South Africa’s Inflation Slightly Eased to %5.1 YoY in June

Bottom Line: According to the inflation figures announced by Department of Statistics of South Africa (Stats SA) on July 24, CPI marginally decreased to 5.1% YoY in June due to slowdown in costs for food, fuel and transportation coupled with suspended power cuts (load shedding) in June. The inflation continued to be some way off from the 4.5% midpoint of target band of 3% - 6% which led South African Reserve Bank (SARB) to remain cautious. Given geopolitical risks, the U.S. presidential election in November, volatility in Rand (ZAR) and the new coalition government will likely be weaker at least for some time, we foresee the first rate cut could happen in Q4, if inflation trajectory will allow in Q3.

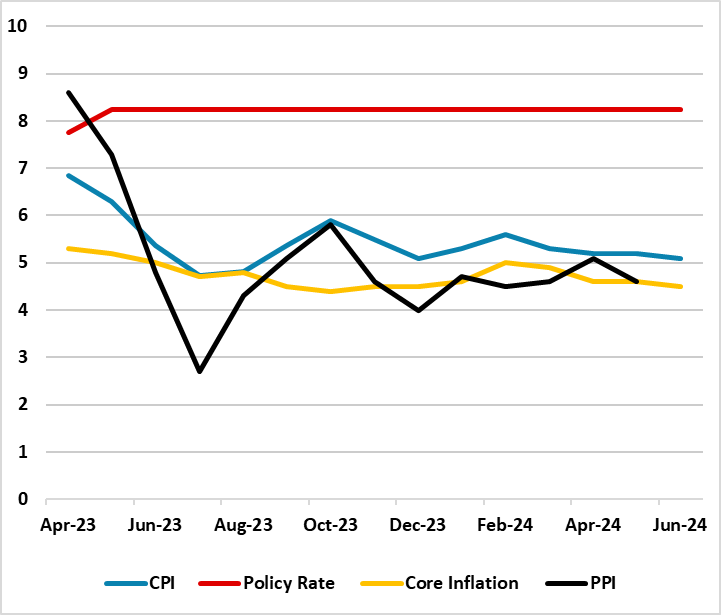

Figure 1: Policy Rate (%), CPI, PPI and Core Inflation (YoY, % Change), April 2023 – June 2024

Source: Continuum Economics

South Africa’s inflation eased to 5.1% YoY in June, the lowest reading rate since December last year, partly due to lower food, fuel and transportation prices. Prices for food and non-alcoholic beverages (NAB) grew 4.6% YoY in June, slightly below the 4.7% seen in May. Transport costs also moderated (5.5% in June vs 6.3% in May) due to easing fuel prices (7.6% in June vs 9.3% in May).

On the other side of the coin, inflation in June was driven by higher prices of restaurant and hotels (7.5% in June vs. 6.5% in May) and household contents and services (2.6% in June vs. 1.8% in May). On a monthly basis, inflation was at 0.1% in June softer than the 0.2% rise a month before. Annual core inflation ticked down to 4.5% YoY in June from 4.6% in May.

There was good news from the load shedding front in June, strongly supporting June inflation reading. After Stages 2 and 3 load shedding was implemented broadly in March, Eskom announced on July 19 that that load shedding remained suspended for 114 consecutive days since 26 March 2024, reflecting an improvement in the reliability and stability of the generation coal fleet. Mentioned period included 80 days of constant supply since throughout the winter period, Eskom highlighted. June inflation outlook was also supported by the stronger ZAR following the elections, particularly between June 5-20.

Despite moderate easing, SARB continues to remain cautious. SARB kept its main interest rate unchanged for a seventh meeting in a row at 8.25% on July 18 despite MPC decision was not unanimous, with four members preferring an unchanged stance and two favoring a 25 bps rate cut. With respect to this, SARB governor Kganyago said last week that the committee would prefer to see a couple of inflation prints fall before easing policy but stressed the bank was not backward-looking. Inflation expectations also remain uncomfortably above the central bank's targeted midpoint of 4.5%, Kganyago added.

Despite slight fall in June, we think risks to the inflationary outlook remain strong. Given geopolitical risks, the U.S. presidential election in November, volatility in ZAR and the new coalition government will likely be weaker at least for some time, and less able to undertake necessary fiscal reform policies abruptly and deal with load shedding in the near future -as signaled by the delays in forming the coalition government and announcing the cabinet-, we continue to foresee the first rate cut could happen in Q4, if inflation trajectory will allow in Q3.