China/U.S. Trade War and next To Talks?

China’s targeted and measured counter tariffs against the U.S. are designed to push the U.S. towards the negotiating table on the wider issue of the U.S./China trade deficit. Negotiating will likely start into the spring, but negotiating will be tough as the U.S. wants a phase 2 deal with new objectives to boost U.S. exports and penalties if goals are not achieved. China will likely be quick to make concessions on (needed) agricultural imports and illegal Fentanyl from China, but slow to concede on the idea of penalties. It will be a volatile road to an eventual deal late H1/early H2.

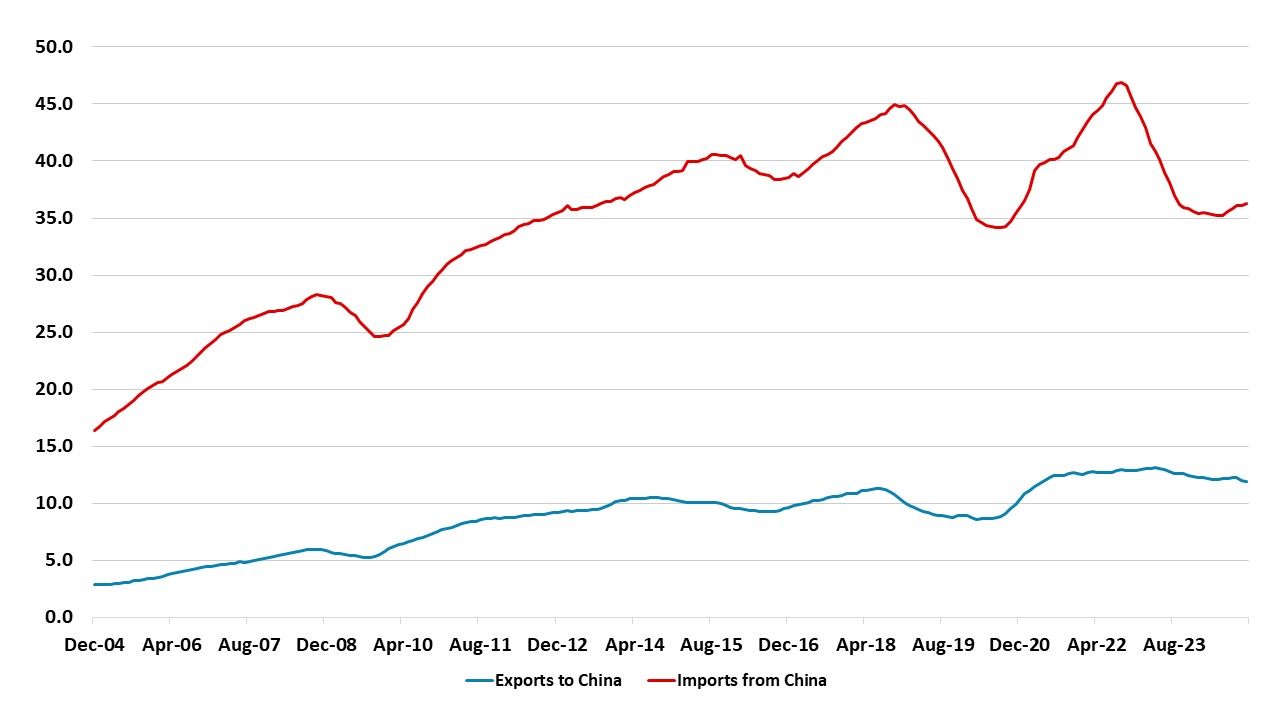

Figure 1: U.S./China Exports and Imports (12mth MA USD Blns)

Source: Datastream

As planned the U.S. has imposed an extra 10% tariff on all China exports to the U.S. and China has announced targeted counter tariffs against the U.S. Key points to note are.

· China tariff increases to deescalate. China has not imposed an across-the-board tariff on exports from the U.S. but rather focused on oil/LNG/coal and agricultural products, alongside restriction on rare earth minerals exports from China to the U.S. State media are viewing this as a measured response, which avoid China losing face but opening a path to trade talks.

· Next to phase 2 trade deal talks? China authorities could easily have made credible promises to stem the flow of illegal Fentanyl to the U.S., but appears willing to skip onto the main U.S. concern over the size of the U.S./China trade deficit. This is probably earlier than President Donald Trump planned, but is likely an attempt by China to force the U.S. to the negotiating table over a revised phase 1 deal or a new wider phase 2 deal. The April 1 review deadline under “America First Trade Policy” (here) executive order for the phase 1 2020 U.S./China trade deal will likely judge that it has failed to boost exports to China enough.

· Tough negotiations. While optimism could arise over the prospect of a quick trade deal, the reality is that negotiations could be tough. Firstly, Trump has the option of threatening or imposing more tariffs against China in response to China measured counter tariffs announced today – this was a tactic that Trump used in 2018-19. Secondly, Trump and the Republican party will want a phase 2 deal to have more enforcement and penalties should China fail to meet targets in a new trade deal. An increase in U.S. exports to China was the main goal of the phase 1 agreement, but China failed to deliver on this (Figure 1). Thirdly, the U.S. will want rules of origin to become tighter in a revised USMCA deal to curtail China using Mexico as an assembly area for their exports to the U.S. and this means parallel negotiations with Mexico and Canada on trade. The U.S. could also threat tariffs on Vietnam soon for the same reason. Fourthly, China officials will give way initial on increased imports from the U.S., especially China’s need for agricultural imports. Additionally, credible promises on illegal Fentanyl will also likely be offered by China. However, China will likely be initially reluctant to accept penalties if imports from the U.S. fail to meet targets. Finally, U.S. strategic hawks will also likely try to convince Trump to tighten U.S. control of technology exports to restrain China.

· Trade deal in late H1/early H2. It took 4 months from President Trump and Xi agree a trade truce in June 2019 to final agreement on a deal in October 2019. It could take a similar period, which would suggest a trade deal late H1 or early H2. This is unlikely to be a smooth process for markets to assume a trade deal will be smoothly delivered. Trump nature means that the talks will be volatile and it is worth remembering that Trump imposed extra tariffs after the truce to get a deal done.