FX Weekly Strategy: July 28th - August 1st

US employment report likely to be less of a focus than usual

Tariff news should be the main trigger for market moves

EUR/USD reaction uncertain

JPY continues to suffer in risk positive environment

Strategy for the week ahead

While this is US employment report week, the bigger market focus is likely to be on the August 1st deadline for trade deals to reduce the level of reciprocal tariffs to acceptable levels. While the market is currently assuming that the EU will reach a deal similar to the US/Japan deal involving a 15% base tariff with exemptions for some products (and higher tariffs for some others), this is still unconfirmed. Such a deal looks to be nearly priced in, with the equity markets performing solidly in anticipation. The announcement of such a deal might trigger a mild risk positive reaction, but there looks to be a greater risk of a negative reaction if expectations of a deal are disappointed. Even if such a deal is agreed, it should be realised that

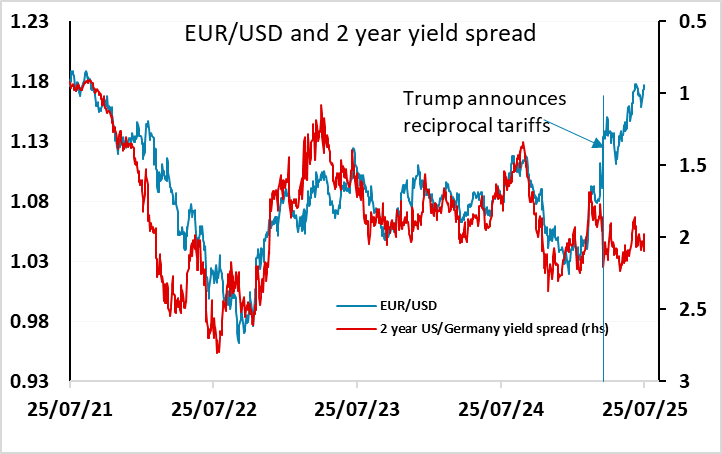

The impact on EUR/USD is far from clear, even if we knew the details of any trade deal. The USD fell back after the initial reciprocal tariff announcement in April, so logically we should see further USD weakness if tariffs turned out to be higher than expected. The rationale is that higher tariffs will mean a weaker US economy and less reason for international investors to favour the US as a relatively high growth area. There have certainly been reports that international investors have reduced their exposure to the US in the wake of the initial tariff announcement, and this has been seen as the main cause of the USD weakness since April. However, recent reactions to news suggests that the market would see higher tariffs as bad news for the EUR. There was also a positive JPY reaction to the news of a US/Japan trade deal. So it is far from clear whether EUR/USD would rise or fall on tariff news. It seems clearer that a deal that is in line with current thinking would be seen as mildly risk positive and would lead to more JPY weakness, while any bumps in the road would be seen as JPY positive.

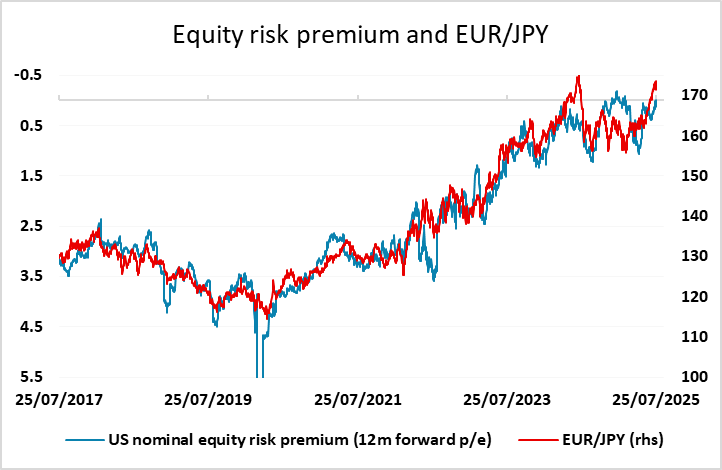

The JPY was weak on Friday, in part because of a general risk positive tone but also because of some concerns that Ishiba might resign due to the LDP losses in the Upper House election. If he is still in place on Monday, this may allow some JPY recovery, while if he goes expect more initial JPY weakness, although in practice we doubt this would make much difference in the longer run. EUR/JPY hit another new 1 year high on Friday and completed an unprecedented ninth consecutive weeks of gains, coming at a level of EUR/JPY which is close to all time highs, and without any real justification from any moves in yield spreads. The support for EUR/JPY seemingly comes almost entirely from the (inverse) correlation with risk premia. The resilience of equity markets, bolstered by talk of trade deals in recent days, has mean that equity risk premia are heading towards their recent 23 year highs seen at the beginning of the year.

Can the trend continue? Certainly, it seems that as long as risk premia continue to fall it will be hard to break the trend. Value is a weak attractor in FX markets, and there is no immediate likelihood of any policy action intended to halt the EUR/JPY gain. While the JPY is still very weak on a real trade-weighted basis, the focus tends to be more on USD/JPY as far as intervention is concerned. The ECB is becoming more concerned about the gains in the EUR, but the EUR is still not particularly strong in fundamental terms. Nevertheless, 9 consecutive weeks of gains is unprecedented, and a pause seems likely soon. The BoJ meeting on Thursday this week will be a focus, and although no change in policy or official outlook is likely, comments from Ueda are likely to be more hawkish in view of the US/Japan trade deal, and may trigger a JPY recovery.

Elsewhere, we have a Fed and a BoC meeting, neither of which is likely to see any change of policy, and Eurozone and Australian CPI data ahead of the US employment data. None of this is likely to have significant FX impact, with the risk positive market tone still the dominant factor and only likely to be threatened either by tariff news or an unlikely significant weakening in the US employment data.

Data and events for the week ahead

USA

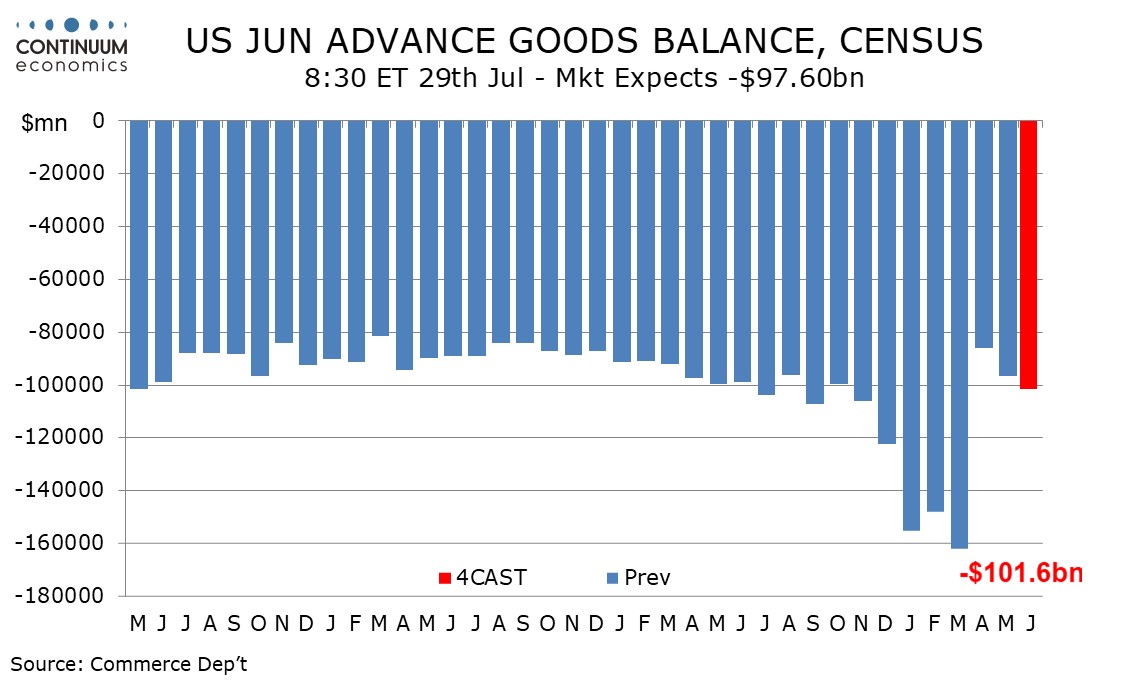

After a quiet Monday the US calendar is busy. On Tuesday we expect the advance goods trade deficit to rise to $101.6bn in June from $96.4bn in May. This and accompanying advance June retail and whole sales inventory data could bring fine tuning to Q2 GDP estimates. Also due on Tuesday are May house price data from FHFA and S and P Case-Shiller, June job openings and July consumer confidence.

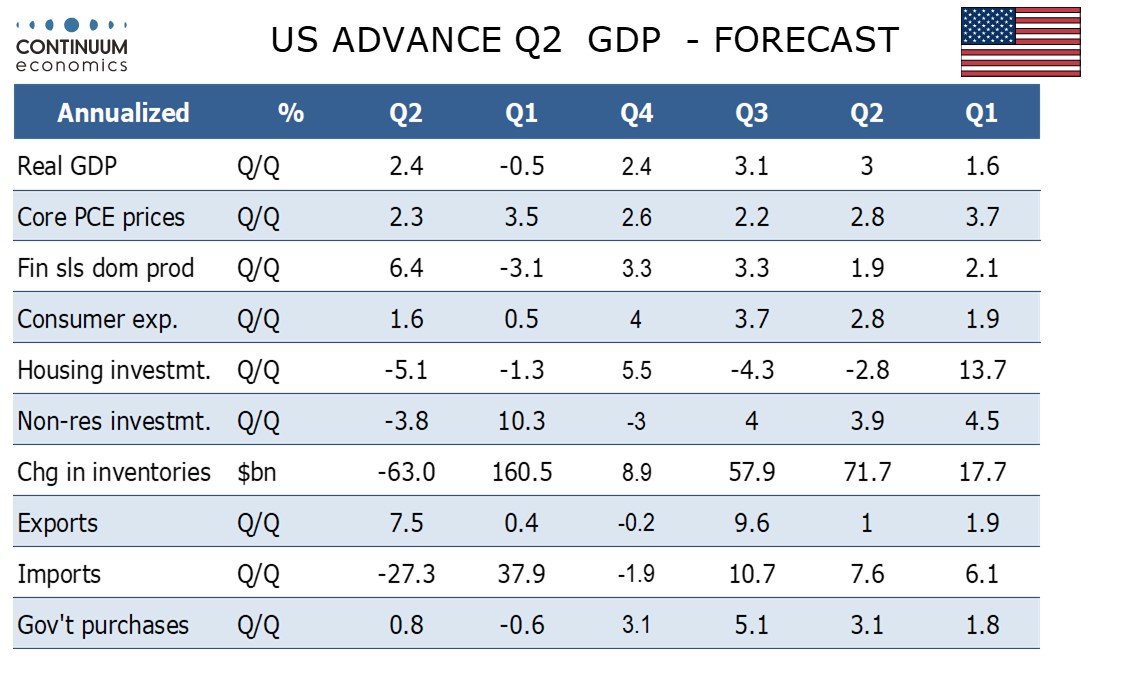

On Wednesday we expect a 70k rise in July’s ADP estimate of private sector employment, rebounding from a negative July. We expect Q2 GDP to rise by 2.4% annualized after a 0.5% decline in Q1, with a 2.3% increase in core PCE prices. June pending home sales are also due. The FOMC decision follows, which looks set to leave rates unchanged given recent resilient data and uncertainty over tariffs. Whether there are any dissents should be closely watched given pressure from Trump to lower rates but we do not expect any.

Thursday’s personal income and spending report will be largely old news with Q2 totals due with GDP. We expect gains of 0.3% in core PCE prices, 0.2% in personal income and 0.5% in personal spending. We also expect a slower 0.7% increase in the Q2 employment cost index, while weekly intial claims are due.

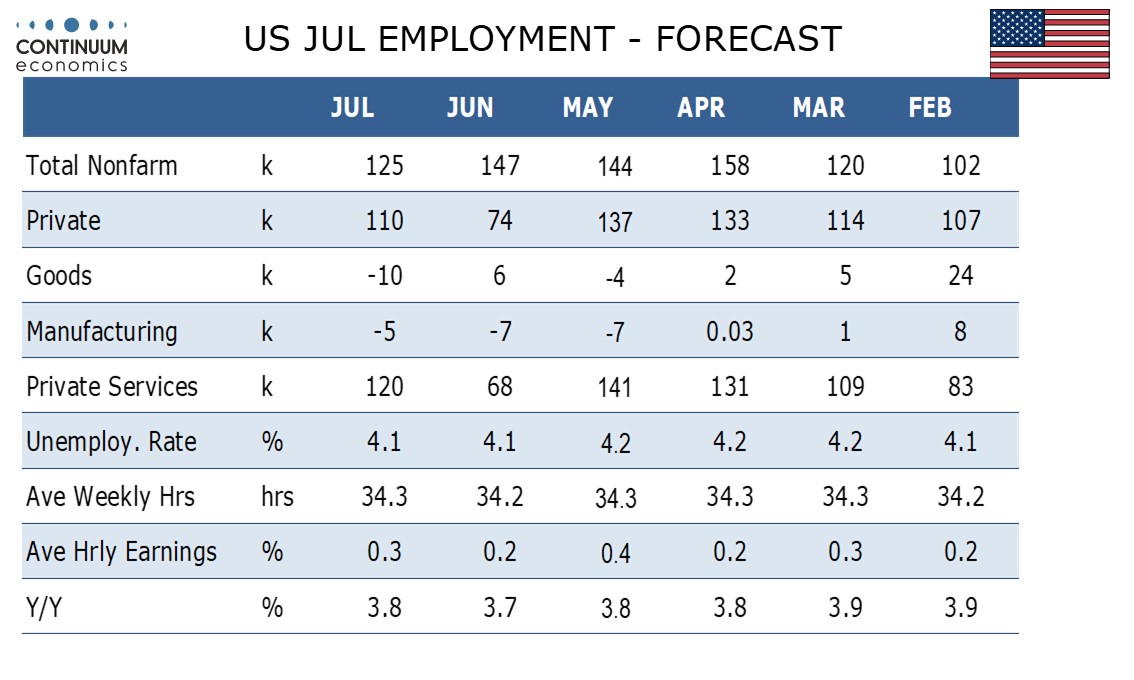

On Friday we expect a 125k increase in July’s non-farm payroll, slightly slower than in June though a 110k in private sector employment would be stronger. We expect unemployment to be unchanged at 4.1% and a slightly stronger 0.3% increase in average hourly earnings. Later we expect an unchanged ISM manufacturing index of 49.0 for July. June construction spending is also due.

Canada

The Bank of Canada meets on Wednesday and given recent firm employment and CPI data and uncertainty over tariffs we expect rates to be left unchanged. On Thursday we expect Canadian GDP to fall by 0.1% in May, but with a preliminary estimate for a 0.1% increase in June.

UK

The week has little of interest data wise save for BoE money and credit data (Tue) where housing market volatility and distortions may again be the order of the day. Final Manufacturing PMI (Fri) will attract little interest.

Eurozone

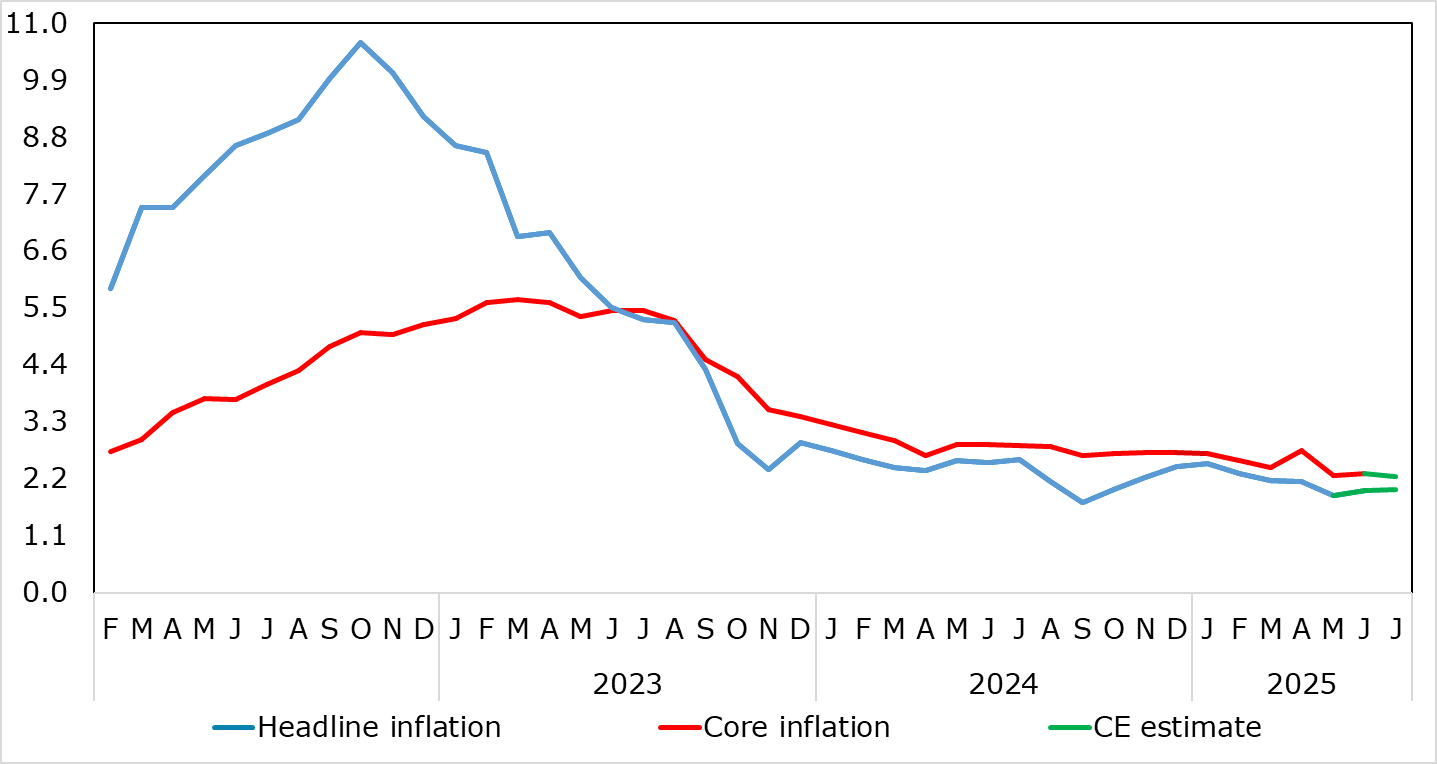

Several important updates are due this week even though the focus will be the U.S. tariff deadline on Friday 1 Aug. The main data focus is also on Friday with the flash HICP for July. Despite adverse energy base effects, we see the flash July HICP staying at June’s 2.0%. More notably, and something to calm the hawks, having jumped to 4.0% in April, very probably due to the impact of the timing of Easter we see further calendar effects taking it down to 3.0% in July - the softest since Mar 2022. As a result, the core rate may drop 0.1 ppt to 2.2%, which would be the lowest since Oct 2021. As a precursor, German CPI/HICP numbers for July arrive on Thursday. After the lower-than-expected June preliminary numbers refreshing and reinforcing a sideways pattern, with a 0.1 ppt drop to 2.0%, a 10-mth low! But we see no further drop in the July preliminary numbers largely due to adverse energy base effects

Headline Back at Target as Services Hits Cycle-Low

Source: Eurostat, CE, ECB

For an economy that has seen repeated upside surprises and above trend growth of 1.5% in the year to Q1, EZ GDP data do not seem to have had much impact is shaping, let alone dominating, ECB policy thinking. We think this will continue to be the case even where the looming flash EZ GDP Q2 data (Wed) may show a modest contraction of 0.1% q/q, with a similar German outcome after Tuesday’s Spanish figure once again underscores continued economic divergences. But there is more survey data, not least European Commission consumer and business numbers which have been offering a more downbeat picture than the PMIs, the latter seeing an update on Friday. Otherwise, both from the ECB, wage tracker numbers may be in the offing (Wed) with the consumer expectations survey due Tuesday.

Weaker But Still Divergent EZ GDP Picture?

Source: Eurostat, Continuum Economics, Bloomberg

Rest of Western Europe

There are key events in Sweden, with Tuesday’s monthly GDP indicator where another soft outcome may still feed into a small rise for the whole of Q2. Otherwise, in Switzerland, Wednesday sees KOF survey numbers.

Japan

The BoJ Interest Rate decision will be announced on Thursday and we don’t see a hike nor forward guidance change. After the clarity on the trade front, the BoJ will be open to hike rates but they will need time to assess the potential impact of U.S. tariffs. Else, we also have retail trade and consumer confidence on the same day, industrial production on Wednesday.

Australia

The critical CPI will be released on Wednesday. Headline CPI will likely edge higher but within the RBA target range of 2-3%. Trimmed mean will carry more weight and we expect it to trade closer to the middle point of range. Any downside surprise will likely see the RBA brings an imminent cut. Retail sales, building permits are on Thursday and PPI on Friday.

NZ

Consumer confidence and building permits on Friday only.