Softer Fuel and Transportation Prices Helped South Africa’s Inflation Decelerate in November

Bottom Line: After increasing sharply on food and fuel prices in October with 5.9%, inflation cooled off to 5.5% in November largely due to slowing fuel prices and transport prices. Core inflation slightly rose to 4.5% YoY in November from 4.4% in October. Department of Statistics of South Africa (Stats SA) announced on December 13 that the main contributors to the November reading was food and non-alcoholic beverages accelerated to a four-month high of 9.0%, pharmaceutical products recorded an annual price increase of 7.5% and household maintenance services registered a 7.4% YoY hike in November.

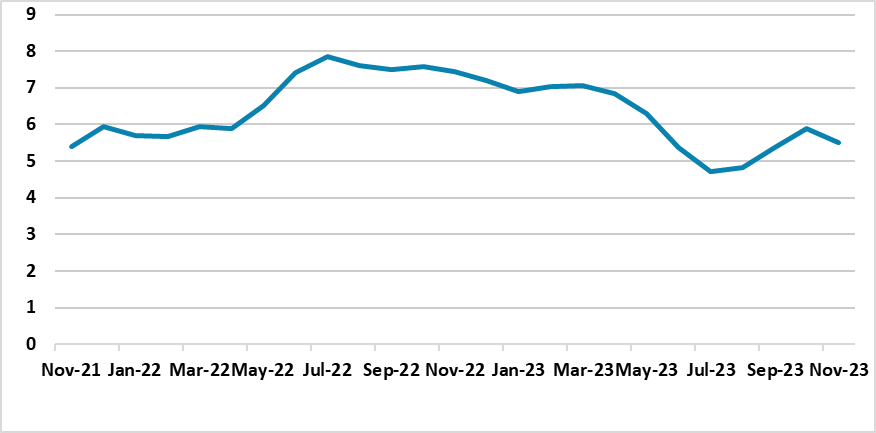

Figure 1: CPI Inflation Rate (%, YoY), November 2021 – November 2023

Source: Datastream

South African inflation fell to 5.5% in November Yr/Yr partly driven by a monthly decrease of 5.5% in the fuel price index leading to the annual rate for fuel lower to 1.8% in November from 11.2% in October. In addition, it seems softer fuel prices helped the annual rate for transport prices to fall to 4.3% from 7.4%. Despite this, food prices continued to surge and remained higher than expected. Inflation for food and non-alcoholic beverages accelerated for a third consecutive month, rising to 9.0% in November after hitting 8.7% and 8.1% in October and September, respectively. Pharmaceutical products recorded an annual price increase of 7.5% and household maintenance services registered a 7.4% YoY hike in November.

Despite the relative fall in the November CPI reading, we think electricity prices continue to present clear inflation risks, and with logistical constraints as the operation of ports and rail has become problematic, both are likely to have broader effects on the cost of doing business and the cost of living, as mentioned by the South African Reserve Bank (SARB) in its last Monetary Policy statement on November 23. SARB remains concerned over other risks such as a possible pick-up in oil and food prices in the near future, or a weaker Rand which can influence via its impact on import prices. (Note: Rand has already slipped more than 10% in 2023 so far, and stands at 19.09 as of December 13).

Despite the abovementioned risks, we are of the view that inflation will continue its decreasing pattern in early 2024 thanks to SARB’s previous tightening and as power cuts (loadshedding) will partly be relieved. In addition, inflation will be dampened by lower household expenditure as households continue struggling with finding spare funds in an environment of high interest rates.

Since inflation is still within SARB’s target of between 3% and 6% and the inflation reading is likely to hover around 5% midterm target over the coming months, we still suspect that SARB will wait and see, given that the lagged impact of the tightening cycle is still feeding through, thus will likely keep the rate unchanged at 8.25% on its next MPC meeting scheduled for January 25, 2024. We foresee an end to SARB tightening and likely easing to start in Q2 of 2024 if the CPI trajectory allows, as SARB recently hinted that 2024 rate cuts would likely be smaller.

We think the developments that will be followed closely by the SARB will be the course of elevated food inflation, currency rate and inflationary expectations. We expect SARB would remain on stand-by to lift the policy rate further should data point demonstrate a reacceleration in price pressure, but the reality is that rates have likely peaked and SARB will likely cut the rates if data and expectations would support.