U.S.-Gilt Yields and Fed v BOE policy

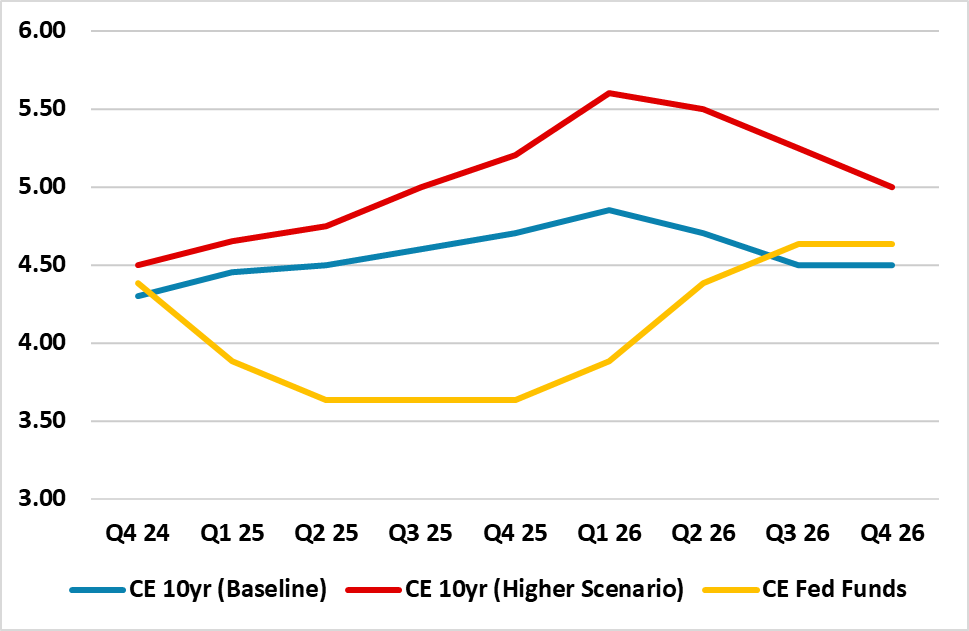

We see scope for 10yr UK yields to diverge from the U.S. despite our new forecast of rising U.S. Treasury yields (here). We feel that the BOE will ease by more than the Fed in 2025 and ease selectively in 2026 before and after our forecast of Fed Funds hikes. Meanwhile, the UK fiscal stance is less supportive to growth relative to the prospective expansionary fiscal policy under the Trump administration and much wider budget deficit/issuance in U.S. Treasuries. This can see 10yr Gilt yields moving to a 40bps below versus U.S. Treasuries in 2025 and 75bps in 2026.

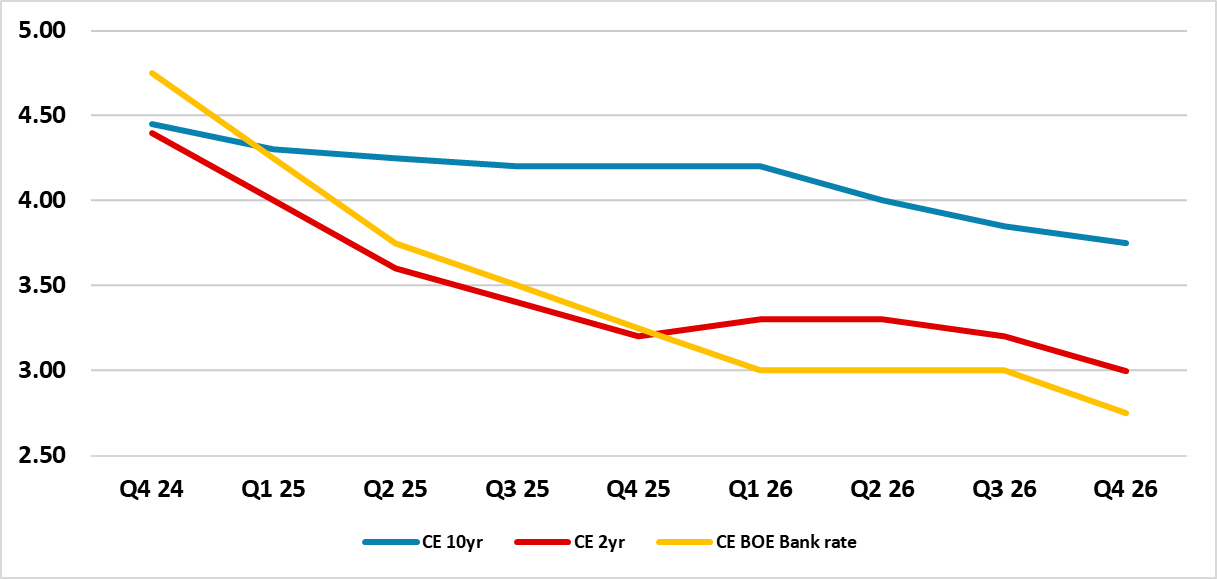

Figure 1: BOE Policy Rate, 2 and 10yr Gilt Yield Forecasts (%)

Source: Continuum Economics

The outlook for the 10yr U.S. Treasury-Gilt bond spread is dependent on relative fiscal policy and monetary policy. Though the new measures in the recent UK budget was net stimulative to the economy in 2025-26 due to expenditure increases outstripping new taxation increases, the UK still has other fiscal tightening come through due to freezing of income tax allowances. Prior to the budget, the IMF had been forecasting that the UK cyclically adjusted budget deficit would decline from -1.8% of GDP in 2024 to -0.7% of GDP in 2027. Over the next 2-5 years, the UK fiscal policy is not really stimulative due to the need to meet fiscal targets. The contrast with U.S. fiscal policy will likely be stark and we fear that the U.S. budget deficit could blow out to 8-9% of GDP (here) in 2026. The gilt market does face heavier QT than U.S. Treasuries, where the Fed are widely expected to stop QT by mid-2025. In contrast, the BOE is maintaining a £100bln pace including outright gilt sales with its medium-term aim as much to to change the composition of its balance sheet in order to reduce its interest rate risk However, as the BOE easing cycle continues and the risk of liquidity tightening increases, we would still expect the BOE to slow the pace of QT in the September 2025 annual review, especially as at that juncture banks may then have the level of liquid reserves needed both to meet regulatory requirements and to ensure they can meet daily payments.

The other key issue is BOE policy. While we expect the Fed to have finished the easing cycle by June 2025, we see the BOE easing consistently through 2025 and look for a cumulative 150bps (Figure 1) – our new forecast pencils in one extra BOE cut in 2025. The BOE is too optimistic on the economy and too concerned about core inflation pressures (here) and the next few quarters will see a slower economic pace and more labor market slack. The lagged feedthrough of monetary policy tightening still dominates, as the BOE have only cut by 50bps. This macro environment can surprise the MPC and extend the easing cycle through H2 2025, as inflation moves consistently back to target. We also see a further 25bps early 2026 and late 2026, with a pause in between as the Fed undertakes a 100bps of tightening. This drives substantive movement of the BOE policy rate relative to Fed Funds (Figure 2). When the Fed tightened in 2018 and the BOE did not the BOE policy rate went to 175bps under Fed Funds and 10yr gilts to a 150-175bps discount versus U.S. Treasuries. However, this was an era of ultra-low rates and the BOE is doing QT, but we feel that the fiscal and monetary policy divergence can see 10yr gilts at 75bps below 10yr Treasuries by 2026.

Figure 2: 10yr U.S.-UK Gilt Spread and Fed Funds-BOE policy rate Spread (%)

Source: Datastream/Continuum Economics

Meanwhile, we do not see a U.S./China trade war (here) having much impact indirectly on the UK inflation outlook, but does risk some upward price pressures in the U.S. from higher tariffs. Also a U.S./EU trade war may or may not include the UK, due to the UK military commitments with the U.S. in Asia and close to China – the UK government’s Indo-Pacific tilt policy. China hawks around Trump will point out the UK-EU difference, while we also feel that Trump will not go straight to 10-20% tariffs against the EU but would target certain industries e.g. autos.