LatAm Outlook: Economic Shifts

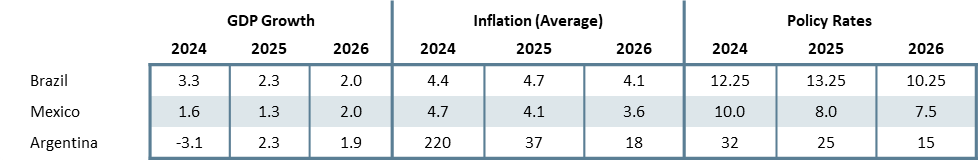

· Brazil and Mexico economy are likely to decelerate in terms of growth in 2025, although we see this being stronger in Mexico. Mexico legal reforms and its close ties with U.S. increases uncertainty for 2025, especially after Trump elections, although we see tariffs in 2025 as unlikely with Mexico likely to compromise. Brazil’s growth will be affected by contractionary monetary policy and a slightly lower fiscal push. In Argentina, the economy will likely begin its recovery from the recession caused by the stabilization plan, although we see a slow rebound in the upcoming years.

· Inflation is showing some stickiness in Brazil, and inflation expectations are unanchored, especially after the timid fiscal package presented by the government. We see some stickiness of inflation in the beginning of the year which in the second half will wane as monetary policy gets tighter and the economy weakens. Mexico’s CPI is showing sign it will converge in 2025, especially in the core group, headline CPI will likely continue to be affected by supply shocks, while weakened demand will compensate it. Argentina CPI will likely continue to slowdown and we forecast it to reach 1% monthly inflation in the second half of 2025.

· In terms of interest rates, we see Brazil resumed hiking due to a positive output gap, de-anchoring of inflation expectations and fiscal credibility issues, with a 14.25% policy rate peak in the first quarter of 2025 followed by cut in the last quarter of this year. In Mexico, we forecast Banxico to continue cutting the interest rate at 25bps pace meaning it will finish 2025 at 8.0% and 2026 at 7.5%.

· Forecast changes: From our September outlook, we increased our forecast for Brazil growth for 2025 to 2.3%, due to the stronger growth in the second half of 2024, while we reduce Mexico’s growth forecast to 1.3% due to a weaker internal demand. We also increase our CPI and interest rates for Brazil while we made only marginal changes in our Mexico’s forecasts. We increase GDP growth forecast for Argentina and reduced our inflation forecasts as Argentina’s inflation is falling quicker than we previously expected.

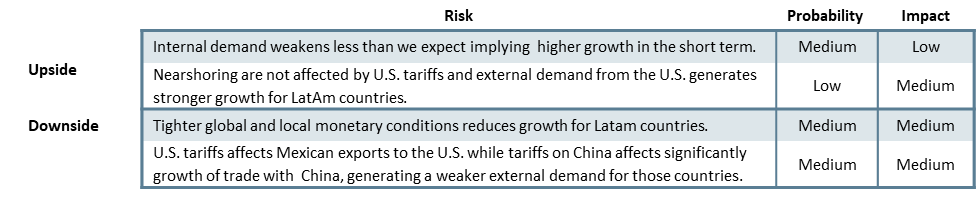

Risks to Our Views

Source: Continuum Economic

Risks to Our Views

Source: Continuum Economics

Brazil: Interest Rates Shock

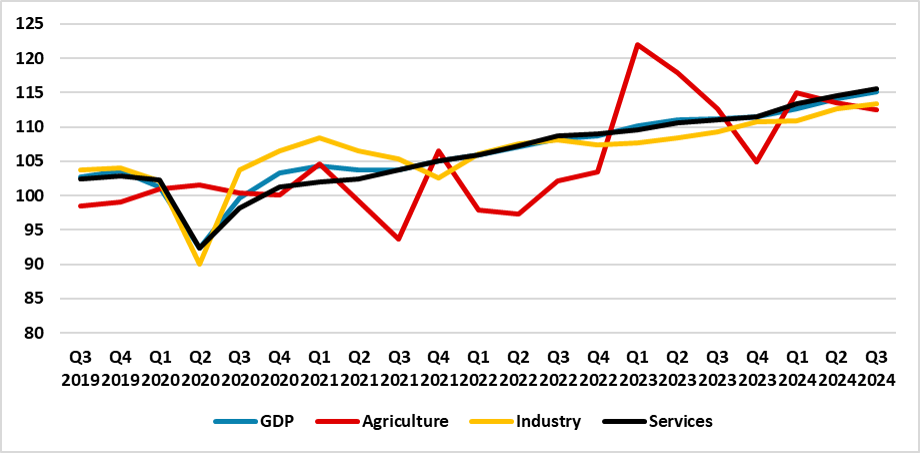

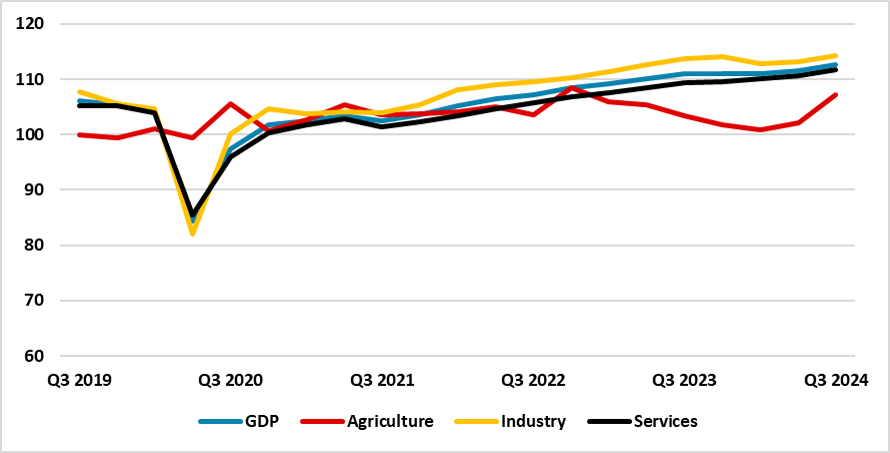

The Brazilian economy has continued to grow above its pre-pandemic trend in recent quarters, and we are now forecasting 3.3% GDP growth in 2024, marking the third consecutive year of growth exceeding 3%. We believe this is not indicative of a new structural growth trend but rather stems from a strong fiscal push initiated last year, coupled with the high idle capacity that has persisted since the 2014-2016 crisis. During this period, Brazil’s fiscal policy was focused on consolidation rather than expansion. However, as idle capacity from this crisis remained unaddressed, the fiscal stimulus at the end of 2023 narrowed this capacity, prompting the recent strong growth.

Figure 1: Brazil GDP by Sectors (2019 = 100, Seasonally Adjusted)

Source: IBGE

Despite this, we have reasons to believe that such growth will not persist in the coming months. As we have shown (here), most of Brazil’s growth originated from labor absorption rather than productivity gains. The unemployment rate has fallen to 6.4%, the historical minimum since the series began in 2012. While some claim this approaches the natural rate, we believe the neutral unemployment rate is likely closer to 5%. Anyway, we believe we will see a slowdown in growth. Additionally, the fiscal stimulus of the past two years will not be repeated as the government aims to reduce the significant deficit (here). We project growth to slow to 2.3% in 2025 and to approximately 2.0% in 2026, reflecting a return to a slower growth trend.

One area of concern for markets is the conduct of fiscal policy. The recent fiscal package presented (here) was seen as too modest, with the inclusion of tax exemptions raising doubts about the political will to achieve primary surpluses. In recent weeks, market sentiment has deteriorated, with inflation expectations and policy rates increasing, while the Brazilian Real has depreciated by around 12%. However, we believe markets are overreacting. The devaluation’s impact will likely reverse, as Brazilian yields remain excessively high. Once it becomes evident that the fiscal situation is far from catastrophic, the BRL is expected to appreciate somewhat. Additionally, Brazil’s relatively closed economy means that the inflationary impact of devaluation will likely be limited.

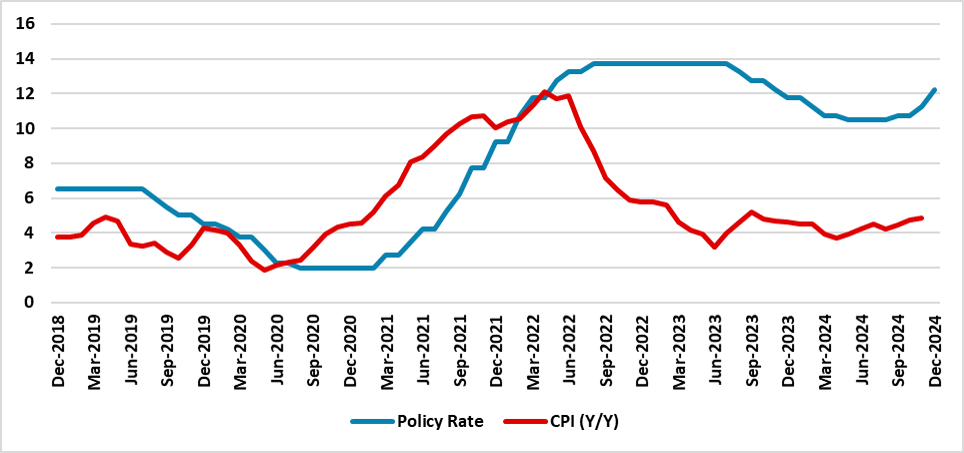

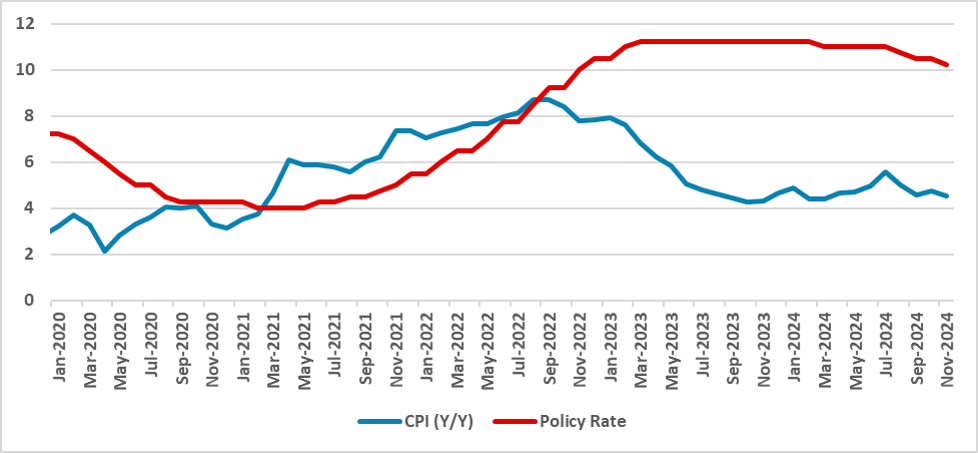

Nevertheless, the Central Bank of Brazil (BCB) must bring inflation back to target. With market expectations becoming unanchored, the cost of disinflation will be higher. The BCB has resumed rate hikes in response to worsening conditions, and they have committed themselves to be more aggressive. We expect two additional 100 bps hikes, bringing the terminal policy rate to 14.25% by the end of Q1 2025, matching the peak of 2014. Afterward, we anticipate a pause to allow inflation expectations to converge to the BCB target. By late 2025, as conditions for easing become clearer, including improved fiscal results and closer inflation expectations, the BCB is likely to begin a cutting cycle. This cycle will likely continue throughout 2026, with the policy rate ending at 13.25% by year-end.

Figure 2: Brazil CPI and Policy Rate (%, Y/Y)

Source: IBGE and BCB

Looking specifically at inflation, two unexpected factors have emerged since our last outlook. First, the output gap is now positive, indicating that supply is struggling to meet demand. Second, the depreciation of the exchange rate will likely keep USD/BRL above 5.6 for an extended period. Recent inflation measures show increases concentrated in energy and food prices, while core CPI remains relatively stable. We believe these factors will sustain higher inflation levels in 2025 and 2026. While monthly inflation will slow more gradually than previously expected, it is unlikely to result in a wage-inflation spiral. Our updated forecast places 2025 CPI at 4.7% (Yr/Yr average), with a decline to 4.1% (Yr/Yr average) in 2026.

On the political front, municipal elections have highlighted the strength of Brazil's center-right (here), with these parties prevailing over more leftist groups like those aligned with President Lula. However, municipal elections are better predictors of Congress's composition than the presidential race. These results suggest that Congress’s political makeup will remain largely unchanged. For the 2026 general elections, we continue to foresee a close contest between Lula, who is likely to seek re-election, and a right or center-right candidate, as Jair Bolsonaro will likely remain ineligible due to an Electoral Tribunal decision.

Mexico: Bracing for a Weaken Demand

Claudia Sheinbaum has begun her presidency amid marked controversy. Her party, Morena, has managed to gather a coalition holding over two-thirds of the Senate and the Chamber of Deputies, meaning they can now approve constitutional changes without negotiating with the opposition. The first set of measures focused on changing the judicial system. Now, all federal judges – including Supreme Court justices – will be elected by popular vote, and the current ones will be dismissed. During the previous administration, the Supreme Court barred some laws they deemed unconstitutional. With Morena’s popularity, Sheinbaum expects to elect judges politically aligned with her thinking, meaning the court will likely not block any of her measures in the future. Whether this new balance of power will be used to persecute political enemies or to perpetuate Morena’s hold on power remains to be seen. So far, we see Claudia Sheinbaum as being democratic, meaning she will likely leave office when her term ends in 2030, but we cannot rule out any change of course.

Another important development for Mexico is the election of Donald Trump, reigniting fears that tariffs might be imposed on Mexican exports to the U.S. In response to these threats, the Mexican government is open to talks with the U.S. to understand their demands, which we believe will relate to immigration and drugs. The U.S., Mexico, and Canada still have a trade deal set to be reviewed in 2026. Until then, we are expecting no significant tariffs on Mexican exports, although Trump will likely continue using the threat of tariffs as leverage. Additionally, some demands from the U.S. government related to Chinese enterprises using Mexico to avoid tariffs are likely to be made in terms of maximum content from China.

Figure 3: Mexico GDP (2019 =100)

Source: INEGI

In terms of economic growth, it is now clear that the Mexican economy is decelerating, and internal demand has been weakening. During the post-pandemic period, Mexico’s economy showed strong growth, driven by exports to the U.S. and the recovery of internal demand. However, as the country approaches full employment and monetary policy tightens, this growth has been slowing. Since productivity growth – which could make this growth sustainable – has been subpar (here), we believe Mexico will likely return to its pre-pandemic growth trend, around 2%. We estimate Mexico’s economy will grow 1.6% in 2024.

In 2025, we see the Mexican economy continuing to weaken. Monetary policy will remain contractionary, with its lagged effects continuing to feed through. Moreover, we believe the institutional reforms and the uncertainty they generate will hold back investments during this year. Additionally, the Mexican government will implement a consolidation package (here), which, by increasing revenues and holding expenditures, aims to achieve a fiscal consolidation of 2% of GDP, further weakening internal demand. We forecast the Mexican economy will grow 1.4% in 2025, with clear downside risks. In 2026, policy rates will be moved to neutral, providing some breathing room for growth, while most uncertainties around tariffs and institutional reforms will be resolved. We forecast the Mexican economy will rebound to 2.0% growth that year.

Figure 4: Mexico’s CPI and Policy Rate (%)

Source: INEGI and Banxico

On the monetary policy front, Mexico’s Central Bank (Banxico) has begun its cutting cycle, applying 25 bps cuts. Despite shocks to agricultural goods, Banxico is confident that core CPI will continue to drop towards its target, a trend confirmed by the weakening of internal demand. The weakere peso versus the USD will have little impact on headline inflation, according to Banxico estimates, and this will likely give the board more confidence to continue cutting rates. We forecast Mexico’s policy rate will finish 2024 at 10.0%. In 2025, our main scenario is that Banxico will remain cautious, especially given what happened in Brazil when the BCB had to resume hiking. Some members want to see how the fiscal adjustment plays out and its impact on expectations. That’s why we anticipate Banxico will proceed with gradual 25 bps cuts, finishing 2025 at 8.0%. In 2026, we foresee two additional cuts, moving the policy rate towards its neutral level of around 7.5%.

On the inflation front, we believe Banxico will be successful in driving inflation down, especially as internal demand weakens. However, some concentrated shocks to food prices, mainly due to climate changes, could still push headline inflation higher than the 3.0% target. We forecast the Mexican CPI will finish 2024 at 4.7% (Yr/Yr average) and further decline to 4.1% in 2025. Additionally, it is important to note the contrast with core CPI, which we project to finish 2024 at 4.1% and 2025 at 3.5%. By 2026, we expect Mexico’s CPI to finally converge to Banxico’s targets, with headline CPI finishing at 3.6% and core CPI at 3.0%.

Argentina: Stabilization Program Going as Expected

Argentina has proceeded with fiscal adjustment, with the central government registering primary surpluses in all months so far (data up to September). The fiscal anchor has had two significant impacts. First, it has suppressed growth, with Argentina experiencing a GDP contraction of approximately 4% in the first half of the year. However, early indications suggest the Argentine economy will likely rebound in Q3, with preliminary data pointing to a 3% (q/q) expansion. Second, it has allowed the Central Bank of Argentina to avoid printing money to finance the deficit, reducing inflationary pressures. Monthly inflation has dropped from 21% in January to 2.4% in November. Another positive development is that the gap between the official exchange rate and the BLUE (parallel) market rate has fallen below 5%. In 2023, this gap averaged around 50%.

We believe the Argentine economy will continue to recover in the coming quarters, although at a slower pace than the current contraction. We expect the Argentine economy to shrink by 3.1% in 2024, followed by a 2.3% recovery in 2025 and 1.9% growth in 2026. The primary driver of this recovery will likely be domestic demand, supported by a decline in inflation. On the external side, the economy will benefit from gas exports via the new "Vaca Muerta" pipeline.

Regarding inflation, we believe a fiscally disciplined government will enable inflation to converge to around 1% (monthly) in the second half of 2025. We currently forecast Argentina’s CPI to grow 220% in 2024, driven by the strong devaluation at the start of the year, and 37% in 2025. In 2026, we anticipate CPI growth of approximately 18%.

The Central Bank is currently maintaining a policy rate of around 32%, with a primary focus on cleaning up its balance sheet rather than implementing a contractionary monetary policy. In 2025, we forecast this rate to drop to 25% and further to 15% in 2026. By the end of 2025, it will be crucial to maintain a positive real interest rate as we believe Argentina will begin lifting capital controls around this time and unifying its multiple exchange rate systems. This transition will likely be supported by a new agreement with the IMF, enabling the Central Bank to bolster its reserves and manage potential volatility stemming from these changes.