France Budget Deal or Crisis?

Concerns about the 2025 French budget failing have caused new spread widening for 10yr France v Germany. What are the prospects?If the new and still very much minority government reaches agreement with National Rally and passes the 2025 budget, then it will produce some relief in markets but will not fix the huge medium-term fiscal problems. Failure of the budget to pass with agreement could then risk a no confidence vote and fall of the current government and then a vacuum, as new parliamentary elections cannot occur constitutionally before July 2025. The 10yr France-Germany spread could explode to 150bps in this scenario, as non-residents hold 53% of the market and take fright at new French budget drama. This could spill over to produce a risk off phase in European markets including the EUR and the ECB trying to avoid a crisis.

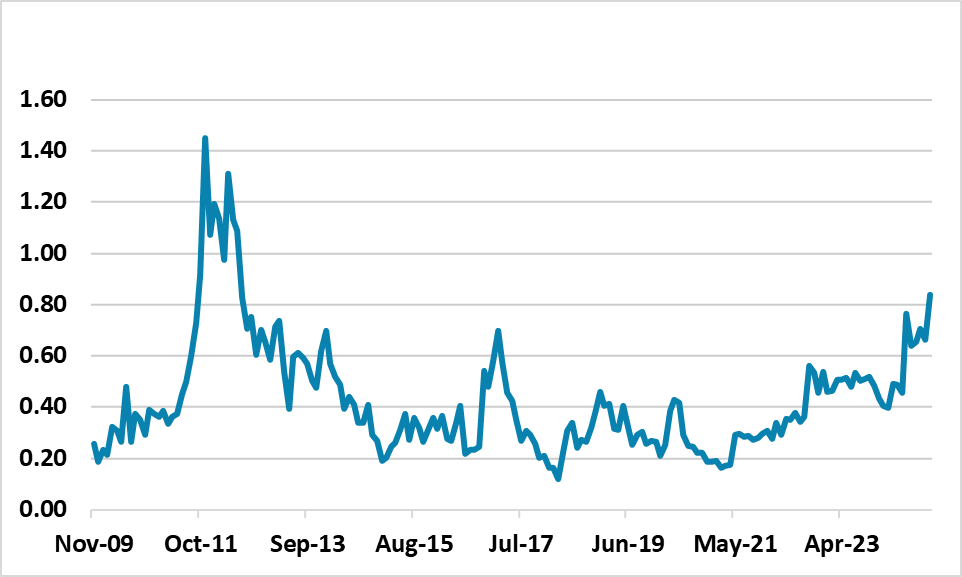

Figure 1: 10Yr French-Germany Government Bond Spread (%)

Source: Datastream/Continuum Economics

Source: Datastream/Continuum Economics

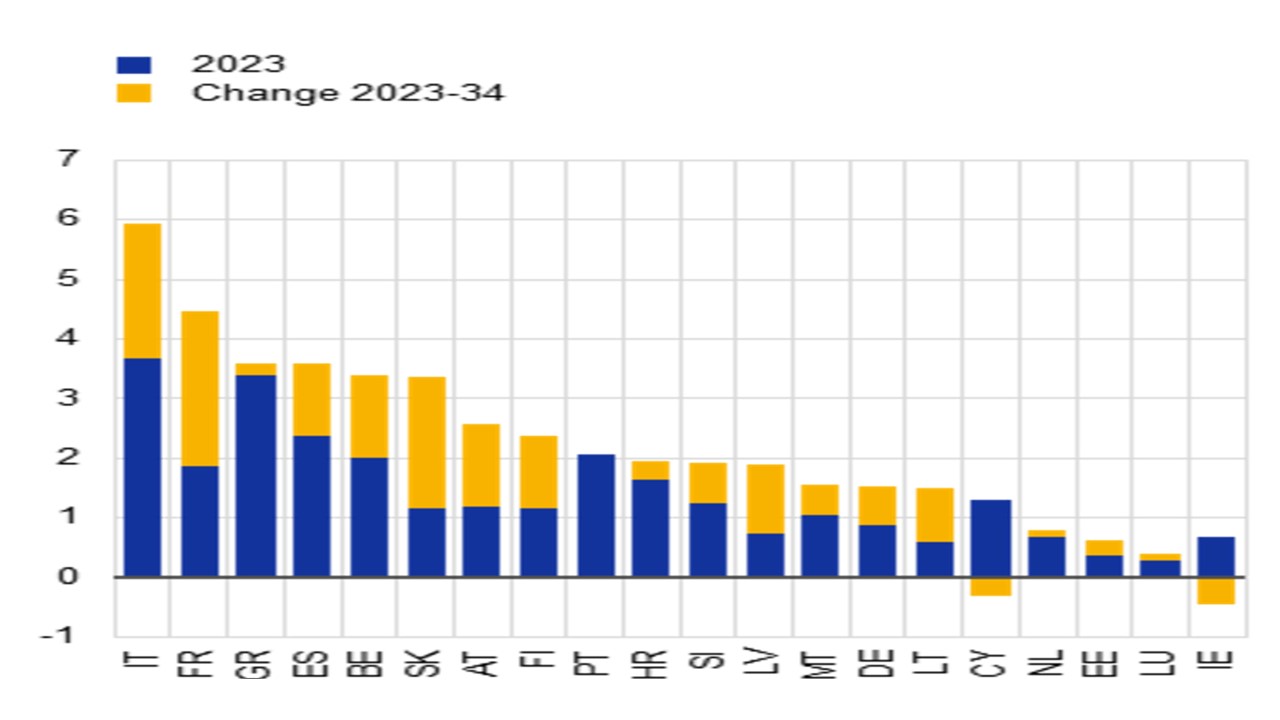

The 10yr French-German government spread has stabilized after hopes that the government and National Rally could agree less fiscal tightening, particularly if a contentious planned increase in electricity taxes (worth some EUR billion) is dropped. The question is whether National Rally will back the Budget bill directly or merely not vote down the government should a non-confidence vote occurs after the government instead uses emergency legislation to pilot the Budget bill through. National Rally could be interested in helping the budget to pass, if they think it could help them in the 2027 presidential election – Macron is unlikely to resign given how the July 2024 parliamentary elections backfired, plus the higher European geopolitical tensions over Ukraine. It is also unclear to what extent Le Pen is exacerbating the fiscal situation to divert attention from or even delay an impending court decision on the embezzlement charges she and other National Rally members faceIf the budget were to pass and avoid a failure of the government then a modest tightening of the 10yr spread could be seen. However, this would not fix France’s huge budget deficit and government debt problems that requires years of substantive fiscal tightening to get a primary surplus. With the end of ultra-low interest rates, France’s debt servicing costs are projected by the ECB to rise above 4% by 2034 (Figure 2), which would cause a major and persistent debt crisis. However, further multi-year fiscal tightening is unlikely before the next parliamentary election from July 2025 and perhaps the presidential election in 2027. France needs a high-risk premium to reflect political problems; insufficient momentum on fiscal consolidation and the risk that non-resident reduce their huge holdings (53% of outstanding debt). Spread narrowing would likely prove temporary in this scenario and 100bps would likely be seen by next summer for the 10yr spread versus Germany.

Figure 2: Projected Interest Payments on Government Debt 2023-34 (% of GDP)

Source: ECB Financial Stability Report Nov 2024

As suggested above, failure to reach an agreement with the National Rally could led to the government using the constitution to get the 2025 budget passed, but then the government falling in a non-confidence vote. That would lead to political limbo or crisis until the next parliamentary election at least, as no guarantee exists that a majority coalition with fiscal consolidation credentials will win. This could produce a crisis for French government bonds and Eurozone assets.

BDF data shows that non-residents held 52.7% of French government debt in Q1 2024. France has been successful in convincing foreign investors to buy French debt for decades, but this could now be a weakness. Most are investors from other EZ countries that face no currency risk, but do face interest rate risk if they need to sell before maturity. They could decide to reduce exposure in the face of more French budget drama. In a real crisis, the super spike in the 10yr government bond spread to the 150bps area is feasible and potentially 200bps if ECB does not cap yields.

ECB easing would not in itself rescue the day, but what about the ECB’s Transmission Protection Mechanism (TPI) -- here. Though European politicians and the ECB would desperately want to avoid a French budget crisis from become a 2nd EZ debt crisis, the TPI requires sound fiscal policy and no excessive deficit procedure. Some ECB hawks would be reluctant and this could delay timely action from the ECB. The ECB could fudge and buy French debt under the TPI to safeguard the transmission of ECB policy easing, but further fiscal consolidation is required in France to have a lasting impact on market sentiment. The EZ finance ministers cannot rely on ESM support measures as they have too much stigma and could worsen a crisis as happened in 2011. The ECB could also consider pausing the QT PEPP and APP programs just like the BOE did in 2022 with QT after UK market turbulence.

Failure of the current government in a no confidence vote would trigger risk off for other EZ debt markets (e.g. Italy); EZ equities and the EUR and French budget progress is not to be overlooked despite the dominant focus on what Donald Trump’s policies will mean for the world.