FX Weekly Strategy: July 21st-25th

Little data of note with PMIs the main focus

EUR/USD can hold above recent lows if Eurozone PMI shows another modest gain

Long trend higher in EUR/JPY looks excessive and suggests downside risks

NOK has potential to extend Friday’s recovery versus EUR and SEK

Strategy for the week ahead

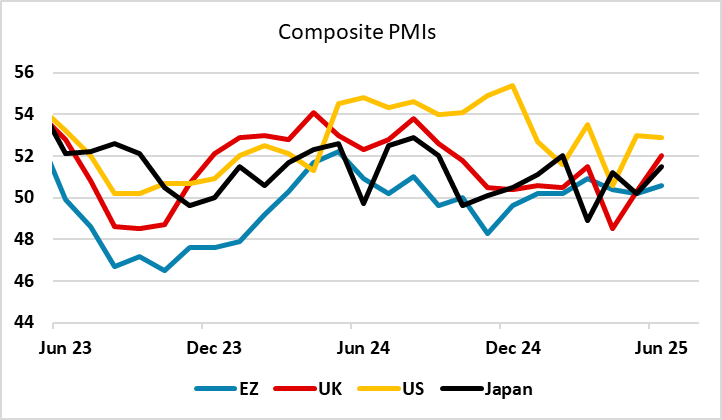

A fairly quiet data week is in the offing, with the preliminary July PMI data providing the main interest. June saw a general improvement in the composite PMIs around the world, but the Eurozone lagged behind the other majors. The Eurozone data is generally taken a little more seriously than the PMI indices elsewhere, as there is some evidence that it is a good contemporaneous indicator of GDP, more so than in the other regions. An improvement in July could be expected to provide more EUR support, holding the 1.16 area in EUR/USD, although the consensus view is only for a modest improvement.

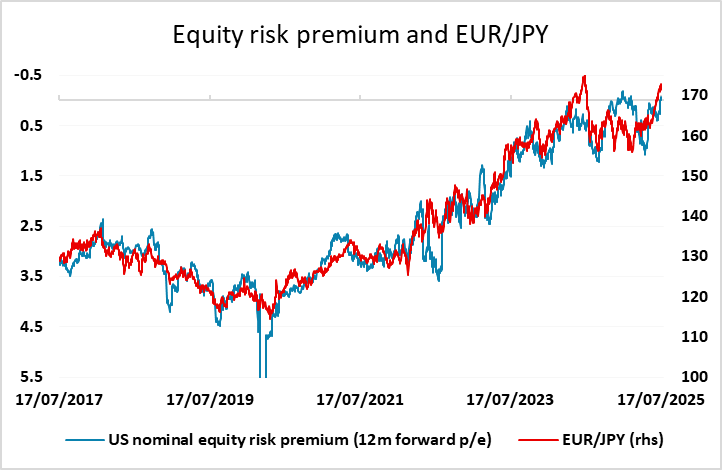

The JPY continues to provide the most potential for volatility, with EUR/JPY now having seen 8 consecutive weeks of gains. This is extremely unusual, with no more than a handful of occasions seen since the creation of the EUR, and we can only find one occasion where we saw 9 consecutive weeks of gains, in the week ending January 6th 2017. On that occasion, EUR/JPY gained 9 figures from the close on November 4 2016 to January 6th 2017, and finished just below 124. In the last 8 weeks we have already seen more than 10 figures gained in EUR/JPY, and it has reached a high above 173. This suggests that short term positioning is likely to be quite extended. While the CFTC positioning data still show speculative positioning as being longer JPY than anything else, this data likely captures medium and long term positioning more than short term positioning.

The underlying basis for JPY weakness continues to be the resilience of risk sentiment, demonstrated in the continual new highs in the S&P 500, and the continued decline in equity risk premia to close to 25 year lows. The JPY retains its status as the favoured funding currency in risk positive conditions, even though it is no longer the lowest yielder. That honour is taken by the CHF, but EUR/CHF continues to hover just above post-2015 lows, with the lack of yield in the CHF seen as an irrelevance by those looking for safety. The rationale for CHF strength looks to be at least in part due to a favouring of those currencies with solid fiscal positions, with the JPY suffering for the same reason. But the logic behind this looks weak, especially since some currencies, notably the NOK, have suffered in spite of extremely strong fiscal positions. For now, the JPY seems likely to struggle as long as risk sentiment remains strong, but as the August 1st tariff deadline approaches it may be harder for the risk positive tone to be sustained, especially given the long run higher in EUR/JPY in the last two months. Risks consequently look weighted to the JPY upside, even though the trend is hard to oppose.

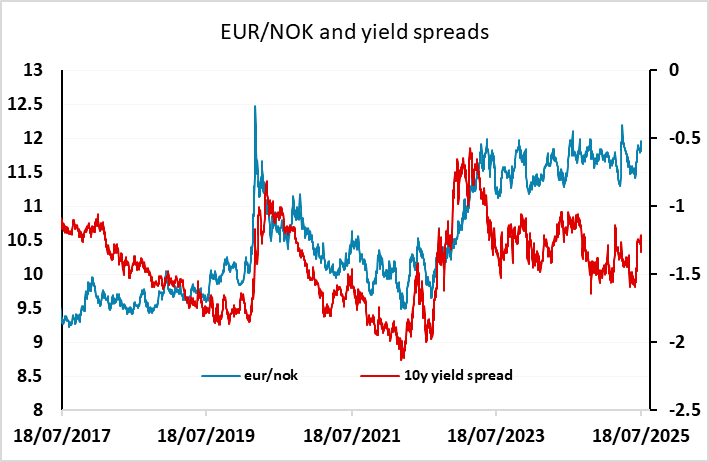

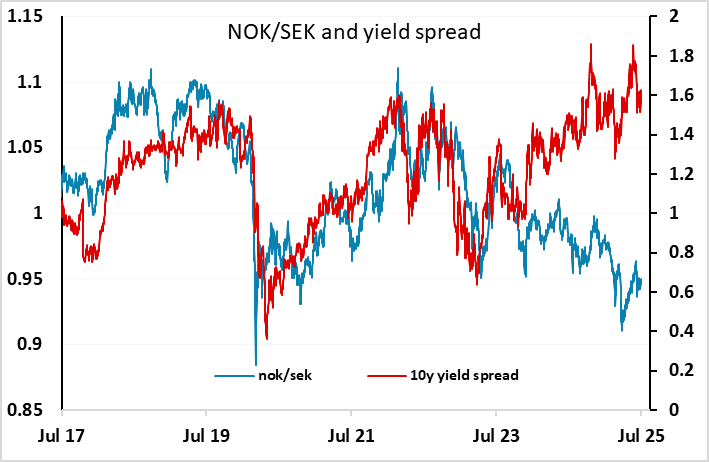

Having mentioned the NOK it’s worth noting that EUR/NOK had another strong week last week, but reversed most of the gains on Friday and failed to break above the key 12 level. We continue to see scope for the NOK to recover, both against the EUR and the SEK, and any approach to 12 in EUR/NOK looks likely to be a selling opportunity. NOK/SEK below 0.95 remains at a level that looks extremely undervalued relative to yield spreads.

Data and events for the week ahead

USA

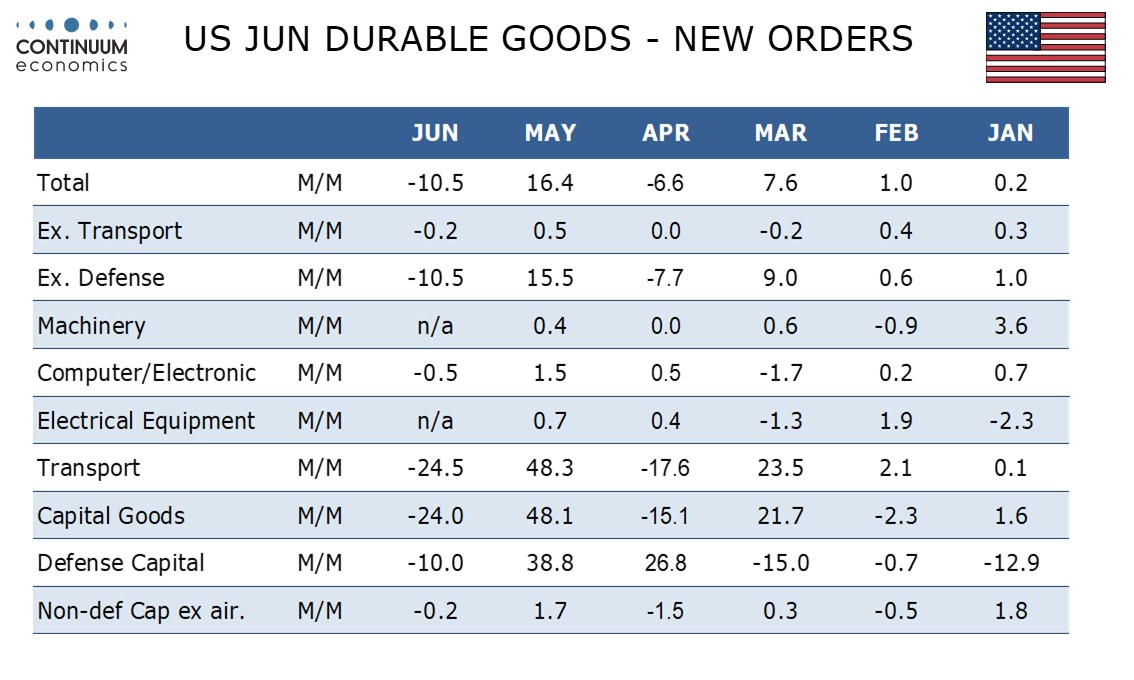

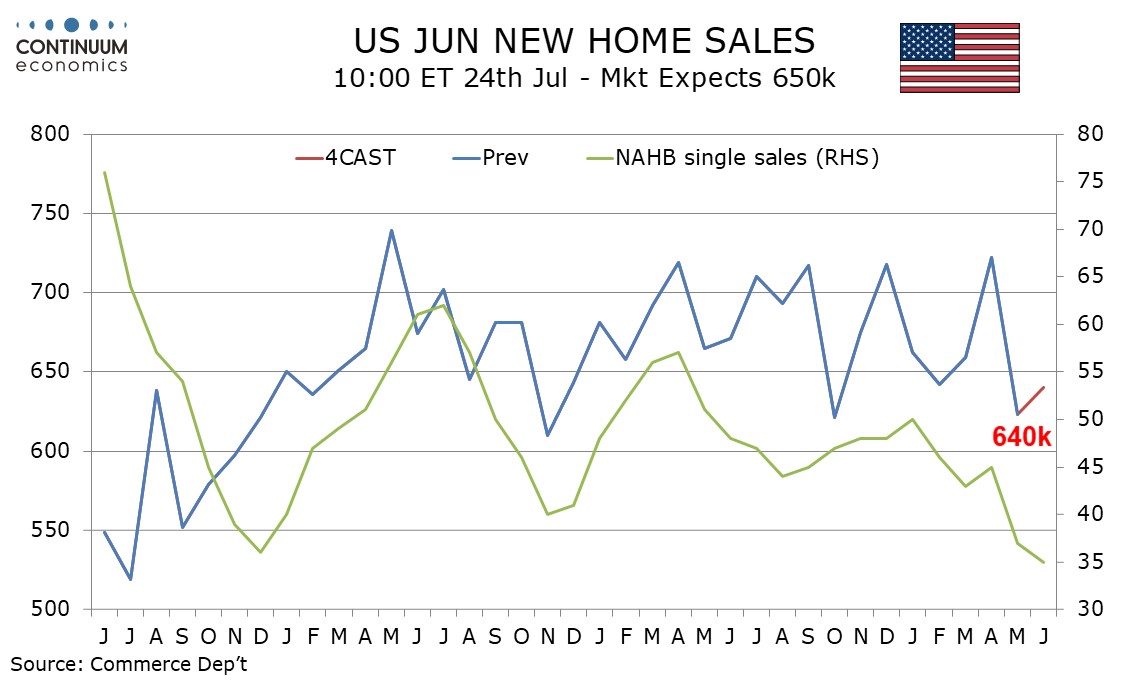

It is a quiet week for US data. Monday sees June leading indicators. June home sales are due. We expect existing home sales on Wednesday to fall by 0.5% to 4.01m and new home sales on Thursday to rise by 2.7% to 640k. Thursday also sees weekly initial claims and S and P PMI data for July. On Friday we expect June durable goods orders to correct from a strong May with a 10.5% fall overall, with ex transport slipping by 0.2%. Fed speakers will be quiet ahead of the June 30 rates decision.

Canada

The Bank of Canada releases its quarterly business outlook survey on Monday. May retail sales are due on Thursday. The preliminary estimate was for a 1.1% decline.

UK

Tuesday sees the next set of Public borrowing data where a further overshoot is in the offing. Indeed, in the first two months of FY 2025-26 borrowing was £1.6 billion above the same period last year, but £2.9 billion below the monthly profile consistent with the OBR forecast. The same day sees the Bank of England Financial Stability Reports - Oral evidence to the Commons Treasury Committee. The question is whether the BoE judges that it is part of the increasing adverse narrative where its slow conventional easing and persistent unconventional tightening have accentuated risks to both the fiscal and financial side.

Thursday sees July flash PMI. In June , the Composite Output Index rose to 52.0 from 50.3 in May but we see some correction back this time around. Perhaps more notable would be if the price measures slipped any further; in June, input costs rose at the slowest pace in 2025 to date, while prices charged inflation among private sector firms was the weakest since February 2021. Friday sees what may be a sideways move in GfK consumer confidence and later in the day we see a recovery in June retail sales, at least in m/m terms, albeit unsure of the weather impact as it was the warmest June on record.

Eurozone

More ECB updates arrive. Indeed, the next ECB Council meeting decision looms (Thu) but where markets (understandably) sees no further cut, at least at this juncture. Indeed, the ECB may signal signs of economic resilience albeit noting that the added uncertainty emanating from the latest U.S. tariff threat warrants more circumspection than immediate policy action. But that perceived resilience we think is misplaced, in particular given its complacent view on financial conditions and credit growth, something the bank lending survey (Tue) may further highlight as may Friday’s ECB survey of professional forecasters.

Otherwise, the week sees a wide array of consumer (Wed) and business survey data, the latter from France (Thu) and German IFO (Fri) – both moving little. But the survey focus will be Thursday’s flash PMI for July. In June the Composite PMI rose to 50.6 in June, from 50.2 in May – we see little change Eurozone companies apparently hired additional staff for the fourth month running in June. Input price inflation was unchanged from May’s six-month low, and below the long-run average. Similarly, manufacturing output prices fell whereas service providers raised their charges at a rate that remained above the long-run average.

Rest of Western Europe

There are no key events in Sweden over and beyond Friday’s labor market update – where unemployment numbers have looked more troubling if late. Norway sees industrial confidence (Thu).

Japan

July Tokyo CPI is on Friday. It should point towards further moderation for headline but may continue to suggest solid underlying inflation and see ex fresh food & energy rise further. Still, it may not be enough to persuade the BoJ to tighten just yet with the trade conflict between U.S. and Japan unresolved.

Australia

Rather empty calendar for the Aussie next week with only PMIs on early Thursday. RBA meeting minutes are unlikely to provide more cues given the stance of slow and data dependent further cut signalled in the July meeting.

NZ

Q2 CPI on Monday will be more important than Trade balance on Tuesday. The RBNZ is only forecasting one more 25bps cut as they see CPI will flare up for the rest of 2025 and taking it slow. If the Q2 CPI spike less than forecast, we may see the next hike coming faster. Trade balance’s importance will be of lower priority in RBNZ’s eye.