FX Daily Strategy: APAC, July 24th

PMIs a focus ahead of the ECB meeting

ECB likely to be uneventful with latest ECB bank lending survey encouraging

US claims data likely to be of more interest than home sales

JPY still has upside scope despite political risks

PMIs a focus ahead of the ECB meeting

ECB likely to be uneventful with latest ECB bank lending survey encouraging

US claims data likely to be of more interest than home sales

JPY still has upside scope despite political risks

Thursday is the most eventful day in what has been a very quiet week for events. We have the preliminary PMI data for July and the ECB meeting, as well as new home sales and jobless claims data from the US.

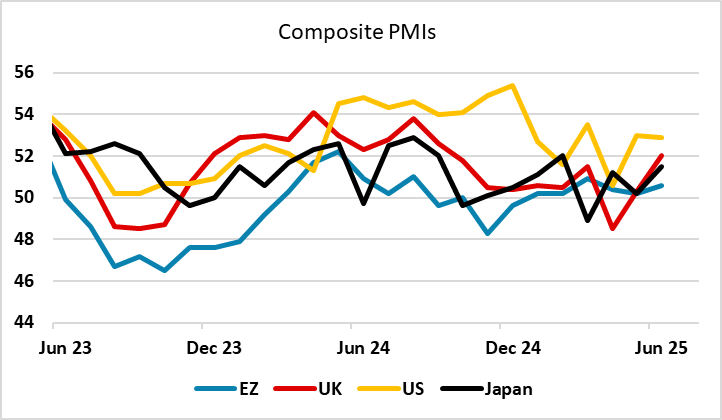

As usual, the European PMI data will tend to be the main focus among the global PMIs, especially since it is quickly followed by the ECB meeting. Market consensus is looking for a small gain in the Eurozone PMI and little change in the US PMI. Typically, there is more focus in the US on the ISM survey, but given the tariff situation and the fact that the PMIs precede the ISM, there will also be interest in the US numbers this month. The modest increase in the Eurozone PMI anticipated by the consensus reflects the fact that the Eurozone index has underperformed in June. The EUR could be vulnerable if we don’t see the anticipated increase.

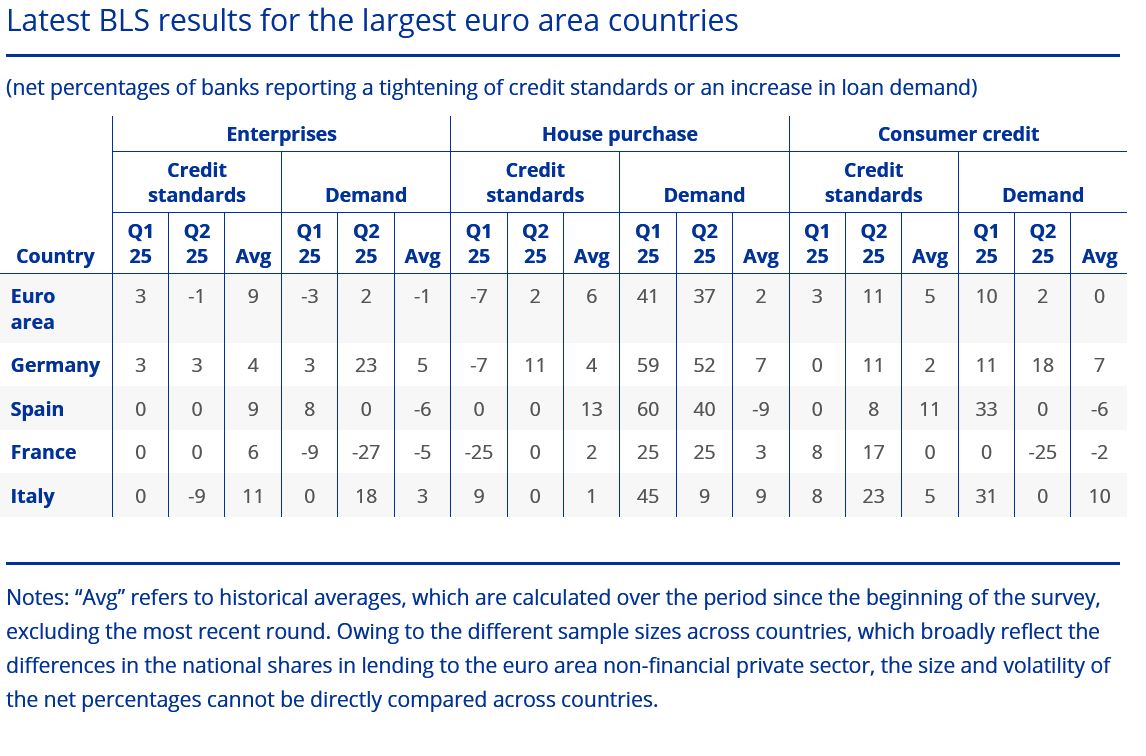

Markets see no further cut from the ECB this time around. However, we think that the ECB will ultimately still have to ease further - two more 25 bp cuts in H2. Indeed, over and above what we think is over-optimism regarding the labor market, we think that the ECB has a complacent view on financial conditions and credit growth. But for the Council it is likely that this time around the added uncertainty emanating from the latest and extended U.S. tariff threat warrants more circumspection than immediate policy action. However, the latest bank lending survey this week didn’t see any increase in concerns emanating from the tariff uncertainty, so we doubt there will be any notable policy statements to move the market. But with only one more rate cut priced into the curve this year, there isn’t much scope for FX impact.

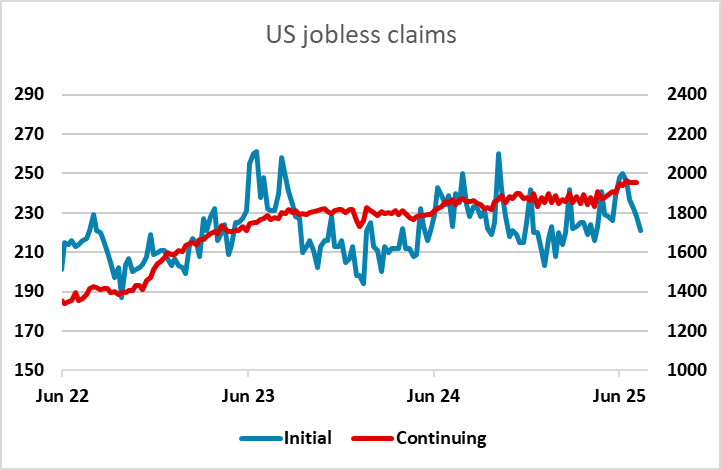

We expect a June new home sales level of 640k, which would be a 2.7% increase if May’s 13.7% decline to 623k, which followed a 9.6% increase to 722k in April, is unrevised. Trend in new home sales has no clear direction but the NAHB homebuilders’ survey suggested a weakening picture in June, which saw only a partial correction in July. Our forecast is similar to the market consensus, and given the lack of a clear trend in home sales there may be more interest in the jobless claims data, which has shown significant declines in the last few weeks after a rise in the first half of June. The USD could be sensitive to weak data, with Waller having called for a July easing last week and nothing priced into the curve for the July 30 meeting.

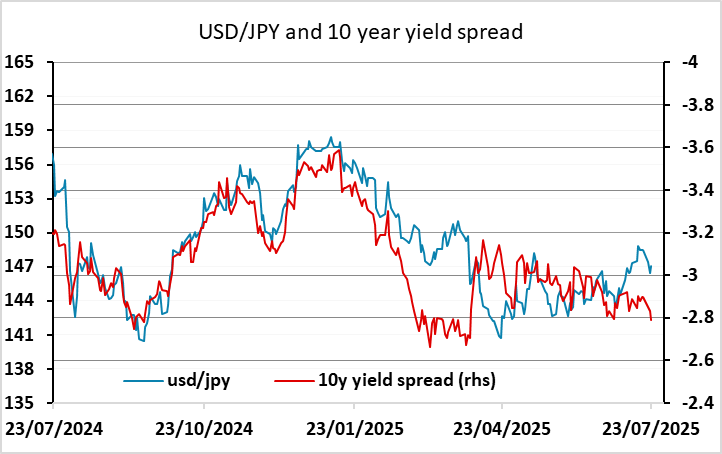

In general, there still looks to be scope for the JPY to extend the gains seen this week, even though there is still talk of a potential Ishiba resignation after the LDP losses in the Upper House elections. In practice, this could be JPY negative in the short run, but yield spreads still point to scope for more JPY gains against the USD.