Asia/Pacific (ex-China/Japan) Outlook: Going Big, Going Strong

· Following a stellar performance in 2023, the momentum of economic activity in emerging Asian economies is anticipated to remain broadly stable, albeit lose some sheen in the subsequent quarters. The economic activity levels should be sustained despite a tight oil market and a potential rise of crude oil prices, constricted liquidity conditions and the feedthrough of the 2023 tightening, only a gradual recovery in China, climate change-related incidents, and overarching global uncertainties.

· The prevailing theme for Asian economies in H1-2024 revolves around pre-election spending and a general uptick in government expenditure, notably in Indonesia and India. Over H2-2024, growth is expected to be buoyed by interest rate cuts, private investment and private consumption.

· These economies have also mostly witnessed a faster than anticipated slowdown in inflation (although susceptible to food inflation), outdoing developed economies and other emerging market peers. This suggests that inflation levels should remain manageable in Asia. A main concern for Asia stems from higher food inflation in the event of a climate change related shock.

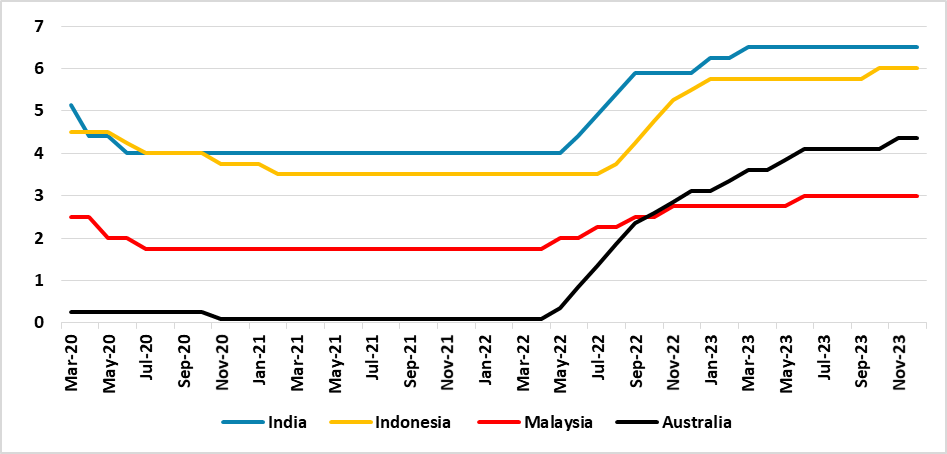

· In 2024, a shift towards more accommodative policy measures is anticipated, aided by the return of inflation to target levels and a broader global trend towards unwinding some of the previous tightening measures. Central banks are likely to remain hawkish in H1-2024, but rate tightening cycle has ended in these economies, in our view. A more manageable inflation trajectory will provide headroom for rate cuts, which are likely now in H2-2024. Australia will be reluctant due to lingering CPI concerns, but will likely start cutting from Q3 2024.

· Global slowdown, slower than anticipated recovery in China, persisting tight liquidity conditions, a regional tensions in the Middle East, conflict in South China sea, and climate change-related events pose risks to Asia’s growth trajectory in 2024.

Forecast changes: Evolving Federal Reserve commentary and strong domestic demand impulses have prompted changes to our monetary policy forecasts. We now anticipated rate cuts in both India and Indonesia only in H2-2024, helped by earlier cuts from the Fed.

Our Forecasts

Source: Continuum Economics

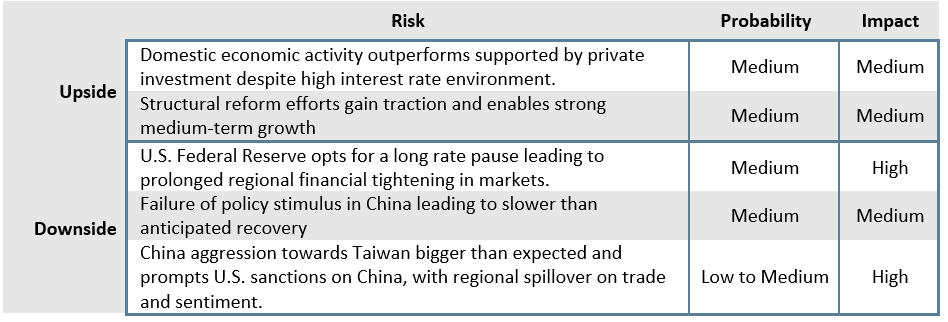

Risks to Our Views

Source: Continuum Economics

Regional Dynamics: Mixed Prospects in 2024

In H1-2024, much like in 2023, the emerging economies in Asia will continue to outperform other emerging markets and display notable resilience in comparison to developed economies. Projections suggest that Asia is poised to play a substantial role in driving global growth in 2024, with significant contributions expected from key players such as India, China, and Indonesia. Particularly noteworthy though is that Asia's economic growth is slowing down; however, it is expected to surpass other regions and remain robust over 2024-25.

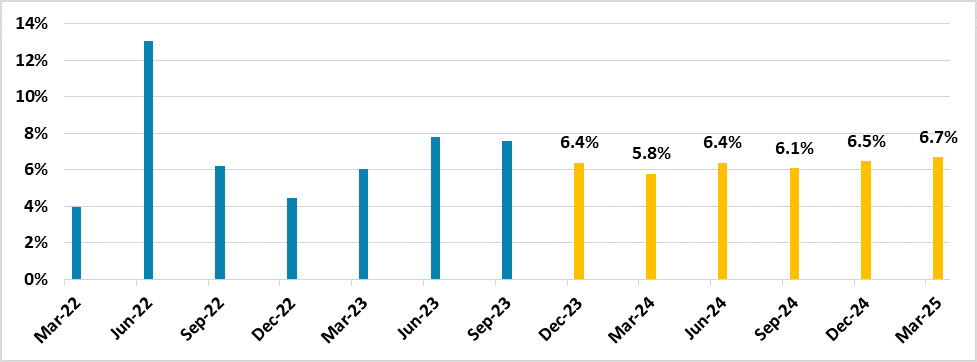

Figure 1: Real GDP Growth Forecast 2024 (% change, y/y)

Source: Continuum Economics

The regional growth outlook for 2024 is mixed, as a recovery in global demand is expected only in the latter half of 2024, and will be supportive. However, many economies still face challenges due to the lagged feedthrough of rapid monetary tightening in 2022-23. China's real GDP growth is also expected to remain tepid, with efforts to stabilize the economy after a challenging post-COVID recovery (here). The government aims to boost consumer sentiment through easing property market regulations and stabilizing foreign investment. However, the impact on the rest of Asia will still be minimal from this recovery. Consequently, export-oriented economies like Indonesia, Singapore, Taiwan, and Vietnam may underperform in 2024. The global electronics cycle is expected to improve in H2-2024, benefiting economies with domestic demand and natural resource endowments. South-east Asian economies, including Indonesia, Malaysia, and the Philippines, will benefit from investor interest, supply chain diversification and steady domestic demand. South Asia, comprising Afghanistan, Bangladesh, Bhutan, India, the Maldives, Nepal, Pakistan, and Sri Lanka anticipate a robust growth outlook in 2024. However, persistent challenges related to substantial debt burdens and hurdles in fiscal consolidation implementation will persist.

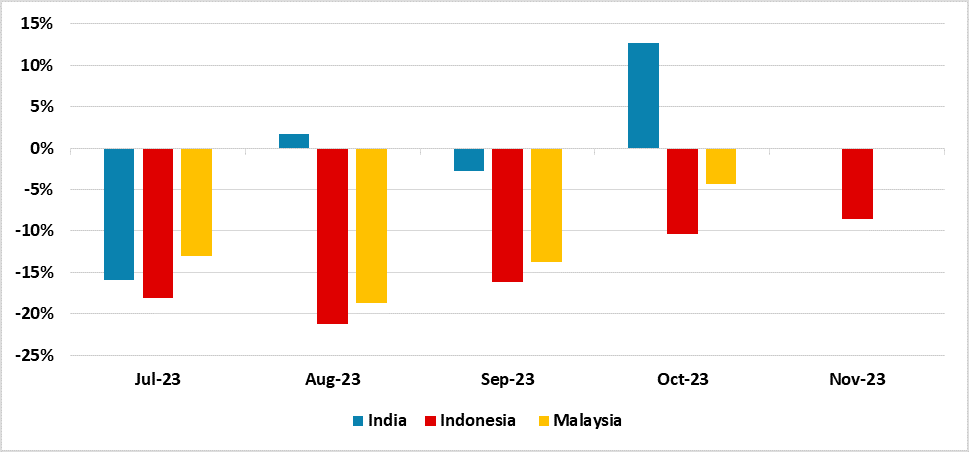

Figure 2: Nominal Export Growth (% change value, y/y)

Source: Datastream, Reserve Bank of India, Bank Indonesia

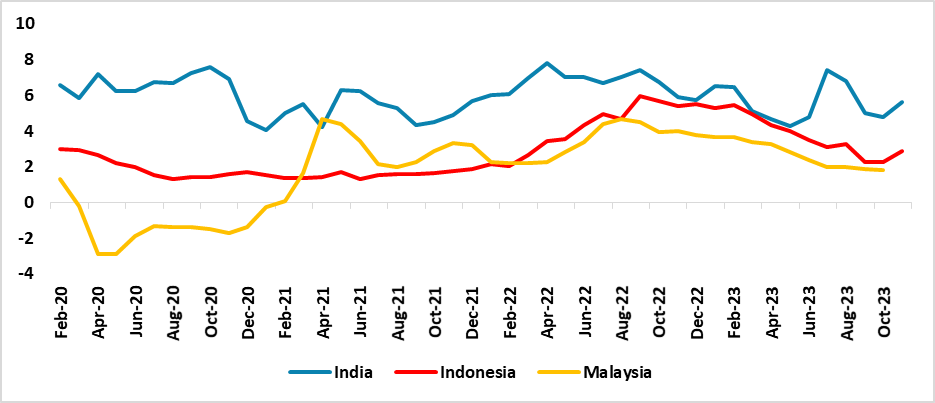

Inflation Pressures to Ease

While Q3 and Q4 2023 has presented a somewhat disappointing scenario for Asian economies in terms of inflation, marked by higher-than-anticipated price increases in countries like India and Indonesia, the overall outlook suggests that price pressures are expected to remain manageable, extending into 2024-25. A potential risk to this benign inflation forecast, however, emanates from a tightly regulated oil market. With OPEC+ planning to sustain production cuts throughout 2024, there is a likelihood that crude oil prices will remain elevated, potentially prompting an uptrend in prices. Nevertheless, the currently manageable inflation levels provide these economies with sufficient flexibility to assess market conditions and contemplate adjustments to interest rates accordingly.

Figure 3: Asia Inflation Forecast 2024 (% change, y/y)

Source: Datastream

Fiscal Consolidation To Limit Growth

Fiscal retrenchment is expected in Asia for 2024 and beyond. Heavy fiscal outlays during the pandemic and the cost-of-living crisis will prompt governments to consolidate public finances. Measures to raise public revenue, including higher taxes, will be implemented. Balance-of-payment-strained countries under IMF programs, like Bangladesh, Pakistan, and Sri Lanka, are adopting various measures to broaden revenue bases. Richer countries are likely to follow suit, staggering measures to mitigate the impact on domestic demand. However, countries such as India and Indonesia are likely to remain on the path of increased capital expenditure. Indonesia and India are expected to focus on infrastructure-led growth in 2024-2025, particularly as they head to elections in H1-2024 and new governments would be keen to come up with spectacular budgets. The forthcoming elections in various Asian economies are poised to drive increased public expenditure, acting as a pivotal support for headline growth figures. Notably, countries such as Indonesia and India are motivated to avert entering their 2024 elections against a backdrop of decelerating economic activity. While private demand played a substantial role in propelling economic growth in Asia during 2023, public investment, especially in India and Indonesia, will make a significant contribution in the first half of 2024.

India's government is expected to advance its ambitious capital spending plans, ushering in a surge of infrastructure projects in the lead-up to the national elections. Concurrently, populist policies in India and other nations like Malaysia are set to boost household incomes and stimulate private demand. In the Indian context, the rural economy is poised to receive a cash infusion as elections approach, with both central and regional governments rolling out initiatives to support farmers, provide incentives, and prioritize infrastructure projects. A parallel trajectory is anticipated for Indonesia, which witnessed a 5.7% y/y growth in fixed capital formation in Q3-2023. However, a return to fiscal deficit in (albeit marginal) in Indonesia, could limit spending over 2024.

Election Volatility to Restrain Investment

The political landscape in Asia will see elevated risks due to a busy electoral calendar in the first half of 2024. Incumbent administrations are expected to prevail, reflecting better economic prospects and tightly managed democratic systems. However, the region stands in contrast to anti-incumbency and populist sentiment in other parts of the world. Elections scheduled in four out of eight South Asian countries in 2024, coupled with security concerns and a lack of major structural reforms, are likely to restrain investor sentiment beyond India.

Major elections are scheduled in Bangladesh, Pakistan, Indonesia, India, and Sri Lanka, influencing policy directions and regional relations. In Indonesia, while Prabowo Subianto currently leads in polls, NasDem's candidate, Anies Baswedan is gaining popularity and could provide stiff competition. In India, the Bharatiya Janata Party (BJP) is forecasted to secure a third term, with Prime Minister Narendra Modi expected to continue.

Monetary Easing and Friend-shoring Will Provide Tailwinds

Certain countries in Asia will see tailwinds from evolving geopolitical alignments. Geopolitically, South Asia will remain a crucial theatre for evolving dynamics between India and China, with India possibly facing challenges in cultivating alliances as China expands its geopolitical ambitions. The Belt and Road Initiative, China's infrastructure development plan, will influence alliances in India's neighbourhood. India will strive to maintain cordial relations through economic and military support, relying on the U.S. for joint investment ventures. The geopolitical tussle between India and China will impact South Asia's stance, with countries attempting to benefit from the competition while avoiding alignment with either side. China’s trade disputes with the EU and the U.S. may impact Chinese exports, leading to supply chain shifts in South-east Asia. Consequently, India and Bangladesh may benefit from the global shift in manufacturing away from China.

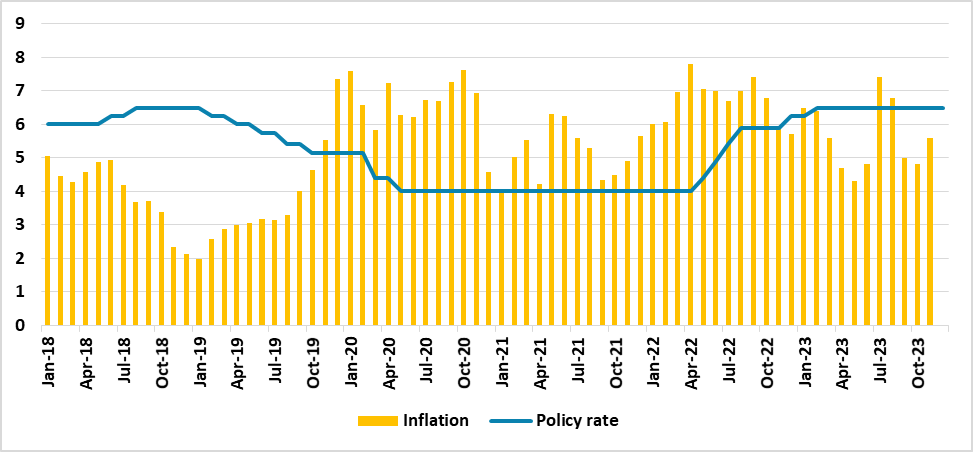

Figure 4: Benchmark Policy Rate (%)

Source: Reserve Bank of India, Bank Indonesia, Reserve Bank of Australia, Bank Negara Malaysia

Major Asian emerging markets (India, Indonesia, and Malaysia) are likely to undertake monetary easing in favour of spurring domestic growth. However, limited scope for monetary easing is anticipated due to renewed food price pressures, and tight labour markets in some economies. Upside inflation risks related to oil prices and geopolitical conflicts may lead to further caution, maintaining a high-interest-rate environment that could impact consumption, private investment, and access to low-cost financing for governments for at-least part of 2024.

Australia: RBA Dovishly Data Dependent

Domestic demand in Australia continues to be stronger than expected, lending support to the Australian economy and also underpin inflation. The solid Australian labor market remain red hot after showing signs of peaking in H1 2023, showing on average +35.6k for headline employment change while the rise in unemployment rate (3.5%-3.9%) balanced by higher participation rate (66.5-67.2%). The tight labor market sees the wage price index at its highest level of 4% y/y but the pace of growth has slowed. The household saving ratio is very low at 1.1% for Q3 2023, suggesting household spending will be significantly limited in the coming quarters. The high mortgage payment is putting extra strain on household balance sheets as house prices have already begun its recovery after a brief correction from the peak. Negative real wages will continue to weigh on private consumption in 2024, as wage growth is outpaced by inflation but is expected to move closer to positive real wage after Q2 2024. The re-opening of Australia post COVID has brought back international students/tourists and has been supporting demand for consumer-facing firms and supported consumption. Commodity prices also remain solid for 2023 and is supporting the Australian economy. The RBA highlighted the Israel-Hamas war increasing the uncertainty for global outlook, yet given the proximity of trade they are more concerned about the Chinese economy where they are looking at a mixed outlook. RBA’s tilt towards data dependency does not mean they are disregarding the balance between inflation and economic growth. Our central forecast is unchanged and believe the Australian economic growth will tread lower till Q3 2024 when we see RBA easing and household consumption fares better on more balanced real wage.

Global demand for Australian commodity is strong despite soft demand from Chinese property development sector as other Chinese sectors are also demanding Australian iron ore. Overall, we revised GDP growth in 2023 higher to 2% and keeping 2024 at 1.3% because the Australian economy is healthy enough to buffer the cumulative impact of tightening which would still inevitably hinder the Australian economic growth. We forecast in 2025 Australia will have an average growth at 2.2%, benefiting from RBA rate cuts.

We forecast headline CPI inflation to continue moderating throughout 2024/25 until breaking below 3% in Q3 2025. Despite dissipating supply chain disruption and global monetary tightening, inflation for 2023/24 CPI has been revised marginally higher to 5.6% and 3.4% respectively as energy prices spiked in Q3 2023. RBA has revised the inflation forecast slightly higher (Q4 2023 4.5% from 4.25% and Q4 2024 3.5% from 3.25%) but continue to expect inflation to be back to target range by year end 2025. The transitionary inflation factors have mostly dissipated yet it would take an extended period of time for sticky core inflation to rotate lower from high levels. The pace of moderation has been slower on strong domestic demand and it should pick up for household saving no long supporting such spending behaviour. Moreover, there is little room for food inflation to be sustainably higher, though there maybe an occasionally spike in energy prices under the shadow of geopolitical tension. The high housing cost has corrected from peak levels with mortgage rates rising significantly and housing investment has also dropped from high levels but in the recent months we are seeing a recovery in housing prices as demand outpaces supply. Wage inflation is being outpaced by inflation currently because the labour market had been at maximum capacity. The RBA is recognizing the peak in labour market and slower than forecast pace of wage inflation, which may translate to lower inflation in the medium run.

The RBA is keeping both doors open on holding and hiking rates, but as major items continue to deflate such rhetoric is almost identical to suggest a pause in tightening cycle. One cannot rule out the RBA tightening when CPI spikes like Q3 2023 but the chances are slim going forward. It is wise for the RBA to be cautious with its tightening step as not only it takes time for the cumulative effect of hiking interest rate to feed into the system, but a potential crash in the housing market from aggressive interest rate increase would create more trouble for the central bank. We now see RBA holding cash rate at 4.35% before cutting in Q3 2024 as inflation fell closer to 3%. We see 60bps of cuts in 2024. We see the RBA moving back towards neutral policy rates of 3.0% rates by end 2025.

India: Economic Powerhouse

India will emerge as a global economic powerhouse as it navigates the economic landscape of 2024-2025. The political scenario, dominated by the Bharatiya Janata Party (BJP), sets the stage for policy decisions that will significantly influence economic outcomes. The political dynamics, marked by the BJP's expected retention of power for a record third term, present a backdrop for economic stability. Prime minister, Narendra Modi's popularity, stemming from successful last-mile delivery of reforms and a perceived enhancement of India's global stature, is poised to reinforce policy continuity. While the BJP faces challenges in diversifying its leadership beyond Modi, existing policies focusing on last-mile delivery of public services and subsidy schemes contribute to retaining public support.

On the policy front, infrastructure development is slated to remain a focus, reflecting India's pursuit of enhanced transport and logistics infrastructure. The government's initiatives such as Bharatmala, Sagarmala, dedicated freight corridors, and Udaan aim to improve connectivity, with the National Logistics Policy focusing on reducing costs through standardization and digitization. This commitment to infrastructure is expected to be a pivotal driver of growth in 2024-2025. Fiscal policy is anticipated to play a crucial role, with the government's budget for FY24 emphasizing fiscal consolidation. Increased capital spending on transport infrastructure, defence, renewable energy, and telecommunications is expected over 2024 and 2025.

Figure 5: India GDP Forecast (% change, y/y)

Source: Continuum Economics, MOSPI

India's economic growth trajectory for 2024-2025 exhibits sustained economic activity. The manufacturing sector, buoyed by Production Linked Incentive schemes and an emerging trend of international firms extending their manufacturing activities into India, is set to contribute significantly to economic expansion. The agriculture sector, however, faces headwinds from adverse weather conditions, including a subdued monsoon, reservoir shortages, and warmer temperatures. Climate change-induced challenges pose a threat to productivity, prompting rural-to-urban migration. Nevertheless, government initiatives promoting scientific warehousing and capital investment aim to mitigate these challenges to some extent. The services sector, encompassing retail trade, software services, commercial real estate, and travel, remains a resilient driver of growth. Employment in manufacturing-related services is expected to grow, contributing to overall economic vibrancy. Economic growth is expected to be sustained at over 6% y/y level, with real GDP growth expected to touch 6.4% y/y in 2024 (FY25) and 6.3% in 2025 (FY26).

India's external sector outlook is poised for improvement, with the current-account deficit projected to narrow. A robust services account surplus and high remittances inflows contribute to this positive trend. However, potential upside risks linger due to uncertainties in global commodity prices and energy costs. The inclusion of Indian bonds in JP Morgan's Government Bond Index-Emerging Markets, starting from June 2024, is poised to diversify the investor base, support foreign portfolio inflows and gradually lower government borrowing costs.

Figure 6: India Inflation and Policy Rate Trajectory (%)

Source: Datastream

India's inflation trajectory is expected to see a shift, with consumer price inflation decelerating from an average of 5.7% in 2023 to 4.5% in 2024. However, challenges arise from the lingering effects of the El Niño climate phenomenon, impacting rainfall and food prices. Wage inflation is expected to remain modest in the agricultural and industrial sectors due to excess labor supply. However, high-end services may witness moderate wage increases. Given easing inflation, the Reserve Bank of India (RBI), after cumulative rate increases, is expected to initiate monetary easing from the third quarter of 2024. Gradual rate reductions, reaching a policy rate of 5.75% by the end of 2024, and 5.5% by end 2025 aim to ease pressure on households and businesses. The RBI is unlikely to curb demand impulses ahead of the election in May 2024, and therefore any rate cuts are only likely in H2-2024.

However, risks are embedded in the political and security landscape. Communal clashes, exacerbated by the BJP's intensification of its Hindu nationalist agenda, pose threats to social stability. Meanwhile, clashes with China along the border and in the Indo-Pacific cannot be entirely ruled out either. The declining effectiveness of the Indian National Congress as the main opposition party may impact policy formulation and debate, potentially affecting the overall health of democracy. Overall though, India will likely emerge as the destination for investment and growth, supported by adept leadership and expectations of policy continuity and as global business diversify China centric global supply chains.

Indonesia: Sustained Trajectory

Indonesia faces both domestic and external headwinds going into 2024, however, prospects remain bright over the medium term. Economic stability is expected to play a crucial role in the political landscape, with the legislative and presidential elections scheduled for February 14th, 2024. The Indonesian Democratic Party-Struggle (PDI-P) is anticipated to maintain its position as the largest single party in the House of People's Representatives, benefiting from easing inflation and resilient economic growth. A closely contested presidential race is expected, with Prabowo Subianto and Gibran Rakabuming Raka forming a notable tie-up. Prabowo's endorsement by Gerindra and support from various parties position him as a strong contender, with implicit backing from Jokowi influencing voters.

Private consumption is anticipated to maintain its role as the primary driver of economic growth by expenditure during this period. The implementation of the Government Regulation in Lieu of Law on Job Creation (Job Creation Perppu) will likely stimulate private investment. This policy initiative aims to streamline regulations and reduce bureaucratic hurdles, fostering a more conducive environment for business and investment. Consequently, increased private investment is projected to drive growth in key sectors such as industry (including mining and quarrying) and services, collectively contributing close to 90% of the total value added to the economy. However, Indonesia faces challenges in competing with its regional counterparts for foreign investment, especially in labour-intensive manufacturing. Factors such as corruption and relatively high wages pose obstacles to attracting foreign investment in industries characterized by significant labour input. Nevertheless, targeted industrial policies in the medium term are anticipated to yield substantial gains in capital-intensive sectors, including metals, chemicals, electronic components, and automotive manufacturing. Broader investment activities beyond the minerals sector are likely to be constrained by higher interest rates until late 2024. Meanwhile, the external sector performance is expected to face challenges in the first half of 2024, with a deceleration in real GDP growth attributed to a contraction in exports, notably in key markets like China and the U.S.

Driven by these factors, real GDP growth is expected to experience a slight moderation in 2024 to 4.8% y/y. Household spending is anticipated to firm up by mid-2024 as inflation recedes. Nevertheless, the aftermath of the El Niño weather event, leading to higher food prices, may pose challenges to household expenditure in the following year. Infrastructure development remains a priority, with the completion of the new national capital, Nusantara, in East Kalimantan scheduled for early 2024. However, delays are anticipated until at least 2025, posing challenges in attracting investors. As a consequence, growth is expected to remain broadly stable in 4.7%-5% range over the 2024-2026.

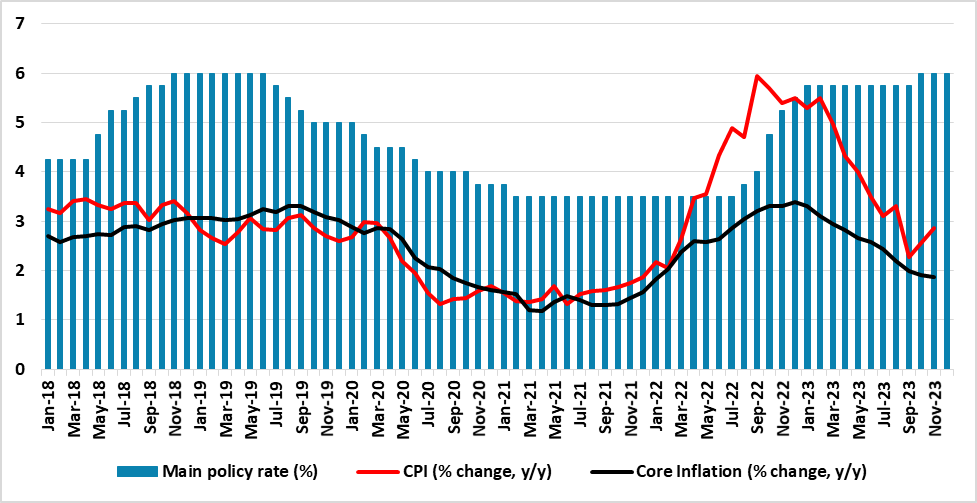

Figure 7: Indonesia Inflation, Core Inflation and Main Policy Rate (%)

Source: Datastream

Consumer price inflation are expected to continue its deceleration in 2024, influenced by the stabilization of global food and fuel prices. Indonesia, being a net importer of many grains and energy commodities, is likely to benefit from these global trends. Tighter monetary policies implemented in 2023 are anticipated to constrain demand, further contributing to the moderation of inflation. However, challenges persist due to the impact of the El Niño weather event in late 2023/early 2024, leading to droughts that may exert upward pressure on food prices in 2024. Additionally, the relative weakness of the rupiah could contribute to keeping inflation higher than the baseline forecast. On the external sector front, export growth is expected to face challenges due to weakened demand from Indonesia's major export partner, China. Further, anticipated inflation moderation could pave the way for rate cuts in advanced economies, boosting external demand. The steady recovery of the tourism sector is anticipated to support services exports in the months ahead.

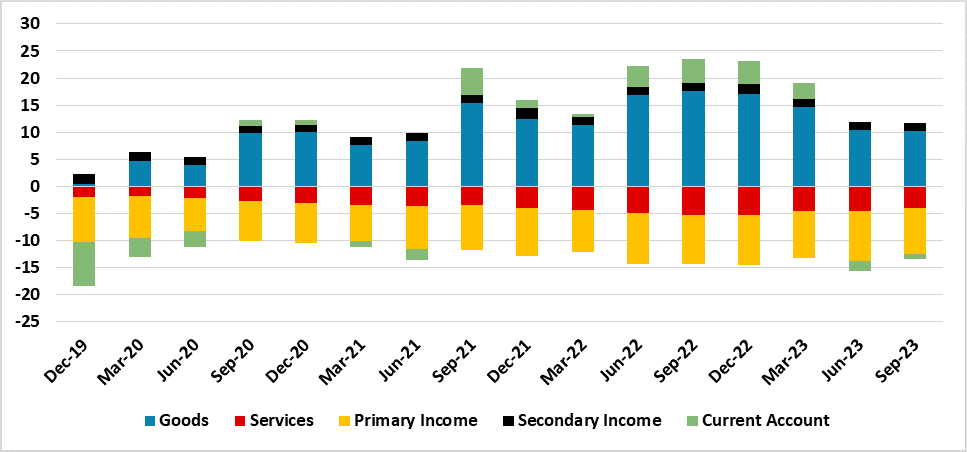

Figure 8: Indonesia Current Account (in US$ bn)

Source: Bank Indonesia

High interest rates are likely to persist until the third quarter of 2024, impacting private investment and household spending. Monetary policy, guided by Bank Indonesia, is expected to hold its policy rate at 6% until H1-2024. Subsequent reductions are forecasted in the second half of 2024, supporting economic growth. We expect two rate cuts of 25bps each in H2 2024. The benchmark policy rate is expected to trend down to 5.5% in end-2024, and further to 5% in end-2025. On the public finance front, fiscal policy is expected to see a narrowing budget deficit to 2.4% of GDP in 2024, supported by the removal of income assistance expenditure and a higher corporate tax intake. Future tax increases, including VAT adjustments, are anticipated to contribute to a gradual decline in the public debt/GDP ratio.

Despite challenges in the global economic landscape and domestic factors, Indonesia's economic prospects for 2024-2025 indicate a resilient trajectory. Risks include potential disruptions in political stability, moderation in external demand, and delays in infrastructure projects.

Malaysia: Steady Road Ahead

Malaysia's economic forecast for the years 2024-2025 paints a picture of broadly stable growth, supported by several key factors. Real GDP growth is expected to sustain at 3.8% y/y in 2024 and further increase to 4% in 2025. The recovery of electronics demand and strengthened consumer spending in advanced economies are anticipated to boost exports gradually in the latter half of 2024. Additionally, the services sector is expected to receive support from growing international visitors, primarily driven by intra-ASEAN tourism. One of the crucial contributors to economic growth during this period is anticipated to be private consumption. Despite the high level of household debt, households' purchasing power and real wage growth are expected to remain robust, supported by targeted government subsidies and low consumption taxes. However, private consumption growth is expected to be softer compared to historical levels. On the production side, the services sector is projected to be the main contributor to GDP, supported by various industries such as wholesale and retail trade, information and communications, and financial services. The New Industrial Master Plan 2030 (NIMP2030) emphasizes digitalization and allocates more resources to key sectors like chemicals, electric vehicles, pharmaceuticals, and aerospace, aiming to boost value-added in the manufacturing sector.

In terms of inflation, we expect consumer price inflation to ease slightly to 2.2% y/y in 2024, driven by lower commodity prices. However, domestic policies such as the removal of price caps and diesel subsidies may preclude a quicker slowdown in inflation. The El Niño phenomenon might exert upward pressure on food prices though. In terms of fiscal policy, the authorities in Malaysia aim to mitigate the impact of elevated food and energy prices on lower- and middle-income households in 2024. Fiscal consolidation measures include the introduction of a capital gains tax, higher services tax, and a luxury tax. The targeted subsidy program for electricity and diesel is expected to ease the fiscal burden, leading to a forecasted fiscal deficit narrowing to 4.3% of GDP in 2024. The Public Finance and Fiscal Responsibility Act, passed in October 2023, sets clear fiscal targets for 2024-28, including a cap on the fiscal deficit at 3% of GDP. However, achieving this target may be ambitious, given the historical fiscal deficit average. The government's focus on fiscal consolidation is expected to keep public debt manageable despite a higher interest burden.

In terms of monetary policy, the tightening cycle by the Central Bank of Malaysia (BNM) is expected to end in 2024. The overnight policy rate (OPR) is anticipated to be trimmed by 75bps in the latter half of 2024. However, the central bank will aim to strike a balance between taming inflation and supporting economic growth. Another 25-basis-point cut in the OPR is forecasted in the first half of 2025, followed by stability until late 2026.

Despite the optimistic outlook, there are potential risks to the forecast. Extended weakness in external demand, caused by delayed effects of monetary tightening in advanced economies, poses a downside risk. On the upside, a weaker-than-expected El Niño phenomenon could alleviate supply constraints on agricultural produce in South‑east Asia, reducing food inflation and providing more disposable income for households. In conclusion, Malaysia's economic outlook for 2024-2025 appears positive, with growth driven by various factors such as increased exports, private consumption, and targeted fiscal measures. However, external risks and potential inflationary pressures highlight the importance of vigilant economic management during this period.