SARB to Hold the Key Rate Stable on January 25

Bottom line: South African Reserve Bank (SARB) is likely to keep the key rate at 8.25% at the upcoming meeting on January 25, given recent fall in inflation, relatively less power cuts (loadshedding) and a stable Rand (ZAR) since December.

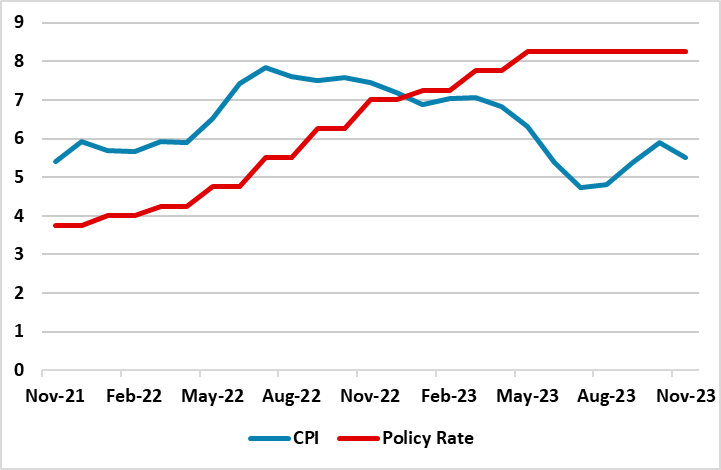

Figure 1: Policy Rate (%) and CPI (YoY, % Change), November 2021 – November 2023

Source: Datastream, Continuum Economics

SARB will announce its next interest-rate decision on January 25, and we expect the Bank to hold the policy rate at 8.25%. First, on the inflation front, after increasing sharply on food and fuel prices in October with 5.9%, inflation cooled off to 5.5% in November largely due to slowing fuel prices and transport prices, and we expect the decreasing pattern in CPI inflation to continue in December, partly due to relatively less load-shedding and a relative stable ZAR particularly in the 2H of December. December inflation figures will be announced on January 24. (Note: Although inflation has slightly trended downward, supply side problems like crisis at SA ports contribute to supplier delivery times and threaten to push up costs and prices going forward).

Speaking to Reuters in Davos, SARB Governor Lesetja Kganyago said on January 17 that the disinflation process had begun, and expected inflation to average 5% in 2024. (Note: We also foresee headline inflation will fall to 4.9% and 4.5% in 2024 and 2025, respectively, thanks to SARB’s sensitivity to inflation and loadshedding will partly relieve in the near future). Kganyago added that “Despite the rising food costs, annual inflation slowed for the first time in four months in November to 5.5 percent – due to cooling fuel prices”. Kganyago, however, declined to indicate when SARB would start cutting rates, mentioning that these decisions would continue to be data-dependent.

In addition to inflation readings, positive news is coming from the production side. According to Department of Statistics of South Africa (Stats SA), annual manufacturing production surged by 1.9% in November. The Absa PMI closed the year on a better reading and surged by 2.7 points to 50.9 index points in December 2023, partly due to increase in business activity. Additionally, according to retail survey results in Q4 2023, the percentage of retailers reporting that they are satisfied with prevailing business conditions increased from 32 to 47 in Q4 – the highest reading since 2022Q3, demonstrating improvements in profitability and general business conditions.

Under current macroeconomic circumstances and data announcements, SARB is likely to keep the key rate at 8.25% next week. We foresee an end to SARB tightening and likely easing to start in Q2 of 2024 if the CPI trajectory allows, as SARB recently hinted that 2024 rate cuts would likely be smaller while strong tightening still feeds through with lagging impacts. Our end year prediction is 7.5% for 2024 SARB policy rate, and 6.5% for 2025.

As SARB intermittingly signalled that it plans to start cutting interest rates after the inflationary pressures are under control, SARB will have time to decide on timing once it sees monthly inflation outcomes in Q1 2024. We expect SARB would remain on stand-by, but the reality is that rates have likely peaked and SARB will cut the rates if data and expectations would support. The biggest concern during this process would be the presidential elections in May-August, 2024, which can be followed by a likely some moderate political volatility, and repercussions over economic decision making.