South African Reserve Bank

View:

December 16, 2025

EMEA Outlook: Uncertainties Give Mixed Signals

December 16, 2025 7:00 AM UTC

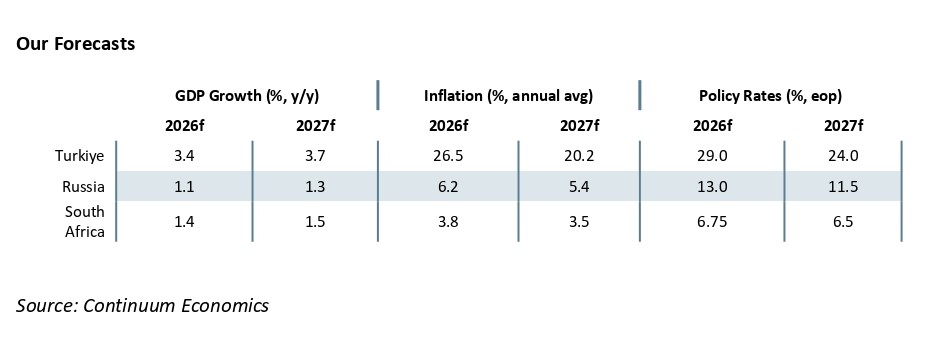

· In South Africa, we foresee average headline inflation will stand at 3.8% and 3.5% in 2026 and 2027, respectively. Upside risks to inflation remain such as, utility costs, and supply chain destructions. We see growth to be 1.4% and 1.5% in 2026 and 2027, respectively. Risks to the growth

September 22, 2025

EMEA Outlooks Stay Mixed into 2026: Domestic and Global Uncertainties

September 22, 2025 6:58 AM UTC

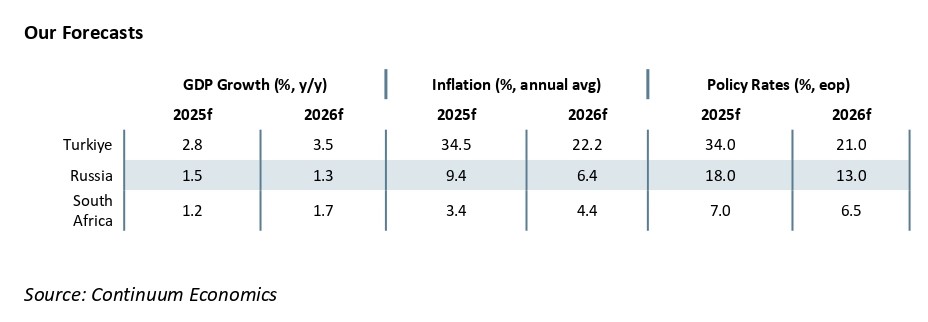

· In South Africa, we foresee average headline inflation will stand at 3.4% and 4.2% in 2025 and 2026, respectively, despite upside risks to inflation such as swings in food prices, supply chain destructions including energy shortages and port inefficiencies and global uncertainties. We see

June 24, 2025

EMEA Outlook: Global Uncertainties and Domestic Dynamics Continue to Dominate

June 24, 2025 7:00 AM UTC

· In South Africa, we foresee average headline inflation will stand at 3.4% and 4.4% in 2025 and 2026, respectively, despite upside risks to inflation such as power cuts (loadshedding), tariff hikes by Eskom, spike in food prices, and global uncertainties. We see growth to be 1.2% and 1.7%

March 25, 2025

EMEA Outlook: Mixed Prospects Due to Global Uncertainties and Domestic Dynamics

March 25, 2025 7:00 AM UTC

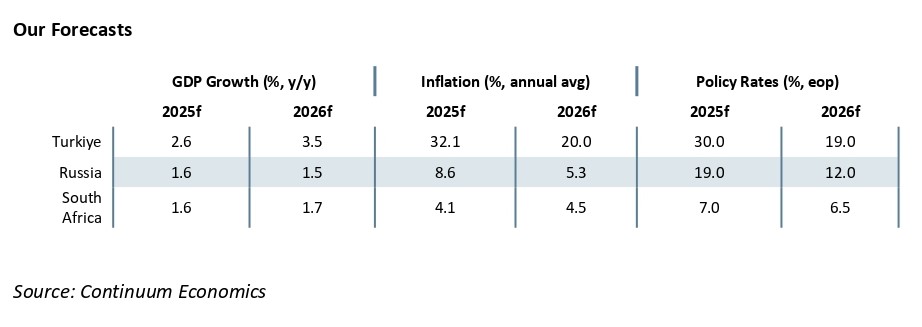

· In South Africa, we foresee average headline inflation will stand at 4.1% and 4.5% in 2025 and 2026, respectively, despite there are upside risks to inflation such as remaining power cuts (loadshedding), tariff hikes by Eskom, spike in food and housing prices, and global uncertainties. We

January 24, 2025

SA MPC Preview: SARB will Likely Cut the Key Rate to 7.5% on January 30

January 24, 2025 1:19 PM UTC

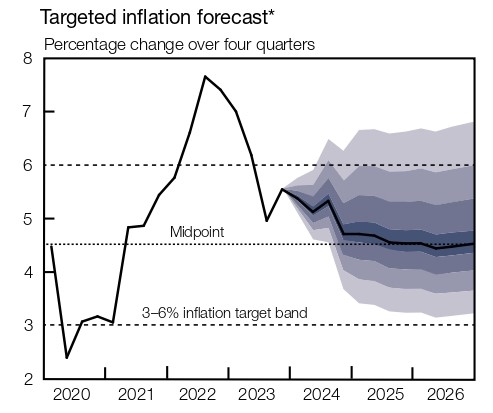

Bottom Line: After StatsSA announced on January 22 that annual inflation stood at 3.0% in December, which is below midpoint of target band of 3% - 6%, we now think it is likely that South African Reserve Bank (SARB) will cut the key rate from 7.75% to 7.5% on January 30 as inflation remains moderate

January 09, 2025

SARB to Continue Rate Cuts in 2025, but the Pace Will Depend on Inflation Trajectory and Global Developments

January 9, 2025 11:23 AM UTC

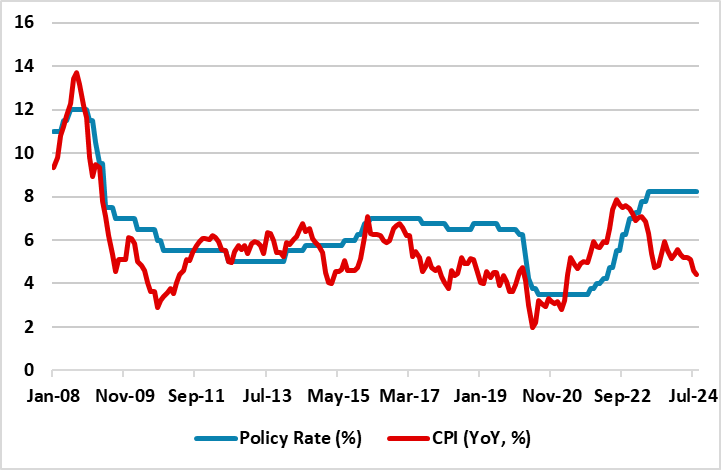

Bottom line: After South African Reserve Bank (SARB) started cutting the key rate on September 19 and decreased the rate from 8.25% to 7.75% in 2024 given fall in inflation below midpoint of target band of 3% - 6%, suspended power cuts (loadshedding) and deceleration in inflation expectation, we for

December 17, 2024

EMEA Outlook: Rate Cuts in 2025 Despite Global Uncertainties

December 17, 2024 8:00 AM UTC

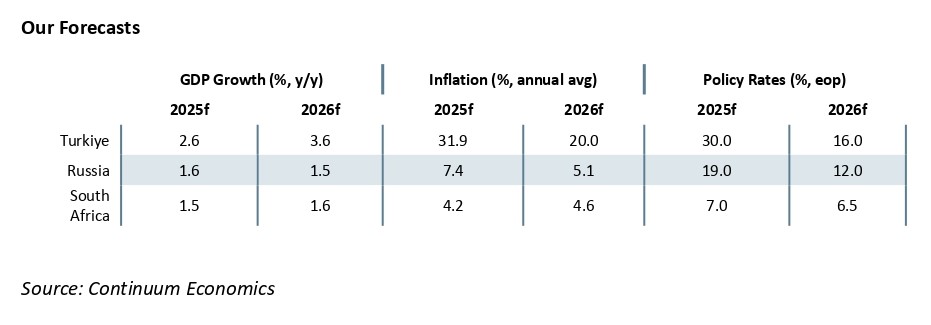

· In South Africa, our end-year policy rate prediction remains at 7.0% for 2025 and 6.5% for 2026. We foresee headline inflation will fall to 4.2% and 4.6% in 2025 and 2026, respectively, considering power cuts (loadshedding) are relieved and the domestic fiscal outlook is moderately stab

November 21, 2024

SARB MPC Review: Fall in Inflation Sparked Easing Cycle to Continue on November 21

November 21, 2024 3:58 PM UTC

Bottom line: South African Reserve Bank (SARB) cut the key rate by 25 bps to 7.75% at its final meeting of the year on November 21 given power cuts (loadshedding) are suspended, inflation expectations decelerated, and CPI softened further to 2.8% YoY in October due to falling fuel prices and slowing

October 08, 2024

SARB in 2025: Rate Cuts Will Continue

October 8, 2024 5:25 PM UTC

Bottom line: After South African Reserve Bank (SARB) started cutting the key rate on September 19 and decreased it from 8.25% to 8.0% given fall in inflation below midpoint of target band of 3% - 6%, suspended power cuts (loadshedding) and deceleration in inflation expectation, we now foresee the ra

September 25, 2024

EMEA Outlook: Rate Cuts Loading in 2025

September 25, 2024 7:00 AM UTC

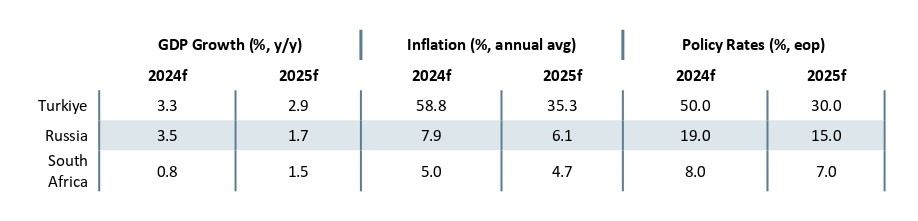

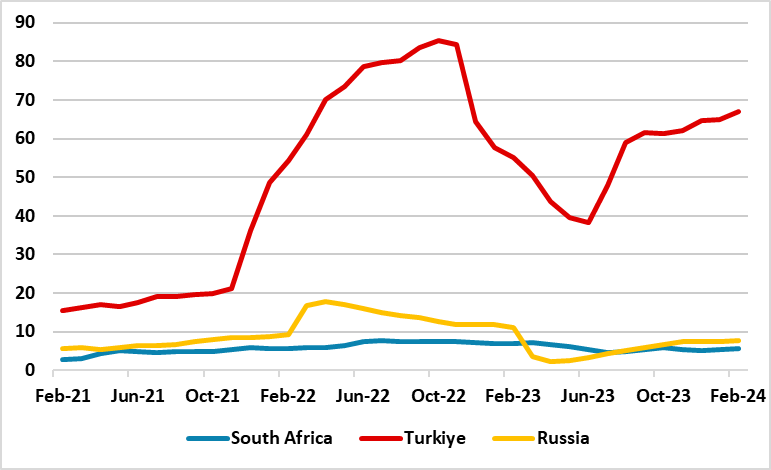

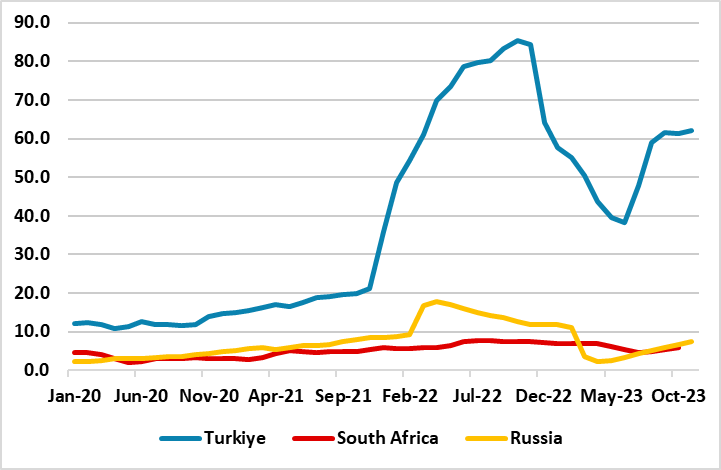

· In Turkiye, we still foresee upside risks emanating from buoyant domestic demand, the stickiness of services inflation, and adverse geopolitical impacts leading average inflation to stand at 58.8% and 35.3% in 2024 and 2025, respectively. We think Central Bank of Republic of Turkiye (CBRT

September 19, 2024

Time Has Come: SARB Cut the Key Rate to 8.0% on September 19

September 19, 2024 3:57 PM UTC

Bottom line: As we expected, South African Reserve Bank (SARB) started cutting the key rate at the upcoming MPC meeting on September 19 and decreased it from 8.25% to 8.0% given recent fall in inflation, suspended power cuts (loadshedding) after March, deceleration in inflation expectations and a re

September 12, 2024

Time Has Come: SARB will Likely Decrease the Key Rate to 8.0% on September 19

September 12, 2024 7:09 PM UTC

Bottom line: South African Reserve Bank (SARB) will likely start cutting the key rate at the upcoming MPC meeting on September 19 and decrease the rate from 8.25% to 8.0% given recent fall in inflation, suspended power cuts (loadshedding) after March, deceleration in inflation expectations and a rel

July 24, 2024

South Africa’s Inflation Slightly Eased to %5.1 YoY in June

July 24, 2024 11:25 AM UTC

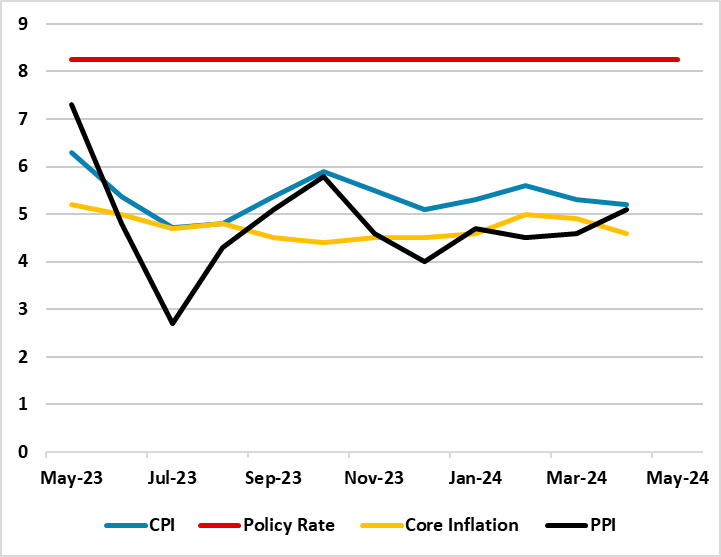

Bottom Line: According to the inflation figures announced by Department of Statistics of South Africa (Stats SA) on July 24, CPI marginally decreased to 5.1% YoY in June due to slowdown in costs for food, fuel and transportation coupled with suspended power cuts (load shedding) in June. The inflatio

May 30, 2024

SARB Held the Key Rate Stable at 8.25%

May 30, 2024 3:06 PM UTC

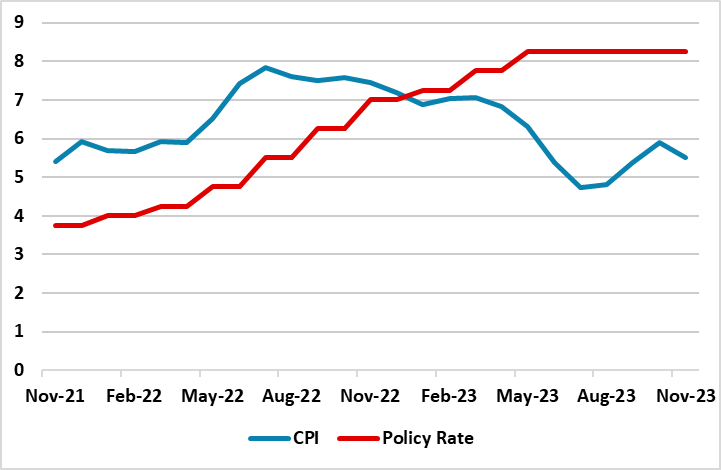

Bottom line: As widely expected, South African Reserve Bank (SARB) kept the key rate constant at a 15-year high of 8.25% on May 30 despite inflation rate fell for a second consecutive month in April due to less severe power cuts (load shedding), a firmer South African rand (ZAR) coupled with lower f

April 24, 2024

Sticky Inflation Causes Concerns over the Horizon

April 24, 2024 9:26 AM UTC

Bottom line: According to the Monetary Policy Review Report by the South African Reserve Bank (SARB) on April 23, the risk of higher inflation still remains and inflation returning to the midpoint of the target band is only expected in the last quarter of 2025. SARB highlighted in its report that ma

March 27, 2024

Beware of Inflation: SARB Held the Key Rate Stable at 8.25%

March 27, 2024 3:26 PM UTC

Bottom line: As widely expected, South African Reserve Bank (SARB) kept the key rate constant at 8.25% on March 27. It appears the decision targeted to anchor inflation expectations around the target midpoint, and enhance confidence in achieving the inflation goal as SARB signalled that its fight to

March 25, 2024

EMEA Outlook: Elections Set the Scene in Q2

March 25, 2024 2:00 PM UTC

· Unlike South Africa and Russia, Turkiye continued with tightening monetary policy in Q1 due to stubborn inflation, pressure on FX and reserves. Meanwhile, Russia and South Africa halted their tightening cycles as of 2024 and will likely start cutting interest rates in Q3 depending on how

January 29, 2024

South Africa: Structural Issues to Dominate Long Term Growth

January 29, 2024 9:00 AM UTC

Bottom line: We expect 1.3-1.5% GDP growth in South Africa in the 2025-2030 period. We are concerned with the structural problems affecting economic dynamics negatively, including loadshedding, transportation bottlenecks, and shrinking trade surplus. Despite structural problems; growing population,

January 25, 2024

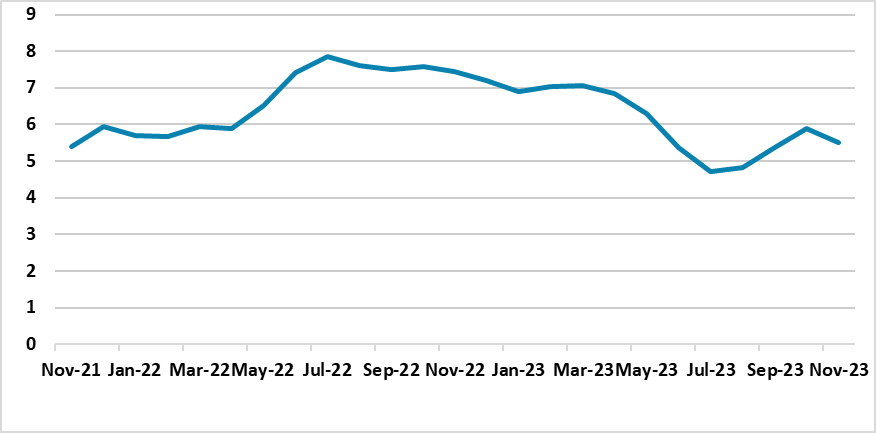

SARB Held the Key Rate Stable at 8.25% on January 25

January 25, 2024 2:02 PM UTC

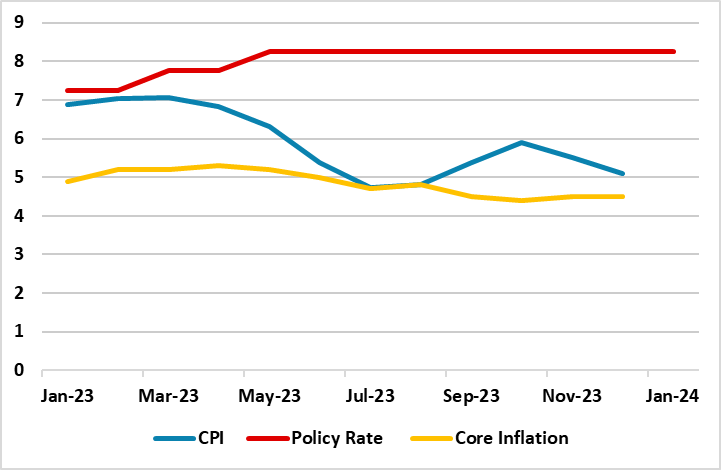

Bottom line: As widely expected, South African Reserve Bank (SARB) kept the key rate at 8.25% on January 25, given recent fall in inflation, coupled with relatively less power cuts (loadshedding), a stable Rand (ZAR) and softer global oil prices since December. It appears the decision targeted to a

January 18, 2024

SARB to Hold the Key Rate Stable on January 25

January 18, 2024 1:57 PM UTC

Bottom line: South African Reserve Bank (SARB) is likely to keep the key rate at 8.25% at the upcoming meeting on January 25, given recent fall in inflation, relatively less power cuts (loadshedding) and a stable Rand (ZAR) since December.

December 18, 2023

EMEA Outlook: Inflationary Pressures Remain Strong

December 18, 2023 10:01 AM UTC

· The EMEA economies such as Russia and Turkiye will continue with restrictive monetary policy in H1 2024 due to the desire to control inflation. Meanwhile South Africa has likely halted its tightening cycle at 8.25% and will likely start cutting interest rates in Q2 2024 depending on how soon in

December 13, 2023

Softer Fuel and Transportation Prices Helped South Africa’s Inflation Decelerate in November

December 13, 2023 1:43 PM UTC

Bottom Line: After increasing sharply on food and fuel prices in October with 5.9%, inflation cooled off to 5.5% in November largely due to slowing fuel prices and transport prices. Core inflation slightly rose to 4.5% YoY in November from 4.4% in October. Department of Statistics of South Africa (S

November 14, 2023

South Africa: Structural Issues to Dominate Long Term Growth

November 14, 2023 1:07 PM UTC

Bottom line: We expect 1.3-1.5% GDP growth in South Africa in the 2025-2030 period. We are concerned with the structural problems affecting economic dynamics negatively, including loadshedding, transportation bottlenecks, and shrinking trade surplus. Despite structural problems; growing population,