Asia/Pacific (ex-China/Japan) Outlook: Shifting Gears for Growth

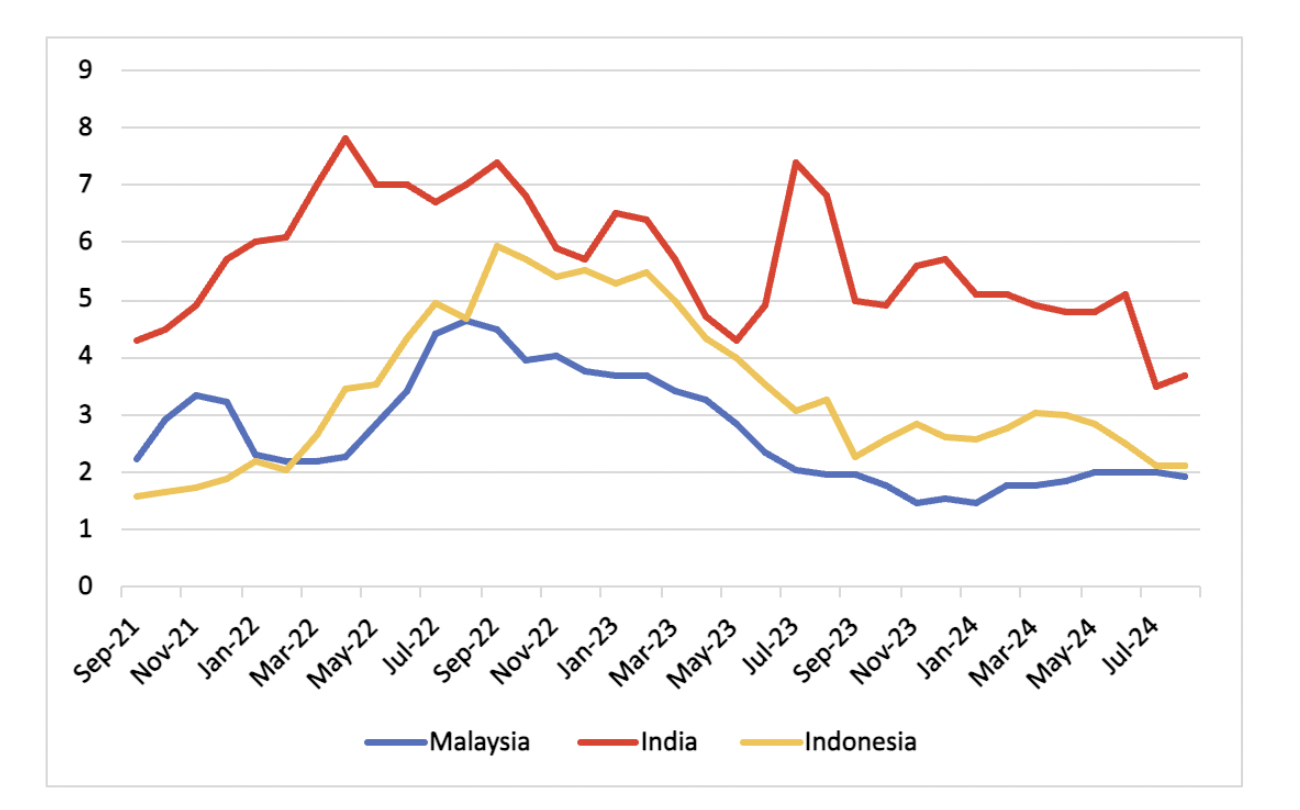

Emerging Asian economies are poised to remain the fastest growing globally. India and Southeast Asia will drive regional resilience amid China’s cooling growth engine in 2025. For India, while the external environment remains challenging due to weaker global demand and geopolitical tensions, domestic drivers of growth—especially private consumption and investment—are expected to remain robust. Indonesia’s economic outlook for 2024 and 2025 is promising, driven by a mix of recovering exports, infrastructure investments, and resilient domestic consumption. Inflationary pressures will moderate across the region, allowing central banks to adopt more accommodative monetary policies after a long rate pause. The Federal Reserve’s rate cuts will also allow less external constraints, though emerging Asia will be lower magnitude than the Fed.

Governments will prioritise investments in digital infrastructure and green energy as part of fiscal consolidation but ongoing investment efforts and climate commitments. Populist measures will dominate in India and Indonesia, as governments also look to please the public. Trade within Asia will increase as regional agreements and supply chain diversification reduce reliance on Western markets. India will continue to drive its external sector growth through free trade agreements, while Indonesia ramps up mineral exports.

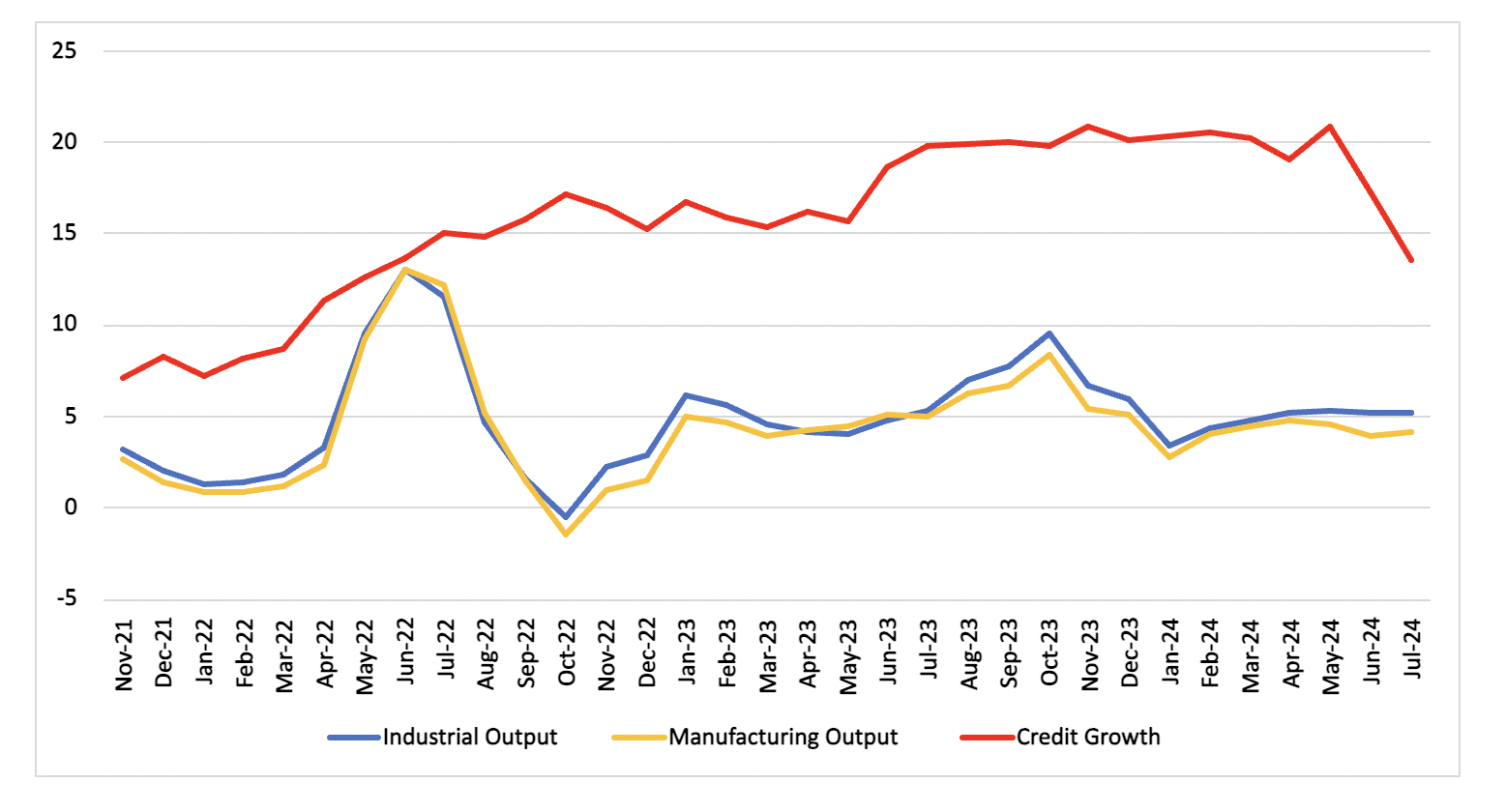

Key Risks: China’s slower growth, structural weaknesses, and climate-related vulnerabilities remain the primary risks to Asia’s growth prospects. If a harder landing is seen it would spillover to have a modest impact on EM Asia, especially commodity producers.

Forecast changes: A favourable harvest and sustained rate pause till Q4-2024 has prompted a downward revision to India’s 2025 inflation forecast. Meanwhile, Indonesia is expected to face slightly lower inflation than previously forecasted in 2025. On the policy front, we now expect only more policy cut in Indonesia of 25bps in 2024.

Our Forecasts

Risks to Our Views

Growth Momentum and Economic Resilience

Emerging Asia is expected to witness a broadly stable regional growth, marking a slight deceleration from 2024. This slowdown stems primarily from spillovers from China’s ongoing economic restructuring, where structural shifts, real estate challenges, and demographic issues are constraining growth. However, India and Indonesia will maintain higher growth rates supported by rising domestic demand, industrial activity, and infrastructure development. Key contributors to the region’s resilience will be investments in technology, manufacturing, and services, particularly in countries looking to strengthen their global supply chain roles. Southeast Asian nations will benefit from increased trade flows as global firms diversify operations, making the region integral to global supply chain resilience.

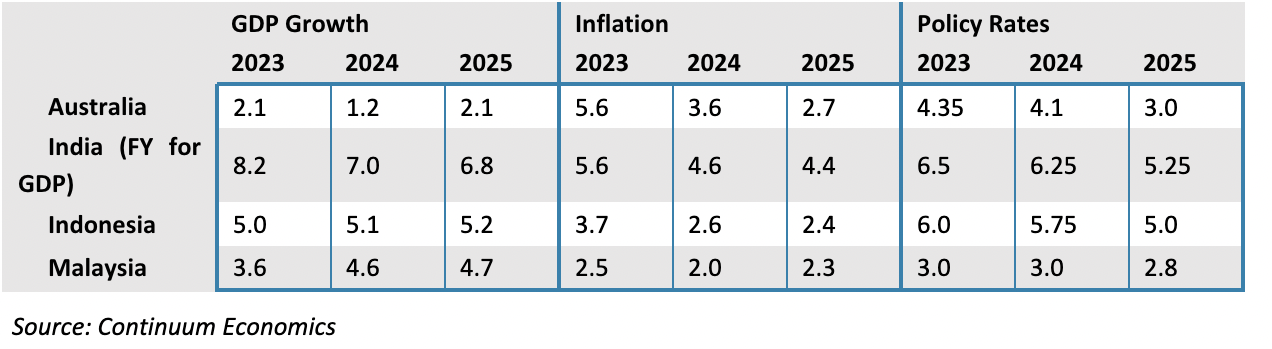

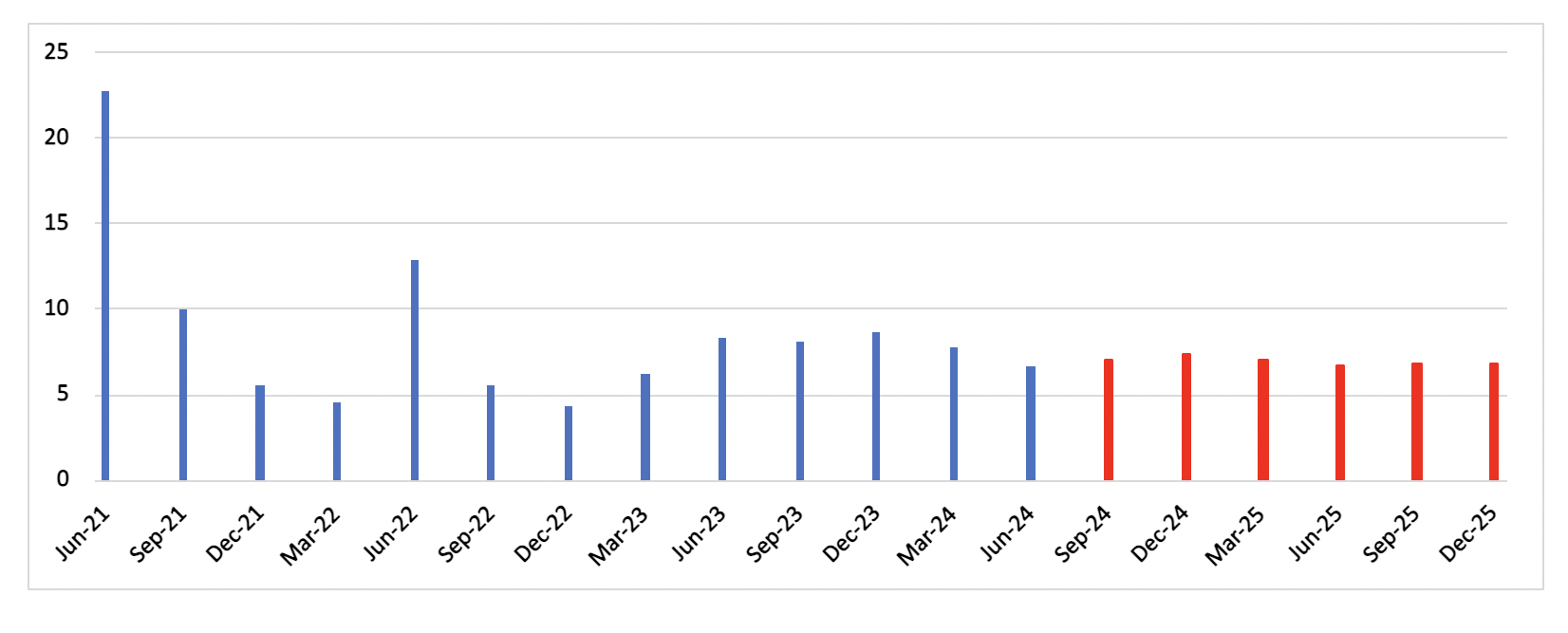

Inflationary pressures, a key concern in recent years, are expected to moderate across Asia in 2024 and 2025. Prices pressures have already abated since the start of 2024. Falling commodity prices and reduced global supply chain disruptions will allow for better price stability. Central banks across the region are likely to gradually transition from tight monetary stances to more accommodative policies to support growth, reflecting a shift from the sharp rate hikes of the past two years.

Inflation, while easing, will vary by country. Higher costs in sectors like energy and food may persist in some economies due to structural challenges or continued reliance on imports. However, overall price moderation will provide policymakers with the room to stimulate growth through fiscal and monetary measures, especially in countries like India, Indonesia, and Malaysia. Indonesia has already begun its monetary easing cycle, and India is expected to follow suit by end-2024. Meanwhile, Australia will wait to see further slowdown of price pressures below it begin a rate cut cycle.

Figure 1: Asia Inflation Trajectory (% change, yr/yr)

Source: Continuum Economics

Source: Continuum Economics

All Eyes on India: Star Asian Performer

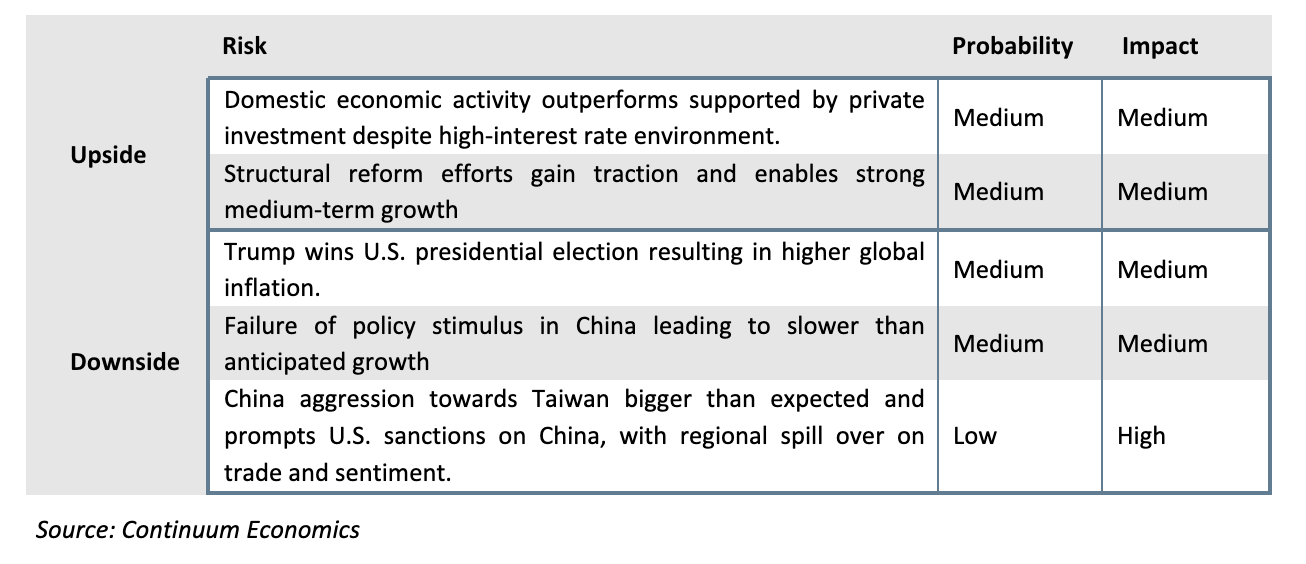

India's economic outlook for 2025 presents a complex but promising trajectory, shaped by strong domestic demand, infrastructure growth and industrial policy. However, the Bharatiya Janta Party’s narrow parliamentary majority will introduce hurdles in implementing critical reforms, potentially dampening investor sentiment in certain sectors. India is expected to grow at 7% yr/yr in FY25 and 6.8% yr/yr in FY26. While the external environment remains challenging due to weaker global demand and geopolitical tensions, domestic drivers of growth—especially private consumption and investment—are expected to remain robust. Credit growth continues to reflect optimism, rising by 17.7% yr/yr in Apr-Jul 2024, signalling strong business confidence. Industrial output grew by an estimated 5.1% in the Apr-Jul in FY25, supported by manufacturing, mining, and electricity generation.

Figure 2: India Industrial Output, Manufacturing Output, Credit Growth (% yr/yr)

Source: Continuum Economics

The services sector, which constitutes over 50% of India’s GDP, is set to maintain its dominant role. Growth in services is projected to stay strong in 2025, with key drivers being IT services, finance, tourism and retail. India’s information technology outsourcing remains resilient amid global digital transformation trends, while domestic consumption is fuelling sectors such as retail, hospitality, and e-commerce. Private consumption will be driven by rising urban wages, easing inflation and strengthening rural demand given the expectations of a favourable harvest. Wage growth in urban areas, along with the expansion of small and medium enterprises (SMEs), will contribute to the upward trend in disposable incomes. Additionally, government’s populist schemes such as the free food grain scheme will allow for increased disposable income in rural India.

On the investment front, gross fixed capital formation is expected to trend upward as well in 2025, following significant growth in infrastructure projects. Public infrastructure spending, especially in transportation and logistics, will be a central theme as India ramps up its efforts to boost competitiveness and attract foreign investments. Additionally, the government's Production Linked Incentive (PLI) scheme continues to support manufacturing sectors such as electronics, semiconductors, electric vehicles and pharmaceuticals. India’s nascent chip industry is poised to benefit from increased fiscal outlays and global partnerships, positioning it as a crucial node in the global supply chain diversification. More recently, India has signed a key agreement with the U.S. to set-up a semiconductor fabrication plant in India with a projected investment of USD1bn. Alongside semiconductors, India is ramping up investments in defence equipment manufacturing and renewable energy. This comes at a time when India’s key defence supplier Russia is facing supply constraints of its own. India is now looking to acquire technology to locally produce ammunition for previously bought equipment and new equipment. In terms of clean energy, the government is driving investments in both hydro and solar power. The government recently approved an INR 124.6bn outlay for a hydro project.

Figure 3: India Real GDP Growth Forecast (% yr/yr)

Source: Continuum Economics

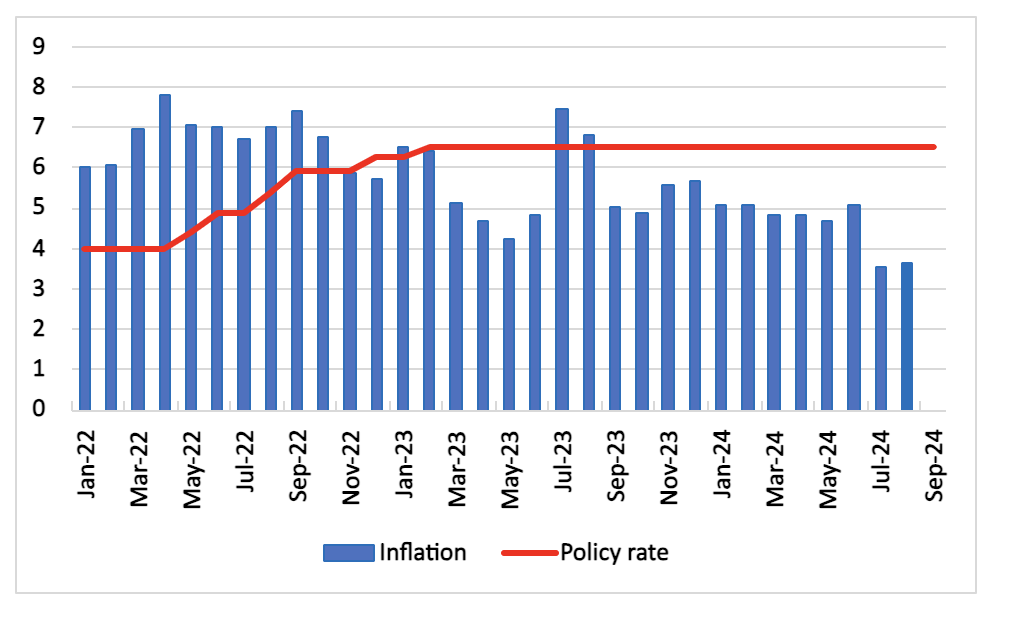

India's inflation is forecast to ease to 4.4% in 2025 from 4.6% in 2024, primarily due to moderation in global commodity prices and domestic demand. A positive 2024 monsoon season should support a robust kharif harvest, easing food inflation. Wheat imports, facilitated by lower duties, are expected to bolster domestic supplies. Meanwhile, the government is also undertaking other supply side measures such as subsidised retail sales of buffer stock and offloading of wholesale stock. We anticipate that demand-driven price pressures will intensify in the final quarter of the year following the festive season in August. This is likely to result in a significant rise in consumer demand across sectors such as apparel, electronics, jewellery, and automobiles. Additionally, inflation in services is expected to increase, driven by a projected surge in demand for travel, hospitality, entertainment, and logistics.

Figure 4: India Consumer Price Inflation and Main Policy Rate (%)

Source: Continuum Economics

Keeping in mind these dynamics, the Reserve Bank of India (RBI) is likely to embark on a cautious monetary easing cycle, starting with a 25-basis-point rate cut to 6.25% in December 2024. By maintaining steady rates till Q4, the central bank aims to balance inflation management with supporting economic growth, avoiding premature cuts that could reignite price pressures. Although India’s headline inflation trended to below 4% in recent months, the RBI anticipates the favourable base effect to drop out of the equation, and an uptick over Q4 is expected. As inflation is expected to ease in early 2025, driven by better food supplies and a stable oil market, the RBI is positioning for a gradual rate cut to stimulate consumption and investment. Further rate reductions could bring the repo rate down to 5.25% by end-2025, providing relief for consumption and investment growth.

Fiscal consolidation will continue through improved tax compliance and digital record-keeping, broadening the tax base. However, the BJP's reduced parliamentary majority will impede comprehensive reforms in land acquisition, labour laws, and asset monetisation. This presents a key downside risk to our growth forecast. Despite these challenges, infrastructure projects, such as highway expansion and railway modernisation, will proceed with bipartisan support, ensuring steady public sector investment. The government has expedited ministerial spending starting Q2-FY25 especially after economic growth dipped in Q1, as public spending was suspended due to elections.

India will benefit from global trends such as "de-risking" from China, attracting foreign investment in manufacturing and supply chains. While bilateral trade deals with countries like the UK and regional blocs such as the Gulf Cooperation Council (GCC) are likely to expand market access, trade-oriented reforms will face delays due to legislative gridlock.

India’s outlook for 2025 remains positive, underpinned by strong growth in the services sector, the success of the PLI schemes, and significant public sector investment in infrastructure. However, challenges in implementing large-scale reforms and the unpredictability of global markets could temper some of the country’s ambitions. India will remain a key focus for global investors seeking to enter the domestic market through foreign direct investment and capital markets.

Empowering Indonesia: Prabowo's Economic Agenda for 2025

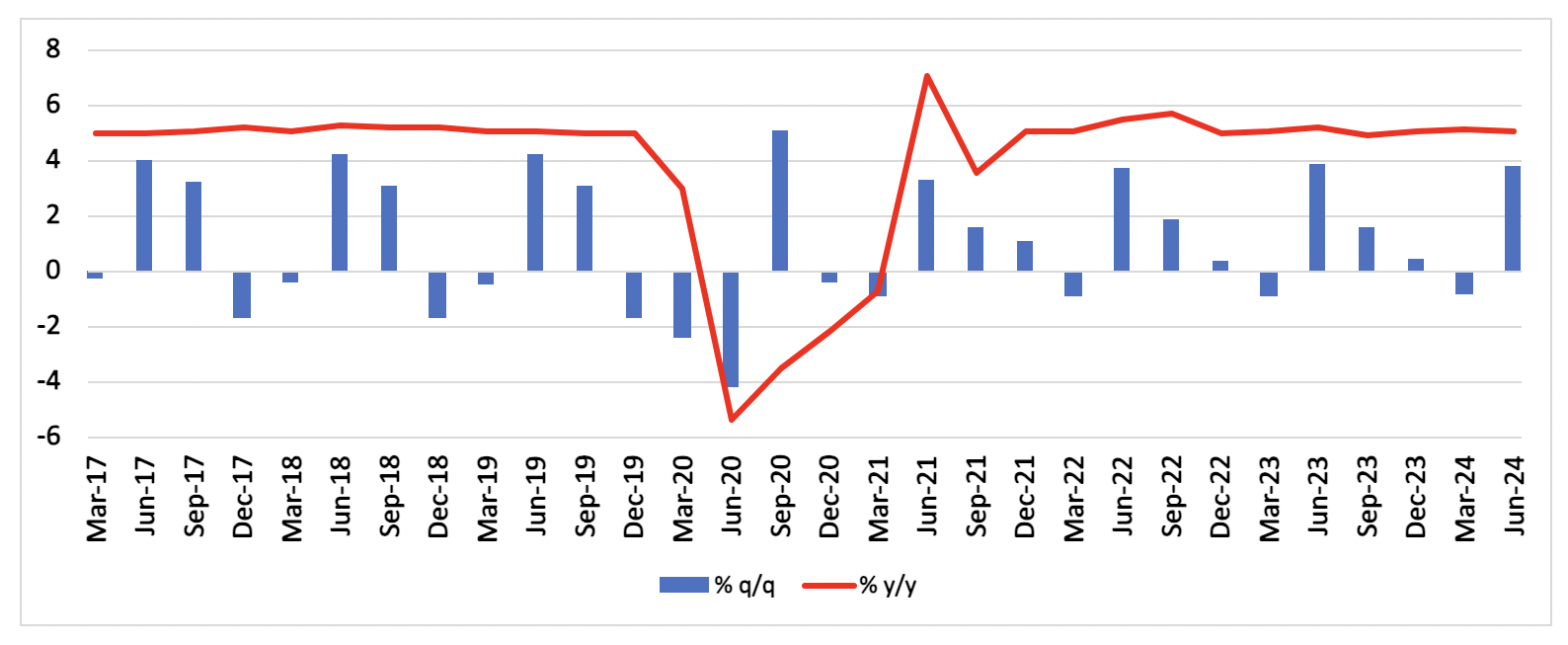

Indonesia’s economic outlook for 2024 and 2025 is promising, with growth projected to accelerate from 5.1% in 2024 to 5.2% in 2025, driven by a mix of recovering exports, infrastructure investments, and resilient domestic consumption. In 2024 and 2025, President Prabowo’s administration will focus on expanding food production through the government’s food estate programme, which aims to boost strategic crop yields beyond Java. This initiative, along with the provision of free meals to students, will help address food security and price stability, supporting the broader economy by easing inflationary pressures. However, delays in key infrastructure projects, particularly the construction of the new capital, Nusantara, in East Kalimantan, are likely to persist into 2025, potentially slowing investment inflows and curbing growth in the short term. It is worth noting that the first phase of construction for Nusantara has reached 93% completion. The remaining work is expected to be finalised by October, ahead of the inauguration of President-elect Prabowo Subianto. This initial phase includes essential infrastructure such as roads, communication systems, water supply, electricity, and government facilities, including ministerial buildings and housing for public servants. The subsequent phase will take significantly longer and will rely heavily on substantial private-sector investment. Following Prabowo's inauguration, the second phase is anticipated to commence, with interest from several sovereign investment funds in the new capital. The total projected development cost for Nusantara is estimated at USD32bn. The capital relocation to Nusantara will be largely symbolic in 2024, with substantial economic benefits not materializing until 2025 and beyond. Despite delays in Nusantara, Indonesia’s long-term growth prospects are bolstered by Prabowo’s commitment to continuing infrastructure development, particularly on the islands of Java and Sumatra.

Figure 5: Indonesia Real GDP Growth (% yr/yr)

Source: Continuum Economics

Source: Continuum Economics

Meanwhile, Indonesia’s industrial policy, centred on downstream processing of commodities such as nickel, will drive foreign direct investment (FDI) in key sectors like electric vehicles (EVs). Significant investments in nickel processing and electric vehicle (EV) manufacturing, along with Indonesia's leadership in global nickel supply chains, are expected to yield substantial economic benefits in 2025 and beyond. President Jokowi has set a target of producing 600,000 EVs annually by 2030, which we expect Indonesia to achieve easily. However, there are downside risks, particularly from a potential oversupply in global nickel markets, which could put downward pressure on prices in the short term. Indonesia's reliance on China for nickel mining poses risks to its nickel supply chain, influenced by both the dynamics of the Chinese market and geopolitical tensions between China and the West. The government’s push to improve food security will also stimulate the agricultural sector, with increased farm output supporting price stability. Additionally, the digital economy, particularly e-commerce and fintech, will continue to expand, leveraging Indonesia’s young and tech-savvy population.

Private consumption in 2024 and 2025 will be robust, driven by higher household incomes, bolstered by strong job creation in sectors like manufacturing, mining and tourism. The government’s social assistance programs, such as cash transfers and fuel and food subsidies, are also sustaining consumer spending by mitigating inflationary pressures. Urbanisation is expanding, particularly in major cities like Jakarta and Surabaya, where rising middle-class incomes are increasing demand for retail, housing, and services. Additionally, increased exports will contribute to rising incomes, as stronger global demand for commodities and manufactured goods boosts economic activity.

On the fiscal side, the government’s budget deficit is expected to widen in 2024 due to lower tax revenues. Prabowo’s administration is likely to implement tax reforms, including an increase in the value-added tax (VAT) rate from 11% to 12% in 2025 to enhance revenue collection. Fiscal resources will continue to be devoted to education and healthcare, aligning with Indonesia’s push to build a skilled workforce capable of supporting higher value-added manufacturing, particularly in the EV sector.

Figure 6: Indonesia Headline Inflation and Food inflation (% yr/yr)

Source: Continuum Economics

Inflation is expected to moderate, with headline inflation averaging 2.6% in 2024, down from earlier highs driven by food price spikes due to El Niño. Bank Indonesia (BI) has begun to lower interest rates, after raising the policy rate to 6.25% to defend the rupiah, now that the rupiah has started to rebound with the shift to a softer USD. With BI having cut interest rate by 25bps in September, we expect another rate cut in end-2024 of similar magnitude. In 2025, inflation will remain stable within BI’s target range of 1.5%-3.5%, allowing the central bank to gradually ease monetary policy to around 5.5% by year-end. Concerns around sustained economic growth will ensure that BI remains on the monetary loosening path. However, external risks, such as a potential return of Donald Trump to the U.S. presidency, could create an inflationary environment globally, limiting BI’s ability to cut rates substantially.

Overall, while Indonesia faces external risks from geopolitical events, slow recovery in China and volatile commodity price volatility, the country’s economic fundamentals remain strong. A combination of infrastructure projects, strategic sectoral investments, and prudent fiscal and monetary policies will sustain steady growth into 2025.

Australia: Still Waiting for Lower Inflation Before Easing

Domestic demand in Australia remains soft as household saving to income ratio lingers at a low of 0.6% in Q2 2024. Household spending has contracted by 0.4% q/q, the worst since September 2021 and recent import data continue pointing towards weak domestic demand. However, the strength of Australian labour market exceeded expectations to stay solid but it is hard to see a continuous uptrend. The majority of headline employment gains came from part time positions. The tight labour market (unemployment rate 4.1% and participation rate 67% are both near historical level) has kept the wage price index steadily high at 4.1% y/y and the pace of growth is expected to moderate in the coming quarters, given softer domestic demand. Household balance sheets would remain restrained by mortgage payment in 2024, even when house prices recover from the trough of a brief correction, as RBA suggests keeping current rates longer to tame persistent inflation.

Real wages has been in positive territory and with monthly CPI resumes its moderation, we should see some improvement in 2025’s consumption. Although solid commodity prices are still supporting the Australian economy, commodity exports are seeing a slower growth after the boom in previous quarters. The RBA highlighted the uncertainty in global economic outlook and acknowledged the stubbornness in CPI. RBA are trying to balance between inflation and economic growth with data dependency guiding their path but is going to have a hard time as the Australian economy remains soft near-term while CPI remains above target range in 2024 and is only expected to return to target range in late 2025. Our central economic forecast is unchanged and believe the Australian economic growth will tread lower until Q3 2024 when household consumption fares better on stronger real wage and we now see the RBA only ease once in Q4 2024 to avoid sending the wrong signal and further delay the time for inflation to return to target range.

Global long-term demand for Australian commodity remains solid with strong demand for Australian coal. Coal export has exceeded iron ore for the first time in decades and seems to have stronger growth momentum. Regional Japan and China and Vietnam, Philippines and Thailand are providing growing demand. While the Chinese property sector is needing less steel and iron ore, other demand globally is helping Australian commodity exports. Overall, our GDP growth in 2024 is unchanged at 1.2%. We forecast in 2025 Australia will have an average growth at 2.1%, benefiting from RBA rate cuts, inflationary pressure easing and the subsequent recovery in consumption.

We forecast headline y/y CPI moderate for the rest of 2024 and throughout 2025 as household refills their savings before spending. It is clear Australian households are focusing on essential items with discretionary spending falling 1.1%, with transport services (-4.4%) and hotels, cafes & restaurants (-1.5%). Our 2024 CPI forecast has been revised higher from 3.4% to 3.6% as transitory items flare up in Q2 2024. Even so, service inflation is expected to moderate gradually while rent inflation is not expected to ease.

The pace of moderation has been slower than anticipated due to a rise in energy prices and the unwinding of electricity rebates, as well as elevated service inflation and some transitory items. Food inflation, the largest inflationary factor in the previous year has rotated lower. The RBA sees limited capacity from the labour market and led to higher wages. Wage growth in private sector has begun to slow as business struggles from higher input prices and labour cost. The wage price index should be heading lower gradually in 2025.

The RBA has kept the door open by suggesting the rate path is dependent on data. But realistically, there is little room for the RBA to tighten especially after the soft Australian GDP in 2024, showing that domestic demand, the pillar of strong 2023 growth, is dissipating on the effects of restrictive monetary policy. Unless there is a structural shift in the global inflation picture, headline inflation should return to target range in 2025. The RBA held the cash rate at 4.35% in September, but we see the RBA cutting by 25bps in Q4 2024 as inflation inch closer to 3%. We see 110bps of cut in 2025 and the RBA moving back towards neutral policy rates of 3.0% rates by end 2025.

2024 and Beyond: Malaysia's Madani Economy in Action

Malaysia’s economic outlook for 2024 and 2025 is marked by steady growth, although the country faces both domestic and external challenges that could affect its trajectory. In 2024, Malaysia's economy is expected to grow by around 4.5%, recovering from a dip in 2023 due to weaker external demand and inflationary pressures. Headline growth number will also be supported by a 5.9% yr/yr growth observed in Q2 2024. However, growth is expected to moderate over Q3 and Q4. Thereafter, growth is expected to accelerate to 4.8% in 2025, supported by robust domestic consumption, continued government infrastructure spending, and a gradual recovery in global trade. However, the economy's resilience will depend heavily on global conditions, particularly China’s economic recovery and shifts in global commodity prices, given Malaysia's dependence on exports of palm oil, oil, gas, and electronics.

Under the leadership of Prime Minister Anwar Ibrahim, Malaysia's economic framework, known as the Madani Economy, seeks to enhance competitiveness, boost national income, and narrow the fiscal deficit. However, rising political polarization, driven by ethnic and religious identity politics, may impede Mr. Anwar's reformist agenda, leading to potential policy gridlock. Complementing the Madani Economy framework are several major policy initiatives, including the New Industrial Master Plan 2030 (NIMP2030) and the Forest City initiative. Further, the National Semiconductor Strategy (NSS), launched in May 2024 with MYR USD25bn in fiscal support, targets improvements in Malaysia's capabilities in chip design and wafer fabrication, although a shortage of high-skilled talent remains a significant challenge. The Forest City, a USD100bn project aimed at creating a special financial zone targets securing crucial investment through provision of incentives.

Domestic consumption will remain the primary driver of growth, bolstered by improving labour market conditions, wage growth, and government support measures. The government will continue to focus on subsidy reforms, especially related to fuel and food prices, which could influence consumer spending patterns.

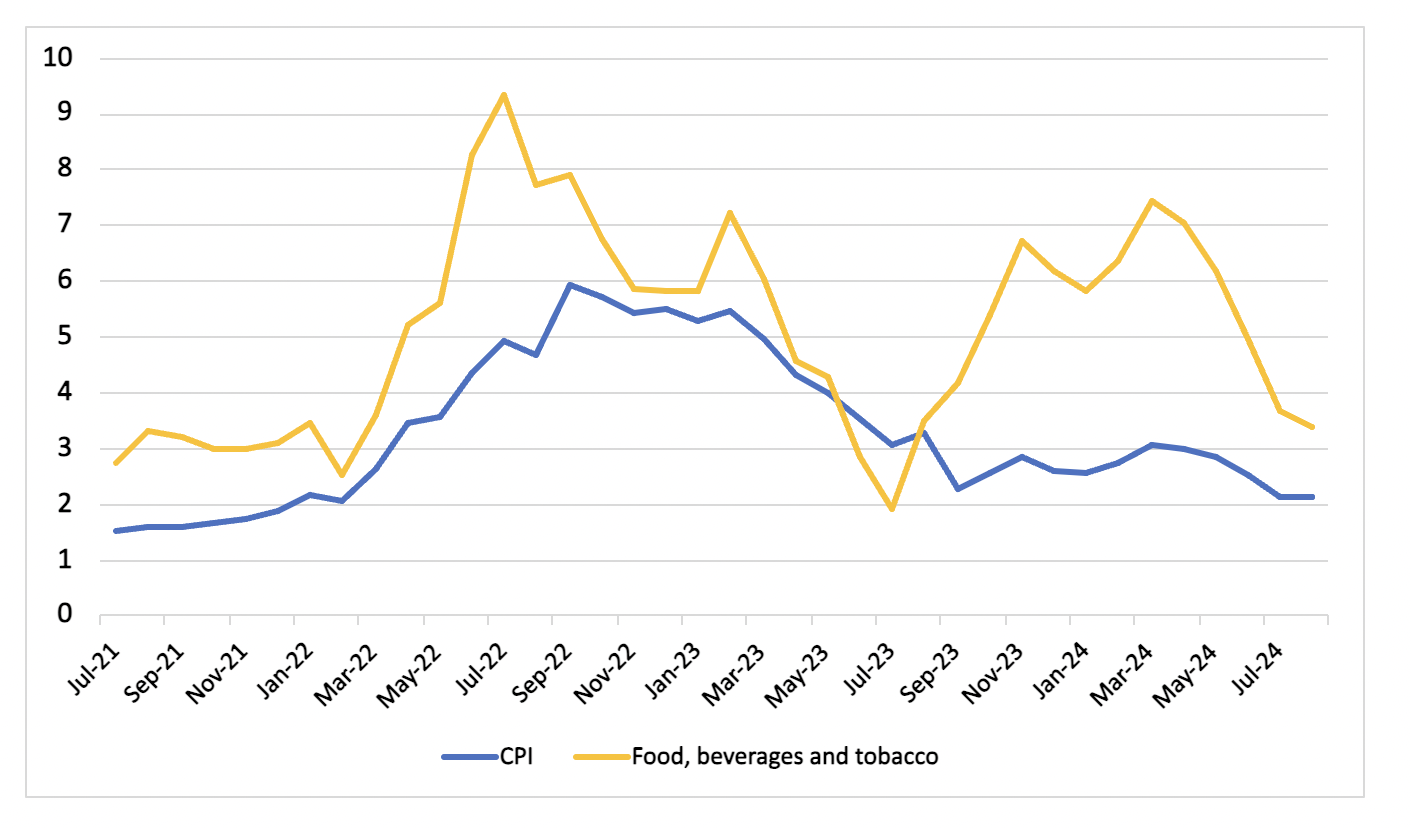

Fiscal consolidation is set to be a primary focus of government policy in 2024 and 2025, with subsidy rationalisation playing a crucial role. The government has already eliminated electricity subsidies for the top 10% of consumers and introduced a targeted approach for diesel subsidies. A gradual removal of petrol subsidies is anticipated by the end of 2024, aimed at mitigating inflationary pressures. While certain blanket subsidies, such as those for eggs and cooking oil, will remain, this shift is expected to create greater fiscal space, allowing for increased welfare spending to support vulnerable populations. Fiscal consolidation efforts will also include a broader implementation of the goods and services tax (GST), potentially set for 2025.

Inflation is forecast to average 2% in 2024, with upward pressure stemming from the gradual removal of fuel subsidies and civil service wage increases. By 2025, inflation may trend slightly upward to 2.3%, reflecting the anticipated rollout of the targeted petrol subsidy and continued wage growth. Nevertheless, the easing of commodity prices is expected to mitigate excessive price increases.

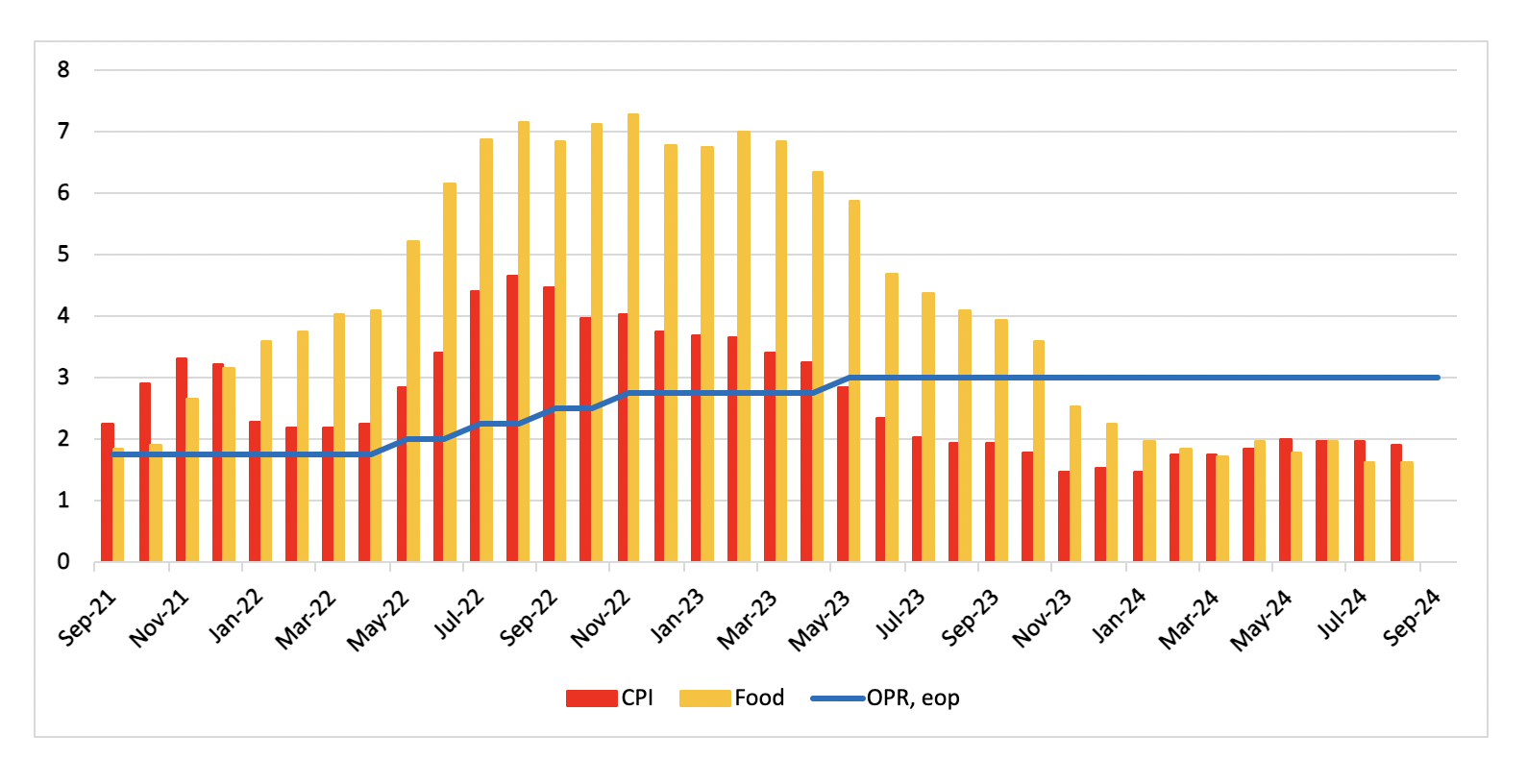

Figure 7: Malaysia Headline Inflation, Food Inflation and Main Policy Rate (%)

Source: Continuum Economics

On the monetary front, we expect Bank Negara Malaysia (BNM) to maintain the overnight policy rate (OPR) at 3% throughout 2024 and cut rate twice in 2025 by 10bps each to 2.8%, as it navigates the delicate balance between controlling inflation and supporting economic growth. This cautious approach will be influenced by the Federal Reserve’s rate cut cycle, ongoing fiscal adjustments and domestic policies that may exert upward pressure on prices.

Externally, Malaysia's export performance will be critical in its growth story. The electronics sector, which contributes significantly to Malaysia's exports, will benefit from a global semiconductor demand recovery in 2025, although challenges such as increased competition from other regional players could limit its upside potential. Moreover, Malaysia's commodity exports, particularly palm oil and liquefied natural gas (LNG), will remain sensitive to fluctuations in global prices, which could dampen trade performance. More recently, Indian traders cancelled in one day about 50,000 metric tonnes of palm oil orders scheduled for Q4 2024 delivery. Further, the country’s heavy dependence on global trade makes it vulnerable to external shocks, particularly from the U.S.-China trade tensions, which could disrupt supply chains and affect demand for Malaysian exports.