SARB Held the Key Rate Stable at 8.25% on January 25

Bottom line: As widely expected, South African Reserve Bank (SARB) kept the key rate at 8.25% on January 25, given recent fall in inflation, coupled with relatively less power cuts (loadshedding), a stable Rand (ZAR) and softer global oil prices since December. It appears the decision targeted to anchor inflation expectations around the target midpoint, and enhance confidence in achieving the inflation goal as SARB signalled that its fight to quash inflation is not yet done.

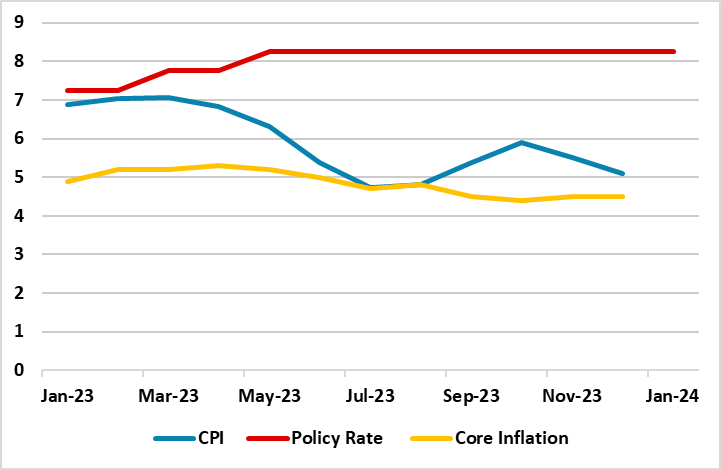

Figure 1: Policy Rate (%), CPI and Core Inflation (YoY, % Change), January 2023 – January 2024

Source: Datastream, Continuum Economics

SARB announced its first interest-rate decision in 2024 on January 25, and as we expected, the Bank held the policy rate at 8.25%. The decision was unanimous, with the MPC currently made up of 5 members after David Fowkes, who was appointed as an advisor to the governors on December 1, was made part of the MPC.

First, on the inflation front, after increasing on food and fuel prices in October with 5.9% YoY, inflation cooled off to 5.5% and 5.1% in November and December, respectively, due to slowing fuel prices and food prices, and relatively less load-shedding and a stable ZAR particularly in the 2H of December. Concerning inflation, SARB Governor Kganyago said in his presentation on January 25 that "While headline inflation continues to ease, core inflation remains sticky and high." (Note: Core inflation was unchanged in December at 4.5% in annual terms, and recorded an average of 4.9% in 2023 while SARB’s core inflation forecast for 2024 and 2025 remained at 4.6%).

Additionally, Kganyago said on January 17 that the disinflation process had begun, and expected inflation to average 5% in 2024. (Note: We also foresee headline inflation will fall to 4.9% and 4.5% in 2024 and 2025, respectively, thanks to SARB’s sensitivity to inflation and loadshedding will partly relieve in the near future).

Under current macroeconomic circumstances and data announcements, we predict an end to SARB tightening and likely easing to start in Q2 of 2024 if the CPI trajectory allows, as SARB recently hinted that 2024 rate cuts would likely be smaller while strong tightening still feeds through with lagging impacts. On the key rate front, Kganyago declined to indicate when SARB would start cutting rates, mentioning that these decisions would continue to be data-dependent. We think the recent CPI readings are increasing SARB’s flexibility, as inflation remains within SARB’s target of between 3% and 6% and the inflation reading hovers around 5% midterm target in the near term. (Note: Our end year prediction is 7.5% for 2024 SARB policy rate, and 6.5% for 2025). As SARB intermittingly signalled that it plans to start cutting interest rates after the inflationary pressures are under control, SARB will have time to decide on timing once it sees monthly inflation outcomes in Q1 2024.

We feel the inflation is on track now, but sources of worry during deceleration process could be the logistical constraints, loadshedding, adverse global developments, and the presidential elections in May-August, 2024, which can be followed by some moderate political volatility, and repercussions over economic decision making. In line with our reasoning, Kganyago also mentioned that the baseline inflation forecast is of continued gradual moderation in global and domestic inflation, and the risks to the outlook are still assessed to the upside, demonstrating the cautious stance of SARB and signalling that SARB’s fight to quash inflation is not yet done.