY worked in a short run but fail to reverse the broader trend. 1991 to 1992's BOJ intervention to sell USD buy JPY began a trend reversal. 1988's BOJ intervention to buy USD and sell JPY is fruitful for half a year.

Taking things at a face value, one can think that most intervention failed to stop JPY's strength or weakness. However, the goal of intervention is never stopping or reversing the trend. but to stall the underlying momentum. Simply because BoJ and the Japanese government can accept a gradual strengthening or weakening of the currency for such have its pros and cons yet a spike in either way of the currency will lead to an economics shock. While previous intervention has not unable to put a stop to underlying momentum, almost every intervention is successful in stalling and bring USD/JPY into a period of consolidation.

Once we understand the goal of intervention, it will be easier to manage our expectation towards coming intervention. Instead of any figure or line in the sand, the pace of strengthening or weakening and the underlying factor are the focus from the Japanese government and BoJ's eyes. The recent weakness in USD/JPY is mainly driven by monetary policy led yield differential with the latest rally in USD/JPY began in Mar 2024 and see the pair up slightly more than 6%. It does not seem to be substantially weakening in a short period of time by any shock. In comparison, the last intervention in Aug and Oct 2022 saw USD/JPY rose by 25% in six months.

As aforementioned, the goal of intervention is stalling and wait for fundamental shift in the picture. The BoJ have exited negative rates and we forecast they to further tighten in June where the Fed is expected to begin cutting as soon as July. This is the playbook the Japanese government and BoJ looking at. Such may allow them to not intervene, unless let's say a spike of more than 1% everyday for a week surfaced, and let the fundamental shift to take care of JPY's relative weakness against the JPY. Our central forecast sees no intervention unless the climb in USD/JPY is reckless in a short period of time and they would rather let the fundamental shift take care of foreign exchange rate.