Sticky Inflation Causes Concerns over the Horizon

Bottom line: According to the Monetary Policy Review Report by the South African Reserve Bank (SARB) on April 23, the risk of higher inflation still remains and inflation returning to the midpoint of the target band is only expected in the last quarter of 2025. SARB highlighted in its report that markets now expect policy rate to remain unchanged this year, and signalled that the current rates could be maintained longer than expected if inflation would stay higher for a longer period. We now foresee sticky inflation figures could cause SARB to delay the rate cuts to late Q3/Q4 as drought conditions, administered prices, load shedding, logistical constraints, elevated inflation expectations and renewed rand weakness continue to present clear risks to the inflation outlook. We think the rate decision will also be affected by the presidential elections outcome on May 29 as a coalition with an uncertain fiscal and load shedding policy could cause conditions that delay easing further to 2025.

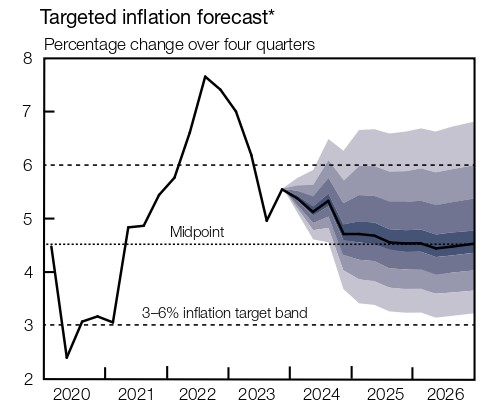

Figure 1: Targeted Inflation Forecast

Source: SARB

According to the Monetary Policy Review Report released by SARB on April 23, the risk of higher inflation still remains, and the return of inflation to the midpoint of the target band (4.5%) is only expected in the last quarter of 2025. The report emphasized that the slower pace of disinflation reflects a range of issues, including normalising services components, housing prices and elevated inflation expectations while administered prices continue to exert substantial upward pressure on headline inflation. Electricity and water prices, in particular, have for several years inflated at rates well above the 4.5% target.

Additionally, SARB indicated that oil markets remained tight and supply chains strained by geopolitical tensions. At the same time, domestic food price inflation remained volatile and susceptible to El Niño weather conditions as well as higher-than-expected load-shedding. A weaker rand, along with elevated inflation in trading-partner economies, added to imported inflation, while inflation expectations remained elevated despite the moderation in headline inflation.

Beyond the monetary policy efforts, SARB also noted that domestic economic conditions should be improved by achieving a more prudent public-debt level, improving the adequacy and efficiency of network industries, lowering administered price inflation, and keeping real wage growth in line with productivity gains.

Similarly, SARB Governor Kganyago said on April 18 that “It is too early to tell what a discernible inflation trend would be following the latest inflation data”. He also underscored in his presentation on March 27 that "We still see headline inflation heading back to 4.5%, but very slowly.”

Interestingly, SARB also highlighted in its April 23 report that markets now expect South Africa’s policy rate to remain unchanged this year amid setbacks in recent domestic inflation outcomes, along with heightened uncertainty about global disinflation owing to stickiness in services inflation. SARB signalled that the current rates could be maintained longer than expected, if inflation would stay higher for a longer period.

In this respect, we now foresee sticky inflation figures could cause SARB to delay the rate cuts to late Q3/Q4 if the CPI trajectory allows in the upcoming months. However, drought conditions, administered prices, load shedding, logistical constraints, elevated inflation expectations and renewed rand weakness continue to present risks to the inflation outlook. We think the rate decision will also be affected by the presidential elections outcome on May 29 as a coalition with an uncertain fiscal and load shedding policy could cause conditions that delay easing further to 2025.